Free Secu Auto Loan Calculators: Our Top 5 Picks for 2025

Finding the Best Secu Auto Loan Calculator: An Introduction

Finding the right online tool for calculating auto loans can be a daunting task, especially when it comes to specific offerings like the SECU (State Employees Credit Union) auto loan calculator. With numerous calculators available, users often struggle to identify which tool will provide the most accurate estimates and user-friendly experience. This article aims to alleviate that challenge by reviewing and ranking the top SECU auto loan calculators available online, saving you valuable time and effort.

The Importance of a Reliable Calculator

Using a reliable auto loan calculator is crucial for making informed financial decisions. It can help you understand your monthly payments, compare loan terms, and determine the total cost of your vehicle over time. However, not all calculators are created equal. Some may lack essential features, while others might not offer the level of accuracy you require. Therefore, selecting the best calculator tailored to your needs is essential.

Goal of This Article

The primary goal of this article is to provide a comprehensive review of the top SECU auto loan calculators, ranking them based on key criteria. By the end of this review, you will have a clear understanding of which tools best meet your needs and how to use them effectively.

Ranking Criteria

To ensure a fair and thorough evaluation, we will consider several factors in our rankings, including:

- Accuracy: How precise are the calculations provided by the tool?

- Ease of Use: Is the interface user-friendly and intuitive?

- Features: What additional functionalities does the calculator offer, such as comparison tools or loan term options?

With these criteria in mind, we are committed to helping you find the best SECU auto loan calculator to simplify your financing journey.

Our Criteria: How We Selected the Top Tools

Selecting the Best SECU Auto Loan Calculators

When evaluating the best online tools for calculating SECU auto loans, we considered several essential criteria to ensure that users find the most effective and user-friendly calculators. Here’s a breakdown of the key factors that guided our selection process:

-

Accuracy and Reliability

The primary purpose of an auto loan calculator is to provide accurate estimates of monthly payments, total interest paid, and overall loan costs. We prioritized tools that utilize up-to-date interest rates, loan terms, and other relevant financial variables to ensure that users receive reliable calculations. -

Ease of Use

A calculator should be intuitive and user-friendly, allowing individuals to navigate through the inputs and results effortlessly. We assessed the interface design, clarity of instructions, and overall user experience to determine how easily a user could input their loan details and interpret the results. -

Key Features

Effective auto loan calculators should offer a range of inputs to accommodate various user needs. We looked for features that include:

– Loan Amount: The total amount being financed.

– Interest Rate: The annual percentage rate (APR) for the loan.

– Loan Term: The duration of the loan in months (e.g., 36, 48, 60 months).

– Down Payment: An optional field for users to input any upfront payment.

– Trade-in Value: An option to account for the value of a vehicle being traded in, which can affect the loan amount.

– Sales Tax and Fees: The ability to include applicable taxes and fees for a more accurate total loan cost. -

Cost (Free vs. Paid)

We focused on tools that are freely accessible to users, as cost can be a barrier to entry for many individuals. The best calculators provide valuable insights without requiring a subscription or payment. We ensured that the selected tools offered comprehensive features without hidden fees.

-

Additional Resources

We considered whether the calculators were part of a broader suite of financial tools that could assist users in making informed decisions about auto loans. Features like budgeting tools, loan comparison options, and educational resources enhance the overall value of the calculators. -

Mobile Compatibility

In today’s digital age, many users access tools via mobile devices. We evaluated the mobile responsiveness of each calculator to ensure that users can easily perform calculations on their smartphones or tablets. -

Customer Support

Finally, we assessed the availability of customer support for users who may have questions or need assistance with the calculators. Access to help through chat, email, or phone can significantly improve the user experience.

By applying these criteria, we identified the top auto loan calculators that cater specifically to SECU members, ensuring they can make informed financial decisions when purchasing a vehicle.

The Best Secu Auto Loan Calculators of 2025

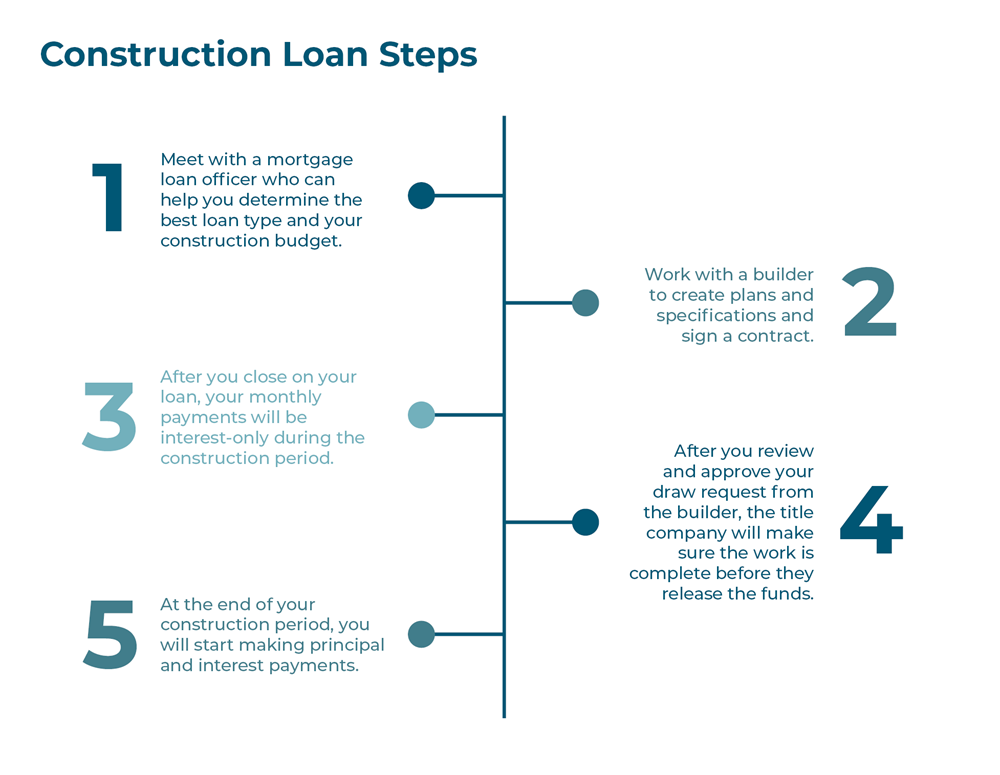

1. Calculate a Vehicle Payment

The “Calculate a Vehicle Payment” tool from the State Employees’ Credit Union is designed to help users assess the financial implications of leasing versus buying a vehicle. By inputting relevant financial data, users can evaluate how different options affect their monthly payments, making it easier to make informed decisions. The calculator’s straightforward interface and focus on comparative analysis enhance its usability for potential car buyers and lessees alike.

- Website: ncsecu.org

- Established: Approx. 28 years (domain registered in 1997)

3. Auto & Refinancing

The Auto & Refinancing tool from SLB Employees Credit Union is designed to assist users in estimating their monthly car payments prior to making a purchase. Key features include a user-friendly Loan Calculators page that provides accurate payment estimates and an informative Auto Buyer’s Video that offers quick tips for navigating the car buying process. This resource is invaluable for individuals looking to make informed financial decisions related to auto loans.

- Website: secutx.com

- Established: Approx. 1 years (domain registered in 2024)

4. Auto Loans: Rates, Calculator, Requirements & More

PSECU offers a comprehensive auto loan service that allows users to explore competitive interest rates and understand the necessary requirements for financing a vehicle. The platform features an easy-to-use calculator for estimating monthly payments, aiding potential borrowers in budgeting effectively. Additionally, users can initiate their auto loan application directly through the site, streamlining the process of securing financing for their automotive needs.

- Website: psecu.com

- Established: Approx. 29 years (domain registered in 1996)

5. Vehicle Loans

The Vehicle Loans tool from South Carolina State Credit Union features a user-friendly loan calculator designed to help prospective borrowers estimate their monthly payments. By inputting the loan amount and repayment duration, users can quickly assess their financial commitments, making it easier to plan for vehicle purchases. This tool streamlines the decision-making process, ensuring that members can make informed choices regarding their auto financing options.

- Website: scscu.com

- Established: Approx. 29 years (domain registered in 1996)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using an online auto loan calculator, accuracy is key. Ensure that all the inputs you provide—such as loan amount, interest rate, loan term, and down payment—are correct. Even a small error can lead to misleading results. Take the time to verify the figures you enter. If you’re unsure about your credit score or the interest rate you’re eligible for, consider checking your credit report beforehand. This will help you provide more accurate information and receive better estimates.

Understand the Underlying Assumptions

Every calculator has certain assumptions that can affect the output. For example, some calculators may assume a fixed interest rate throughout the loan term, while others might factor in variable rates. Be sure to read the calculator’s guidelines or FAQs to understand these assumptions. Knowing what the calculator is based on can help you interpret the results more effectively and make better-informed decisions.

Use Multiple Tools for Comparison

To get a well-rounded view of your potential auto loan payments, consider using multiple calculators from different sources. Each tool may have its unique features or assumptions, which can lead to varying results. By comparing outputs from different calculators, you can identify trends and get a more accurate estimate of your loan payments. This is especially useful if you’re considering offers from multiple lenders.

Explore Additional Features

Many auto loan calculators offer additional features that can enhance your understanding of your financing options. For instance, some tools allow you to compare different loan terms, interest rates, and payment schedules. Utilize these features to explore how changes in these variables can impact your monthly payment and overall loan cost. This comprehensive approach will give you a clearer picture of what to expect.

Review Your Financial Situation

Before finalizing any loan decisions, take a moment to evaluate your overall financial situation. Consider factors like your monthly budget, existing debt, and long-term financial goals. This reflection will not only help you make informed decisions but also ensure that the loan you choose aligns with your financial capacity. A calculator can provide estimates, but your personal financial health should guide your final choices.

Seek Professional Advice

If you find the calculations overwhelming or are unsure about certain financial terms, don’t hesitate to reach out for professional advice. Financial advisors can provide personalized insights based on your specific situation, helping you interpret calculator results and make sound financial decisions. This step can be invaluable, especially for first-time car buyers or those unfamiliar with loan processes.

By following these tips, you can maximize the effectiveness of online auto loan calculators and make informed decisions about your financing options.

Frequently Asked Questions (FAQs)

1. What is a SECU auto loan calculator?

A SECU auto loan calculator is an online tool provided by the State Employees’ Credit Union (SECU) that helps users estimate their monthly vehicle payments based on various inputs. This calculator typically requires information such as the loan amount, interest rate, loan term, and down payment to provide an estimated monthly payment amount.

2. How do I use the SECU auto loan calculator?

To use the SECU auto loan calculator, follow these steps:

1. Visit the SECU website and navigate to the calculators section.

2. Select the auto loan calculator.

3. Enter the required details, including the purchase price of the vehicle, down payment, loan term (in months), and interest rate.

4. Click the ‘Calculate’ button to view your estimated monthly payment, total interest paid, and the total cost of the loan.

3. Can I use the calculator for both new and used vehicles?

Yes, the SECU auto loan calculator can be used for both new and used vehicles. You can enter the purchase price and other relevant details for either type of vehicle to see how the loan terms may differ based on the vehicle’s age, loan amount, and interest rates.

4. Are the estimates provided by the SECU auto loan calculator accurate?

The estimates provided by the SECU auto loan calculator are based on the inputs you provide and the current interest rates available through SECU. However, they are approximations. For an official loan offer, you should contact SECU directly or apply for a loan to receive a definitive quote based on your credit profile and specific loan terms.

5. What other calculators are available on the SECU website?

In addition to the auto loan calculator, SECU offers a variety of financial calculators, including those for mortgage payments, savings goals, debt consolidation, and retirement planning. These tools can help you assess different aspects of your financial situation and make informed decisions about loans and savings.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.