Free Ytd Calculators: Our Top 5 Picks for 2025

Finding the Best Ytd Calculator: An Introduction

Finding a reliable Year-to-Date (YTD) calculator can be a daunting task, especially with the plethora of options available online. As businesses and individuals strive to track their performance and financial health, the importance of accurate and user-friendly YTD calculators cannot be overstated. Whether you’re assessing business growth, calculating annual income for loan applications, or simply monitoring personal finances, the right tool can make all the difference. Unfortunately, not all calculators are created equal; some may lack essential features, provide inaccurate results, or be overly complicated to navigate.

This article aims to simplify your search by reviewing and ranking the top YTD calculators available online. We have meticulously analyzed a variety of tools to save you time and ensure you choose the best fit for your needs. Our goal is to provide a comprehensive overview of each tool’s strengths and weaknesses, allowing you to make an informed decision.

Criteria for Ranking

To ensure a fair and thorough evaluation, we used several key criteria in our ranking process:

-

Accuracy: The primary function of any calculator is to provide precise results. We assessed how well each tool calculates YTD growth or income based on user inputs.

-

Ease of Use: A user-friendly interface is crucial for a smooth experience. We considered the design and accessibility of each calculator, focusing on how intuitive the navigation and input process are.

-

Features: Beyond basic calculations, we looked for additional functionalities that enhance usability, such as the ability to track multiple periods, provide industry benchmarks, and offer insights based on the results.

By evaluating these aspects, we hope to guide you in selecting the best YTD calculator that meets your specific requirements.

Our Criteria: How We Selected the Top Tools

Selection Criteria for the Best YTD Calculators

When evaluating various YTD (Year-to-Date) calculators, we established a comprehensive set of criteria to ensure that our recommendations meet the needs of a general audience. Here are the key factors we considered:

-

Accuracy and Reliability

– The primary function of a YTD calculator is to provide accurate calculations of growth or income based on user inputs. We looked for tools that are known for their precision and have established credibility in the market. This includes checking user reviews and testing the calculators against known values to verify their accuracy. -

Ease of Use

– A good YTD calculator should be user-friendly, requiring minimal effort to input data. We assessed the user interface and overall experience, focusing on how intuitive it is for users of all skill levels. This includes straightforward navigation, clear instructions, and a clean layout that makes it easy to find where to enter information. -

Key Features

– We identified essential features that enhance the functionality of YTD calculators:- Input Options: The calculators should allow users to input key data such as current period value, beginning of period value, and any relevant additional metrics (e.g., overtime, bonuses for income calculators).

- Calculation Breakdown: Transparency in how the YTD calculations are performed, including showing the formula used, is a plus.

- Historical Data: The ability to analyze and compare YTD growth over different periods can be beneficial for tracking trends.

- Export Options: Some calculators offer the ability to export results, which can be useful for record-keeping or reporting.

-

Cost (Free vs. Paid)

– We considered the cost of using each tool. While many calculators are available for free, some may offer advanced features under a paid model. We evaluated whether the additional features provided in paid versions justify the cost. Our goal was to highlight tools that offer good value, whether they are free or require a subscription. -

Support and Resources

– The availability of support options, such as FAQs, user guides, or customer service, plays a crucial role in user satisfaction. We looked for calculators that provide adequate resources to assist users in understanding how to use the tool effectively and troubleshoot any issues.

-

Mobile Compatibility

– In today’s digital age, many users prefer accessing tools on their mobile devices. We assessed whether the calculators are mobile-friendly or have dedicated apps, ensuring that users can calculate YTD values on the go. -

User Feedback and Reviews

– We considered community feedback and expert reviews to gauge user satisfaction and identify any common issues or praises. Tools that consistently receive positive feedback were prioritized.

By applying these criteria, we aimed to ensure that the YTD calculators we recommend are not only functional but also enhance user experience, making them suitable for a wide range of needs.

The Best Ytd Calculators of 2025

1. YTD Calculator: Calculate Year to Date

The YTD Calculator by upGrowth is a user-friendly tool designed to help businesses calculate their year-to-date growth rates for various metrics. By inputting relevant data from the beginning of the year up to the current date, users can efficiently assess their performance and make informed decisions. This calculator streamlines the process, making it accessible for entrepreneurs and analysts looking to track and optimize growth over time.

- Website: upgrowth.in

- Established: Approx. 8 years (domain registered in 2017)

2. YTD Income

The YTD Income Calculator from Home Loan Experts is a practical tool designed to help users calculate their annual income based on earnings accrued in a portion of the year. This calculator simplifies the process of determining year-to-date income, making it especially useful for individuals assessing their financial status or preparing for loan applications. Its user-friendly interface ensures that users can quickly and accurately compute their income figures.

- Website: homeloanexperts.com.au

3. Salary Calculator · Federal & State Tax Tools

The Salary Calculator by PaycheckCity is a user-friendly online tool designed to help individuals determine their net pay or take-home salary. By inputting their per-period or annual salary alongside relevant federal, state, and local W4 information, users can easily calculate their earnings after taxes. This tool is particularly useful for those looking to understand their take-home pay in relation to various tax obligations.

- Website: paycheckcity.com

- Established: Approx. 26 years (domain registered in 1999)

5. Salary Paycheck Calculator – Calculate Net Income

The ADP Salary Paycheck Calculator is a robust online tool designed to help users calculate their net income after taxes. It simplifies the gross-to-net calculations, providing accurate estimates of take-home pay across all 50 states. This user-friendly calculator is essential for employers and employees alike, offering insights into wage deductions and helping users better understand their financial planning.

- Website: adp.com

- Established: Approx. 34 years (domain registered in 1991)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy begins with the information you provide. Ensure that you carefully input the correct values into the YTD calculator. For instance, if you are calculating Year-to-Date growth, enter both the current period value and the beginning of the period value correctly. Even a small typo can lead to significant discrepancies in your results. Take a moment to verify that all numbers are accurate and correspond to the correct time frame. If you’re using an income calculator, make sure to use the most recent payslip or financial documents to reflect your current income accurately.

Understand the Underlying Assumptions

Every YTD calculator comes with certain assumptions built into its functionality. For instance, when calculating growth rates, the tool might assume a straightforward linear growth model without accounting for seasonal fluctuations or extraordinary income events. Familiarize yourself with the methodology behind the calculator, including how it defines the “current period” and “beginning of period.” By understanding these assumptions, you can better interpret the results and adjust your expectations accordingly.

Use Multiple Tools for Comparison

Different calculators may utilize varying algorithms or formulas, which can lead to different results for the same data. To ensure you are receiving the most accurate and reliable information, consider using multiple YTD calculators. This cross-verification can help you identify outliers and arrive at a more balanced understanding of your financial performance or growth rate. If one tool suggests a YTD growth of 20% while another shows 25%, it might be worth investigating why those differences exist.

Review Industry Benchmarks

Understanding industry benchmarks can provide context for your results. Many calculators will offer insights into typical YTD growth rates for specific sectors or metrics. By comparing your results against these benchmarks, you can gauge how well you are performing relative to others in your industry. This information can guide your strategic decisions moving forward, helping you identify areas for improvement or opportunities for growth.

Keep Track of Changes Over Time

YTD calculations are most useful when monitored regularly. Instead of relying on a one-time calculation, set a schedule to input your data monthly or quarterly. This practice will help you track trends and adjust your strategies based on your performance trajectory. Regularly updating your inputs not only keeps your calculations accurate but also allows you to see how your business or personal finances evolve throughout the year.

Seek Expert Guidance if Needed

If you find the results of your YTD calculations confusing or if the implications for your business or finances are significant, don’t hesitate to seek professional advice. Financial advisors or accountants can provide insights that go beyond the numbers and help you develop strategies based on your YTD growth. They can also assist in interpreting the data, ensuring that you make informed decisions that align with your financial goals.

By following these tips, you can maximize the accuracy and utility of YTD calculators, enabling you to make better-informed decisions based on your financial data.

Frequently Asked Questions (FAQs)

1. What is a YTD calculator used for?

A YTD (Year to Date) calculator is primarily used to assess financial performance over the course of a year. It calculates the growth or income from the start of the year to the current date, helping users evaluate progress towards financial goals. This tool can be beneficial for businesses tracking growth metrics or individuals assessing their income for budgeting or loan applications.

2. How is YTD growth calculated?

YTD growth is calculated using the formula:

[ \text{YTD Growth (\%)} = \frac{\text{Current Period Value} – \text{Beginning of Period Value}}{\text{Beginning of Period Value}} \times 100 ]

This formula allows you to determine the percentage change from the beginning of the year to the current date, providing insight into financial performance.

3. What are some common applications for a YTD calculator?

YTD calculators can be used in various scenarios, including:

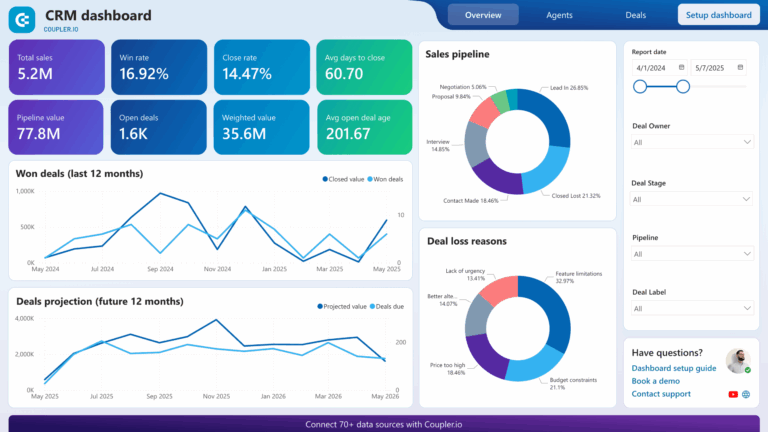

– Business Performance Tracking: To measure growth in revenue or other key performance indicators.

– Income Assessment for Loans: To annualize income from partial-year earnings for mortgage applications or other financial assessments.

– Investment Analysis: To evaluate the performance of investments over the year.

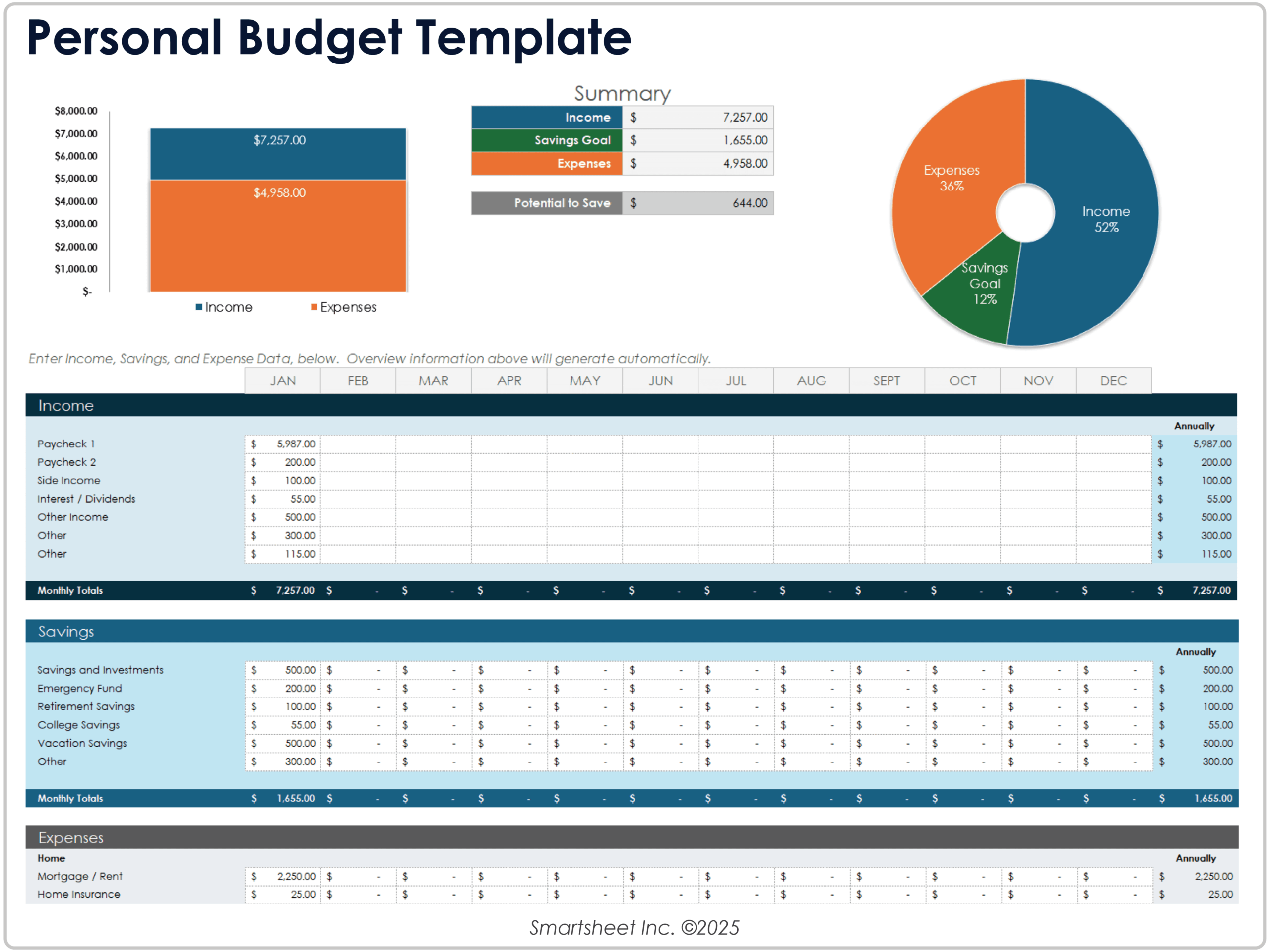

– Budgeting: To help individuals or businesses track expenses and ensure they are on target with their financial plans.

4. How often should I calculate my YTD growth?

It is advisable to calculate YTD growth at regular intervals, such as monthly or quarterly. Regular calculations help you stay informed about your financial performance and enable you to make timely adjustments to your strategies or budget to meet your yearly goals.

5. Can I use a YTD calculator for multiple periods?

Yes, many YTD calculators allow you to assess growth across different time frames. You can use them to compare YTD growth monthly, quarterly, or even over multiple years, which can help identify trends and inform future financial planning decisions.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.