Free Psers Retirement Calculators: Our Top 5 Picks for 2025

Finding the Best Psers Retirement Calculator: An Introduction

Finding the right retirement calculator for the Public School Employees’ Retirement System (PSERS) can be a daunting task. With a variety of options available online, it’s essential to identify a reliable tool that accurately reflects your unique retirement circumstances. Many users struggle with understanding the intricate details of their pension plans, such as eligibility requirements, benefit calculations, and the nuances between different retirement options. This complexity can make it challenging to choose a calculator that not only meets your needs but also provides clear, actionable insights.

The goal of this article is to simplify this process by reviewing and ranking the top PSERS retirement calculators available online. We aim to save you time and effort by presenting a curated list of tools that have been evaluated based on several key criteria.

Criteria for Ranking

-

Accuracy: The primary function of any retirement calculator is to provide precise estimates of your pension benefits. We examined each tool’s ability to deliver reliable calculations based on PSERS guidelines.

-

Ease of Use: A user-friendly interface can significantly enhance your experience. We considered how intuitive each calculator is, including the clarity of instructions and the simplicity of the input process.

-

Features: Different calculators offer varying functionalities, such as the ability to factor in additional variables like years of service, salary history, and different retirement options. We assessed the range of features that each tool provides to cater to diverse user needs.

By focusing on these criteria, this article aims to equip you with the information necessary to make an informed choice about which PSERS retirement calculator will best serve your retirement planning needs.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best PSERS Retirement Calculators

When evaluating the top PSERS retirement calculators, we considered a variety of factors to ensure they meet the needs of users looking for accurate and helpful retirement planning tools. Below are the key criteria that guided our selection process:

-

Accuracy and Reliability

– The calculators must provide precise estimates based on the latest PSERS regulations and benefit calculations. This includes adherence to the rules governing eligibility, benefit factors, and service years.

– We looked for tools that have been verified by financial experts or have a strong reputation among users for delivering reliable results. -

Ease of Use

– A user-friendly interface is crucial. The calculators should be intuitive, allowing users to navigate easily without needing extensive technical knowledge.

– Clear instructions and explanations should accompany each input field, helping users understand what information is required and why it matters. -

Key Features

– Comprehensive input options are essential for accurate calculations. The calculators should allow users to input:- Years of service

- Age at retirement

- Final average salary (FAS)

- Selected retirement option (e.g., single life, survivorship options)

- Any additional factors that might affect pension calculations, such as early retirement or partial lump-sum options.

- The ability to simulate various retirement scenarios (e.g., adjusting retirement age or salary projections) can provide valuable insights into potential outcomes.

-

Cost (Free vs. Paid)

– We assessed whether the tools are free to use or require a subscription or one-time payment. Free tools are generally more accessible, but we also considered the value of paid options that might offer advanced features or personalized guidance.

– Transparency regarding any fees or charges associated with the calculators is vital to ensure users can make informed decisions. -

Customer Support and Resources

– The availability of customer support or guidance is an important factor. Tools that offer FAQs, tutorials, or direct assistance can help users who may have questions or need clarification.

– Additional resources, such as educational articles or access to financial advisors, enhance the overall value of the tool by aiding users in understanding their retirement options. -

User Reviews and Testimonials

– We examined user feedback and testimonials to gauge overall satisfaction and effectiveness. Tools with a high volume of positive reviews tend to indicate reliability and user trust.

– User experiences can provide insights into potential drawbacks or limitations of a calculator that may not be immediately apparent.

By applying these criteria, we ensured that the recommended PSERS retirement calculators not only meet the basic functional requirements but also empower users to make informed retirement planning decisions.

The Best Psers Retirement Calculators of 2025

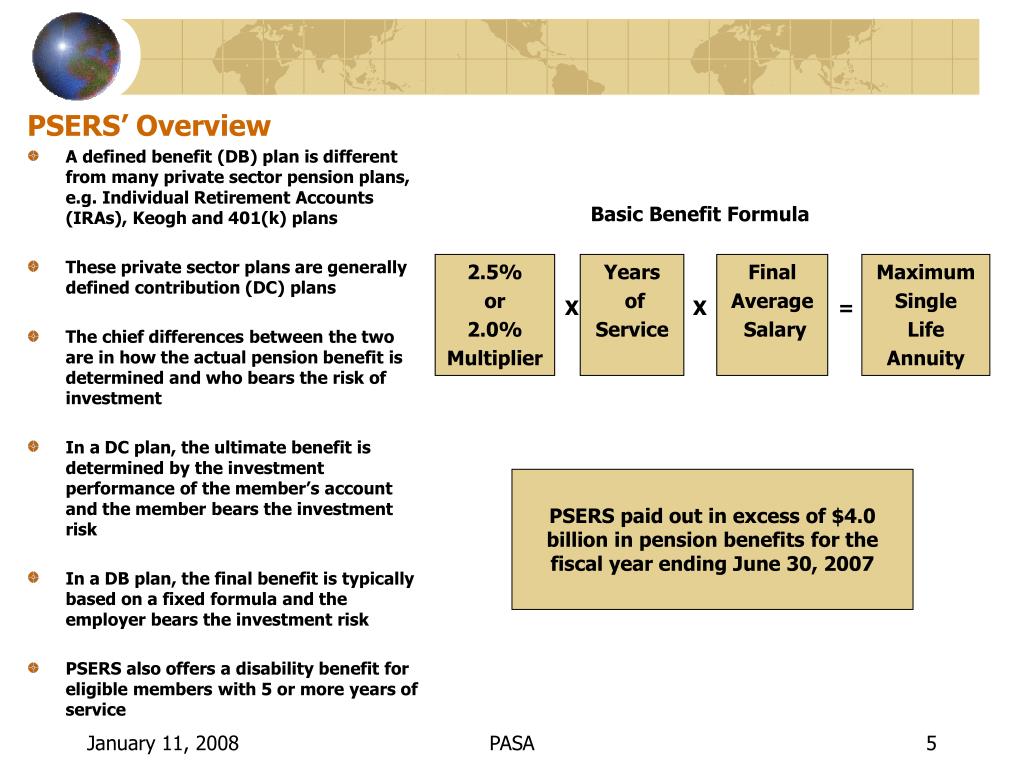

1. Retirement Estimate Calculator

The Retirement Estimate Calculator provided by the Commonwealth of Pennsylvania allows users to generate personalized retirement estimates by logging into their PSERS Member Self-Service (MSS) account. This tool is designed to help members of the Pennsylvania Public School Employees’ Retirement System (PSERS) plan for their financial future by offering tailored projections based on individual service records and contribution data, making it a valuable resource for effective retirement planning.

- Website: pa.gov

- Established: Approx. 24 years (domain registered in 2001)

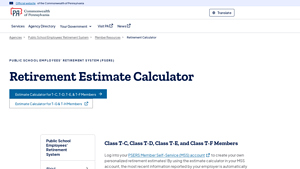

2. the Generic PSERS Retirement Benefit Calculator

The Generic PSERS Retirement Benefit Calculator, available at PA.Gov, is designed to help members of the Pennsylvania Public School Employees’ Retirement System estimate their potential retirement benefits. This user-friendly tool allows individuals to explore various retirement options by inputting both current and future dates, providing general estimates that assist in planning for retirement. Its focus on flexibility and accessibility makes it a valuable resource for PSERS members.

- Website: psersapps.pa.gov

- Established: Approx. 24 years (domain registered in 2001)

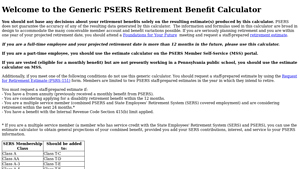

3. Eligibility and Calculations

The “Eligibility and Calculations” tool on psrs-peers.org is designed to help users determine their eligibility for early retirement benefits under the 25-and-Out formula. It provides clear guidelines for individuals under age 55 who have accrued between 25 and 30 years of service. This tool simplifies the retirement planning process by offering essential calculations and eligibility criteria, making it easier for users to assess their retirement options effectively.

- Website: psrs-peers.org

- Established: Approx. 20 years (domain registered in 2005)

4. Understanding PSERS Retirement Options

The “Understanding PSERS Retirement Options” tool by Menninger & Associates is designed to help users navigate the Pennsylvania Public School Employees’ Retirement System (PSERS) retirement process. It features a BASIC PSERS retirement formula that calculates retirement benefits based on the Final Average Salary (FAS), years of service, and a specific multiplier. Additionally, the tool includes a PSERS retirement tax calculator, providing essential insights for planning a secure financial future.

- Website: maaplanning.com

- Established: Approx. 7 years (domain registered in 2018)

5. PSERS Plan 2

The PSERS Plan 2 Benefit Estimator, offered by the Department of Retirement Systems, is a user-friendly online tool designed to help members quickly estimate their retirement benefits. By accessing their personalized account, users can input their years of service and other relevant information to receive an accurate projection of their total pension amount. This efficient tool simplifies retirement planning, making it accessible and straightforward for individuals preparing for their future.

- Website: drs.wa.gov

- Established: Approx. 28 years (domain registered in 1997)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a PSERS retirement calculator, the accuracy of your results heavily relies on the data you input. Take the time to carefully enter your information, including your age, years of service, salary, and any relevant contributions. Even a small mistake can lead to significant discrepancies in your retirement estimates. After entering your details, review them thoroughly before hitting ‘calculate.’ If the tool offers a summary of your inputs, use this feature to ensure everything is correct.

Understand the Underlying Assumptions

Each retirement calculator may operate under different assumptions regarding factors like salary growth, inflation rates, and retirement age. Familiarize yourself with these assumptions, as they can greatly influence your projected retirement benefits. For instance, some calculators may assume a constant salary, while others might factor in potential raises. Understanding these assumptions helps you interpret the results more accurately and provides a clearer picture of what to expect in retirement.

Use Multiple Tools for Comparison

No single calculator is perfect; they all have their strengths and weaknesses. To get a comprehensive understanding of your retirement options, consider using multiple PSERS retirement calculators. By comparing results across different tools, you can identify any significant variances and better gauge what to expect. This approach can also help you spot potential errors or omissions in your inputs. Each calculator might present unique features or methods of calculation that could yield different insights into your retirement planning.

Keep Your Information Updated

Your retirement situation can change over time due to various factors such as salary increases, changes in employment, or shifts in retirement goals. To maintain accurate projections, make it a habit to regularly update your information in the calculators you use. This ensures that the estimates reflect your current situation and allow you to make informed decisions regarding your retirement planning.

Consult a Financial Advisor

While online calculators are valuable tools, they should not be your sole resource for retirement planning. If you have complex financial situations or specific questions about your PSERS benefits, consider consulting a financial advisor who specializes in retirement planning. They can provide personalized advice, help you understand the implications of different retirement options, and assist in creating a comprehensive plan tailored to your needs.

Document Your Findings

After using the calculators, document the results and any insights you gather. This record will be beneficial for future reference and can help you track changes over time. Include notes on how each calculator operates, the assumptions made, and any advice you received from financial advisors. This documentation can serve as a foundation for ongoing discussions about your retirement strategy, helping you stay organized and focused as you approach retirement.

Frequently Asked Questions (FAQs)

1. What is a PSERS retirement calculator?

A PSERS retirement calculator is an online tool designed to help members of the Pennsylvania Public School Employees’ Retirement System (PSERS) estimate their retirement benefits. By inputting personal information such as years of service, final average salary, and retirement age, users can receive a projection of their monthly pension benefits, including options for early retirement, full retirement, and various payout structures.

2. How do I use a PSERS retirement calculator?

To use a PSERS retirement calculator, you typically need to provide specific details about your employment and earnings history. This may include your current age, years of service with PSERS, your highest salary over a three-year period, and your planned retirement age. Once you enter this information, the calculator will process the data to provide an estimate of your monthly pension benefits based on the PSERS formulas and rules.

3. Can a PSERS retirement calculator give me an exact amount for my benefits?

No, a PSERS retirement calculator provides estimates rather than exact amounts. The results are based on the information you input and the assumptions made within the calculator, such as salary growth and future changes to the pension plan. It’s important to remember that actual benefits can vary due to factors like changes in legislation, your employment status, and adjustments made by PSERS.

4. Are there different calculators for old and new PSERS plans?

Yes, there are different calculators for the old and new PSERS plans, as the benefit structures and contribution rates differ significantly between the two. Members who joined PSERS before July 1, 2011, fall under the old plan, while those who joined after this date are subject to the new plan rules. It’s essential to use the correct calculator corresponding to your plan to get the most accurate estimates.

5. What factors should I consider when using a PSERS retirement calculator?

When using a PSERS retirement calculator, consider several key factors that can influence your benefits:

– Years of Service: More years typically lead to higher benefits.

– Final Average Salary: This is based on your highest three years of earnings, so be sure to input accurate figures.

– Retirement Age: Early retirement may result in reduced benefits.

– Pension Options: Different payout options (e.g., single life, survivor benefits) can affect your monthly amounts.

– Future Contributions: If you plan to continue working or contributing to the system, this can impact your final benefits.

Understanding these elements will help you use the calculator more effectively and make informed decisions about your retirement planning.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.