Free Missouri Car Sales Tax Calculators: Our Top 5 Picks for 2025

Finding the Best Missouri Car Sales Tax Calculator: An Introduction

Navigating the complexities of sales tax calculations can be a daunting task, especially when it comes to purchasing a vehicle in Missouri. With varying tax rates across different counties and cities, understanding how much sales tax will be applied to your car purchase is crucial for budgeting and financial planning. Unfortunately, not all online tools provide the same level of reliability, accuracy, or user-friendliness, making it challenging to find a dependable Missouri car sales tax calculator.

The goal of this article is to review and rank the top Missouri car sales tax calculators available online, ultimately saving you time and effort in your search for the right tool. Whether you are a potential car buyer, a dealership, or simply someone looking to understand the tax implications of a vehicle purchase, having access to a reliable calculator is essential.

To ensure a comprehensive evaluation, we employed specific criteria in our ranking process. Key factors include accuracy, as it is vital that the calculators provide precise tax calculations based on current rates; ease of use, which assesses how intuitive and user-friendly each tool is; and features, which looks at additional functionalities such as tax breakdowns and the ability to account for various exemptions. By considering these aspects, we aim to present you with a curated list of the best Missouri car sales tax calculators that meet your needs effectively and efficiently.

Our Criteria: How We Selected the Top Tools

How We Selected the Top Tools

When evaluating the best Missouri car sales tax calculators, we focused on several key criteria to ensure that users have access to the most effective and user-friendly tools available. Here’s a breakdown of the factors we considered:

-

Accuracy and Reliability

– It is crucial that the calculators provide accurate tax calculations based on current Missouri tax laws. We verified that the tools use up-to-date tax rates, including state, county, city, and special district taxes. The ability to reflect changes in tax legislation ensures users receive precise calculations. -

Ease of Use

– A user-friendly interface is essential for an effective calculator. We assessed how intuitive the tools are, including the simplicity of navigation and the clarity of instructions. Tools that minimize user input errors and provide straightforward steps for calculation were prioritized. -

Key Features

– Effective calculators should include specific inputs relevant to Missouri car sales tax, such as:- Sale Amount: The total price of the vehicle before tax.

- ZIP Code or Tax Region: Options to calculate tax based on geographic location to capture local tax rates accurately.

- Tax Breakdown: The ability to display individual tax rates (state, county, city) and the total tax amount.

- Total Calculation: A clear presentation of the total amount due, combining the sale price and calculated tax.

-

Cost (Free vs. Paid)

– We prioritized free tools that offer comprehensive features without requiring payment. While some paid options may provide additional services, our focus was on accessibility for all users. We evaluated the value of any paid features against the free options available. -

Additional Resources and Support

– We looked for calculators that provide educational resources, such as tax rate explanations or FAQs, to help users understand the complexities of Missouri sales tax. Tools that offer customer support or contact options for further assistance were also considered beneficial.

-

User Feedback and Reviews

– We analyzed user reviews and feedback to gauge overall satisfaction with each calculator. Tools that consistently received positive feedback for accuracy, ease of use, and customer service were given higher consideration. -

Mobile Compatibility

– In today’s digital landscape, it’s important that calculators work seamlessly on various devices, including smartphones and tablets. We evaluated whether the tools are optimized for mobile use, ensuring that users can access them conveniently from anywhere.

By considering these criteria, we aimed to compile a list of Missouri car sales tax calculators that are not only functional and reliable but also easy to use for a wide range of users, from car buyers to dealers.

The Best Missouri Car Sales Tax Calculators of 2025

3. Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator by TimeTrex is a user-friendly tool designed to help users accurately calculate sales tax based on ZIP code or region. This calculator provides precise rates and tax amounts, making it an essential resource for businesses and individuals looking to ensure compliance with Missouri’s tax regulations. Its straightforward interface allows for quick and efficient calculations, streamlining the tax assessment process.

- Website: timetrex.com

- Established: Approx. 21 years (domain registered in 2004)

4. Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator from Omni Calculator is a user-friendly tool designed to help individuals estimate the sales tax on their purchases in Missouri. By simply entering the purchase amount, users can quickly calculate the applicable sales tax, making it easier to budget for expenses. This calculator is particularly useful for residents and visitors alike who want to ensure accurate financial planning when shopping in the state.

- Website: omnicalculator.com

- Established: Approx. 11 years (domain registered in 2014)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a Missouri car sales tax calculator, accuracy starts with the inputs you provide. Make sure to enter the correct sale amount and choose the appropriate ZIP code or tax region. A simple typographical error can lead to significant discrepancies in your tax calculations. To avoid mistakes, take a moment to review your entries before hitting the “Calculate” button. If you’re unsure about the sale amount, consider verifying it with the seller or referencing any available documentation.

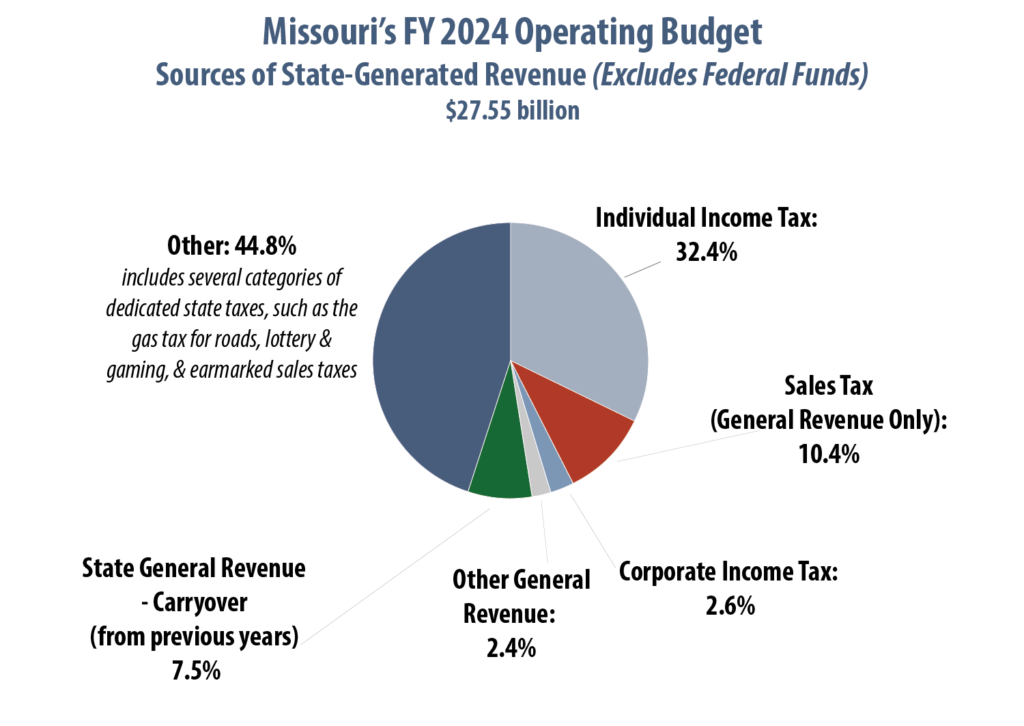

Understand the Underlying Assumptions

Different calculators may use various assumptions regarding tax rates and exemptions. Familiarize yourself with the current Missouri sales tax rates, which include state, county, city, and any applicable special district taxes. Keep in mind that these rates can fluctuate based on local legislation, so it’s essential to stay updated on any changes that might impact your calculation. Additionally, some calculators may automatically factor in exemptions for specific purchases, while others may require you to manually input this information. Knowing how the calculator works will help you interpret the results more accurately.

Use Multiple Tools for Comparison

For the most reliable results, consider using multiple Missouri car sales tax calculators. Different tools may have slight variations in their calculations due to differences in data sources or updates. By cross-referencing results from several calculators, you can identify any inconsistencies and arrive at a more accurate estimate. This practice not only helps ensure you’re getting the right figures but also provides peace of mind that you’re accounting for all relevant tax components.

Review the Tax Breakdown

After calculating your sales tax, take the time to review the breakdown provided by the calculator. Understanding the individual components of the total tax amount—including state, county, city, and special district taxes—will give you a clearer picture of what you’re paying. This information can be particularly useful if you need to dispute a charge or if you’re budgeting for future purchases. It also helps you understand how different locations can impact your overall tax burden.

Stay Informed About Exemptions

Certain purchases in Missouri may qualify for tax exemptions, which can significantly affect the total tax amount. Familiarize yourself with common exemptions related to car sales, such as those for agricultural vehicles or resale transactions. If you believe you qualify for an exemption, check if the calculator you are using allows you to input this information. Always verify the current exemption laws, as they can change and may not be reflected in all calculators.

Keep Records

Finally, maintain a record of your calculations and any relevant documentation related to your vehicle purchase. This information can be valuable for future reference, especially if you need to address tax-related questions or issues later on. Keeping thorough records will also help you stay organized when it comes time to file taxes or report any changes to your financial situation.

By following these tips, you can maximize the accuracy and reliability of your Missouri car sales tax calculations, helping you make informed financial decisions.

Frequently Asked Questions (FAQs)

1. What is a Missouri car sales tax calculator?

A Missouri car sales tax calculator is an online tool designed to help individuals and businesses calculate the sales tax on vehicle purchases in Missouri. By entering the sale amount and either a ZIP code or tax region, users can quickly determine the total sales tax owed, as well as the combined tax rate that includes state, county, and city taxes.

2. How do I use a Missouri car sales tax calculator?

Using a Missouri car sales tax calculator is straightforward. First, you need to select a ZIP code or tax region where the vehicle purchase will take place. Then, enter the sale amount before tax in the designated field. After you click the “Calculate Tax” button, the tool will display the estimated combined tax rate, a breakdown of the individual tax components (state, county, city, and special taxes), the total tax amount, and the final amount due including tax.

3. Why is it important to calculate car sales tax in Missouri?

Calculating car sales tax in Missouri is essential for ensuring compliance with state tax laws and for budgeting the total cost of a vehicle purchase. Sales tax rates can vary significantly by location due to additional county and city taxes. Accurately calculating the tax helps avoid unexpected expenses and ensures that buyers are prepared for the total cost of their vehicle.

4. Are there any exemptions to Missouri car sales tax?

Yes, Missouri offers various sales tax exemptions that may apply to vehicle purchases. For example, certain agricultural vehicles may be exempt from sales tax if used exclusively for agricultural purposes. Additionally, nonprofit organizations and government entities often have exemptions. It’s important to check if your purchase qualifies for any exemptions to potentially reduce the sales tax owed.

5. Can I use a Missouri car sales tax calculator for online vehicle purchases?

Yes, you can use a Missouri car sales tax calculator for online vehicle purchases as long as you know the relevant tax region or ZIP code where the vehicle will be registered. This is particularly useful for individuals buying vehicles from out-of-state dealerships or online platforms, as it helps to ensure they account for the correct tax rates applicable in Missouri.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.