Free Land Financing Calculators: Our Top 5 Picks for 2025

Finding the Best Land Financing Calculator: An Introduction

When it comes to purchasing land, understanding the financial implications is crucial. However, navigating the world of land financing can be daunting, especially when it comes to finding a reliable and efficient land financing calculator. Unlike traditional mortgages, land loans come with unique considerations, such as varying interest rates, down payment requirements, and loan terms. These complexities make it essential to have a trustworthy tool at your disposal to estimate potential costs accurately.

This article aims to save you time and effort by reviewing and ranking the best land financing calculators available online. Our goal is to provide you with a comprehensive overview of the top tools, allowing you to make informed decisions as you venture into land acquisition. We understand that each user has different needs; therefore, our rankings take into account a variety of factors that contribute to the overall effectiveness of these calculators.

Criteria for Ranking

To ensure a fair and thorough evaluation, we employed several criteria in our ranking process:

- Accuracy: We assessed how closely the calculators reflect real-world loan scenarios, ensuring that users receive reliable estimates.

- Ease of Use: User-friendly interfaces and intuitive designs are crucial for effective calculators. We considered how easily users can navigate the tools and input their data.

- Features: Additional functionalities, such as amortization schedules and customizable payment frequencies, were evaluated to enhance user experience and decision-making.

- Support and Resources: We also looked at the availability of educational resources or customer support that can assist users in understanding land financing better.

By focusing on these criteria, we aim to equip you with the best calculators to streamline your land financing process, ultimately making your investment decisions more straightforward and informed.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting Land Financing Calculators

When it comes to choosing the best land financing calculators, we evaluated a variety of tools based on several essential criteria. This approach ensures that we recommend calculators that not only meet the needs of users but also provide accurate and reliable information. Here are the key factors that influenced our selection:

-

Accuracy and Reliability

– The primary purpose of a financing calculator is to provide accurate estimates of loan payments and total financing costs. We prioritized tools that have a strong reputation for reliability and use up-to-date interest rates and financial models. Each calculator should clearly state any assumptions made in the calculations. -

Ease of Use

– User-friendliness is crucial for any online tool. We selected calculators that feature intuitive interfaces, making it easy for users of all experience levels to input their data and interpret the results. Clear instructions and a straightforward design enhance the overall user experience. -

Key Features

– A comprehensive land financing calculator should include various inputs to cater to different user needs. We looked for calculators that allow users to input:- Loan Amount: The total amount being financed.

- Interest Rate: The annual percentage rate for the loan.

- Loan Term: The duration of the loan, typically expressed in years.

- Down Payment: The upfront payment made towards the purchase.

- Amortization Type: Options for regular amortization or fixed principal payments.

- Payment Frequency: Choices between monthly, quarterly, semiannual, or annual payments.

- The inclusion of these features helps users customize their calculations based on their specific financial scenarios.

-

Cost (Free vs. Paid)

– We evaluated the cost associated with each calculator. While many high-quality calculators are available for free, some offer premium features at a cost. We aimed to highlight tools that provide excellent value, ensuring users can access essential calculations without incurring unnecessary expenses. -

Additional Resources

– We considered calculators that offer supplemental information, such as guides on land financing, tips for improving loan approval chances, and explanations of different loan types. These resources can significantly enhance the user’s understanding of the financing process. -

Mobile Compatibility

– In today’s digital age, having a tool that works well on mobile devices is essential. We favored calculators that are responsive and provide a seamless experience across different devices, allowing users to access them conveniently from anywhere. -

User Reviews and Ratings

– Finally, we took into account user feedback and ratings for each calculator. Tools that have received positive reviews from users regarding their accuracy, ease of use, and overall effectiveness were given priority in our selection process.

By applying these criteria, we aimed to present a curated list of the best land financing calculators that empower users to make informed financial decisions.

The Best Land Financing Calculators of 2025

2. Vacant Land Loan Calculator: 100% Financing Property Purchase …

The Vacant Land Loan Calculator from mortgagecalculator.org is a valuable tool designed to help users estimate their monthly payments and total interest for purchasing vacant land. By inputting essential details such as the purchase price, down payment amount, interest rate, and loan term, users can quickly assess their financing options, making it easier to plan their property investment with 100% financing.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

3. Loan Payment Calculator

The Loan Payment Calculator from Farm Credit Services of America is a user-friendly tool designed to help users calculate their loan payments for agricultural purposes. It allows for customization of payment frequency—monthly, quarterly, semiannual, or annual—and provides access to competitive farm loan rates and terms. This calculator is ideal for farmers and landowners looking to manage their financing effectively and make informed financial decisions.

- Website: fcsamerica.com

- Established: Approx. 27 years (domain registered in 1998)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using an online land financing calculator, the accuracy of the results heavily relies on the information you provide. Take the time to carefully enter the loan amount, interest rate, loan term, and any other relevant details. Small errors in input can lead to significant discrepancies in your estimated payments and total costs. Before hitting the calculate button, review all your entries to ensure they reflect your actual financial situation and goals.

Understand the Underlying Assumptions

Each calculator may have different assumptions built into its algorithm. For instance, some calculators might assume a fixed interest rate while others may consider variable rates. Additionally, they may use different amortization methods, such as regular amortization or fixed principal payments. Familiarize yourself with these assumptions to better interpret the results. Understanding how these factors influence your calculations will help you make more informed decisions regarding your land financing options.

Use Multiple Tools for Comparison

No single calculator can capture every nuance of your financial situation. Therefore, it’s wise to use multiple calculators to compare results. Different tools may offer varying features, such as additional cost breakdowns or different calculation methods. By cross-referencing results from multiple calculators, you can gain a more comprehensive view of your potential loan costs and payments. This approach can also highlight any discrepancies, prompting you to investigate further or adjust your inputs.

Consider Additional Costs

While calculators focus on monthly payments and total loan costs, remember that purchasing land often incurs additional expenses. These may include closing costs, property taxes, insurance, and potential maintenance fees. Ensure you factor these costs into your overall budget, as they can significantly impact your financial planning. Some calculators may allow you to include these additional costs, providing a more accurate picture of your financial commitment.

Consult Financial Advisors

If you’re new to land financing or feel uncertain about the results generated by the calculators, consider consulting a financial advisor or mortgage professional. They can offer personalized insights based on your unique situation and help you interpret the calculator results accurately. This professional guidance can be invaluable in navigating the complexities of land financing and securing the best possible terms for your loan.

Stay Updated on Market Conditions

Interest rates and lending criteria can fluctuate due to economic conditions. Regularly check for updates in the market rates and consider how these changes may affect your financing options. Some calculators allow you to input current rates, but staying informed ensures that your calculations remain relevant and accurate. By keeping an eye on market trends, you can adjust your financing strategy accordingly and make more informed decisions.

Frequently Asked Questions (FAQs)

1. What is a land financing calculator?

A land financing calculator is an online tool that helps users estimate the costs associated with purchasing land, including monthly payments, total interest paid, and overall financing costs. By inputting details such as purchase price, down payment, interest rate, and loan term, users can gain insights into how much they can expect to pay over the life of the loan.

2. How do I use a land financing calculator?

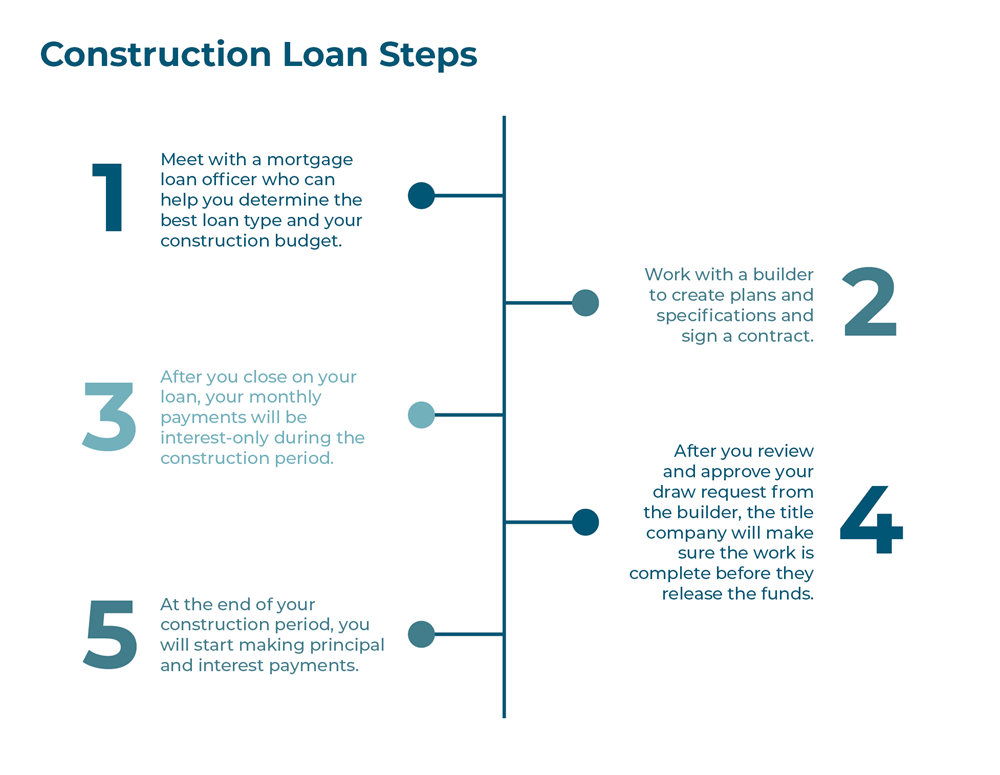

To use a land financing calculator, follow these steps:

1. Enter the purchase price of the land you are considering.

2. Input the down payment amount you plan to make.

3. Specify the interest rate for the loan.

4. Select the loan term (in years) that you are considering.

5. Click the calculate button to view your estimated monthly payment, total interest paid, and total cost of financing.

3. Are the results from a land financing calculator accurate?

While land financing calculators provide useful estimates, the results are based on the information you input and are intended for informational purposes only. Actual loan terms, interest rates, and monthly payments can vary based on lender policies, your credit history, and market conditions. It’s advisable to consult with a financial advisor or lender for precise figures tailored to your specific situation.

4. Can a land financing calculator help me compare different loan options?

Yes, a land financing calculator can be an effective tool for comparing different loan scenarios. By adjusting variables such as the loan amount, interest rate, and term length, you can see how these factors impact your monthly payments and overall costs. This allows you to make more informed decisions about which loan option may be best for your financial situation.

5. What should I consider when using a land financing calculator?

When using a land financing calculator, consider the following:

– Interest Rates: Research current market rates, as they can greatly affect your monthly payment and total interest paid.

– Loan Terms: Different lenders may offer various terms, so it’s important to understand how the length of the loan influences your payments.

– Down Payment: The size of your down payment can significantly impact your financing options and monthly payments.

– Property Type: Understand that loans for raw land may have different terms and conditions compared to improved land.

– Consult a Professional: Always consider seeking advice from a financial advisor or lender to discuss your specific circumstances and options.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.