Free Ramsey Retirement Calculators: Our Top 5 Picks for 2025

Finding the Best Ramsey Retirement Calculator: An Introduction

When planning for retirement, one of the most crucial steps is understanding how much you need to save and how your investments will grow over time. However, with countless retirement calculators available online, finding a reliable and efficient ‘Ramsey Retirement Calculator’ can be quite a challenge. Not all calculators provide the same level of accuracy, features, or user experience, making it essential to choose the right tool to meet your financial planning needs.

This article aims to simplify that process by reviewing and ranking the top Ramsey retirement calculators available online. By compiling a list of the best tools, we hope to save you time and effort, allowing you to focus on crafting your retirement plan rather than sifting through subpar calculators.

To ensure a comprehensive evaluation, we considered several key criteria in our rankings. Accuracy is paramount; we assessed how well each calculator estimates retirement savings based on the inputs provided. Ease of use was also a significant factor, as a user-friendly interface can make the planning process less daunting. Additionally, we looked at the features offered, such as customizable inputs, projections for different scenarios, and educational resources that enhance the user experience.

Whether you’re just starting to save for retirement or looking to refine your existing plan, our curated list of the best Ramsey retirement calculators will help you make informed decisions and set yourself up for a financially secure future.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Ramsey Retirement Calculators

When evaluating the best Ramsey retirement calculators, we considered several important criteria to ensure that users have access to effective and reliable tools. Below are the key factors that guided our selection process:

-

Accuracy and Reliability

– The foremost criterion is the accuracy of the calculations provided by the tool. A reliable retirement calculator should use up-to-date financial data and proven mathematical formulas to project potential retirement savings accurately. We looked for calculators that offer realistic estimates based on common investment returns and inflation rates. -

Ease of Use

– User experience is critical when selecting a retirement calculator. The tool should have a user-friendly interface that allows individuals to input their data easily without any technical expertise. We prioritized calculators that guide users through the process with clear instructions and intuitive design. -

Key Features

– A comprehensive retirement calculator should include essential input fields that reflect various aspects of an individual’s financial situation. We focused on tools that allow users to input:- Current age and planned retirement age

- Current investment balance

- Monthly contribution amounts

- Expected annual return on investments

- Other optional features such as expected inflation rates and additional savings scenarios (e.g., increasing contributions or adjusting for lifestyle changes).

-

Cost (Free vs. Paid)

– We assessed whether the calculators are free to use or require payment. While many quality retirement calculators are available at no cost, some premium tools may offer advanced features that justify a fee. We aimed to provide options that cater to different budgets, ensuring users can find a calculator that meets their needs without financial strain. -

Comprehensive Outputs

– The effectiveness of a retirement calculator is not just in its inputs but also in the outputs it generates. We looked for tools that provide detailed results, including estimated retirement savings, potential growth from contributions, and breakdowns of how different scenarios could impact overall savings. -

Educational Resources

– Retirement planning can be complex, so we valued calculators that offer educational resources or links to further information. This includes explanations of financial terms, investment strategies, and retirement planning tips, which can help users make informed decisions. -

Customization Options

– Finally, we considered the ability to customize scenarios within the calculator. Tools that allow users to experiment with different variables—such as varying contribution amounts or investment returns—provide a more personalized and insightful experience.

By using these criteria, we aimed to identify the top Ramsey retirement calculators that not only meet users’ needs but also enhance their understanding of retirement planning, enabling them to make informed financial decisions for their future.

The Best Ramsey Retirement Calculators of 2025

1. Retirement Calculator

The Retirement Calculator from Ramsey Solutions is designed to help users estimate the potential value of their investments at retirement. By inputting personal financial data, users can gain insights into their future financial landscape, making it easier to plan for a secure retirement. This tool is user-friendly and serves as a valuable resource for individuals looking to assess their retirement savings strategy effectively.

- Website: ramseysolutions.com

- Established: Approx. 13 years (domain registered in 2012)

2. Your favorite retirement calculator? : r/DaveRamsey

The Reddit discussion titled “Your favorite retirement calculator?” highlights popular retirement planning tools recommended by users, specifically the AARP Retirement Calculator and the Bankrate Retirement Calculator. Both tools aim to help individuals estimate their retirement savings needs by considering factors such as current savings, expected retirement age, and lifestyle choices. Users appreciate their user-friendly interfaces and the ability to customize inputs for more accurate projections, making them valuable resources for retirement planning.

- Website: reddit.com

- Established: Approx. 20 years (domain registered in 2005)

3. The Retirement Budget Calculator vs. Dave Ramsey’s Retirement …

The Retirement Budget Calculator (RBC) is a versatile tool designed to help users create a personalized retirement budget. Its key features include detailed budgeting options, inflation adjustments, and AI-driven insights, ensuring a comprehensive and accurate financial planning experience. Unlike other tools, such as Dave Ramsey’s retirement resources, RBC emphasizes customization, allowing users to tailor their retirement plans to fit their unique financial situations.

- Website: retirementbudgetcalculator.com

- Established: Approx. 9 years (domain registered in 2016)

4. Financial Calculators

The Financial Calculators offered by Heritage Financial AZ, featuring tools from Dave Ramsey and FINRA, are designed to assist users in planning for their financial futures. One key feature is the retirement savings calculator, which estimates the annual savings needed to reach specific retirement goals. This user-friendly tool empowers individuals to make informed decisions about their savings strategies, ensuring they are better prepared for retirement.

- Website: heritagefinancialaz.com

- Established: Approx. 10 years (domain registered in 2015)

5. Best Retirement Savings Calculators

Annuity Resources presents a comprehensive list of the 20 best retirement savings calculators, designed to help individuals effectively plan for their financial future. Among the featured tools are Dave Ramsey’s Investment Calculator and AARP’s retirement planning calculator, both of which offer user-friendly interfaces and insightful features. These calculators assist users in estimating their retirement savings needs, evaluating investment strategies, and making informed decisions to secure a comfortable retirement.

- Website: annuityresources.com

- Established: Approx. 21 years (domain registered in 2004)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using the Ramsey Retirement Calculator or any similar online tool, accuracy in your inputs is crucial for obtaining reliable results. Ensure that you enter your current age, planned retirement age, current investment amounts, and monthly contributions correctly. Even a small error in these figures can significantly impact your projected retirement savings. Take a moment to review each entry before proceeding with the calculations.

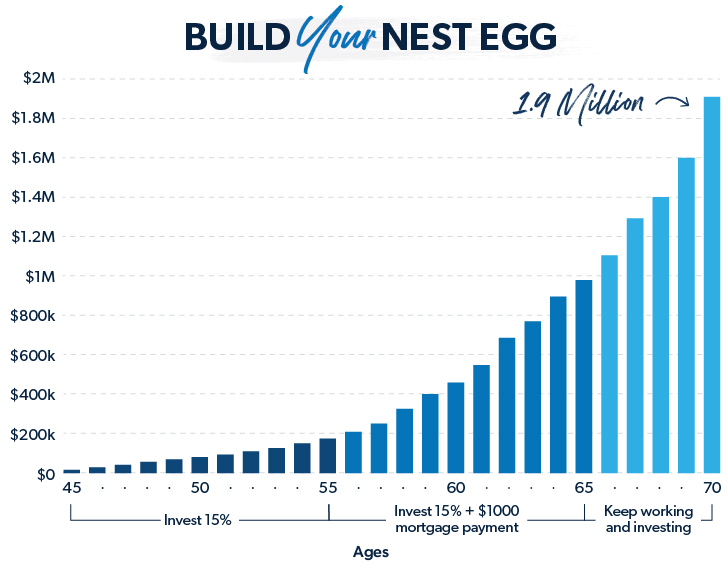

Understand the Underlying Assumptions

Every retirement calculator operates on certain assumptions regarding investment returns, inflation rates, and other economic factors. For instance, the Ramsey Retirement Calculator typically suggests an expected annual return of 10-12% based on historical performance of the S&P 500. However, past performance is not indicative of future results. Familiarize yourself with the assumptions used by the calculator to understand how they may affect your output. Adjust these parameters if necessary to reflect your personal investment strategy and market outlook.

Use Multiple Tools for Comparison

No single retirement calculator can provide a complete picture of your financial future. To gain a well-rounded perspective, consider using multiple calculators. Each tool may have different algorithms, assumptions, and features that could yield varying results. By comparing outputs from different calculators, you can identify trends and better assess your retirement needs. This practice can help you make more informed decisions about your financial planning.

Factor in Additional Variables

While calculators like Ramsey’s can provide a solid starting point, they may not account for all variables that can impact your retirement savings. Consider including factors such as expected healthcare costs, lifestyle changes, and any potential inheritances or debts. Adjust your inputs accordingly to reflect these variables, as they can significantly influence your retirement strategy and overall savings goals.

Regularly Update Your Information

Your financial situation and the economic landscape can change over time. Make it a habit to revisit your retirement calculator regularly, especially after major life events like a new job, a raise, or changes in your family situation. Update your inputs to ensure that your projections remain relevant and useful. This proactive approach will help you stay on track toward your retirement goals and allow for adjustments as needed.

Consult a Financial Professional

While online calculators are helpful tools, they cannot replace personalized financial advice. If you’re uncertain about your inputs, assumptions, or retirement strategy, consider consulting a financial professional. They can provide tailored advice based on your unique circumstances, helping you refine your retirement plan and achieve your financial objectives more effectively.

Frequently Asked Questions (FAQs)

1. What is the Ramsey Retirement Calculator used for?

The Ramsey Retirement Calculator is an online tool designed to help users estimate how much their investments could grow by the time they retire. By inputting various factors such as current age, planned retirement age, current investment amounts, monthly contributions, and expected annual return rates, users can see potential outcomes for their retirement savings.

2. How do I use the Ramsey Retirement Calculator?

To use the calculator, simply enter your current age, the age at which you plan to retire, your current investment total, your expected monthly contributions, and the anticipated annual return rate. After entering this information, click “Calculate” to view an estimate of your retirement savings at your planned retirement age, along with a breakdown of contributions and growth.

3. What factors affect the results of the Ramsey Retirement Calculator?

Several key factors influence the calculator’s results:

– Current Age: Determines how long your investments will grow.

– Retirement Age: Indicates the investment period before withdrawals begin.

– Current Investments: The total amount already saved or invested plays a significant role in growth potential.

– Monthly Contributions: Regular contributions can significantly boost savings over time.

– Expected Annual Return: This is typically based on historical market performance, affecting how much your investments will grow.

4. Is the Ramsey Retirement Calculator accurate?

While the Ramsey Retirement Calculator provides a helpful estimate based on the information you provide, the accuracy of the results depends on the assumptions made regarding investment returns and personal financial habits. The calculator uses historical averages, but actual market performance can vary. It’s essential to view the results as a guideline rather than a precise prediction.

5. Can I make adjustments to my retirement plan based on the calculator’s results?

Absolutely! The Ramsey Retirement Calculator is designed to help you visualize the impact of different savings strategies. If the results suggest that you may not have enough saved for your desired retirement lifestyle, you can adjust factors such as increasing monthly contributions, changing your expected retirement age, or aiming for higher returns through different investment strategies. This insight can help you create a more effective retirement plan.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.