Free Utv Loan Calculators: Our Top 5 Picks for 2025

Finding the Best Utv Loan Calculator: An Introduction

Finding a reliable UTV loan calculator can be a daunting task for anyone looking to finance their next off-road adventure. With numerous options available online, each promising to deliver precise estimates and user-friendly interfaces, it becomes increasingly challenging to discern which tools are truly effective. Whether you’re a seasoned enthusiast or a first-time buyer, having access to a dependable calculator is essential for making informed financial decisions.

The primary goal of this article is to review and rank the best UTV loan calculators currently available online. We aim to save you time and effort by providing a curated list of tools that can help you estimate your monthly payments, assess your budget, and understand the overall cost of financing a UTV. Our selection process is grounded in key criteria that ensure each calculator meets the needs of potential buyers.

Criteria for Ranking

- Accuracy: We evaluate how closely the calculators’ estimates align with real-world loan scenarios, taking into account various factors such as interest rates, loan terms, and down payments.

- Ease of Use: A user-friendly interface is crucial. We consider how intuitive each tool is, including the clarity of instructions and the overall design.

- Features: Additional functionalities, such as the ability to compare multiple scenarios, affordability assessments, and customization options, are also taken into account.

- Reputation: We review the credibility of the platforms offering these calculators, ensuring they are well-regarded in the financial services industry.

By the end of this article, you’ll have a clearer understanding of which UTV loan calculators can best meet your needs, enabling you to make confident financial choices as you prepare to hit the trails.

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting UTV Loan Calculators

When evaluating the best UTV loan calculators available online, we focused on several essential criteria that ensure users can make informed financing decisions. Here’s how we selected the top tools:

-

Accuracy and Reliability

– The primary purpose of a loan calculator is to provide accurate estimates of monthly payments and total loan costs. We prioritized tools that use standard formulas for calculating payments based on user inputs such as loan amount, interest rate, and loan term. Reliable calculators also clearly state any limitations regarding the estimates they provide, such as the impact of personal credit history or additional fees. -

Ease of Use

– User experience is crucial for ensuring that individuals can quickly and effectively navigate the calculator. We selected tools that have intuitive interfaces, allowing users to input their data with minimal hassle. A straightforward design with clear instructions and responsive features enhances user satisfaction and encourages repeat usage. -

Key Features

– Effective UTV loan calculators should include various inputs that cater to the specific needs of users. We looked for tools that allow users to enter:- Desired Vehicle Price: The total cost of the UTV.

- Down Payment: The amount the user plans to pay upfront.

- Interest Rate/APR: The estimated annual percentage rate for the loan.

- Loan Term: The duration for which the loan will be taken, typically in months.

- Sales Tax and Trade-In Value: Options to include state taxes and the value of any trade-in vehicle for a more accurate estimate.

- Additional features, such as the ability to compare different loan scenarios, were also considered valuable.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators offered free services or required payment. The best tools are typically free to use, providing users with an accessible means to estimate their loan costs without hidden fees. We also considered whether calculators provided additional services, such as connecting users with lenders or offering personalized loan recommendations. -

Transparency and User Guidance

– A good UTV loan calculator should provide transparency regarding its calculations and assumptions. We favored tools that educate users on how different variables impact their loan estimates. This includes clarifying factors that may affect interest rates, such as credit scores and loan amounts. -

Mobile Compatibility

– With many users accessing tools from mobile devices, we ensured that the selected calculators are optimized for mobile use. Responsive design allows users to calculate loan estimates on-the-go, making it convenient for those who may be shopping for a UTV at dealerships or exploring financing options remotely.

By focusing on these criteria, we aim to guide users toward the most effective UTV loan calculators that not only meet their needs but also enhance their understanding of the financing process.

The Best Utv Loan Calculators of 2025

2. Powersports Vehicle Loan Calculator

The Powersports Vehicle Loan Calculator from Brinson Powersports of Athens is a user-friendly tool designed to help potential buyers determine financing options for ATVs and jet skis. By inputting specific loan details, users can easily calculate monthly payments and assess affordability, ensuring they find a financing plan that fits their budget. This calculator is an essential resource for anyone looking to make an informed purchasing decision in the powersports market.

- Website: brinsonpowersportsofathens.com

- Established: Approx. 11 years (domain registered in 2014)

4. ATV / UTV Loans

Credit Union West in Arizona offers a user-friendly platform for ATV and UTV loans, featuring flexible, low-interest rates designed to make financing recreational vehicles accessible. The loan application process is straightforward, ensuring that potential borrowers can easily navigate it. Additionally, the credit union provides personalized assistance throughout the loan process, enhancing the overall customer experience and making it easier for enthusiasts to pursue their outdoor adventures.

- Website: cuwest.org

- Established: Approx. 26 years (domain registered in 1999)

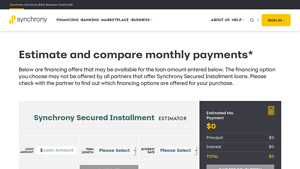

5. Outdoor Powersports Calculator

The Outdoor Powersports Calculator by Synchrony is a user-friendly tool designed to help consumers explore financing options for their outdoor powersports purchases. By inputting specific purchase details, users can quickly assess how promotional financing can make their desired vehicles or equipment more affordable. This calculator streamlines the decision-making process, allowing potential buyers to plan their investments effectively and confidently.

- Website: synchrony.com

- Established: Approx. 30 years (domain registered in 1995)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using an online UTV loan calculator, accuracy in your inputs is crucial for obtaining reliable estimates. Ensure that you enter the correct figures for the desired vehicle price, down payment, interest rate, and loan term. Even small discrepancies can lead to significant differences in your estimated monthly payments. To enhance accuracy, gather your financial documents beforehand, including your credit score, income details, and any additional fees that might apply. This preparation will help you input precise numbers into the calculator.

Understand the Underlying Assumptions

Each loan calculator may have different underlying assumptions that can affect the results. For instance, some calculators might not account for sales tax, registration fees, or other costs associated with purchasing a UTV. Additionally, they may operate on the premise of fixed interest rates or specific loan terms. Familiarize yourself with what each calculator includes and excludes to better understand the estimates provided. This will help you interpret the results more accurately and align them with your personal financial situation.

Use Multiple Tools for Comparison

It’s wise to utilize several loan calculators before making a final decision. Different calculators may yield varying results based on their algorithms, interest rates, and the assumptions they make. By comparing estimates from multiple sources, you can identify a range of potential payments, which provides a broader perspective on what to expect. This practice can also reveal discrepancies that may highlight the need for further research or adjustments in your loan application.

Experiment with Different Scenarios

Don’t hesitate to play around with different scenarios within the calculators. Adjust variables such as the loan amount, interest rate, and loan term to see how they impact your monthly payments. For example, extending the loan term may lower your monthly payment but increase the total interest paid over time. Conversely, a larger down payment can significantly reduce your monthly obligation. By exploring these scenarios, you can find a loan structure that best fits your budget and financial goals.

Consult a Financial Advisor

If you’re uncertain about the estimates or how to interpret them, consider consulting a financial advisor. They can provide personalized guidance based on your financial situation and help you understand the implications of different loan options. A professional can also assist you in comparing offers from lenders and navigating the terms of your loan agreement, ensuring you make an informed decision.

Keep Track of Market Trends

Lastly, stay informed about current interest rates and market trends in UTV financing. Rates can fluctuate based on economic conditions, so being aware of these changes can help you secure a better deal. Regularly check reputable financial news sources or lender websites to stay updated, which can aid in timing your loan application to your advantage. By following these tips, you can leverage online UTV loan calculators more effectively and make well-informed financial decisions.

Frequently Asked Questions (FAQs)

1. What is a UTV loan calculator, and how does it work?

A UTV loan calculator is an online tool designed to help potential buyers estimate their monthly payments for financing a Utility Task Vehicle (UTV). Users input various parameters such as the vehicle price, down payment, interest rate, and loan term. The calculator then provides an estimated monthly payment based on these inputs, allowing users to better understand their financing options.

2. What factors should I consider when using a UTV loan calculator?

When using a UTV loan calculator, consider the following factors:

– Vehicle Price: The total cost of the UTV you wish to purchase.

– Down Payment: The amount you can pay upfront, which will reduce the overall loan amount.

– Interest Rate (APR): The annual percentage rate, which can vary based on credit score and lender.

– Loan Term: The duration over which you will repay the loan, typically ranging from 24 to 84 months.

– Sales Tax and Fees: Additional costs that may affect the total price and should be included for a more accurate estimate.

3. Can I use a UTV loan calculator if I have bad credit?

Yes, you can use a UTV loan calculator even if you have bad credit. However, it’s important to note that the interest rates you may qualify for could be higher than average. The calculator can help you understand potential monthly payments based on various scenarios, but it’s advisable to consult with lenders to get prequalified and determine the rates available to you.

4. Are the estimates provided by a UTV loan calculator accurate?

The estimates provided by a UTV loan calculator are intended for informational purposes and should be viewed as rough estimates. They do not account for all variables such as title, registration, taxes, and personal financial circumstances. For precise payment amounts and loan terms, it’s best to consult directly with your lender or dealer, as they can provide tailored information based on your financial situation.

5. Is it better to choose a longer or shorter loan term when financing a UTV?

Choosing between a longer or shorter loan term depends on your financial situation and preferences:

– Longer Loan Term: This typically results in lower monthly payments, making it easier to fit into your budget. However, you will pay more interest over the life of the loan.

– Shorter Loan Term: While monthly payments will be higher, you will pay less interest overall and may qualify for lower rates. This option is often preferable for those who can afford higher payments and want to pay off the vehicle sooner.

Ultimately, consider your budget and financial goals when deciding on the loan term.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.