Free Investment Dave Ramsey Calculators: Our Top 5 Picks for 2025

Finding the Best Investment Calculator Dave Ramsey: An Introduction

Finding the right investment calculator can be a daunting task, especially when you’re looking for one that aligns with the principles of financial guru Dave Ramsey. With countless online tools available, it can be overwhelming to sift through them to find a reliable, user-friendly calculator that meets your specific investment needs. Whether you’re a novice investor or someone looking to refine your existing strategies, having access to a quality investment calculator can make a significant difference in planning for your financial future.

This article aims to streamline your search by reviewing and ranking the top investment calculators that reflect Dave Ramsey’s investment philosophy. We will provide insights into each tool’s features, usability, and accuracy, helping you make an informed decision without the hassle of trial and error. Our goal is to save you time and enhance your understanding of how these calculators can assist you in achieving your financial goals.

Criteria for Ranking

To ensure that our recommendations are both practical and effective, we have established several key criteria for evaluating each investment calculator. These include:

- Accuracy: We assess how well each calculator performs in providing realistic projections based on user inputs.

- Ease of Use: A user-friendly interface is crucial for anyone looking to quickly navigate the calculator without confusion.

- Features: We consider the range of functionalities offered, such as the ability to account for different investment types, contributions, and estimated returns.

- Educational Resources: Tools that provide additional information or resources about investing, in line with Dave Ramsey’s teachings, are given extra consideration.

By following these criteria, we hope to guide you to the best investment calculators that will empower you to take charge of your financial future.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Best Investment Calculators

When evaluating the best investment calculators, particularly those aligned with Dave Ramsey’s investment philosophy, we focused on several essential criteria to ensure users have access to reliable and effective tools. Here’s a detailed breakdown of the key factors we considered:

-

Accuracy and Reliability

– Precision in Calculations: The calculators must provide accurate projections based on user inputs, reflecting realistic investment growth over time.

– Historical Data Reference: Tools that reference historical data, such as average returns of the S&P 500 (around 10-12%), enhance reliability and set user expectations correctly. -

Ease of Use

– User-Friendly Interface: A straightforward design allows users of all experience levels to navigate the calculator without confusion.

– Clear Instructions: Each input field should be clearly labeled, with guidance provided on what information is required, making it accessible for beginners. -

Key Features

– Comprehensive Input Fields: Effective calculators should allow users to input crucial data such as:- Current age and retirement age.

- Total current investments (401(k)s, IRAs, mutual funds, etc.).

- Monthly contribution amounts.

- Expected annual return percentages.

- Scenario Analysis: The ability to model different scenarios (e.g., varying monthly contributions) is vital for users to understand potential outcomes based on changes in their investment strategy.

-

Cost (Free vs. Paid)

– Accessibility: We prioritized tools that are available for free, ensuring that anyone can use them without financial barriers.

– Transparency in Costs: If there are premium features or associated costs, these should be clearly outlined, allowing users to make informed decisions. -

Educational Resources

– Supplementary Learning Materials: The best calculators often provide additional resources or links to educational content that helps users understand investment principles better.

– Integration with Professional Guidance: Options to connect with financial advisors or investment professionals, like those in Ramsey’s SmartVestor program, enhance the overall utility of the tool. -

Responsive Design

– Mobile Compatibility: As many users access tools via mobile devices, responsive design ensures that the calculator functions well across various platforms, providing a seamless experience. -

User Feedback and Reviews

– Community Insights: We considered user reviews and feedback to gauge satisfaction and the effectiveness of the calculators, ensuring that the tools we recommend are well-regarded by their users.

By adhering to these criteria, we have curated a list of investment calculators that not only align with Dave Ramsey’s investment philosophies but also empower users to make informed financial decisions confidently.

The Best Investment Calculator Dave Ramseys of 2025

2. Financial Calculators

The financial calculators offered by Dave Ramsey and FINRA provide users with essential tools for effective money management. These calculators assist in planning investments, savings strategies, and retirement goals, enabling individuals to make informed financial decisions. With a user-friendly interface, the calculators are designed to simplify complex financial concepts, making them accessible for users at all levels of financial literacy.

- Website: heritagefinancialaz.com

- Established: Approx. 10 years (domain registered in 2015)

3. Dave Ramsey

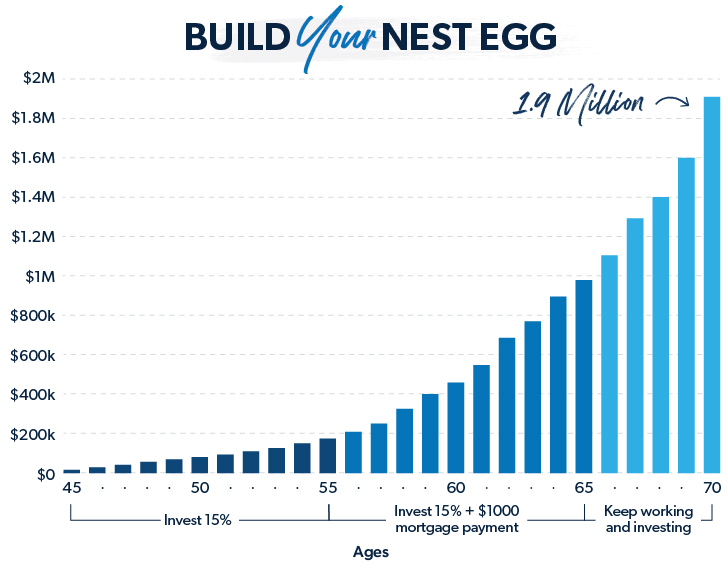

Dave Ramsey’s Facebook page offers an investment calculator designed to empower users with insights into their financial futures. By illustrating the potential growth of a $100 monthly investment from age 25 to 65, the tool demonstrates how disciplined saving can lead to significant wealth accumulation, totaling over $1.1 million. This resource emphasizes the importance of proactive financial planning, encouraging individuals to take control of their retirement savings and avoid financial insecurity.

- Website: facebook.com

- Established: Approx. 28 years (domain registered in 1997)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps to getting accurate results from an investment calculator is ensuring that all your inputs are correct. Before you hit the calculate button, take a moment to verify the numbers you’ve entered. Check that your current age, planned retirement age, current investment amount, monthly contributions, and expected annual return are all accurate. Even a small error in any of these figures can lead to significantly skewed results. It may help to gather your financial documents beforehand, such as account statements and pay stubs, to ensure you have the most accurate data at your fingertips.

Understand the Underlying Assumptions

Investment calculators often operate on certain assumptions that can affect the accuracy of their projections. For instance, many calculators use historical averages for annual returns, typically around 10-12% for the stock market. However, past performance is not always indicative of future results. Familiarize yourself with the assumptions made by the calculator, including inflation rates and market volatility, as these can impact your projections. Understanding these factors will allow you to interpret the results more effectively and make more informed decisions about your investment strategies.

Use Multiple Tools for Comparison

To get a comprehensive view of your potential investment outcomes, consider using multiple investment calculators. Different tools may employ varying methodologies or assumptions, which can provide a broader range of projections. By comparing results from several calculators, you can identify trends and gain a more nuanced understanding of your potential financial future. This practice will also help you recognize outliers and give you more confidence in your planning.

Experiment with Different Scenarios

Investment calculators often allow you to simulate various scenarios by adjusting your inputs. Take advantage of this feature to see how changes in your contributions, retirement age, or expected returns can impact your final savings. For example, you could test how saving an extra $100 per month affects your total at retirement. This exploratory approach not only aids in understanding the calculator’s functionality but also helps you discover the best savings strategies tailored to your financial goals.

Consult a Financial Professional

While online calculators are valuable tools, they should not replace personalized financial advice. For tailored guidance, consider consulting with a financial professional. A knowledgeable advisor can help you interpret the results from your calculations, take into account your unique financial situation, and assist you in creating a solid investment plan. This partnership can provide additional insights that calculators alone cannot offer, leading to more informed and effective investment decisions.

By following these tips, you can maximize the accuracy and utility of investment calculators, helping you make more informed decisions about your financial future.

Frequently Asked Questions (FAQs)

1. What is the purpose of an investment calculator like Dave Ramsey’s?

An investment calculator, such as the one offered by Dave Ramsey, is designed to help individuals estimate the potential growth of their investments over time. By inputting variables like current age, retirement age, current investment amounts, monthly contributions, and expected annual returns, users can gain insights into how much their investments may be worth when they retire. This tool is particularly beneficial for setting financial goals and assessing whether you are on track to meet your retirement aspirations.

2. How do I use the investment calculator effectively?

To use the investment calculator effectively, follow these steps:

1. Input Your Current Age: Enter your current age to determine how many years you have until retirement.

2. Set Your Retirement Age: Specify the age at which you plan to retire. This will help the calculator understand your investment horizon.

3. Enter Current Investments: Provide the total amount of money you currently have in all investment accounts, such as 401(k)s, IRAs, or mutual funds.

4. Monthly Contributions: Specify how much you plan to contribute each month. A common recommendation is to invest around 15% of your income.

5. Expected Annual Return: Estimate the annual return on your investments. Historical returns for the S&P 500 range from 10% to 12%, which can serve as a guideline.

Once you have entered this information, click on the “Calculate” button to see your estimated retirement savings.

3. What factors can affect the accuracy of the investment calculator results?

The accuracy of the results from an investment calculator can be influenced by several factors, including:

– Assumed Rate of Return: The estimated annual return you input can significantly impact the final results. If your expectations are too optimistic or pessimistic, the outcome will reflect that.

– Inflation: Failing to account for inflation can give a misleading impression of your purchasing power in the future.

– Changes in Contributions: If your ability to contribute varies over time due to changes in income or expenses, the calculator’s projections may not align with reality.

– Market Volatility: The calculator assumes a steady rate of return, but markets can be unpredictable, which can affect actual investment performance.

4. Can I rely solely on the investment calculator for my retirement planning?

While an investment calculator is a valuable tool for estimating potential growth and setting goals, it should not be your only resource for retirement planning. It’s essential to consider a comprehensive financial strategy that includes:

– Consultation with Financial Advisors: Engaging with investment professionals can provide personalized advice tailored to your financial situation and goals.

– Regular Reviews: Periodically reassessing your investment strategy and contributions based on life changes, market conditions, and financial goals is crucial.

– Diversification: Understanding different investment vehicles and diversifying your portfolio can help mitigate risks and improve potential returns.

5. What should I do if my calculator results indicate I’m not on track for retirement?

If the investment calculator indicates that you may not be on track to meet your retirement goals, consider taking the following steps:

– Increase Monthly Contributions: If possible, increase the amount you contribute each month to boost your investment growth.

– Adjust Your Retirement Age: Extending your working years can provide more time for your investments to grow and may reduce the amount you need to save.

– Review Your Investment Strategy: Look into diversifying your investments or changing your asset allocation to potentially increase returns.

– Consult a Financial Advisor: Seek professional guidance to develop a more robust financial plan and make informed decisions regarding your investments.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.