Free Manufactured Home Loan Calculators: Our Top 5 Picks for 2025

Finding the Best Manufactured Home Loan Calculator: An Introduction

When embarking on the journey of purchasing a manufactured home, one of the most crucial steps is understanding your financing options. However, finding a reliable manufactured home loan calculator can be a daunting task. With countless tools available online, it can be challenging to determine which calculators provide accurate estimates and user-friendly experiences. Many calculators promise quick results but may lack the necessary features or fail to deliver precise calculations, leading to confusion and frustration for potential buyers.

This article aims to simplify your search by reviewing and ranking the top manufactured home loan calculators available online. Our goal is to save you time and help you make informed decisions by providing insights into the most effective tools on the market. We understand that the right calculator can not only give you an accurate estimate of your monthly payments but also help you assess your overall budget and financial readiness.

To ensure a comprehensive evaluation, we considered several criteria when ranking these calculators. Key factors include:

- Accuracy: The precision of the calculations based on the inputs provided, ensuring that users receive realistic estimates.

- Ease of Use: A user-friendly interface that allows for straightforward navigation and quick adjustments to inputs.

- Features: The availability of customizable options, such as varying interest rates, loan terms, and additional costs like property taxes and insurance, which can significantly affect your overall payment.

By the end of this article, you’ll have a curated list of the best manufactured home loan calculators, enabling you to choose the one that best suits your needs and financial situation.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Manufactured Home Loan Calculators

When evaluating the top manufactured home loan calculators, we considered several essential factors to ensure that our recommendations meet the needs of potential borrowers. Here are the key criteria we used in our selection process:

-

Accuracy and Reliability

– Precision of Calculations: The primary function of any loan calculator is to provide accurate estimates of monthly payments based on user inputs. We prioritized tools that consistently deliver reliable calculations based on current interest rates and loan terms.

– Transparency in Results: Tools that clearly outline how the calculations are derived enhance user trust and allow borrowers to make informed decisions. -

Ease of Use

– User-Friendly Interface: A simple and intuitive design is crucial for users unfamiliar with financial terms. We selected calculators that guide users through the input process without overwhelming them with jargon.

– Mobile Compatibility: With many users accessing tools via smartphones, calculators optimized for mobile devices were given preference to ensure accessibility on-the-go. -

Key Features

– Adjustable Inputs: The best calculators allow users to modify essential parameters, such as:- Loan amount

- Interest rate

- Loan term (e.g., 15, 20, or 30 years)

- Down payment amount

- Property taxes and insurance estimates

- Private Mortgage Insurance (PMI) if applicable

- Comparison Capabilities: Tools that enable users to compare different loan scenarios or generate amortization schedules were highly valued, as they provide a comprehensive understanding of potential financial obligations.

-

Cost (Free vs. Paid)

– Accessibility: We focused on free calculators that do not require a subscription or payment to access full features. This ensures that all potential borrowers can utilize these resources without financial barriers.

– Value of Paid Options: If a paid calculator offers unique features or additional benefits, we assessed whether the cost justified the value provided, ensuring users have options that fit their budget.

-

Customer Support and Resources

– Availability of Help: Tools that offer customer support or additional resources, such as FAQs or educational content, were prioritized. This helps users feel supported throughout their loan calculation process.

– Expertise in Manufactured Home Financing: We looked for calculators backed by companies with a strong reputation in manufactured home financing, as this adds credibility and reliability to the tools.

By focusing on these criteria, we aimed to identify the most effective and user-friendly manufactured home loan calculators available online, ensuring that borrowers can confidently navigate their financing options.

The Best Manufactured Home Loan Calculators of 2025

3. Calculator

The Manufactured Home Mortgage Calculator on mhmloan.com is a user-friendly tool designed to help potential homebuyers estimate their monthly mortgage payments. By inputting specific loan details, such as the loan type and down payment amount, users can quickly determine their total payment, exemplified by a scenario showing a payment of $1,523.64 for a conventional loan with no down payment. This calculator simplifies the mortgage planning process for manufactured home buyers.

- Website: mhmloan.com

- Established: Approx. 20 years (domain registered in 2005)

4. Monthly Payment Calculator

The Monthly Payment Calculator from Champion Homes is a user-friendly tool designed to empower homebuyers by providing an estimate of affordable mortgage rates. Users can easily input and adjust various financial values to calculate potential monthly payments, enabling them to make informed decisions throughout their home buying journey. This calculator serves as a valuable resource for prospective homeowners seeking to understand their financing options and budget effectively.

- Website: championhomes.com

- Established: Approx. 25 years (domain registered in 2000)

5. Loan Calculator

The Loan Calculator from National Manufactured Homes is a versatile tool designed to assist users in securing financing for various types of manufactured housing, including mobile home parks, accessory dwelling units (ADUs), and custom homes. This calculator simplifies the loan process by allowing users to explore different financing options, including construction loans, ensuring they can make informed decisions tailored to their specific housing needs.

- Website: nationalmanufacturedhomes.com

- Established: Approx. 5 years (domain registered in 2020)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps in obtaining accurate results from a manufactured home loan calculator is to ensure that all your inputs are correct. This includes the loan amount, interest rate, loan term, and down payment. Even a small error in any of these figures can significantly impact your estimated monthly payment and overall loan cost. Take a moment to double-check your numbers before hitting the calculate button. If you’re unsure about any values, consider researching current interest rates or speaking with a financial advisor.

Understand the Underlying Assumptions

Manufactured home loan calculators often operate under specific assumptions that can affect your results. For example, some calculators may assume a certain property tax rate, insurance cost, or private mortgage insurance (PMI) requirement, which may not apply to your situation. Familiarize yourself with these assumptions and adjust them accordingly to reflect your personal circumstances. If a calculator allows customization of these factors, take advantage of it for a more tailored estimate.

Use Multiple Tools for Comparison

No single calculator can provide a complete picture of your financing options. To get the most accurate results, it’s beneficial to use multiple online calculators. Each tool may have different algorithms, assumptions, or features that can yield varying results. By comparing estimates from different calculators, you can identify any discrepancies and gain a broader understanding of what to expect. This approach also helps you feel more confident in your financial planning.

Review Additional Costs

When calculating your monthly payment, it’s essential to consider all potential costs associated with your manufactured home loan. This includes not only the principal and interest but also property taxes, homeowners insurance, and any applicable PMI. Some calculators allow you to input these additional expenses, providing a more comprehensive view of your financial obligations. Make sure to include these costs to avoid surprises down the line.

Consult with a Financial Advisor

While online calculators are excellent tools for initial estimates, consulting with a financial advisor can provide personalized insights and guidance tailored to your situation. A professional can help clarify complex terms, offer advice on loan types, and assist in understanding the impact of your financial decisions. This additional layer of expertise can help ensure that you are making informed choices about your manufactured home financing.

Stay Updated on Market Trends

Interest rates and lending criteria can change frequently. To ensure you are using the most accurate information, stay informed about current market trends. Regularly check financial news, lender websites, or consult with mortgage professionals to get the latest updates. This knowledge will enable you to make well-informed decisions and use the calculators more effectively.

By following these tips, you can maximize the accuracy of the results you obtain from manufactured home loan calculators, empowering you to make informed financial decisions.

Frequently Asked Questions (FAQs)

1. How does a manufactured home loan calculator work?

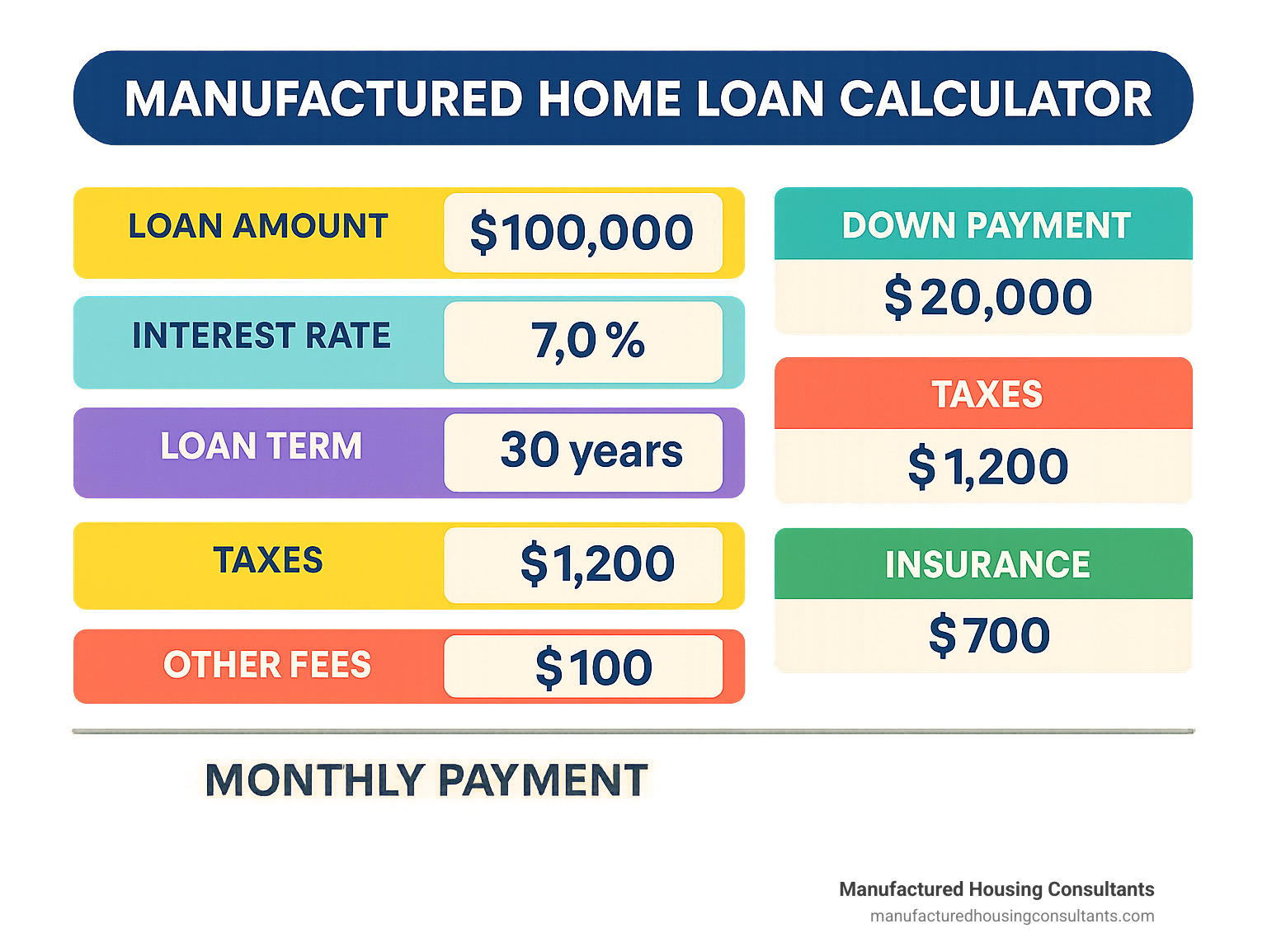

A manufactured home loan calculator is an online tool that helps prospective buyers estimate their monthly mortgage payments based on various inputs. Users can enter information such as the loan amount, interest rate, loan term, down payment, property taxes, and insurance. The calculator processes this data to provide an estimated monthly payment, allowing users to better understand their financing options and budget accordingly.

2. What factors can I adjust in a manufactured home loan calculator?

Most manufactured home loan calculators allow users to adjust several key factors to tailor the estimates to their specific situation. These factors typically include the loan amount, interest rate, loan term (e.g., 15, 20, or 30 years), down payment amount, property taxes, homeowners insurance, and possibly private mortgage insurance (PMI). By modifying these inputs, users can see how different scenarios affect their monthly payments.

3. Is the estimate provided by a manufactured home loan calculator accurate?

While a manufactured home loan calculator can provide a good estimate of potential monthly payments, it is important to remember that these calculations are based on the information entered by the user. The results are approximations and may not reflect actual loan terms or conditions from lenders. For a more accurate assessment, it is advisable to consult with a mortgage professional who can consider your unique financial situation.

4. Can I use a manufactured home loan calculator for different types of loans?

Yes, many manufactured home loan calculators are designed to accommodate various loan types, including FHA, VA, USDA, and conventional loans. Users can often adjust inputs to reflect the specific terms and requirements associated with these different loan programs, helping them explore the best financing options available for their manufactured home purchase.

5. Do I need to provide personal information to use a manufactured home loan calculator?

No, most manufactured home loan calculators do not require users to input personal information to generate estimates. Users can typically access these calculators anonymously and input only the necessary financial data related to their loan scenario. However, if you decide to proceed with a loan application or seek personalized advice, you will need to share personal information with the lender or mortgage professional.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.