Liquid Packing Machine: The Ultimate 2025 Sourcing Guide

Introduction: Navigating the Global Market for Liquid Packing Machines

For manufacturers in the USA and Europe, the liquid packaging sector is defined by a single metric: efficiency per milliliter. Whether you are packaging pharmaceuticals, beverages, or chemical agents, the transition from manual pouring to automated precision is the primary driver of scalability. However, the global marketplace for liquid packing machinery is fragmented, ranging from entry-level semi-automatic units to high-speed industrial rotary lines.

The Sourcing Challenge

The barrier to entry has lowered, but the complexity of choice has increased. Today, a buyer can locate a 50-500ml automatic sachet filling machine online for approximately $3,000–$5,000. While these rear-sealed, film-compatible units offer an accessible entry point for pilot runs or small-batch production, they represent only a fraction of the market.

For established procurement officers and operations managers, the challenge lies in distinguishing between low-cost generic hardware and robust, compliant machinery capable of meeting CE and UL standards. Misalignment between production volume goals and machine capabilities—such as film compatibility, viscosity handling, and seal integrity—can lead to costly downtime and wasted product.

What This Guide Covers

This guide provides a strategic framework for sourcing liquid packing technology. We move beyond basic product descriptions to analyze the operational realities of these investments.

Key takeaways include:

* Technical Segmentation: Comparing vertical form-fill-seal (VFFS) sachet fillers against rotary and inline volumetric systems.

* Cost Analysis: What to expect at the $5,000 entry-level tier versus the $50,000+ industrial tier.

* Material Compatibility: Navigating transparent, printed, and composite film requirements.

* ROI Calculation: Balancing initial capital expenditure (CapEx) with maintenance and throughput speeds.

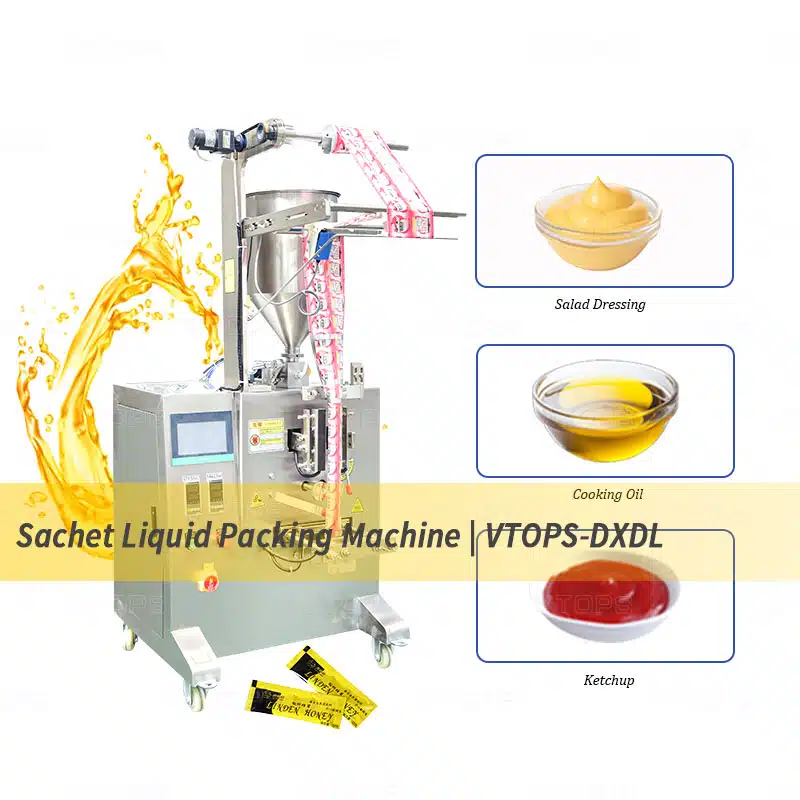

Illustrative Image (Source: Google Search)

Top 10 Liquid Packing Machine Manufacturers & Suppliers List

1. Liquid Packaging Solutions: Custom Packaging Machinery …

Domain: liquidpackagingsolution.com

Registered: 2006 (19 years)

Introduction: We specialize in designing and manufacturing reliable and efficient custom packaging machines tailored specifically to the needs of individual businesses….

2. Top 10 Packaging Machine Manufacturers in the USA – HonorPack

Domain: honorpack.com

Registered: 2009 (16 years)

Introduction: Top 10 Packaging Machine Manufacturers In The USA · 2. Viking Masek Packaging Technologies · 3. Accutek Packaging Equipment · 4. Triangle Package Machinery · 5….

3. The Best Liquid Packing Machine Manufacturer(top 5)

Domain: greatvffs.com

Registered: 2020 (5 years)

Introduction: GREAT PACK company is a renowned packing machine supplier that offers the best liquid packaging solutions in the industry. With vertical ……

4. Best Packaging Solution in USA | Package Machine Manufacturers

Domain: blackforestpkg.com

Registered: 2011 (14 years)

Introduction: Black Forest is a leading packaging machine manufacturer in the packaging industry and can help you to solve your food products packaging challenge….

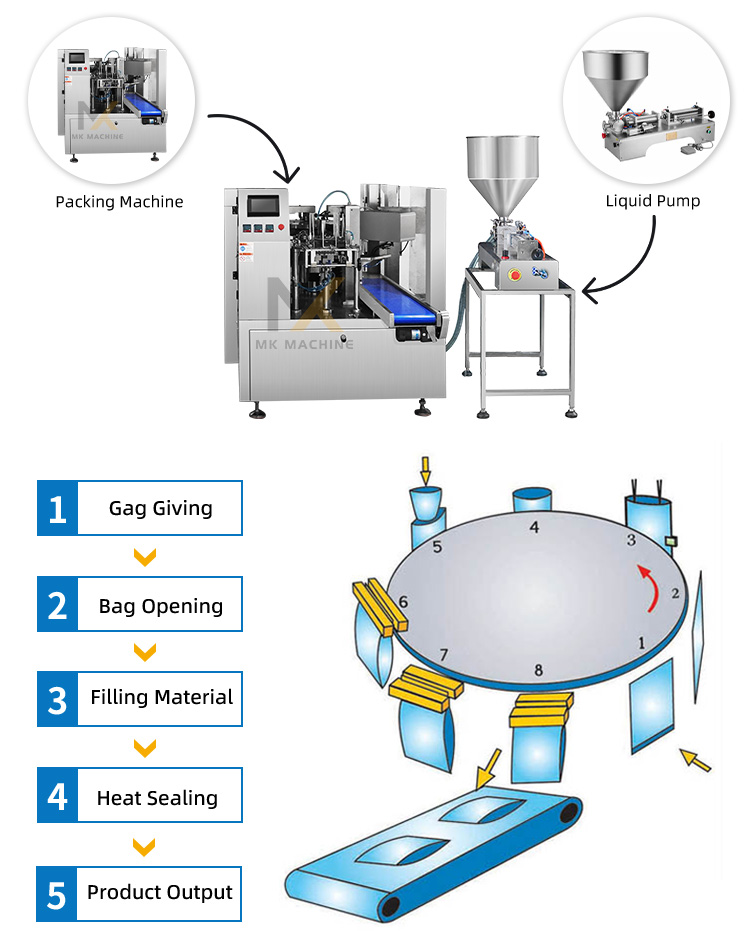

Illustrative Image (Source: Google Search)

5. Bottling & Filling Equipment Manufacturer | E-PAK Machinery

Domain: epakmachinery.com

Registered: 2001 (24 years)

Introduction: E-PAK Machinery manufactures quality liquid filling machines, including cappers and labelers, for the bottling industry. Buy equipment and parts online….

6. Automatic Bottle Filling Equipment for Liquids

Domain: zonesunpack.com

Registered: 2018 (7 years)

Introduction: High-precision liquid filling machines for bottles, jars, and containers. Suitable for water, oil, juice, detergent, cosmetics, and chemical liquid ……

7. Top 10 Liquid Filling Machine Manufacturers in Pharma

Domain: pharmanow.live

Registered: N/A

Introduction: Injectables At Scale: The 10 Best Liquid Filling Machine Manufacturers You Should Know · 1. Syntegon (Germany) · 2. IMA Life (Italy) · 3. Groninger (Germany)….

Understanding liquid packing machine Types and Variations

Understanding Liquid Packing Machine Types and Variations

Selecting the correct liquid packing architecture is the pivot point between production efficiency and operational bottlenecks. For manufacturers in the US and European markets, where labor costs are high and compliance standards (FDA, CE) are rigorous, understanding the distinction between machine types is critical for calculating ROI.

Liquid packing machinery is generally categorized by the direction of the packaging flow (Vertical vs. Horizontal) and the container type (Flexible Pouch vs. Rigid Container).

Comparative Overview: Liquid Packing Technologies

| Machine Type | Key Features | Primary Applications | Pros & Cons |

|---|---|---|---|

| Vertical Form Fill Seal (VFFS) | Uses roll stock film; forms bag, fills vertically, seals. Often supports rear-seal/back-seal styles. | Water sachets, stick packs (condiments), sample pouches, chemical fluids. | Pros: High speed, lower footprint, cost-effective for small doses. Cons: Limited pouch shapes (mostly pillow/stick), lower aesthetic appeal than HFFS. |

| Horizontal Form Fill Seal (HFFS) | Horizontal film travel; allows for complex pouch forming (doypack, spout). | Stand-up pouches with spouts, zipper bags, premium beverages, detergents. | Pros: High aesthetic quality, versatile pouch designs, multi-station filling. Cons: Higher capital cost, larger floor footprint required. |

| Inline Linear Fillers | Conveyor-based; nozzles fill rigid containers sequentially (piston or flow meter). | Bottles, jars, jerry cans (shampoos, oils, sauces). | Pros: High flexibility for different bottle sizes, easy changeover. Cons: Lower speed compared to rotary, potential for splashing at high speeds. |

| Rotary Monoblock Systems | Continuous rotary motion; integrates rinsing, filling, and capping in one unit. | High-volume beverages (water, soda), pharmaceuticals, dairy. | Pros: Extremely high throughput, superior hygiene control. Cons: High initial investment, complex changeovers for different formats. |

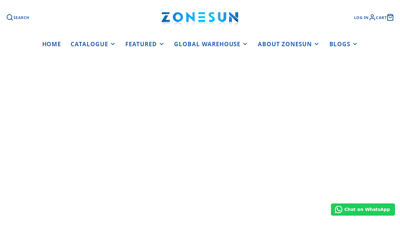

1. Vertical Form Fill Seal (VFFS) Machines

The VFFS is the standard for high-speed, economical flexible packaging. As noted in entry-level industrial models (such as 50-500ml automatic sachet fillers), these machines pull film from a roll, form it into a tube, seal the vertical overlap (rear-seal), fill the liquid, and seal the top/bottom.

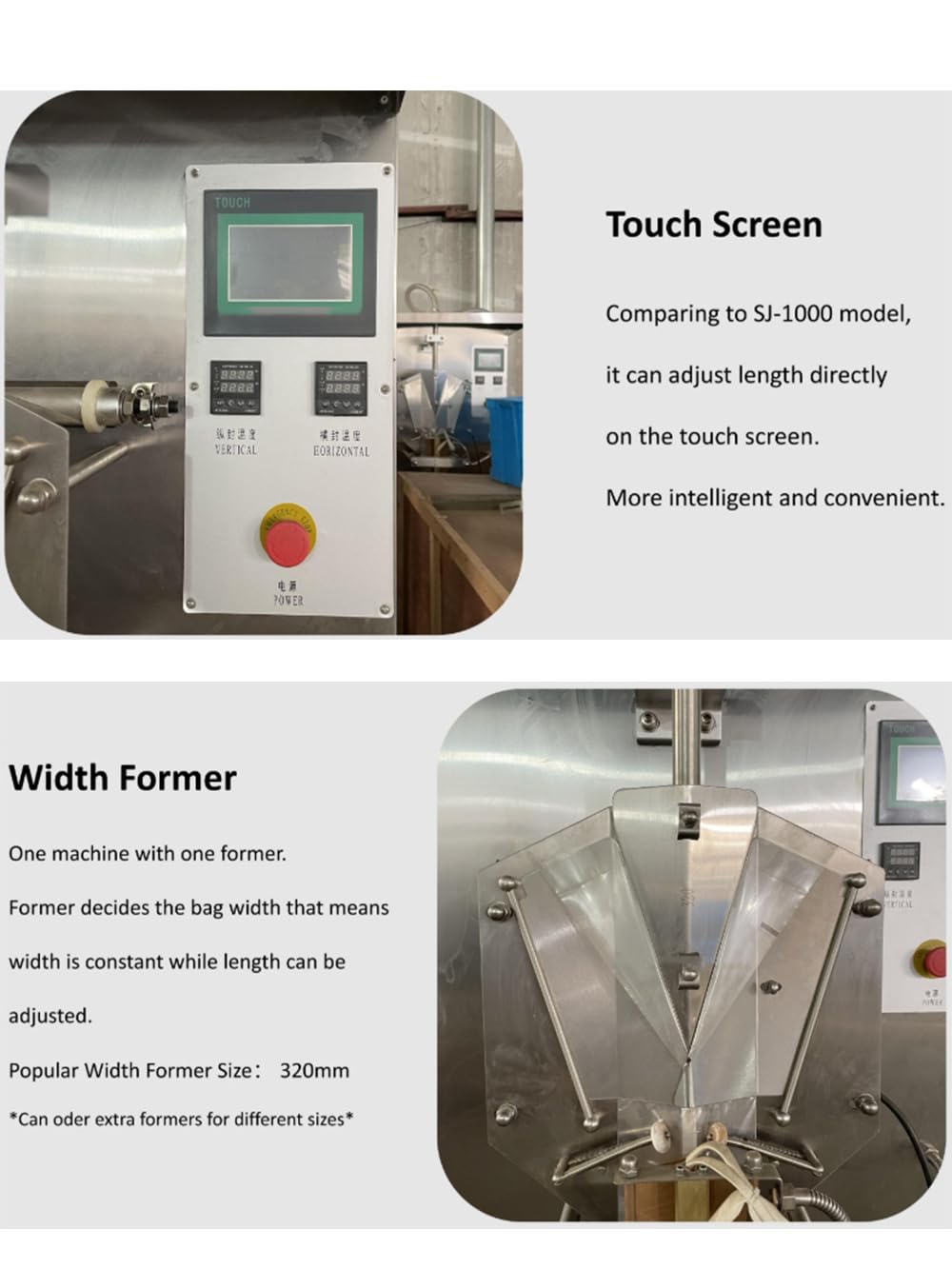

Illustrative Image (Source: Google Search)

- Mechanism: Gravity or pump-fed filling synchronized with vertical film sealing bars.

- Variations:

- Stick Pack Machines: Multi-lane VFFS designed for narrow, tubular pouches (e.g., single-serve coffee syrups).

- Sachet Machines: 3-side or 4-side seal configurations for flat packs.

- B2B Context: Ideal for contract packagers (co-packers) needing to produce high volumes of sample sizes or single-serve condiments. The rear-sealed configuration is particularly common for basic transparent or printed films used in water and juice distribution.

2. Horizontal Form Fill Seal (HFFS) Machines

HFFS machinery is preferred when shelf presence and premium branding are priorities. Unlike the VFFS, the film travels horizontally, allowing for more dwell time at the sealing stations. This enables the creation of complex shapes, such as stand-up pouches (Doypacks) and the insertion of corner spouts or zippers.

- Mechanism: The machine forms the pouch, cuts it, and then opens the top for filling before final sealing.

- Variations:

- Pre-made Pouch Fillers: A variation of HFFS that skips the forming stage, strictly filling and sealing pre-fabricated bags for maximum aesthetic consistency.

- B2B Context: Dominant in the European market for eco-friendly refills (soaps, detergents) and the US market for fruit purees and energy gels.

3. Inline Linear Filling Systems

For rigid containers (glass, PET, HDPE), Inline Linear Fillers are the industry workhorse. Containers move along a conveyor, stopping under a gantry of nozzles.

- Mechanism:

- Piston Fillers: Best for viscous liquids (sauces, creams) requiring precise volumetric dosage.

- Peristaltic/Flow Meter: Best for thin, high-value liquids (pharma, perfumes) requiring zero cross-contamination.

- B2B Context: These systems are highly scalable. A manufacturer can start with a 4-nozzle system and expand to 8 or 12 as demand grows. They offer the highest versatility for facilities running multiple SKUs (e.g., changing from 250ml to 1L bottles).

4. Rotary Monoblock Systems

Rotary systems represent the high-volume tier of liquid packing. “Monoblock” refers to the integration of multiple processes—rinsing, filling, and capping—onto a single machine frame.

- Mechanism: Containers enter a rotating star wheel. Filling happens continuously as the container rotates, rather than stopping and starting (intermittent motion).

- B2B Context: Essential for beverage giants and pharmaceutical companies where output requirements exceed 100 containers per minute (CPM). While the capital expenditure is significant, the cost-per-unit drops drastically at scale due to speed and reduced labor requirements.

Key Industrial Applications of liquid packing machine

Key Industrial Applications of Liquid Packing Machines

Liquid packing machines are critical infrastructure across multiple manufacturing sectors, bridging the gap between bulk processing and retail-ready distribution. While commonly associated with beverages—such as the automatic sachet filling systems used for pure water and drinks—modern equipment must handle a diverse range of viscosities, from free-flowing water to heavy industrial pastes.

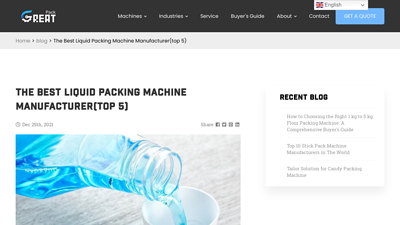

Illustrative Image (Source: Google Search)

The following table outlines the primary industries leveraging liquid packing technology, specific product applications, and common packaging formats.

| Industry Sector | Common Liquid Applications | Typical Packaging Formats |

|---|---|---|

| Food & Beverage | Water, juices, sauces (ketchup/mayonnaise), dairy, edible oils, salad dressings. | Spouted pouches, sachets (rear-sealed), stick packs, PET bottles. |

| Pharmaceuticals | Liquid medicines, syrups, saline solutions, bio-reagents, single-dose sanitizers. | Blister packs, ampoules, single-dose sachets, sterile vials. |

| Cosmetics & Personal Care | Shampoos, conditioners, lotions, creams, gels, serums, liquid soaps. | Sample sachets, flexible tubes, pump bottles, stand-up pouches. |

| Home & Personal Hygiene | Laundry detergents, dishwashing liquids, fabric softeners, surface cleaners. | Refill pouches (doypacks), rigid containers, water-soluble pods. |

| Chemical & Industrial | Motor oils, lubricants, adhesives, paints, agricultural chemicals (fertilizers). | Heavy-duty jerry cans, industrial drums, high-barrier pouches. |

Sector-Specific Operational Benefits

For B2B buyers in the US and European markets, the value of investing in automated liquid packing extends beyond simple filling. The technology addresses specific operational challenges in each sector:

1. Precision Dosing and Waste Reduction

High-value liquids, particularly in the pharmaceutical and cosmetic sectors, require volumetric precision. Modern automatic filling machines utilize piston pumps or flow meters to ensure exact dosage (e.g., 50–500ml ranges). This minimizes product giveaway and ensures regulatory compliance regarding net weight labeling.

2. Enhanced Hygiene and Shelf-Life Extension

In the Food & Beverage industry, maintaining product purity is paramount. Machines designed for these markets often feature:

* Sanitary Construction: Stainless steel (SS304/SS316) contact parts to meet FDA and CE hygiene standards.

* Sealing Integrity: Advanced heat-sealing mechanisms (such as rear-sealing or 3-side sealing) create airtight bonds that prevent contamination and oxidation, significantly extending shelf life for perishable goods like dairy and juices.

Illustrative Image (Source: Google Search)

3. Brand Visibility and Packaging Versatility

As highlighted by standard industrial sachet machines, equipment is capable of handling transparent, printed, and colorful plastic films. This allows manufacturers to:

* Run continuous branding on packaging materials.

* Utilize photo-electric sensors to ensure logos and text are perfectly aligned on every unit.

* Switch between transparent films (for product visibility) and metalized films (for UV protection) depending on the liquid’s sensitivity.

4. Handling Variable Viscosities

Chemical and Industrial manufacturers benefit from machines capable of adjusting pressure and fill speeds. The same machinery platform can often be calibrated to handle low-viscosity fluids (like window cleaner) and high-viscosity fluids (like motor oil) by adjusting the pump mechanism and nozzle diameter, offering flexibility for facilities producing multiple SKUs.

3 Common User Pain Points for ‘liquid packing machine’ & Their Solutions

3 Common User Pain Points for Liquid Packing Machines & Their Solutions

For manufacturers in the USA and Europe, the efficiency of a liquid packing machine is measured by OEE (Overall Equipment Effectiveness). Liquid packaging presents unique challenges compared to solids, primarily regarding hygiene, seal integrity, and volume precision.

Here are the three most critical pain points operators face with automatic liquid sachet and pouch fillers, along with technical solutions.

Illustrative Image (Source: Google Search)

1. Compromised Seal Integrity (Leaking Sachets)

The Scenario:

Production is running at high speed (e.g., 50-500ml sachets), but quality control detects finished pouches dripping or bursting during crate packing. The liquid product has contaminated the sealing jaws, resulting in weak bonds.

The Problem:

Liquid “splash back” or “stringing” occurs when the filling nozzle shuts off. Viscous liquids (like sauces or gels) leave a residue on the nozzle tip, which drips onto the film’s sealing area. Even a microscopic amount of liquid in the seal area prevents the heat seal from bonding the plastic film layers, leading to immediate leaks or reduced shelf-life.

The Solution:

* Anti-Drip & Suck-Back Nozzles: Upgrade to machines equipped with pneumatic anti-drip nozzles with a “suck-back” function. This retracts the last drop of liquid back into the nozzle immediately after filling, ensuring the seal area remains dry.

* PID Temperature Control: Avoid basic analog heating elements. Use PID (Proportional-Integral-Derivative) controllers that maintain sealing jaw temperature within ±1°C. This ensures the film (whether transparent or printed) is sealed at the exact melting point required, regardless of ambient temperature changes.

2. Inconsistent Filling Accuracy (Product Giveaway)

The Scenario:

A manufacturer is packaging 500ml premium beverages. Random sampling reveals volumes fluctuating between 490ml and 515ml. Overfilling results in significant “product giveaway” (financial loss), while underfilling violates EU and US weights and measures regulations.

The Problem:

Inconsistency is often caused by volumetric instability in the pumping system. Standard gravity or time-based fillers struggle when the liquid’s viscosity changes (e.g., oil becomes thinner as the machine heats up) or when the hopper level fluctuates, changing the head pressure.

The Solution:

* Servo-Driven Piston Pumps: Replace pneumatic cylinders with servo-motor driven piston pumps. Servos provide precise control over the stroke length and speed, ensuring the exact same volume (e.g., 50ml or 500ml) is dispensed every cycle, regardless of viscosity changes.

* Hopper Level Sensors: Implement automatic level control sensors in the feed hopper. This ensures the liquid pressure entering the pump remains constant, preventing variance caused by gravity head pressure.

3. Film Tracking & Registration Errors

The Scenario:

The machine is set to run “Printed Colorful Plastic Film” with branding. However, the machine frequently cuts through the logo or text rather than the designated seal area. This results in high material waste and downtime as operators manually realign the film roll.

The Problem:

This is a “registration” failure. As the film roll unwinds, tension varies, causing the film to stretch or slip. Without active correction, the machine loses track of where one bag ends and the next begins.

Illustrative Image (Source: Google Search)

The Solution:

* High-Sensitivity Photoelectric Sensors: Ensure the machine utilizes a high-contrast photoelectric eye-mark sensor. This sensor reads the “eye mark” (a small black block printed on the film edge) to trigger the cutting jaw at the precise millisecond.

* Auto-Correction Film Pulling: The system should feature a motorized film unwind with tension control bars. Advanced machines use the sensor data to automatically adjust the speed of the film-pulling wheels, correcting the alignment in real-time without stopping production.

Summary of Solutions

| Pain Point | Root Cause | Technical Solution |

|---|---|---|

| Leaking Seals | Product dripping on seal area; temp fluctuation. | Anti-drip “suck-back” nozzles; PID Temp Control. |

| Volume Variance | Viscosity changes; inconsistent pressure. | Servo-driven pumps; Hopper level automation. |

| Misaligned Film | Variable tension; sensor failure. | Photoelectric eye-mark tracking; Auto-tensioning. |

Strategic Material Selection Guide for liquid packing machine

Strategic Material Selection Guide for Liquid Packing Machines

Selecting the correct materials—both for the machine’s construction and the packaging films it processes—is critical for operational efficiency, regulatory compliance (FDA/CE), and product integrity. This guide analyzes the material requirements for liquid sachet and pouch packing machinery, specifically focusing on vertical form-fill-seal (VFFS) systems similar to the 50-500ml rear-seal models used for beverages and chemical fluids.

1. Machine Construction Materials: Hygiene and Durability

For markets in the USA and Europe, machine construction must meet strict sanitary standards. The interaction between the liquid product and the machine contact parts dictates the required steel grade.

- Stainless Steel 304 (SS304):

- Application: Standard food and beverage processing (water, milk, neutral pH juices).

- Benefit: Offers excellent corrosion resistance and durability for standard washdown environments. It is the industry standard for the frame and non-contact areas of high-quality packing machines.

- Stainless Steel 316 (SS316):

- Application: Acidic liquids (citrus juices, vinegar), saline solutions, pharmaceuticals, or aggressive chemical detergents.

- Benefit: Contains molybdenum, providing superior resistance to pitting and crevice corrosion caused by chlorides and acids.

- Strategic Advice: If your product has a pH < 4 or > 10, specify SS316 for all liquid contact parts (piston fillers, hoppers, and nozzles) to prevent contamination and equipment degradation.

2. Packaging Film Compatibility (Consumables)

Liquid packing machines, such as automatic sachet fillers, rely on heat-sealable flexible films. The machine’s sealing jaws (rear-seal or 3-side seal) must be calibrated to the specific melting points and thickness of the chosen material.

Illustrative Image (Source: Google Search)

A. Composite/Laminated Films

Laminates are the standard for liquid packaging due to their ability to combine structural integrity with sealing capabilities.

* PET/PE (Polyethylene Terephthalate / Polyethylene):

* Structure: Outer PET layer for printability and strength; inner PE layer for heat sealing.

* Usage: Transparent sachets for water, sauces, and non-sensitive liquids. Allows for the “colorful plastic film” aesthetics noted in commercial listings.

* PET/AL/PE (Aluminum Foil Laminates):

* Structure: Adds an aluminum core.

* Usage: Light-sensitive products (dairy, pharmaceuticals) requiring an absolute barrier against oxygen and UV light.

B. Mono-Material Films (Sustainability Focus)

With increasing regulations in the EU and US regarding plastic waste, newer machines are being adapted to run recyclable mono-materials (e.g., BOPE/PE).

* Challenge: These materials have a narrower sealing window.

* Requirement: Machines must feature precise PID temperature controllers to prevent burn-through or weak seals.

3. Strategic Selection Based on Liquid Viscosity

The physical properties of the liquid dictate the necessary film thickness and seal strength.

- Low Viscosity (Water, Vinegar):

- Risk: Leaking through micro-channels in the seal.

- Material Strategy: Requires high-tack sealant layers (Metallocene PE) and rigid machine jaw pressure.

- High Viscosity (Pastes, Gels, Oils):

- Risk: Product contamination in the seal area (seal contamination).

- Material Strategy: Requires films with “hot tack” strength to hold the weight of the product while the seal is still hot.

4. Comparative Analysis: Packaging Film Options

The following table compares common film structures used in automatic liquid sachet packing machines to assist in procurement decisions.

Illustrative Image (Source: Google Search)

| Material Structure | Barrier Properties (O2 & Moisture) | Transparency | Seal Strength | Best Application | Cost Efficiency |

|---|---|---|---|---|---|

| PET/PE | Moderate | High (Clear) | High | Water, Juice, Shampoo (Short shelf-life) | High |

| PET/AL/PE | Excellent (Total Barrier) | Opaque (Silver/Gold) | Very High | Dairy, Pharma, Ketchup (Long shelf-life) | Medium |

| NY/PE (Nylon) | Good | High (Clear) | Extreme (Tough) | Hot-fill liquids, Oils, Heavy sachets | Medium |

| BOPP/VMCPP | Low to Moderate | Opaque (Metallized) | Moderate | Dry snacks (Not recommended for liquids) | High |

| Mono-PE | Moderate | High (Hazy) | Moderate | Eco-friendly/Recyclable requirements | Low (Material) / High (Machine Tech) |

Strategic Takeaway: For a standard 50-500ml liquid packing operation, PET/PE offers the best balance of cost and performance for short-shelf-life goods. However, for export-grade products or those sensitive to oxidation, PET/AL/PE is the mandatory choice to ensure package integrity during logistics.

In-depth Look: Manufacturing Processes and Quality Assurance for liquid packing machine

In-depth Look: Manufacturing Processes and Quality Assurance

For buyers in the USA and Europe, the value of a liquid packing machine is determined not just by its operational speed, but by the engineering rigor behind its construction. The manufacturing process for equipment—such as automatic sachet fillers or rear-sealed packing units—must adhere to strict protocols to ensure hygiene, durability, and precision.

The following sections detail the standard manufacturing lifecycle and quality control (QC) frameworks required to produce industrial-grade liquid packaging solutions.

1. Manufacturing Workflow: From Raw Metal to Automation

The production of a high-efficiency liquid packing machine involves four distinct phases.

Illustrative Image (Source: Google Search)

Phase I: Material Preparation and Component Machining

- Material Selection: The chassis and contact parts are primarily fabricated from Stainless Steel 304 or 316L. This is a non-negotiable requirement for compliance with FDA (USA) and GMP (Europe) standards regarding food and beverage safety.

- CNC Precision: Critical components, such as the piston pump cylinders and sealing jaws, are shaped using Computer Numerical Control (CNC) machining. High-precision cutting ensures that tolerances are kept within micrometers to prevent leakage during high-pressure filling.

Phase II: Fabrication and Structural Welding

- Frame Stability: The machine base is welded to create a rigid, vibration-resistant structure. Stability is paramount; excessive vibration during the 50–500ml filling cycle can lead to seal failures or inconsistent fill volumes.

- Surface Treatment: All welds are ground smooth and polished. For machines destined for the food or pharmaceutical sectors, bead blasting or electropolishing is applied to eliminate crevices where bacteria could harbor.

Phase III: Assembly and Systems Integration

This phase merges mechanical hardware with electronic and pneumatic systems.

* Pneumatic Integration: Installation of air cylinders and solenoids that drive the sealing jaws and cutting blades.

* Dosing System Assembly: The liquid pump (piston, peristaltic, or mag-drive) is calibrated and installed. For machines handling 50-500ml ranges, the piston stroke is adjusted for maximum repeatability.

* Electrical Cabinet: Wiring of the PLC (Programmable Logic Controller), HMI (Human-Machine Interface), and temperature controllers. Cable management is executed to IP65 standards to protect against liquid splashes.

Phase IV: Software Configuration

Engineers program the PLC to manage the synchronization between film pulling, liquid dosing, and heat sealing. Logic implies specific parameters for “rear-sealed” or “3-side seal” configurations, ensuring the cut happens exactly at the eye-mark on printed films.

2. Quality Assurance (QC) Protocols

Before a machine ships to a facility in Ashburn, VA, or Berlin, Germany, it undergoes a multi-stage validation process.

| QC Stage | Description | Acceptance Criteria |

|---|---|---|

| Dimensional Inspection | Verification of all machined parts against CAD drawings. | Tolerance within ±0.05mm. |

| Dry Cycle Test | Running the machine without liquid or film for 12–24 hours. | No overheating of motors; smooth pneumatic actuation; stable PLC logic. |

| Seal Integrity Test | Running the machine with film to test heat sealing bars. | Seals must withstand pressure without bursting; serration patterns must be uniform. |

| Wet Calibration (Dosing) | Filling sachets with water/viscous liquid across the 50-500ml range. | Fill accuracy must be within ±1% (or industry standard). Zero dripping from nozzles. |

| Electrical Safety | Insulation resistance and ground continuity testing. | Must meet UL (USA) or CE (Europe) voltage safety standards. |

3. Compliance and Industry Standards

For B2B importers and facility managers, verifying the following certifications is essential to ensure liability protection and operational legality.

Illustrative Image (Source: Google Search)

- ISO 9001:2015: Certification that the manufacturer operates under a standardized Quality Management System (QMS), ensuring consistent production processes.

- CE Marking (Conformité Européenne): Mandatory for the European market. It certifies the machine meets EU safety, health, and environmental protection requirements (specifically the Machinery Directive 2006/42/EC).

- GMP (Good Manufacturing Practice): Essential for liquid packing. It ensures the machine design allows for easy cleaning (CIP – Clean In Place) and prevents cross-contamination.

- UL / CSA: While not always mandatory for entry, UL (Underwriters Laboratories) or CSA components are highly preferred for the US and Canadian markets to satisfy local electrical codes and insurance requirements.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘liquid packing machine’

Practical Sourcing Guide: A Step-by-Step Checklist for Liquid Packing Machines

Sourcing liquid packing machinery requires precision. Unlike solid packaging, liquid handling involves fluid dynamics, leakage risks, and strict hygiene standards. Use this checklist to structure your procurement process for the US and European markets.

Phase 1: Technical Requirement Definition

Before contacting suppliers, define your operational parameters to avoid mismatched quotes.

| Parameter | Key Considerations | Example Spec (from Reference) |

|---|---|---|

| Viscosity & Product Type | Is the liquid free-flowing (water/juice) or viscous (sauce/gel)? Does it contain particulates? | Pure Water, Drink (Low viscosity) |

| Fill Volume Range | Define the minimum and maximum capacity required. Machines are rarely “one-size-fits-all.” | 50ml – 500ml |

| Packaging Format | Sachet, stick pack, pillow bag, or stand-up pouch? Define seal type (3-side, 4-side, rear-seal). | Rear-sealed sachet |

| Film Compatibility | PE, BOPP, Aluminum foil, or Paper-PE? Ensure the sealing jaws match the material’s melting point. | Transparent/Printed Colorful Plastic Film |

| Throughput Speed | Required bags per minute (BPM). Note: Higher viscosity often lowers speed. | Define based on production targets |

Phase 2: Supplier Vetting & Compliance (USA/EU Focus)

Markets in Europe and North America have strict regulatory hurdles. Verify these before negotiating price.

- Electrical Standards:

- [ ] USA: Ensure 110V/220V, 60Hz compatibility.

- [ ] Europe: Ensure 220V/240V, 50Hz compatibility.

- [ ] Components: Request major brand electronics (e.g., Siemens, Omron, Schneider) for easier local maintenance.

- Certifications:

- [ ] CE Marking: Mandatory for EU entry.

- [ ] UL/CSA: Highly recommended for US/Canada to ensure insurance coverage and safety compliance.

- Hygiene Standards:

- [ ] Material Construction: Contact parts must be SS304 or SS316 (Food Grade).

- [ ] Cleanability: Check for “Clean-in-Place” (CIP) capabilities or easy disassembly for washdown.

Phase 3: The Sourcing Checklist

When evaluating listings (such as those on Amazon Business or Alibaba) or direct manufacturer quotes:

Illustrative Image (Source: Google Search)

1. Machine Architecture

- [ ] Pump Type: Does it use a piston pump (viscous), magnetic pump (clean liquid), or peristaltic pump (pharma/sterile)?

- [ ] Hopper Design: Is the hopper heated (for waxes/oils) or agitated (to keep particulates suspended)?

- [ ] Sealing Mechanism: Pneumatic vs. Mechanical. Pneumatic generally offers more consistent pressure for liquid seals but requires an external air compressor.

2. Operational Validation

- [ ] Photo Eye Sensor: Verify the machine has high-sensitivity sensors for reading eye-marks on printed film to ensure correct cut points.

- [ ] Drip Prevention: Ask about “suck-back” features or shut-off nozzles to prevent liquid dripping into the seal area (which causes leaking bags).

3. Vendor Reliability (e.g., “YL Packing Machine”)

- [ ] Spare Parts Availability: Does the vendor sell wear-and-tear kits (heating elements, Teflon strips, cutter blades)?

- [ ] Factory vs. Trader: Confirm if the seller manufactures the unit or is a reseller. Manufacturers offer better technical modification support.

- [ ] Video Proof: Request a video call showing the machine running your specific bag size and liquid type.

Phase 4: Commercial & Logistics

- Incoterms:

- [ ] Clarify shipping terms. A machine listed at ~$3,000–$5,000 often excludes international freight, duties, and last-mile delivery.

- [ ] For US buyers: Check HTS codes to estimate tariffs (Section 301 tariffs may apply to machinery from China).

- Warranty & Returns:

- [ ] Return Policy: While some platforms offer returns (e.g., until Jan 31, 2026), returning a heavy industrial crate is logistically difficult and expensive. Focus on the warranty for parts replacement.

- [ ] Remote Support: Ensure the vendor offers WhatsApp/WeChat video support for installation troubleshooting.

🚩 Red Flags to Watch For

- No Brand Components: If the PLC or HMI has no brand name, replacement parts will be impossible to source locally in the US/EU.

- Vague “Universal” Claims: Avoid machines claiming to pack “everything” from water to peanut butter without changing parts.

- Lack of Crate Details: Ensure the machine is packed in a fumigated export-grade wooden crate to prevent transit damage.

Comprehensive Cost and Pricing Analysis for liquid packing machine Sourcing

Comprehensive Cost and Pricing Analysis for Liquid Packing Machine Sourcing

For buyers in the USA and Europe, sourcing liquid packing machinery involves calculating the Total Cost of Ownership (TCO), not merely the Free on Board (FOB) unit price. The following analysis breaks down capital expenditure (CapEx) and operational expenditure (OpEx) based on current market data for standard 50-500ml automatic sachet filling systems.

1. Capital Expenditure: Machine Price Tiers

Pricing correlates directly with automation levels, filling capacity, and construction materials (e.g., SS304 vs. SS316 food-grade stainless steel).

| Machine Tier | Price Range (USD) | Typical Specifications |

|---|---|---|

| Entry-Level (Sachet/Pouch) | $2,500 – $6,000 | Vertical Form Fill Seal (VFFS), 50-500ml capacity, 30-50 bags/min, rear-sealing. Reference: Standard automatic sachet fillers often retail ~$5,000. |

| Mid-Range (Semi-Auto/Linear) | $10,000 – $25,000 | Multi-head piston fillers, higher accuracy (±1%), PLC touchscreens, suitable for viscous liquids (gels, sauces). |

| High-End (Rotary/High Speed) | $45,000+ | Rotary packing, >80 bags/min, multi-lane processing, integrated capping/labeling, full EU/FDA compliance features. |

2. Landed Cost Breakdown (Logistics & Importation)

For a standard $5,000 liquid packing unit imported to the US or EU, the landed cost can exceed the sticker price by 30-50%.

- Freight (Sea vs. Air): Due to the weight and crating dimensions of industrial machinery, sea freight is standard. Expect $800–$2,500 per unit depending on LCL (Less than Container Load) rates and destination port.

- Export Packaging: Wooden crating fees typically range from $150–$300 to ensure compliance with ISPM 15 standards (heat-treated wood).

- Customs & Duties:

- USA: Harmonized Tariff Schedule (HTS) codes for packing machinery (typically under heading 8422) may attract standard duties plus Section 301 tariffs (if sourcing from China), potentially adding 25% to the value.

- Europe: Value Added Tax (VAT) ranges from 19-25% depending on the member state, plus standard import duties.

3. Operational Cost Breakdown (OpEx)

Materials (Consumables)

The primary recurring cost is the packaging film.

* Film Types: PE, PET, Aluminum Foil, or composite laminates.

* Cost Calculation: Films are sold by weight (kg) or roll length.

* Example: A transparent printed colorful plastic film roll might cost $10–$20 per kg.

* Impact: High-quality film prevents leakage in rear-sealed sachets, reducing waste. Cheaper film may save upfront costs but increase machine downtime due to tearing.

Illustrative Image (Source: Google Search)

Labor and Maintenance

- Setup & Changeover: Entry-level machines ($3k-$5k range) often require manual film threading and mechanical adjustments for different sachet sizes. Allocating 1-2 hours of labor per week for calibration is standard.

- Spare Parts: Heating elements, Teflon strips, and cutting blades are wear-and-tear items. Budget 2-5% of the machine cost annually for spare parts kits.

4. Strategic Tips for Cost Optimization

- Standardize Film Widths: Custom-sized film rolls often carry higher Minimum Order Quantities (MOQs). Designing your sachet size around standard film widths (e.g., 320mm, 240mm) reduces material costs.

- Verify Voltage Compatibility: Machines sourced globally may be wired for 220V/50Hz (China/EU). US facilities (110V/60Hz or 220V/60Hz) may require a transformer or a custom motor order. Retrofitting this locally is significantly more expensive than specifying it during manufacture.

- Bundle Spare Parts: When purchasing the machine, negotiate a “wear-and-tear” package (extra heating tubes, thermocouples, and seals). Shipping these small parts separately later incurs disproportionate courier fees.

- Consolidate Logistics: If purchasing multiple units (e.g., a filler and a separate vacuum sealer), consolidate them into a single shipment to minimize port handling fees and customs brokerage charges.

Alternatives Analysis: Comparing liquid packing machine With Other Solutions

Alternatives Analysis: Comparing Liquid Packing Machines With Other Solutions

When evaluating liquid packaging automation, the Automatic Liquid Sachet Packing Machine (specifically Vertical Form Fill Seal or VFFS models) occupies a specific niche: high-speed, low-material-cost production of flexible sachets.

However, depending on your SKU diversity, aesthetic requirements, and production volume, this may not be the optimal solution. Below, we compare the standard Automatic Liquid Packing Machine against two common alternatives: Pre-made Pouch Rotary Machines and Semi-Automatic Filling Systems.

Comparative Overview

| Feature | Automatic Liquid Packing Machine (VFFS) | Alternative 1: Pre-made Pouch Rotary Machine | Alternative 2: Semi-Automatic Filling System |

|---|---|---|---|

| Packaging Type | Sachets/Pillows (Rear-sealed, 3-side, or 4-side seal) | Stand-up Pouches, Doypacks, Zipper Bags | Bottles, Jars, or Pre-made Bags (Manual seal) |

| Throughput | High (30–60+ bags/min) | Medium (15–40 bags/min) | Low (5–15 units/min, operator dependent) |

| Capital Cost (CapEx) | Moderate ($3,000 – $15,000) | High ($25,000 – $80,000+) | Low ($500 – $3,000) |

| Consumable Cost (OpEx) | Lowest (Uses roll stock film) | High (Uses pre-converted bags) | Variable (Depends on container type) |

| Changeover Time | Slow (Requires changing film roll & forming collar) | Fast (Adjustable grippers for bag width) | Very Fast (Simple nozzle/volume adjustment) |

| Labor Requirement | Low (1 operator for multiple machines) | Low (1 operator) | High (1 operator per machine active at all times) |

Analysis of Alternative 1: Pre-made Pouch Rotary Machines

While the Automatic Liquid Packing Machine forms the bag from a roll of film, the Rotary Machine fills and seals bags that have already been manufactured.

- The Upgrade Argument: If your product requires a premium retail presence—such as a stand-up Doypack with a resealable zipper or spout—a standard VFFS sachet machine is insufficient. Rotary machines offer superior packaging aesthetics and stronger shelf presence.

- The Trade-off: The cost per unit is significantly higher. Roll stock film (used in VFFS) costs fractions of a cent per unit, whereas pre-made pouches cost significantly more. Furthermore, the machinery CapEx is often 5x to 10x higher than the $3,000–$5,000 range of standard sachet packers.

- Best Use Case: Premium food and beverage products, cosmetics, and detergents intended for retail shelves where branding is critical.

Analysis of Alternative 2: Semi-Automatic Filling Systems

This solution decouples the filling and sealing processes. An operator manually places a container under a nozzle, triggers the fill, and then moves the container to a separate sealing station (capper or band sealer).

- The Entry-Level Argument: For businesses producing under 500 units per day, or those with frequent SKU changes (e.g., 10 different flavors of sauce), the setup time of an automatic machine is prohibitive. Semi-automatic piston fillers handle high viscosity liquids (like creams or pastes) better than entry-level automatic sachet packers, which may struggle with clogging.

- The Trade-off: You lose the automation advantage. Labor costs increase linearly with production volume. Additionally, consistency relies on the operator, whereas an automatic machine guarantees identical fill levels and seal integrity every cycle.

- Best Use Case: R&D labs, startups, pilot runs, or operations filling rigid containers (bottles/jars) rather than flexible film.

Verdict: When to Stick with the Automatic Liquid Packing Machine

The Automatic Liquid Packing Machine (VFFS) remains the superior choice for mid-to-high volume production where cost-per-unit is the primary KPI.

Based on market specifications for 50-500ml rear-sealed machines:

1. Economy of Scale: By utilizing roll stock film rather than pre-made bags, you maximize margins on single-serve items (condiments, shampoo samples, drink mixes).

2. Speed: With capabilities often exceeding 2,000 bags per hour, it outperforms manual labor by a factor of ten.

3. Hygiene: The “Form-Fill-Seal” process occurs within a closed system, reducing contamination risks compared to open semi-automatic filling.

Recommendation: Choose the Automatic Liquid Packing Machine if your product is a single-use sachet (50-500ml) and you require a production rate exceeding 1,000 units per day with minimal operator intervention.

Essential Technical Properties and Trade Terminology for liquid packing machine

Essential Technical Properties and Trade Terminology

When sourcing liquid packing machines for Western markets (USA and Europe), buyers must navigate specific technical specifications and commercial trade terms to ensure equipment compatibility and procurement efficiency.

Illustrative Image (Source: Google Search)

Key Technical Properties

The following technical parameters define the operational capability of the machinery. These specifications directly impact production throughput, facility integration, and packaging quality.

| Property | Definition | Buyer Context (USA & EU) |

|---|---|---|

| Filling Range (Dosing Volume) | The minimum and maximum liquid volume the machine can dispense per cycle (e.g., 50–500ml). | Select a range that covers your smallest SKU and largest SKU. Note: Wide ranges (e.g., 50–1000ml) may sacrifice precision at the lower end compared to dedicated small-dose machines. |

| Sealing Configuration | The method used to seal the film. Common types include Rear-Seal (Pillow Bag), 3-Side Seal, and 4-Side Seal. | Rear-seal (referenced in standard 50-500ml units) is cost-effective and uses less film, ideal for water and commodity drinks. 3/4-Side seals offer a flatter, premium look for cosmetics or nutritional gels. |

| Throughput (Capacity) | Measured in bags per minute (BPM) or packs per hour (PPH). | Standard single-lane vertical form fill seal (VFFS) units often run 30–60 BPM depending on liquid viscosity and bag length. |

| Film Compatibility | The types of packaging material the machine can handle (e.g., PET/PE, Paper/PE, Foil laminates). | Ensure the machine’s sealing jaws match your film’s melting point. Transparent and printed films often require different optical sensor calibrations (photocell registration). |

| Voltage & Frequency | The electrical power requirements for operation. | Critical: USA requires 110V/60Hz (single phase) or 220V/60Hz. Europe requires 220V/50Hz or 380V/50Hz (3-phase). Verify the machine is wired for your specific region to avoid needing external transformers. |

| Control System | The hardware managing the logic and interface, typically a PLC (Programmable Logic Controller) and HMI (Touchscreen). | Look for reputable brands (e.g., Siemens, Mitsubishi, Omron) to ensure local availability of spare parts and easier troubleshooting in Western markets. |

Essential Trade Terminology

Understanding these terms is required for negotiating contracts and calculating the Total Landed Cost (TLC) of the machinery.

-

MOQ (Minimum Order Quantity):

- Machinery: Typically 1 unit.

- Consumables: If sourcing custom printed film or spare parts alongside the machine, MOQs are significantly higher (often measured by weight, e.g., 200kg of film).

-

OEM (Original Equipment Manufacturer):

- Refers to the factory’s ability to manufacture the machine to your specifications. This includes modifying the filling range, changing the hopper size, or custom-branding the HMI software interface with your company logo.

-

Lead Time:

- The duration from receipt of deposit to shipment. For standard liquid packers (like the 50-500ml sachet models), lead time is often 10–15 days. Custom voltage modifications or OEM requests can extend this to 30–45 days.

-

FAT (Factory Acceptance Test):

- A pre-shipment trial where the machine is run at the manufacturer’s facility using your specific liquid and film.

- Pro Tip: Always request a video FAT showing the machine running at full speed for 10+ minutes to verify seal integrity and dosing accuracy before releasing the final payment.

-

Certifications (CE / UL):

- CE Marking: Mandatory for machinery imported into the European Economic Area (EEA). It certifies conformity with health, safety, and environmental protection standards.

- UL Listing: Highly preferred for the USA. Many insurance companies and local electrical codes require UL-certified components. If the full machine is not UL listed, ensure key components (motors, PLC) carry the certification.

-

Incoterms (Shipping Terms):

- EXW (Ex Works): You pay for everything from the factory floor onwards.

- FOB (Free on Board): Supplier pays to get the machine to their local port; you handle the ocean freight and import.

- DDP (Delivered Duty Paid): The supplier handles all logistics, taxes, and duties, delivering directly to your door. This is common for smaller machines (under $5,000) purchased via platforms like Alibaba or Amazon Business.

Navigating Market Dynamics and Sourcing Trends in the liquid packing machine Sector

Navigating Market Dynamics and Sourcing Trends in the Liquid Packing Machine Sector

The liquid packaging machinery market is undergoing a significant shift, driven by a demand for versatility, compact automation, and strict adherence to sustainability standards in the USA and European markets. For B2B buyers, understanding these dynamics is critical when selecting equipment ranging from entry-level sachet fillers to industrial-scale bottling lines.

1. Market Dynamics: The Rise of Flexible Packaging and Automation

The dominance of rigid containers (glass and heavy plastic) is ceding ground to flexible packaging solutions, such as sachets, pouches, and stick packs. This shift is influenced by logistics costs and consumer convenience.

- Small-Format Dominance: There is a surging demand for machines capable of handling small volumes (50–500ml). This range covers single-serve beverages, cosmetic samples, and condiments. As seen in current market listings, automatic sachet filling machines in this volume range are now accessible for under $5,000, lowering the barrier to entry for small-to-mid-sized manufacturers.

- Versatility Over Speed: While speed remains important, Western markets increasingly prioritize machine versatility. Buyers prefer equipment that can handle multiple viscosities—from pure water to viscous sauces—and accommodate various film types (transparent, printed, colorful) without requiring extensive retooling.

- Rear-Sealed Efficiency: The market favors “rear-sealed” (center seal) architecture for sachets due to its maximizing of internal volume relative to film usage, presenting a cleaner aesthetic for branding.

2. Sourcing Trends: The Digitalization of Industrial Procurement

The sourcing landscape for liquid packing machinery has evolved from strictly trade-show-based procurement to digital direct-buying.

- Direct-to-Consumer (B2B) Channels: Industrial equipment is increasingly available on general e-commerce platforms. Machines previously requiring complex import logistics can now be sourced with transparent pricing (e.g., ~$3,000–$5,000 for standard automatic units) and standardized shipping.

- Key Sourcing Criteria for US/EU Buyers:

- Voltage Compatibility: Sourcing from global manufacturers requires strict attention to electrical standards (110V/60Hz for USA vs. 220V/50Hz for Europe).

- Spare Parts Availability: With the rise of affordable imported machinery, the availability of consumables (heating elements, cutter blades) and aftermarket support has become a primary differentiator between vendors.

- Hygiene Standards: Machines must meet FDA (USA) or CE (Europe) standards, particularly regarding food-contact surfaces (typically SS304 or SS316 stainless steel).

3. Sustainability: Material Compatibility

Sustainability is no longer optional for the US and European markets; it is a regulatory and consumer requirement. This impacts how packing machines are designed and selected.

Illustrative Image (Source: Google Search)

- Down-Gauging Films: Modern machines must be calibrated to handle thinner plastic films to reduce raw material usage without compromising seal integrity.

- Monomaterial & Recyclable Films: Older heating elements often struggle with recyclable monomaterial films (PE/PE), which have narrower sealing temperature windows. Current sourcing trends favor machines equipped with precise PID temperature controllers capable of sealing eco-friendly films without burning or leaking.

4. Historical Context: The Evolution of Liquid Filling

Understanding the trajectory of packing technology helps in assessing the longevity of a potential investment.

| Era | Technology Focus | Key Characteristics |

|---|---|---|

| Pre-2000s | Manual & Semi-Auto | High labor cost, inconsistent fill levels, rigid bottle focus. |

| 2000-2015 | Volumetric Piston Automation | Improved accuracy, introduction of PLC controls, focus on speed. |

| 2015-Present | Compact Flexible Automation | Integration of forming, filling, and sealing in single compact units (like the 50-500ml sachet packers); focus on quick changeovers and film versatility. |

Strategic Takeaway: When sourcing liquid packing machines today, buyers should prioritize equipment that offers a balance between the historical reliability of piston filling and modern requirements for flexible film handling and compact footprints.

Frequently Asked Questions (FAQs) for B2B Buyers of liquid packing machine

Frequently Asked Questions (FAQs) for B2B Buyers of Liquid Packing Machines

1. What is the viscosity range capability of standard liquid packing machines?

Most automatic liquid packing machines are designed to handle a specific viscosity range. Entry-level to mid-range machines (often utilizing piston pumps) generally handle free-flowing liquids (water, juice, vinegar) up to medium-viscosity products (oil, thin sauces, detergent).

* Low Viscosity: Requires anti-drip nozzles to prevent seal contamination.

* High Viscosity: Pastes or heavy creams usually require a specialized hopper with an agitator and a positive displacement pump system.

* Note: Always verify if the machine is rated for your specific centipoise (cP) value.

2. How flexible are the filling volumes, and what is the typical accuracy tolerance?

Machines are typically rated for a specific volume bracket. For example, a standard commercial sachet packer often operates within a 50ml to 500ml range.

* Adjustment: Volume is usually adjusted via a hand-wheel or digital PLC interface that alters the piston stroke length.

* Accuracy: Industrial standards demand a filling accuracy of $\pm$1% to $\pm$1.5%. High-precision pharmaceutical or cosmetic fillers may offer tighter tolerances ($\pm$0.5%).

Illustrative Image (Source: Google Search)

3. What packaging film materials are compatible with vertical form-fill-seal (VFFS) liquid packers?

Liquid packers generally require laminated films to ensure a leak-proof barrier.

* Common Materials: PET/PE, PET/Plated Al/PE, Paper/PE, and Nylon/PE.

* Transparent vs. Printed: Machines typically utilize photoelectric sensors (eye-mark sensors) to cut printed film accurately. If using transparent film without eye marks, the machine must allow for fixed-length cutting configurations.

* Sustainability: For European markets, ensure the sealing jaws can handle mono-material (recyclable) PE films, which often require more precise temperature control than composite laminates.

4. What sealing mechanisms are available, and how is seal integrity maintained?

The sealing method dictates the package format and leak resistance.

* Rear-Sealed (Pillow Pack): Common for sachets (50-500ml). Uses a vertical lap seal and horizontal top/bottom seals.

* 3-Side or 4-Side Seal: Offers a flatter, more premium look but may require different tooling.

* Integrity: For liquids, temperature control must be PID-based (Proportional-Integral-Derivative) to maintain constant heat. Inconsistent heat leads to “leakers” or burnt film.

5. What are the sanitation and cleaning requirements (CIP/COP)?

For food and beverage applications (juices, sauces), the machine must meet FDA or CE hygiene standards.

* Construction: Contact parts must be Stainless Steel 304 or 316.

* Changeover: Look for “Quick Release” fittings on the hopper and nozzle to facilitate Clean-Out-of-Place (COP).

* CIP: Advanced industrial lines may offer Clean-In-Place capabilities, but standalone units (like standard 50-500ml packers) usually require manual disassembly for sanitization.

6. How does the machine handle Date Coding and Batch Numbering?

Most B2B liquid packers include or integrate with coding devices.

* Ribbon Coder: Uses a heated ribbon to stamp the date (low cost, mechanical).

* Thermal Transfer/Inkjet: Programmable, higher clarity, and capable of printing barcodes or QR codes (higher cost).

* Placement: Ensure the machine frame has a designated mounting bracket for the printer to ensure consistent placement on the film before it is formed into a bag.

Illustrative Image (Source: Google Search)

7. What is the expected throughput, and how does liquid density affect speed?

Manufacturers often quote “dry cycle” speeds or maximums (e.g., 30–60 bags per minute). Real-world liquid production differs:

* Viscosity Drag: Thicker liquids fill slower to prevent back-pressure.

* Foaming: Foamy liquids (like soaps) require slower fill speeds or bottom-up filling nozzles to prevent foam from compromising the top seal.

* Bag Length: Longer bags (e.g., 500ml vs 50ml) take longer to pull down, reducing cycles per minute.

8. What are the spare parts availability and voltage requirements for USA/EU markets?

* Voltage: Standard industrial units often run on 220V single-phase or 380V 3-phase. US buyers may need a transformer if 110V is the only available power, though 220V is standard for industrial machinery.

* Wear Parts: The most common replacement parts are Teflon strips (for sealing jaws), heating elements, and cutting blades.

* Support: For imported machinery, verify if the vendor uses proprietary electronics or standard components (e.g., Siemens/Mitsubishi PLC, Omron temperature controllers) that can be sourced locally in the USA or Europe to minimize downtime.

Strategic Sourcing Conclusion and Outlook for liquid packing machine

Strategic Sourcing Conclusion and Outlook

Sourcing liquid packing machinery is no longer solely the domain of heavy industry; it is a critical lever for operational scalability in SMEs and mid-market enterprises. As evidenced by the availability of versatile 50-500ml automatic sachet filling machines in the $3,000–$5,000 range, the barrier to entry for automation has lowered significantly. For buyers in the USA and Europe, this accessibility allows for a strategic shift from labor-intensive manual processes to consistent, high-speed rear-sealed packaging.

The outlook for liquid packaging technology emphasizes flexibility and speed-to-market. Modern sourcing strategies must prioritize equipment that supports diverse packaging materials—such as transparent or printed films—and adjustable volume capacities to accommodate fluctuating SKU demands.

Key Sourcing Takeaways

- ROI & Accessibility: Commercial-grade units around the $5,000 price point offer rapid ROI by standardizing sealing quality and reducing material waste.

- Operational Versatility: Select machines capable of handling a broad volume range (e.g., 50ml to 500ml) to future-proof production lines against changing market trends.

- Vendor Reliability: While e-commerce platforms provide convenient access, ensure vendors offer robust after-sales support and spare parts availability to maintain uptime.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.