Free Investment Property Calculators: Our Top 5 Picks for 2025

Finding the Best Investment Property Calculator: An Introduction

When it comes to investing in real estate, the numbers can often feel overwhelming. With various expenses, potential income streams, and market fluctuations to consider, it’s crucial to have a reliable tool that can help you analyze potential investment properties. However, finding a good investment property calculator can be a challenge. Many calculators promise to simplify the process but fall short on accuracy, features, or user-friendliness, leaving investors frustrated and unsure about their decisions.

The Goal of This Article

This article aims to review and rank the top investment property calculators available online, saving you time and effort in your search. We will explore a range of tools that cater to different needs and preferences, ensuring that you can find one that fits your investment strategy. Whether you are a seasoned investor or just starting, having the right calculator can make a significant difference in your investment outcomes.

Criteria for Ranking

To provide you with a comprehensive overview, we have established specific criteria for evaluating these calculators. Key factors include:

- Accuracy: The calculator’s ability to provide precise calculations based on the data you input.

- Ease of Use: A user-friendly interface that allows you to navigate the tool effortlessly.

- Features: The range of functionalities offered, such as support for multiple property types, detailed expense tracking, and various financial metrics.

- Accessibility: Availability of the tool across different devices and platforms.

By focusing on these criteria, we aim to help you make an informed choice and select the best investment property calculator that aligns with your investment goals.

Our Criteria: How We Selected the Top Tools

Selection Criteria for Investment Property Calculators

When evaluating the best investment property calculators available online, we focused on several key criteria to ensure that users can find a tool that meets their needs effectively. Here’s a breakdown of the essential factors we considered:

-

Accuracy and Reliability

– The calculators must provide accurate results based on the inputs provided by the user. This includes precise calculations of metrics like Net Operating Income (NOI), Cash Flow, and Capitalization Rates. Reliable tools are essential for making informed investment decisions. -

Ease of Use

– User experience is crucial. We prioritized calculators that are intuitive and straightforward, allowing users to input data easily without a steep learning curve. A clean interface and clear instructions help users navigate the tool effectively. -

Key Features

– The best calculators should include a comprehensive range of inputs that cover all aspects of real estate investments. Some important features we looked for include:- Purchase Price and Down Payment: Essential for calculating mortgage details.

- Interest Rate and Loan Term: To determine monthly payments and overall financing costs.

- Recurring Expenses: Inputs for property taxes, insurance, maintenance, and management fees.

- Income Projections: Options to enter expected rental income, vacancy rates, and additional income sources (like laundry or parking fees).

- Selling Costs: Features that allow users to estimate potential profits from selling the property.

-

Cost (Free vs. Paid)

– We assessed whether the calculators are free to use or require payment. Free tools are beneficial for casual users or beginners, while premium options may offer advanced features and more detailed analysis, which can be worth the investment for serious investors. -

Comprehensive Reporting

– The ability to generate detailed reports summarizing the calculations and key metrics is important. This helps users visualize their investment potential and make informed decisions based on comprehensive data. -

Educational Resources

– Tools that provide additional learning resources, such as articles, tutorials, or videos, help users understand real estate investment concepts better. This is particularly beneficial for novice investors looking to enhance their knowledge. -

Compatibility and Accessibility

– We considered how well the calculators perform across various devices, including desktops, tablets, and smartphones. A responsive design ensures that users can access the tool anytime, anywhere.

By focusing on these criteria, we aimed to present a selection of investment property calculators that cater to both novice and experienced investors, ensuring they have the tools necessary to make informed financial decisions in the real estate market.

The Best Investment Property Calculators of 2025

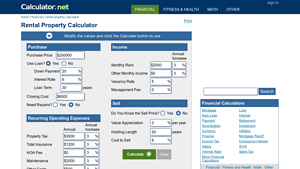

1. Rental Property Calculator

The Rental Property Calculator from Calculator.net is a valuable tool for real estate investors and landlords, designed to provide essential financial insights into rental properties. This free online calculator estimates key metrics such as Internal Rate of Return (IRR), capitalization rate, and cash flow, helping users evaluate the profitability and performance of their investment properties. Its straightforward interface makes it accessible for both novice and experienced investors.

- Website: calculator.net

- Established: Approx. 27 years (domain registered in 1998)

2. Real Estate Calculator For Analyzing Investment Property

The Real Estate Calculator for Analyzing Investment Property on Financial Mentor is designed to help investors assess the viability of rental properties. It calculates essential metrics such as key operating ratios, capitalization rate (cap rate), and cash flow, providing a comprehensive overview of an investment’s potential. Additionally, the tool offers printable results, making it convenient for users to keep track of their analyses and make informed decisions.

- Website: financialmentor.com

- Established: Approx. 26 years (domain registered in 1999)

4. Rental Real Estate Investment Calculator

The Rental Real Estate Investment Calculator from BiggerPockets is a robust tool designed to help investors assess the profitability of rental properties. It offers a comprehensive analysis by incorporating essential expenses such as property taxes, insurance, and maintenance costs, enabling users to make informed investment decisions. With its user-friendly interface, this calculator simplifies the evaluation process, ensuring that potential investors can easily gauge the financial viability of their real estate ventures.

- Website: biggerpockets.com

- Established: Approx. 22 years (domain registered in 2003)

5. 5 Best Rental Property Calculators for Real Estate Investors

In the article “5 Best Rental Property Calculators for Real Estate Investors,” Clozers highlights essential tools designed to help real estate investors evaluate potential rental properties. The review features calculators from Coffee Clozers, Bigger Pockets, Zillow, Financial Mentor, and Rental Analysis Google, each offering unique functionalities such as cash flow analysis, ROI calculations, and comprehensive financial metrics, enabling investors to make informed decisions in their property investments.

- Website: coffeeclozers.com

- Established: Approx. 3 years (domain registered in 2022)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using an investment property calculator, accuracy begins with the information you provide. Take the time to thoroughly review all your inputs, including purchase price, down payment, interest rate, and any ongoing expenses. Even small errors in these figures can lead to significantly skewed results. For example, miscalculating your annual property tax or management fee can alter your net operating income (NOI) and ultimately affect your cash flow analysis. Always double-check your entries to ensure they reflect realistic and current market conditions.

Understand the Underlying Assumptions

Every investment property calculator operates on a set of assumptions that can greatly impact the results. Familiarize yourself with these assumptions, such as average appreciation rates, vacancy rates, and typical operating expenses. For instance, some calculators may use a standard 50% rule for operating expenses, while others might suggest different benchmarks based on the type of property or market conditions. Understanding these assumptions will help you interpret the results more effectively and make adjustments that better align with your specific investment scenario.

Use Multiple Tools for Comparison

No single calculator can capture every nuance of your investment strategy. To obtain the most accurate and comprehensive analysis, consider using multiple online calculators. Each tool may offer unique features or ratios that can provide different insights into your investment. For instance, one calculator may emphasize cash-on-cash return, while another focuses on internal rate of return (IRR). By cross-referencing results from various tools, you can identify inconsistencies and gain a more rounded perspective on the potential success of your investment property.

Keep an Eye on Market Trends

Investment property calculators rely on historical data and averages to generate projections. However, real estate markets can be volatile and influenced by various external factors, such as economic conditions, interest rates, and local market trends. Stay informed about current market conditions and consider how they might affect the assumptions built into the calculators. For example, if you anticipate a rise in interest rates, adjust your inputs accordingly to see how it impacts your cash flow and overall return on investment.

Consult with Real Estate Professionals

While online calculators are valuable tools for preliminary analysis, they should not replace professional advice. Engaging with real estate professionals—such as agents, appraisers, and financial advisors—can provide you with insights that calculators may overlook. They can help you understand market dynamics, identify potential pitfalls, and refine your financial assumptions based on their experience. This additional layer of expertise can enhance your investment strategy and lead to more informed decisions.

By following these guidelines, you can maximize the accuracy and effectiveness of online investment property calculators, ultimately leading to better investment outcomes.

Frequently Asked Questions (FAQs)

1. What is an investment property calculator, and how does it work?

An investment property calculator is a financial tool designed to help real estate investors analyze the potential profitability of a property. By inputting data such as purchase price, down payment, interest rate, operating expenses, and projected rental income, the calculator provides key metrics like cash flow, return on investment (ROI), and capitalization rate. This data helps investors make informed decisions about whether a property is a good investment.

2. Why should I use an investment property calculator?

Using an investment property calculator can save you time and reduce the complexity of analyzing potential real estate investments. It allows you to quickly evaluate multiple properties by providing essential financial metrics, helping you to compare different investment opportunities efficiently. Additionally, it can help identify potential pitfalls, such as negative cash flow or high operating expenses, before committing to a purchase.

3. What key metrics should I look for in the results?

When using an investment property calculator, you should pay attention to several key metrics:

– Net Operating Income (NOI): This represents the total income generated from the property minus operating expenses.

– Cash Flow: This is the amount of money left after all expenses, including mortgage payments, are deducted from the rental income.

– Capitalization Rate (Cap Rate): This ratio helps you assess the potential return on your investment based on the property’s net income relative to its purchase price.

– Debt Service Coverage Ratio (DSCR): This indicates the property’s ability to cover its debt obligations, a crucial factor for lenders.

– Return on Investment (ROI): This metric helps you understand the profitability of your investment compared to its cost.

4. Can I use an investment property calculator for properties other than residential rentals?

Yes, investment property calculators can be used for various types of real estate investments beyond residential rentals. They can analyze commercial properties, multi-family units, and even vacation rentals. However, it is important to customize the inputs based on the specific characteristics and income-generating potential of the property type you are evaluating.

5. Are investment property calculators free to use?

Many investment property calculators are available for free online, providing users with easy access to essential financial analysis tools. However, some platforms may offer premium features or additional resources at a cost. It’s advisable to compare different calculators to find one that suits your needs without incurring unnecessary expenses. Always ensure that the calculator you choose is user-friendly and provides comprehensive results for effective decision-making.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.