Free Income Driven Repayment Plan Calculators: Our Top 5 Picks for …

Finding the Best Income Driven Repayment Plan Calculator: An Introduction

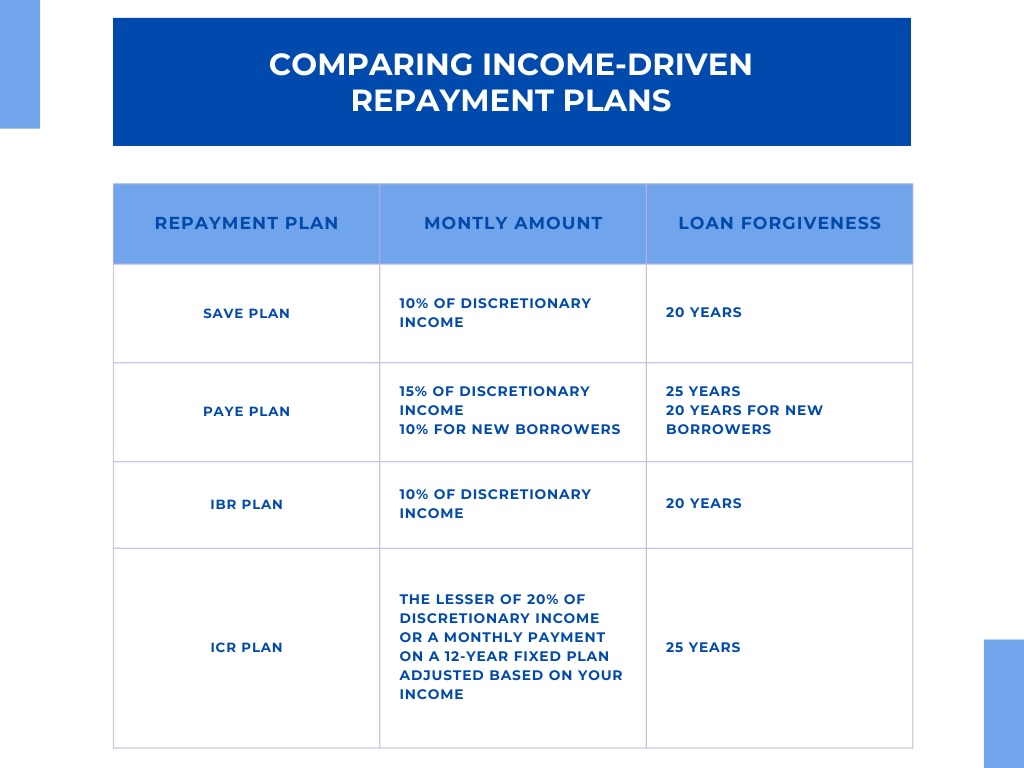

Navigating the complexities of student loan repayment can be a daunting task, particularly when it comes to understanding income-driven repayment plans (IDR). With various options available, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Income-Contingent Repayment (ICR), borrowers often find themselves overwhelmed. The key to making informed decisions lies in utilizing a reliable income-driven repayment plan calculator, which can help estimate monthly payments based on individual financial circumstances.

However, with numerous online calculators claiming to offer accurate results, choosing the right one can be a challenge. Some tools may lack essential features, while others may provide outdated information that could lead to costly mistakes. This article aims to streamline your search by reviewing and ranking the best income-driven repayment plan calculators available online. Our goal is to save you time and effort, allowing you to focus on what truly matters—managing your student loans effectively.

Criteria for Ranking

To ensure a thorough evaluation, we have established specific criteria for our rankings. We focused on accuracy, as it is crucial that the calculators provide reliable estimates based on the latest federal guidelines. Ease of use is another important factor; a user-friendly interface can significantly enhance the overall experience. Additionally, we considered the features offered by each calculator, such as the ability to compare multiple repayment plans and calculate potential loan forgiveness amounts.

By the end of this article, you will have a clear understanding of the top tools available, empowering you to make informed choices regarding your student loan repayment strategy.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Income Driven Repayment Plan Calculators

When evaluating various income driven repayment plan calculators, we considered several essential criteria to ensure users receive the most effective and reliable tools for estimating their monthly student loan payments. Below are the key factors that guided our selection process:

-

Accuracy and Reliability

– The calculators must provide precise estimates of monthly payments based on the most current federal guidelines and income-driven repayment plans. We prioritized tools that use updated poverty line figures and reflect the latest changes in legislation affecting repayment plans. -

Ease of Use

– User-friendly interfaces are crucial for accessibility. We sought calculators that require minimal navigation and offer straightforward instructions for inputting data. The ability to quickly understand how to use the tool without extensive background knowledge is essential for all users. -

Key Features

– Effective calculators should allow users to input a variety of relevant data, including:- Adjusted Gross Income (AGI): Essential for calculating payment amounts.

- Family Size: Impacts the payment calculations and eligibility.

- Loan Types: Users should be able to specify various types of federal loans (e.g., Direct Subsidized, Direct Unsubsidized, PLUS loans).

- Loan Amounts and Interest Rates: Accurate inputs for existing loans ensure that the tool can generate a realistic repayment scenario.

- Additional features, such as comparing multiple repayment plans (e.g., IBR, PAYE, REPAYE), can enhance the user experience by providing comprehensive options.

-

Cost (Free vs. Paid)

– We focused primarily on free calculators, as they are accessible to a broader audience. However, we also considered whether paid tools offered significant advantages, such as personalized financial advice or in-depth analysis, to determine if they justified any associated costs. -

Educational Resources

– The best calculators often come with supplementary information to help users understand their options. We looked for tools that provide explanations of various income-driven repayment plans, eligibility criteria, and potential long-term implications of different repayment strategies. -

Mobile Compatibility

– With an increasing number of users accessing tools via mobile devices, we assessed whether the calculators are optimized for mobile use. Tools that function seamlessly across platforms ensure that users can calculate their payments anywhere, anytime. -

User Reviews and Feedback

– We considered user testimonials and reviews to gauge the overall satisfaction with the calculators. Tools that have a high rating from users are more likely to deliver the quality and reliability that borrowers need.

By applying these criteria, we aimed to highlight the most effective and user-friendly income driven repayment plan calculators available, ensuring that our audience can make informed decisions about managing their student loan payments.

The Best Income Driven Repayment Plan Calculators of 2025

4. Income

The Income-Driven Repayment (IDR) Comparison Calculator by Edcap is a valuable tool designed to help borrowers estimate their monthly payments and potential loan forgiveness under various federal IDR plans. By simply entering loan and income details, users can easily compare different repayment options, enabling them to make informed decisions about their student loan management and financial planning. This calculator streamlines the process of understanding the implications of IDR plans, making it an essential resource for borrowers seeking relief.

- Website: edcapny.org

- Established: Approx. 6 years (domain registered in 2019)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in obtaining accurate results from an income-driven repayment (IDR) plan calculator is ensuring that the information you enter is correct. Start by gathering all necessary documents, such as your latest tax return, student loan statements, and any relevant financial records. Pay close attention to details like your adjusted gross income (AGI), family size, total loan amount, and interest rates. When entering numerical values, follow the calculator’s instructions—omit commas and decimal points to avoid errors. A small mistake in these inputs can lead to significant differences in your estimated monthly payment.

Understand the Underlying Assumptions

Every income-driven repayment calculator operates on specific assumptions regarding your financial situation and the repayment plans available. Familiarize yourself with how these calculators define terms like “discretionary income” and the percentage of income used to calculate your payments. Different calculators may adopt varying definitions or rules, particularly concerning family size or income adjustments. Understanding these assumptions can help you interpret the results correctly and avoid misleading conclusions.

Use Multiple Tools for Comparison

No single calculator can capture every nuance of your financial situation. To get a comprehensive view of your repayment options, use multiple income-driven repayment calculators. This approach allows you to compare results and identify any discrepancies. By analyzing the outcomes from different tools, you can gain insights into which repayment plan might be most beneficial for you. Some calculators may focus on specific plans, while others provide a broader overview, making cross-referencing essential for informed decision-making.

Stay Updated on Policy Changes

Income-driven repayment plans can be affected by legislative changes and updates to federal policies. Therefore, it’s essential to stay informed about any changes that might impact your eligibility or repayment terms. For example, new plans may emerge, or existing plans may undergo modifications, which could alter your monthly payment amounts. Regularly check reliable sources like the U.S. Department of Education’s website or student loan counseling services for the latest information.

Consult with a Financial Advisor

If you’re feeling overwhelmed or uncertain about which repayment plan is best for you, consider seeking advice from a financial advisor or a student loan expert. They can provide personalized guidance based on your unique financial situation and help you navigate the complexities of student loan repayment. Professional advice can be particularly valuable for those with substantial debt or those considering long-term financial planning.

By following these tips, you can maximize the accuracy of the results from income-driven repayment plan calculators and make more informed decisions regarding your student loan repayment strategy.

Frequently Asked Questions (FAQs)

1. What is an income-driven repayment plan calculator?

An income-driven repayment plan calculator is an online tool designed to help borrowers estimate their monthly student loan payments based on their income, family size, and loan details. It calculates potential payments under various income-driven repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Income-Contingent Repayment (ICR). By inputting your financial information, you can get an estimate of what your monthly payments might look like and how long it may take to pay off your loans.

2. How do I use an income-driven repayment plan calculator?

To use an income-driven repayment plan calculator, you typically need to provide specific information including your total federal student loan debt, interest rates, adjusted gross income (AGI), family size, and marital status. Some calculators may ask for additional details, such as the type of loans you have. Once you enter this information, the calculator will generate an estimate of your monthly payment under different repayment plans.

3. What information do I need to provide for accurate calculations?

For the most accurate calculations, you will need to provide:

– Total amount of federal student loans

– Average interest rate of your loans

– Your annual adjusted gross income (AGI)

– Family size (including spouse and dependents)

– Marital status and tax filing status (e.g., Married Filing Jointly or Separately)

This information allows the calculator to determine your discretionary income and evaluate which repayment plans you may qualify for.

4. Can I use the calculator if I have multiple loans?

Yes, you can use the calculator if you have multiple loans. Most income-driven repayment plan calculators allow you to input the total amount of all your federal student loans along with their respective interest rates. This helps to provide a comprehensive estimate of your monthly payments across all your loans under various income-driven repayment plans.

5. What should I do after getting my payment estimate from the calculator?

After obtaining your payment estimate from the calculator, it is advisable to review your repayment options carefully. You can compare the estimated payments under different income-driven plans and consider factors such as potential loan forgiveness and the total interest paid over time. If you decide to proceed with an income-driven repayment plan, you will need to submit an application to your loan servicer. It’s also a good idea to consult with a financial advisor or a student loan expert if you have any questions or need personalized advice.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.