Machinery For Packaging: The Ultimate 2025 Sourcing Guide

Introduction: Navigating the Global Market for machinery for packaging

In the competitive manufacturing landscapes of the USA and Europe, packaging operations are no longer just a final step in production—they are a strategic differentiator. Whether you are scaling food production or streamlining consumer goods logistics, the efficiency of your line directly correlates to your speed-to-market and profitability. However, identifying the right infrastructure among a fragmented global market remains a critical hurdle.

The Challenge: Complexity in Integration

Sourcing equipment is rarely about a single machine; it is about orchestrating a symphony of mechanical and digital systems. Manufacturers must navigate a vast array of technologies—from Fanuc pick-and-place robots to Ishida checkweighers—while ensuring seamless compatibility. A misalignment between your Vertical Form Fill Seal (VFFS) system and your case packer can result in costly bottlenecks, downtime, and material waste.

What This Guide Covers

This guide provides a technical roadmap for procurement managers and operations directors. We move beyond generic advice to analyze the specific machinery categories required to build a fully integrated, high-velocity packaging line.

Key areas of focus include:

- Primary Packaging: High-precision weighing, bagging (VFFS/HFFS), and liquid filling systems.

- Secondary Packaging: Solutions for retail readiness, including cartoning, shrink bundling, and blister sealing.

- End-of-Line Automation: Optimizing logistics with robotic palletizers, strapping machines, and stretch wrappers.

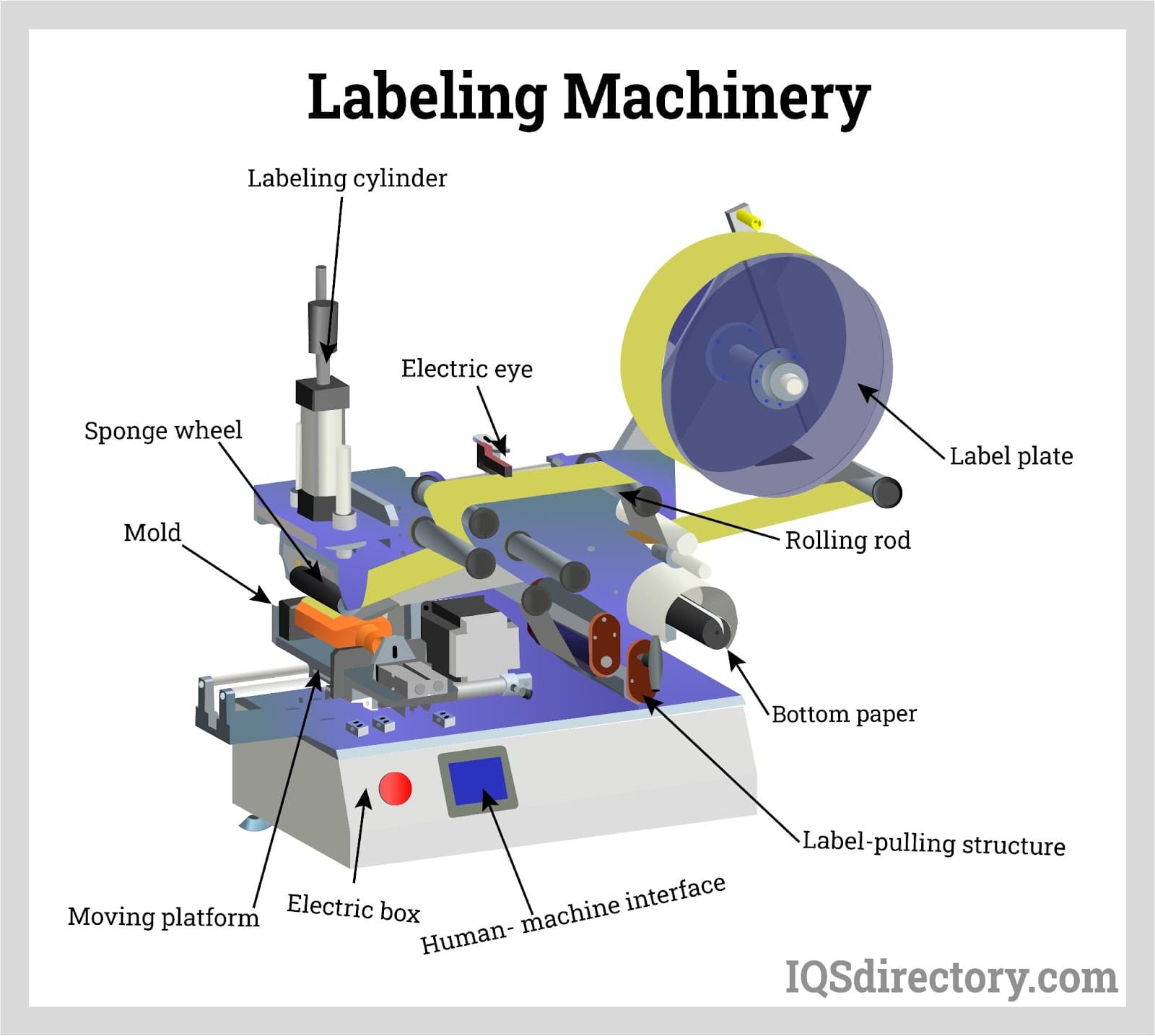

- System Integration: Connecting conveyors, labelers, and coding equipment for unified throughput.

By understanding the distinct capabilities of these systems, you can secure machinery that not only meets current demand but scales for future growth.

Illustrative Image (Source: Google Search)

Top 10 Machinery For Packaging Manufacturers & Suppliers List

1. Packaging Machinery Companies | Packaging Machinery …

Domain: packagingmachinerycompanies.com

Registered: 2019 (6 years)

Introduction: Visit our directory of leading packaging machinery manufacturers or contact us to request personalized recommendations based on your unique needs….

2. Top 10 Packaging Machine Manufacturers in the USA – HonorPack

Domain: honorpack.com

Registered: 2009 (16 years)

Introduction: The top 10 packaging machine manufacturers in the USA are: HonorPack, Viking Masek, Accutek, Triangle, Packline, Paxiom, Matrix, Alliedflex, Masipack, and K- ……

3. Packaging Machinery: 9 Global Leaders to Watch in 2025

Domain: packaging-labelling.com

Registered: 2008 (17 years)

Introduction: The 9 global leaders are: Bosch, Tetra Pak, IMA, Marchesini, Krones, Coesia, Ishida, ProMach, and MULTIVAC….

4. Best Packaging Solution in USA | Package Machine Manufacturers

Domain: blackforestpkg.com

Registered: 2011 (14 years)

Introduction: We are the leading packaging machine manufacturers in USA, with certified and experienced professionals involved in operations and taking care of quality ……

Illustrative Image (Source: Google Search)

5. 24 Packaging Equipment Manufacturers in 2025 – Metoree

Domain: us.metoree.com

Registered: 2020 (5 years)

Introduction: Here are the top-ranked packaging equipment companies as of November, 2025: 1. Loveshaw Corporation, 2….

6. PMI KYOTO | Packaging Machine Manufacturer

Domain: pmikyoto.com

Registered: 2018 (7 years)

Introduction: PMI KYOTO designs high-performance packaging solutions, including case packers, cartoners, and robotic systems, and provides reliable, end-of-line solutions….

7. Top 30 companies in the global packaging machinery market in 2019

Domain: newtonconsultingpartners.com

Registered: 2018 (7 years)

Introduction: Top 30 companies in the global packaging machinery market in 2019 · ADELPHI PACKAGING MACHINERY · AETNA GROUP · BARRY-WEHMILLER COMPANIES, INC….

8. ADCO Packaging Machinery Company | Packaging Machinery …

Domain: adcomfg.com

Registered: 1998 (27 years)

Introduction: ADCO Manufacturing helps the world’s leading consumer goods producers address their most complex packaging machinery and systems automation….

Illustrative Image (Source: Google Search)

9. Massman Automation: Leading Automated Packaging Equipment

Domain: massmanautomation.com

Registered: 2005 (20 years)

Introduction: Specializing in delivering best-in-class packaging machinery, Massman Companies offers Unscramblers, Liquid Fillers, Pouch Fillers, Cappers, Lidders, Cartoners, ……

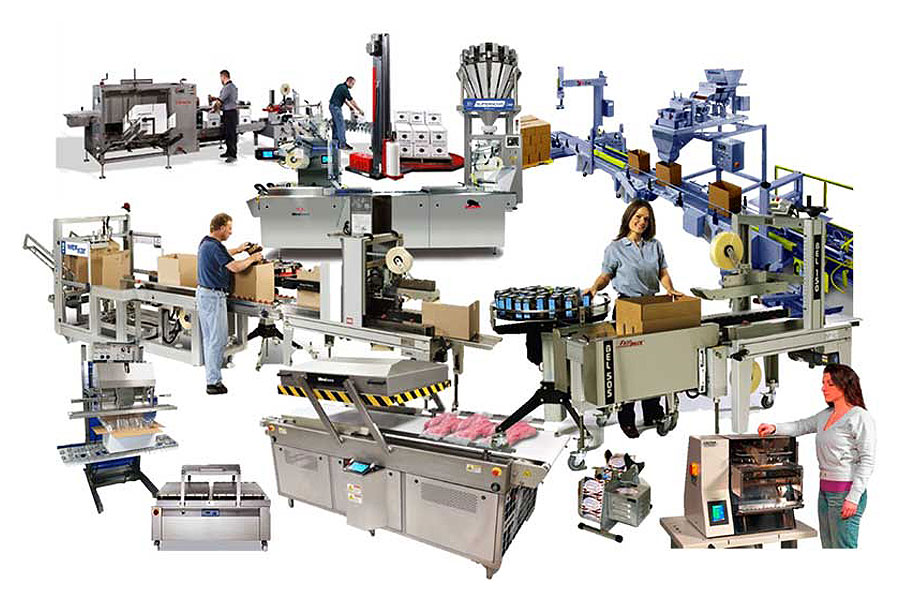

Understanding machinery for packaging Types and Variations

Understanding Machinery for Packaging: Types and Variations

Selecting the correct packaging infrastructure is critical for optimizing throughput, ensuring product integrity, and managing per-unit costs. The following breakdown categorizes the core machinery types found in modern industrial environments, ranging from primary packaging (direct product contact) to tertiary packaging (palletization and logistics).

Illustrative Image (Source: Google Search)

Quick Comparison: Core Packaging Machinery Types

| Machinery Type | Key Features | Typical Applications | Pros & Cons |

|---|---|---|---|

| Form-Fill-Seal (FFS) & Bagging | Uses rollstock to create bags/pouches; simultaneous filling and sealing. | Food (snacks, coffee), liquids, hardware, medical devices. | Pros: High speed, lower material cost. Cons: Complex changeovers for different bag sizes. |

| Shrink & Overwrapping | Applies film via heat tunnels or folding; creates tamper-evident or multipack seals. | Beverage multipacks, software boxes, cosmetics, retail food trays. | Pros: Visual appeal, tamper evidence, bundle stability. Cons: High energy consumption (heat tunnels). |

| Case & Tray Packing | Automates box erecting, packing, and sealing; handles secondary packaging. | E-commerce fulfillment, consumer goods, bulk food distribution. | Pros: Significant labor reduction, consistent square cases. Cons: Large floor footprint required. |

| Palletizing & Load Containment | Stacks cases onto pallets and secures loads for transport. | Warehousing, logistics centers, high-volume manufacturing. | Pros: Workplace safety (heavy lifting), load stability. Cons: High initial capital expenditure (CapEx). |

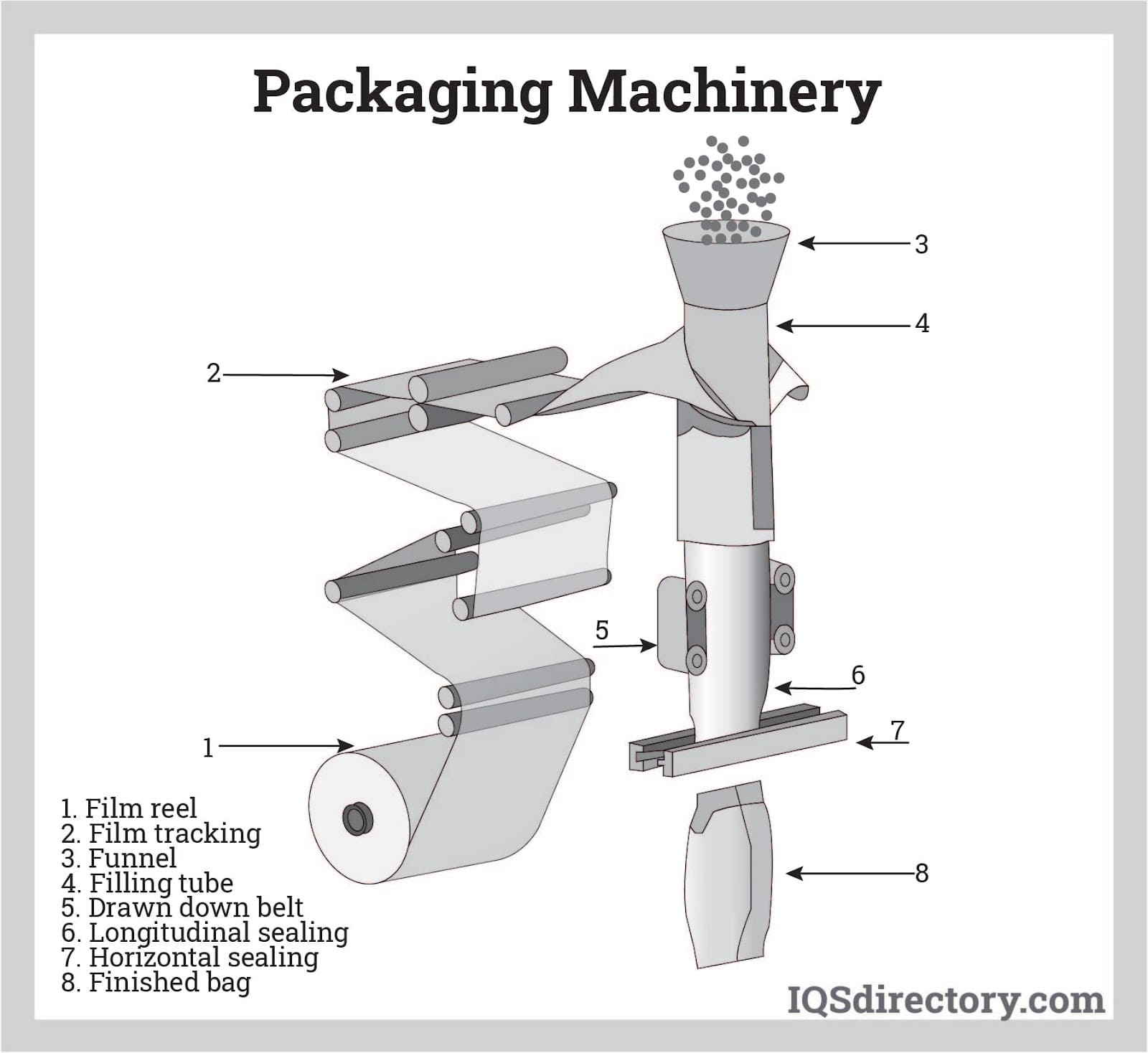

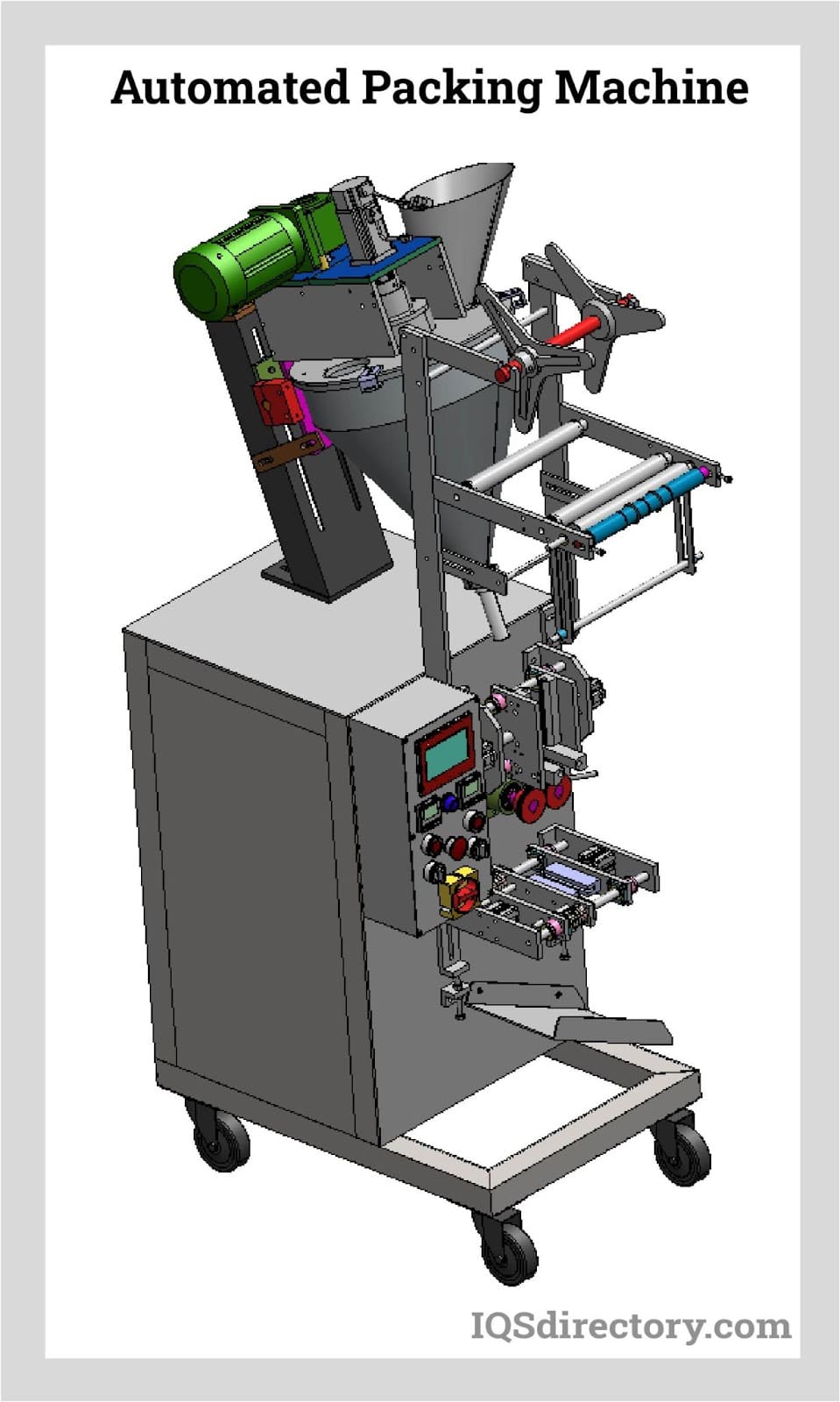

1. Form-Fill-Seal (FFS) and Bagging Systems

This category represents the most common form of primary packaging automation. These machines construct the package from a flat roll of film (rollstock), fill it with the product, and seal it in a continuous operation.

- Vertical Form Fill Seal (VFFS): Gravity-fed systems ideal for loose, granular products. The film is formed into a tube, sealed at the bottom, filled, and then sealed at the top.

- Source Alignment: Includes standard VFFS bagging systems and stick-pack machinery.

- Horizontal Flow Wrapping (HFFS): The product travels on a conveyor while film wraps around it. This is standard for solid, individual items like candy bars, bakery goods, or hardware parts.

- Pouching Systems: Specialized FFS machines designed to create stand-up pouches or handle pre-made pouches, often used for premium liquid or snack products.

2. Shrink Wrapping and Bundling Equipment

These systems are utilized for both aesthetic retail presentation and logistical bundling. They rely on polymer films that contract when heat is applied.

- Shrink Bundling: Uses heavier gauge film to group multiple products together (e.g., a 24-pack of water bottles) without a corrugated tray. This reduces material costs significantly compared to cartoning.

- Shrink Sleeve Equipment: Applies 360-degree decorative labels to bottles and cups. This machinery is essential for branding and providing tamper-evident seals on caps.

- Overwrapping: Unlike shrink wrap, this folds film over a box (cigarette-style) for a premium, tight finish often used in cosmetics and confectionery.

3. Case and Tray Packing Systems

Once individual products are packaged, they must be aggregated for shipping. This machinery handles “secondary packaging” to prepare goods for distribution.

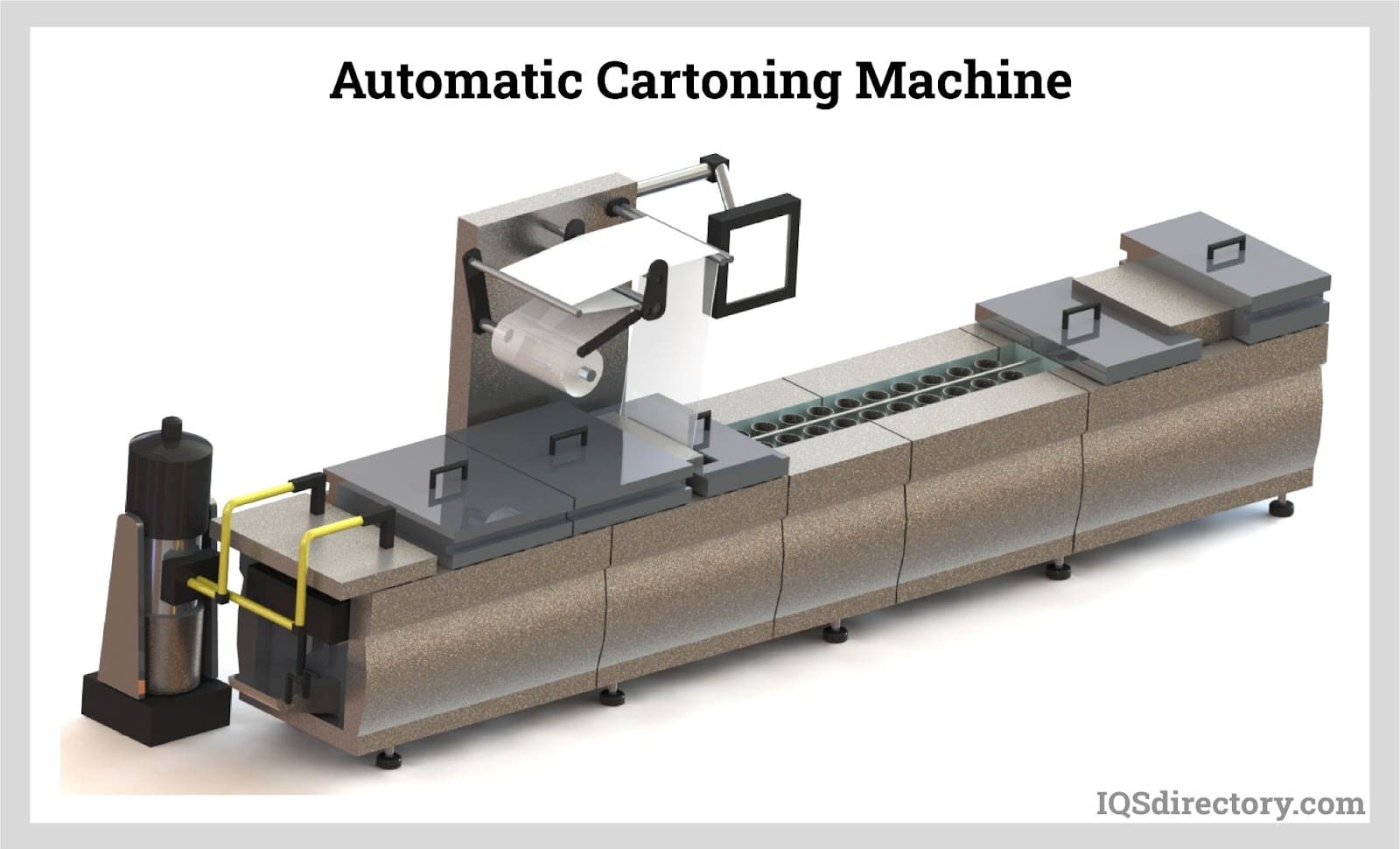

- Carton and Tray Formers: These machines automatically erect flat cardboard blanks into usable boxes or trays, eliminating repetitive manual labor.

- Case Packers: Robotic or mechanical arms pick and place products into the erected cases. Advanced systems can handle flexible patterns to accommodate different SKU counts.

- Case Tapers and Sealers: The final step in the line, these machines apply pressure-sensitive tape or hot melt glue to close the box, ensuring it is ready for the palletizer.

4. Palletizing and End-of-Line Equipment

The final stage of the packaging line focuses on “tertiary packaging”—securing bulk loads for safe transport.

Illustrative Image (Source: Google Search)

- Robotic vs. Conventional Palletizers:

- Robotic: High flexibility; can handle multiple lines and different SKU patterns simultaneously using end-of-arm tooling (EOAT).

- Conventional (Layer): Higher speed for single-SKU lines; pushes entire layers of product onto the pallet at once.

- Stretch Wrappers: These machines wrap the palletized load in stretch film to prevent shifting during transit. Options range from turntable wrappers (load spins) to rotary arm wrappers (load stays stationary), which are better for unstable or heavy loads.

- Strapping Machines: Used for reinforcing heavy loads or securing items that cannot be wrapped, such as lumber or large appliances.

Key Industrial Applications of machinery for packaging

Key Industrial Applications of Machinery for Packaging

Packaging machinery is not a one-size-fits-all solution; its application varies significantly based on product viscosity, fragility, regulatory requirements, and throughput targets. The following breakdown categorizes the equipment ecosystem by industry application, utilizing current market standards relevant to US and European manufacturing sectors.

Industry-Specific Application Matrix

| Industry Sector | Key Machinery Applications | Operational Benefits |

|---|---|---|

| Food & Beverage | • Liquid Filling Systems: For bottles, cups, and pouches. • VFFS & Flow Wrapping: Snack foods, fresh produce, and bakery. • MAP Equipment: Modified Atmosphere Packaging for extending shelf life. • Checkweighers & Metal Detectors: Quality control and compliance. |

• Ensures strict hygiene standards (wash-down capable). • Maximizes shelf-life via MAP technology. • High-speed portion control reduces product giveaway. • Automates primary packaging for high-volume throughput. |

| Pharmaceuticals & Medical | • Blister & Clamshell Sealers: Unit-dose packaging. • Weighing & Counting: Precision counting for tablets/capsules. • Shrink Sleeve & Labeling: Tamper-evident banding. • Coding & Printing: Serialization for track-and-trace compliance. |

• Guarantees regulatory compliance (FDA/EMA serialization). • Provides tamper evidence and child resistance. • Maintains sterile barriers for medical devices. • 100% verification accuracy to prevent recall risks. |

| E-Commerce & Fulfillment | • Autobagging Systems: High-speed bagging for individual orders. • Case Formers & Tapers: Automating box erection and sealing. • Cushioning Equipment: On-demand air pillow, bubble, and paper void fill. • Label Applicators: Shipping label integration. |

• Increases Orders Per Hour (OPH) capabilities. • Reduces dimensional weight (DIM) shipping costs. • Minimizes product damage during last-mile delivery. • Scalable for peak season volume surges. |

| Consumer Goods (CPG) | • Skin Packaging & Die Cutting: High-visibility retail display. • Robotic Pick & Place: Automating complex kit assembly. • Shrink Bundling: Multi-packs for retail warehouse clubs. • Carton & Tray Formers: Shelf-ready packaging. |

• Enhances shelf presence and brand aesthetics. • Reduces theft via secure clamshell/blister sealing. • Optimizes pallet density for retail distribution. • Reduces labor reliance for repetitive assembly tasks. |

| Industrial & Logistics | • Robotic & Conventional Palletizers: End-of-line stacking. • Stretch Wrappers: Securing pallet loads for transport. • Strapping Machines: Heavy-duty load containment. • Conveyor Systems: Material handling and line integration. |

• Significantly reduces workplace injury (ergonomics). • Ensures load stability (DOT/EU transport compliance). • Reduces film waste through pre-stretch technology. • Streamlines flow between manufacturing and warehousing. |

Strategic Advantages of Automation Integration

Beyond specific applications, integrating these systems offers universal advantages for B2B operations:

- Labor Optimization: Utilizing Fanuc Pick & Place Robots and Robotic Palletizers reallocates human workforce from repetitive, injury-prone tasks to higher-value supervisory roles, addressing current labor shortages in manufacturing hubs.

- Material Cost Reduction: Advanced Shrink Wrap and Stretch Wrapping equipment utilize pre-stretch technology, reducing film consumption by up to 50% compared to manual application, aligning with corporate sustainability goals.

- Line Integration: Disparate systems—from Bowl Feeders to Case Packers—can be engineered into a single cohesive line. This integration ensures that the speed of the Liquid Filler matches the capacity of the Case Taper, eliminating bottlenecks.

- Quality Assurance: Inline Ishida Checkweighers and vision systems prevent under-filled or defective products from leaving the facility, protecting brand reputation and avoiding costly retailer chargebacks.

3 Common User Pain Points for ‘machinery for packaging’ & Their Solutions

3 Common User Pain Points for ‘Machinery for Packaging’ & Their Solutions

In the high-volume manufacturing sectors of the USA and Europe, packaging operations are often the bottleneck of the supply chain. Based on current industry demands and equipment capabilities, here are three critical pain points B2B buyers face and the engineering solutions that resolve them.

1. The “Frankenstein Line” (Integration Incompatibility)

The Scenario:

A facility manager purchases a high-speed Vertical Form Fill Seal (VFFS) machine from one vendor and a robotic palletizer from another. While both machines function perfectly in isolation, the conveyor system connecting them fails to synchronize speeds, leading to product jams and inconsistent flow.

Illustrative Image (Source: Google Search)

The Problem:

Disjointed Line Integration. When equipment components (fillers, labelers, case packers) operate as silos, the production line suffers from micro-stops and data blindness. Without a unified control system, the line runs only as fast as its slowest, least-integrated component.

The Solution:

Turnkey Line Integration & Engineering Services.

Instead of piecemeal procurement, successful operations utilize integration services that engineer the entire line as a single organism.

* Unified Controls: Implementing master PLCs (Programmable Logic Controllers) that allow checkweighers, wrappers, and robots to communicate.

* Buffered Conveyance: Using smart conveyor systems (accumulators) that absorb speed variances between the bagger and the case packer.

* Single-Source Accountability: Partnering with suppliers who offer full line integration ensures that upstream weighing equipment is calibrated to match downstream palletizing speeds.

2. The High Cost of Downtime & Changeovers

The Scenario:

A contract packager (co-packer) needs to switch from packaging 10oz coffee bags to 5lb bulk pouches. The maintenance team spends four hours manually adjusting guide rails, replacing sealing jaws, and recalibrating the flow wrapper.

The Problem:

Low OEE (Overall Equipment Effectiveness) due to inflexibility.

In modern manufacturing, SKU proliferation is the norm. Machinery that requires complex, tool-heavy adjustments for every format change kills profitability. Furthermore, lack of available spare parts extends planned maintenance into unplanned shutdowns.

Illustrative Image (Source: Google Search)

The Solution:

Modular Equipment & Reliable Tech Support.

Modern machinery design focuses on agility and “tool-less” changeovers.

* Quick-Change Features: Utilize Flow Wrapping and VFFS systems designed with tool-less removal of forming tubes and sealing jaws to reduce changeover time from hours to minutes.

* Predictive Maintenance: Deploy equipment with HMI (Human-Machine Interface) diagnostics that alert operators to wear before failure.

* Domestic Parts Availability: Prioritize vendors offering robust “Tech Parts & Service” networks. Ensuring rapid access to OEM parts for thermal transfer printers or shrink bundlers is vital for maintaining uptime in US and European markets.

3. Labor Shortages & Ergonomic Liability

The Scenario:

A production plant relies on manual labor to erect boxes, pack products, and stack pallets. The company struggles to retain staff for these repetitive tasks, and workers compensation claims for repetitive strain injuries (RSI) are rising.

The Problem:

Scalability Limits & Labor Dependency.

Manual end-of-line packaging is the most common constraint on growth. It is expensive, prone to human error, and physically taxing. As production scales, adding more bodies becomes spatially impossible and financially unsustainable.

The Solution:

End-of-Line Automation & Robotics.

Transitioning from manual to semi-automated or fully robotic systems.

* Robotic Palletizers: Replacing manual stacking with robotic palletizers stabilizes load containment and eliminates heavy lifting injuries.

* Pick & Place Robots: Utilizing Fanuc or similar delta robots for high-speed placement into trays ensures 100% accuracy that human hands cannot match.

* Automated Case Forming: Implementing automatic case and tray formers ensures consistent box squareness, which is essential for the structural integrity of the final pallet load during shipping.

Illustrative Image (Source: Google Search)

Strategic Material Selection Guide for machinery for packaging

Strategic Material Selection Guide for Packaging Machinery

Optimizing packaging operations requires more than high-performance machinery; it demands the precise pairing of equipment with compatible consumable materials. For manufacturers in the USA and Europe, material selection is currently driven by three converging pressures: machinability (throughput efficiency), barrier protection (shelf-life), and sustainability (regulatory compliance and PCR mandates).

This guide analyzes the strategic selection of consumables for the core machinery categories identified in modern production lines, including VFFS, shrink systems, and end-of-line unitizing equipment.

1. Flexible Films for VFFS and Flow Wrapping

Vertical Form Fill Seal (VFFS) and Horizontal Flow Wrapping systems rely heavily on the slip characteristics and seal initiation temperature of the film.

- Polyethylene (PE) & Polypropylene (BOPP): The standard for high-speed bagging.

- Strategic Selection: For high-speed friction feeders and rotary sealers, prioritize films with consistent coefficient of friction (COF) values to prevent slippage or jamming.

- Barrier Needs: Use metallized BOPP or multi-layer laminates if the product requires moisture or oxygen barriers (e.g., coffee, snacks).

- Mono-Material Films: Increasing in demand across the EU to meet circular economy goals.

- Challenge: Mono-materials often have narrower sealing windows. Ensure VFFS jaws feature precise temperature control (PID) to run these materials without burn-through or leakers.

2. Shrink and Sleeve Materials

Selection here depends on whether the application is for display (shelf appeal) or transit (bundling).

Illustrative Image (Source: Google Search)

- Polyolefin (POF): The preferred choice for display packaging (L-Bar sealers, high-speed tunnels). It is FDA-approved for food contact, highly clear, and puncture-resistant.

- Polyethylene (LDPE): Used in Shrink Bundling Equipment (bullseyes). It is thicker and offers tensile strength for multi-packs of beverages or canned goods.

- PETG vs. PVC for Sleeves: While PVC is traditional for shrink sleeves, PETG is rapidly becoming the standard in US/EU markets due to higher shrinkage rates (up to 78%) and better recyclability profiles compared to PVC, which contaminates PET recycling streams.

3. Rigid and Semi-Rigid Materials (Blister & Skin)

For Starview Blister & Clamshell Sealers and skin packaging machinery, material interaction with the heat source and backing substrate is critical.

- Surlyn (Ionomer) Films: The premium choice for skin packaging. It offers superior clarity, deep draw capabilities, and adheres to coated boards without separate adhesive.

- RPET (Recycled PET): For blister packs and clamshells. Using RPET with at least 30% post-consumer recycled content helps meet plastic tax requirements in the UK and EU while maintaining sufficient rigidity for automated feeders.

4. Corrugated and Paperboard (Cartoning & Case Packing)

Case & Tray Formers and Carton Formers are intolerant of material inconsistencies.

- Board Caliper & Score Lines: Automated erectors require precise score lines. “Soft” board or inconsistent caliper thickness will cause vacuum cups to drop blanks or forming mandrels to jam.

- Adhesives: The choice of hot melt versus tape (for Case Tapers) depends on the environment. Hot melt requires temperature-controlled hoses; pressure-sensitive tape must be rated for the specific corrugated grade (e.g., recycled corrugated often requires more aggressive adhesive).

5. End-of-Line Unitizing (Stretch & Strap)

Robotic Palletizers, Strapping Machines, and Stretch Wrappers secure the load. Material selection here is a cost-per-load calculation.

- Pre-Stretch LLDPE Film: Modern stretch wrappers can pre-stretch film up to 300%.

- Strategy: Do not use “hand wrap” rolls on machines. Purchase high-performance machine film designed to utilize the pre-stretch carriage, significantly reducing plastic waste per pallet.

- PP vs. PET Strapping:

- Polypropylene (PP): Sufficient for light-to-medium bundling.

- Polyester (PET): Essential for heavy pallet loads. PET retains tension longer than PP and does not elongate under heat, making it the superior choice for shipping heavy industrial goods.

Comparative Material Selection Matrix

The following table outlines the correlation between equipment types and strategic material choices based on performance and market requirements.

Illustrative Image (Source: Google Search)

| Equipment Category | Primary Material | Key Performance Indicators (KPIs) | Strategic/Regulatory Note (USA & EU) |

|---|---|---|---|

| VFFS & Flow Wrappers | Co-ex Laminates, PE, BOPP | Hot tack strength, COF (Slip), Seal integrity | Shift toward Mono-PE structures for recyclability; requires precise heat control. |

| Shrink Bundlers | Low-Density Polyethylene (LDPE) | Tensile strength, Puncture resistance | Downgauging (reducing thickness) is a key trend to reduce plastic tax liability. |

| Shrink Sleeve Systems | PETG, PVC, OPS | Shrink curve percentage, Print distortion | PETG is preferred over PVC for better recyclability in PET streams. |

| Blister/Skin Packers | RPET, Surlyn, Coated Board | Clarity, Draw depth, Adhesion to board | Ensure backing board coating is compatible with the specific skin film resin. |

| Case Formers/Sealers | Corrugated (ECT 32/44), Hot Melt, Tape | Board rigidity, Flute consistency, Adhesive set time | High recycled content board creates dust; requires frequent sensor cleaning on machines. |

| Stretch Wrappers | Cast or Blown LLDPE | Pre-stretch yield (200-300%), Cling, Tear resistance | High-performance films allow for significant gauge reduction without compromising load stability. |

| Strapping Machines | Polypropylene (PP), Polyester (PET) | Break strength, Tension retention, Camber | PET strapping is replacing steel for heavy loads due to safety and lower cost. |

In-depth Look: Manufacturing Processes and Quality Assurance for machinery for packaging

In-depth Look: Manufacturing Processes and Quality Assurance

For buyers in the USA and Europe, the value of packaging machinery—whether a standalone Vertical Form Fill Seal (VFFS) unit or a fully integrated robotic palletizing system—is determined by the rigor of its manufacturing and the stringency of its quality control. High-quality fabrication directly correlates to higher Overall Equipment Effectiveness (OEE) and lower Total Cost of Ownership (TCO).

1. The Manufacturing Lifecycle: From Raw Material to Integration

The production of industrial packaging equipment, such as Ishida checkweighers or horizontal flow wrappers, follows a precision-engineered workflow designed to ensure durability and repeatability.

Phase 1: Material Preparation and Fabrication

- Material Selection: For food and liquid filling systems, manufacturers utilize 304 or 316L stainless steel to meet FDA and EU hygiene standards. Non-contact areas (e.g., case taper frames) may use powder-coated carbon steel.

- Laser Cutting and CNC Machining: Chassis components and conveyor frames are precision-cut using laser systems to ensure exact tolerances. CNC machining is employed for high-wear moving parts, such as the sealing jaws of bagging systems or the drive shafts of shrink bundlers, ensuring micron-level accuracy.

- Welding and Finishing: Certified welders perform TIG welding for sanitary joints, eliminating crevices where bacteria could harbor. Surfaces are passivated or electropolished to prevent corrosion, particularly for washdown-ready equipment.

Phase 2: Component Assembly and Sub-Systems

- Mechanical Assembly: Technicians assemble the core mechanics, integrating OEM components like Fanuc pick-and-place robots or friction feeders. This stage involves installing bearings, guide rails, and pneumatic cylinders for actuation.

- Electrical Enclosure Build: The “brain” of the machine is constructed. Control panels are wired to accommodate PLCs (Programmable Logic Controllers), VFDs (Variable Frequency Drives), and servo motors. Proper cable management is critical here to prevent interference and simplify future maintenance.

Phase 3: Software and Logic Integration

- HMI Programming: Human Machine Interfaces are programmed for operator usability, allowing control over variables like seal temperature, conveyor speed, and fill volume.

- Synchronization: For lines requiring integration—such as connecting a liquid filler to a capper and then a label applicator—software is tuned to ensure handshake signals between machines function without latency.

2. Quality Assurance (QA) and Compliance Standards

To serve the North American and European markets, manufacturers must adhere to strict regulatory frameworks. QA is not a final step but an ongoing process throughout fabrication.

Regulatory Compliance Matrix

| Region | Standard | Application |

|---|---|---|

| Global | ISO 9001:2015 | Quality Management Systems ensuring consistent manufacturing processes. |

| Europe | CE Marking | Mandatory conformity marking for health, safety, and environmental protection (Machinery Directive 2006/42/EC). |

| USA | UL / CSA | Electrical safety certification (Underwriters Laboratories) required for control panels and electrical components. |

| Food Safety | HACCP / GMP | Critical for tray sealers, liquid fillers, and equipment in direct contact with consumables. |

Testing Protocols

Before a machine, such as a Starview blister sealer or a shrink sleeve applicator, leaves the facility, it undergoes rigorous validation:

Illustrative Image (Source: Google Search)

- Dry Cycle Testing: The machine runs without product to verify mechanical movement, sensor calibration, and emergency stop functionality.

- Factory Acceptance Testing (FAT): A critical milestone where the buyer (or a third-party representative) visits the factory. The machine runs the actual product (e.g., pouches, bottles, cartons) at contract speeds.

- Key Metrics Verified: Fill accuracy, seal integrity, reject rates, and changeover times.

- Stress Testing: Running the equipment continuously for extended periods (e.g., 24 hours) to identify potential thermal issues in motors or software bugs in the palletizing logic.

3. Line Integration and Final Commissioning

As indicated by providers like Pro Pac, individual machines often require Line Integration. This post-manufacturing phase involves:

* Physical Connection: Linking conveyor systems between the weighing station and the case packer.

* Site Acceptance Testing (SAT): The final QC step performed at the buyer’s facility to confirm the equipment performs in the real-world environment as it did during the FAT.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘machinery for packaging’

Practical Sourcing Guide: A Step-by-Step Checklist for ‘machinery for packaging’

Sourcing industrial packaging machinery requires a strategic approach to balance throughput requirements, budget, and integration capabilities. Whether upgrading a single station (e.g., swapping a manual sealer for a Vertical Form Fill Seal (VFFS) system) or commissioning a full turnkey line, follow this technical checklist to mitigate risk and ensure operational efficiency.

Step 1: Define Operational Parameters & Scope

Before contacting vendors, quantify your production requirements. Vague specifications lead to inaccurate quotes and scope creep.

- Product Specifications: Define exact dimensions, weight, and state (liquid, solid, powder) of the product.

- Throughput Requirements: Determine required units per minute (UPM) or packs per minute (PPM).

- Note: Factor in surge capacity (e.g., requiring 60 PPM to handle upstream spikes).

- Packaging Format: Identify the specific machine category required based on the package type:

- Flexible: VFFS, Horizontal Flow Wrapping, Pouching Systems.

- Rigid: Cartoning, Tray Forming, Case Packing.

- End-of-Line: Palletizers, Stretch Wrappers, Strapping Machines.

- Material Compatibility: Confirm the machine handles your specific consumables (e.g., gauge of shrink film, corrugate strength, or sustainable bio-films).

Step 2: Assess Line Integration & Automation Levels

Machinery must communicate with upstream and downstream equipment. Isolated “islands of automation” reduce overall line efficiency (OEE).

Illustrative Image (Source: Google Search)

- Physical Footprint: Measure available floor space, including clearance for maintenance access and conveyor turns.

- Integration Needs:

- Upstream: How is product fed? (e.g., Bowl feeders, friction feeders, or conveyors).

- Downstream: How is product ejected? (e.g., onto a checkweigher or into a case packer).

- Control Systems: Specify PLC preferences (e.g., Allen-Bradley for US, Siemens for EU) to ensure compatibility with existing plant architecture.

- Automation Level: Decide between semi-automatic (operator assisted) vs. fully automatic (robotic pick-and-place/high-speed).

Step 3: Vendor Qualification (US & EU Focus)

Evaluate vendors not just on machine price, but on engineering capability and after-sales infrastructure.

| Evaluation Criteria | Key Considerations |

|---|---|

| Engineering Services | Does the vendor offer line integration and custom engineering? (Crucial for complex systems like robotic palletizing). |

| Regional Support | USA/EU: Verify local tech support time zones and “boots on the ground” availability. |

| Parts Availability | specificy non-proprietary parts where possible. Ask for a recommended spare parts list (RSPL) availability check. |

| Consumables | Does the vendor also supply materials (films, tapes)? Bundling equipment and consumables can often secure better warranties or pricing. |

Step 4: Compliance, Safety, & Sanitation

Regulatory adherence is non-negotiable in US and European markets.

- Safety Standards:

- USA: OSHA compliance, ANSI B155.1 (Packaging Machinery Safety).

- Europe: CE Marking (Machinery Directive 2006/42/EC).

- Sanitary Design (If Food/Pharma):

- Verify washdown ratings (IP65, IP67, or IP69K).

- Check for stainless steel construction and tool-less disassembly for cleaning.

- Validation: For pharma/medical, request IQ/OQ/PQ (Installation, Operational, and Performance Qualification) documentation protocols.

Step 5: The Request for Proposal (RFP) & Testing

Do not purchase capital equipment based on a brochure.

- Submit Detailed RFP: Include your samples, film specs, and speed requirements.

- Sample Testing: Send physical product samples to the OEM. Request a video of your product running on the machine.

- Factory Acceptance Test (FAT): Schedule an on-site visit to the vendor’s facility to witness the machine running at full speed before shipment.

- Checklist during FAT: Changeover times, error recovery, safety interlocks, and noise levels.

Step 6: Total Cost of Ownership (TCO) Calculation

Compare quotes based on long-term costs, not just the capital expenditure (CapEx).

- Energy Consumption: Check pneumatic (compressed air) and electrical requirements.

- Labor Reduction: Calculate ROI based on FTEs (Full-Time Equivalents) removed from the line.

- Changeover Downtime: How long does it take to switch from Product A to Product B? (e.g., adjusting guide rails on a case taper or changing forming tubes on a bagger).

- Maintenance Contracts: Review costs for annual service agreements and remote diagnostic capabilities.

Comprehensive Cost and Pricing Analysis for machinery for packaging Sourcing

Comprehensive Cost and Pricing Analysis for Machinery for Packaging Sourcing

Date: December 3, 2025

Target Markets: USA, Europe

This section provides a detailed financial analysis for procurement professionals sourcing packaging machinery. It covers current 2025 market price benchmarks, a breakdown of cost drivers (materials, labor, logistics), and actionable strategies for reducing Total Cost of Ownership (TCO).

1. Market Price Benchmarks (2025)

Prices for packaging machinery vary significantly based on automation level, speed (throughput), and origin. The following ranges reflect current market rates for equipment delivered to US and European facilities.

| Machinery Category | Entry-Level / Semi-Auto | Mid-Range / Automatic | High-Speed / Fully Integrated |

|---|---|---|---|

| Vertical Form Fill Seal (VFFS) | $25,000 – $45,000 | $55,000 – $95,000 | $120,000 – $250,000+ |

| Robotic Palletizers | $50,000 – $80,000 (Cobot) | $90,000 – $160,000 | $200,000 – $500,000+ |

| Liquid Filling Systems | $15,000 – $35,000 | $45,000 – $110,000 | $150,000 – $400,000+ |

| Flow Wrapping Machines | $20,000 – $40,000 | $50,000 – $85,000 | $100,000 – $220,000+ |

| Cartoners (End-Load) | $30,000 – $60,000 | $80,000 – $150,000 | $250,000 – $600,000+ |

Note: “High-Speed” systems often include integrated inspection (checkweighers, metal detectors) and advanced HMI/IoT capabilities, which command a 20–30% premium over standard automatic models.

Illustrative Image (Source: Google Search)

2. Cost Breakdown & Drivers

Understanding the composition of the final invoice price is critical for negotiation.

A. Materials & Components (40-50% of Cost)

- Stainless Steel: Price volatility in nickel and chromium markets directly impacts the base cost of washdown-ready and food-grade machinery. Expect a 5-10% surcharge on sanitary designs (IP69K rated) versus standard powder-coated frames.

- Electronics & Automation: The shift toward Industry 4.0 has increased the bill of materials (BOM) for PLCs, servos, and HMIs. Shortages in high-end semiconductor chips can still cause lead-time extensions and spot-price increases of 15-20% for specific control modules.

B. Manufacturing Labor (25-35% of Cost)

Labor rates for skilled assembly and engineering vary by region, influencing the final ex-works price:

* USA/DACH (Germany, Switzerland, Austria): High labor rates ($60–$100+/hr for specialized assembly) result in higher upfront capital costs but typically ensure lower defect rates and faster commissioning.

* Southern/Eastern Europe: Moderate labor rates offer a middle ground, often 20-30% cheaper than DACH-origin machinery.

* Asia (China/Vietnam): significantly lower labor rates can reduce machine cost by 40-60%. However, buyers must factor in higher QA/QC oversight costs and potential re-engineering for US/EU electrical compliance (UL/CE standards).

C. Logistics & Tariffs (10-20% of Cost)

- Shipping:

- Container (FCL/LCL): Standard for modular equipment.

- Ro-Ro / Breakbulk: Required for oversized, non-modular lines. Costs can be 3-4x higher than container shipping.

- Packaging: Export crating (VCI wrapping, heat-treated wood) adds 2-5% to the ex-works price.

- Tariffs (2025 Context):

- EU to USA: Be aware of potential reciprocal tariffs on industrial machinery. Check current HTS codes (e.g., 8422.30 or 8422.40) for duties ranging from 0% to 25% depending on trade dispute status.

- Asia to USA/Europe: Anti-dumping duties or Section 301 tariffs (USA) can add 25% to the landed cost of Chinese machinery.

3. Total Cost of Ownership (TCO) Analysis

The purchase price is typically only 30-40% of the machine’s lifecycle cost.

- Installation & Commissioning: Budget 10–15% of the purchase price.

- Hidden Cost: Technician daily rates ($1,500–$2,500/day) plus travel/per diem.

- Training: Essential for OEE (Overall Equipment Effectiveness). Budget $5,000–$10,000 for initial operator and maintenance training.

- Maintenance & Spare Parts:

- Annual Maintenance: Estimate 3–5% of the asset value annually.

- Spare Parts Inventory: Budget 2% of machine value for initial “crash kit” (critical spares) in Year 1. This typically rises to 5-10% by Year 5 as wear parts require replacement.

- Energy Consumption: Servo-driven machines are generally 20-30% more energy-efficient than older pneumatic-heavy designs, offering long-term OPEX savings.

4. Strategic Cost-Saving Tips

- Modular Sourcing: Instead of a turnkey “monoblock” system from a single premium vendor, consider sourcing modular units (e.g., a filler from Vendor A, a labeler from Vendor B) and using a local systems integrator. This can save 15-25% but requires strong internal project management.

- Refurbished & Certified Pre-Owned:

- Pros: Immediate availability (bypass 20-week lead times) and 30-50% lower capital cost.

- Cons: Limited warranty (often 3-6 months vs. 12-24 months new).

- Tip: Only buy refurbished units that include updated PLCs/controls to avoid obsolescence issues.

- Standardize Components: Specify globally available components (e.g., Siemens/Allen-Bradley PLCs, Festo/SMC pneumatics) in your RFQ. Proprietary “black box” controls force you to buy expensive spares exclusively from the OEM, increasing long-term TCO.

- Off-Peak Shipping: If project timelines allow, avoid shipping heavy machinery during Q4 (holiday peak). Booking logistics in Q1/Q2 can save 10-15% on freight rates.

- Factory Acceptance Test (FAT) Rigor: Investing in a rigorous FAT at the manufacturer’s site prevents costly modifications after delivery. Catching a design flaw at the factory costs $0; fixing it at your facility can cost thousands in downtime and contractor fees.

Alternatives Analysis: Comparing machinery for packaging With Other Solutions

Alternatives Analysis: In-House Machinery vs. Manual Labor and Contract Packaging

When evaluating packaging strategies for markets in the USA and Europe, decision-makers must weigh the Total Cost of Ownership (TCO) of automated machinery against alternative operational models. While in-house machinery provides control and speed, it requires significant capital expenditure (CapEx).

Illustrative Image (Source: Google Search)

The two primary alternatives to purchasing and operating your own packaging equipment are Manual Labor and Contract Packaging (Co-Packing).

The following analysis compares these solutions across critical operational metrics.

Comparative Matrix: Packaging Operational Models

| Criteria | In-House Machinery (Automation) | Manual Labor | Contract Packaging (Co-Packing) |

|---|---|---|---|

| Upfront Investment (CapEx) | High. Purchase of machines (e.g., VFFS, Palletizers), installation, and integration. | Low. Limited to basic tools (tape guns, tables) and PPE. | Low. No equipment purchase required; costs are absorbed in per-unit fees. |

| Operational Cost (OpEx) | Low. Reduced labor; costs shift to energy, maintenance, and consumables. | High. High wages (US/EU), benefits, turnover, and training costs. | Variable. Higher per-unit cost than automation, but scales strictly with volume. |

| Throughput & Speed | High & Constant. Machines like Ishida Checkweighers or Fanuc Robots run continuously without fatigue. | Low & Variable. Limited by human physical constraints and shift limits. | High. Dependent on the co-packer’s capacity and scheduling availability. |

| Quality & Consistency | Precision. Consistent seals, weights, and wrapping (e.g., Shrink Sleeve Equipment). | Inconsistent. Susceptible to human error, fatigue, and variation. | High. Professional co-packers utilize industrial-grade equipment. |

| Flexibility | Moderate. Changeovers require downtime; specialized machines (e.g., Blister Sealers) are application-specific. | High. Humans can adapt to new pack formats instantly without re-tooling. | Low. Tied to the co-packer’s existing capabilities and schedule priority. |

| Scalability | Step-Function. Increasing capacity requires purchasing new units or upgrading lines. | Linear. Hiring more staff (difficult in tight labor markets). | High. Capacity can often be ramped up quickly by the vendor. |

Analysis of Alternatives

1. Manual Labor

Manual packaging remains the default for startups or operations with highly irregular, low-volume runs.

* Pros: It offers the ultimate flexibility for complex, non-standard assemblies that robots (such as pick-and-place systems) may struggle to handle cost-effectively.

* Cons: In high-wage regions like Europe and the US, the ROI on manual labor diminishes rapidly as volume increases. Human operators cannot match the throughput of automated solutions like Horizontal Flow Wrapping or Case Formers, and manual processes often result in higher material waste and inconsistent load stability during palletizing.

2. Contract Packaging (Co-Packing)

Outsourcing to a third party (as offered by providers like Pro Pac) is a strategic alternative for established brands launching new products or managing seasonal spikes.

* Pros: Eliminates the need for in-house maintenance, spare parts inventory, and facility floor space. It grants immediate access to specialized technology—such as Modified Atmosphere Packaging (MAP) or Liquid Filling Systems—without the capital risk.

* Cons: The trade-off is a loss of control. Lead times are dictated by the co-packer’s schedule, and the long-term cost per unit is generally higher than owning the line. Additionally, logistics costs increase as product must be shipped to and from the co-packer.

3. The Case for In-House Machinery

Investing in proprietary machinery is the standard for mature B2B operations aiming for operational excellence.

* Integration: Modern systems allow for full line integration—connecting Weighing & Counting Equipment directly to Vertical Form Fill Seal (VFFS) baggers and Robotic Palletizers. This reduces bottlenecks.

* Cost Control: While the initial outlay is significant, the amortization of equipment like Stretch Wrappers or Case Tapers often results in a lower cost-per-pack within 12–24 months compared to labor or outsourcing.

* Reliability: Owning the asset ensures that production schedules are dictated solely by internal demand, not external vendor availability.

Essential Technical Properties and Trade Terminology for machinery for packaging

Here is a draft of the Essential Technical Properties and Trade Terminology section, tailored for a B2B audience in the USA and Europe.

Essential Technical Properties and Trade Terminology

When evaluating machinery for packaging, technical specifications and trade terms define not just the capability of the equipment, but the feasibility of the investment. This section outlines the critical properties and industry-standard terminology required to navigate supplier negotiations and engineering specifications.

1. Key Technical Properties

Professional procurement requires moving beyond general descriptions to precise, quantifiable metrics.

Illustrative Image (Source: Google Search)

- Throughput & Speed:

- PPM / CPM / BPM: Measured in Packages, Cases, or Bags Per Minute. Speed is often conditional on product viscosity, fill weight, and film quality.

- Cycle Rate: The maximum mechanical speed of the machine (dry cycle), which often differs from the actual production rate under load.

- Footprint & Layout:

- Dimensions: Total length, width, and height (L x W x H). Critical for integrating into existing lines.

- Infeed/Discharge Height: The vertical distance from the floor to the conveyor belt, requiring synchronization with upstream and downstream equipment.

- Utility Requirements:

- Electrical: Voltage (e.g., 110V, 220V, 480V) and Phase (1-phase vs. 3-phase).

- Note for Exporters: USA typically uses 60Hz; Europe uses 50Hz. Dual-frequency motors or transformers may be required.

- Pneumatics (Air): Consumption rate (CFM/LPM) and required pressure (PSI/Bar). Many form-fill-seal and capping machines rely heavily on compressed air.

- Electrical: Voltage (e.g., 110V, 220V, 480V) and Phase (1-phase vs. 3-phase).

- Ingress Protection (IP) Ratings:

- IP54: General protection against dust and splashing water. Standard for dry environments (e.g., cartoning).

- IP65/IP66: Dust-tight and protected against water jets. Required for Washdown environments (e.g., dairy, meat, beverage).

- IP69K: High-pressure, high-temperature washdown protection, essential for strict sanitary compliance.

- Control Systems:

- PLC (Programmable Logic Controller): The industrial computer running the machine (e.g., Siemens, Allen-Bradley/Rockwell, Omron).

- HMI (Human Machine Interface): The touch screen panel for operator control. Look for multi-language support and recipe storage capabilities.

2. Common Trade Terminology (Glossary)

| Term | Definition | B2B Context |

|---|---|---|

| MOQ | Minimum Order Quantity | The lowest quantity of machines or consumables (e.g., film rolls) a supplier will sell. |

| OEM | Original Equipment Manufacturer | A company that manufactures the machinery itself. Buying “direct from OEM” often ensures better technical support than buying from a trading company. |

| FAT | Factory Acceptance Test | A trial run performed at the manufacturer’s facility before shipment. The buyer verifies the machine runs their specific product at agreed speeds. |

| SAT | Site Acceptance Test | A trial run performed at the buyer’s facility after installation. Verifies that the machine integrates correctly with local utilities and existing lines. |

| Changeover | Changeover Time | The time required to switch the machine from running one product size/SKU to another. “Tool-less changeover” is a premium feature reducing downtime. |

| OEE | Overall Equipment Effectiveness | A gold-standard metric for manufacturing productivity, calculated as: Availability × Performance × Quality. |

| Turnkey | Turnkey Solution | A supplier provides a complete, ready-to-operate line (e.g., filler, capper, labeler, packer) rather than just a single machine. |

| Upstream / Downstream | Line Position | Upstream: Equipment before the current machine (e.g., processing). Downstream: Equipment after the current machine (e.g., palletizing). |

3. Compliance and Standards (USA vs. Europe)

Ensuring machinery meets regional safety and legal standards is non-negotiable to avoid liability and customs seizures.

United States

- UL / ETL Listing: Electrical components or the entire control panel may need to be UL (Underwriters Laboratories) listed. This is often a requirement for insurance and local municipal codes.

- ANSI / PMMI B155.1: The primary safety standard for packaging machinery, focusing on risk assessment and hazard reduction.

- OSHA Compliance: Machinery must meet Occupational Safety and Health Administration standards, particularly regarding machine guarding (29 CFR 1910.212) and Lockout/Tagout (LOTO) procedures.

Europe (EU)

- CE Marking: Mandatory conformity marking. The manufacturer acts as the responsible party to declare the equipment meets EU safety, health, and environmental requirements.

- Machinery Directive (2006/42/EC): The core legislation governing machinery safety.

- RoHS / REACH: Regulations restricting hazardous substances in electrical equipment and packaging materials.

Navigating Market Dynamics and Sourcing Trends in the machinery for packaging Sector

Navigating Market Dynamics and Sourcing Trends in the Machinery for Packaging Sector

The packaging machinery market in the USA and Europe is currently defined by a critical intersection of labor constraints, strict regulatory standards, and an urgent demand for sustainability. For B2B buyers, sourcing is no longer about acquiring standalone units; it is about securing integrated systems that drive Overall Equipment Effectiveness (OEE).

The Evolution of Packaging Technology: From Mechanical to Digital

Historically, packaging lines relied on rigid, mechanical cam-driven systems. These legacy machines were durable but lacked flexibility, requiring lengthy changeovers for different SKUs.

The modern era has shifted toward servo-driven technology and digital integration. Today, equipment such as Vertical Form Fill Seal (VFFS) systems and Horizontal Flow Wrappers utilize programmable logic controllers (PLCs) to allow for rapid changeovers and precise synchronization. This evolution has moved the industry from simple containment solutions to sophisticated, data-driven manufacturing assets.

Illustrative Image (Source: Google Search)

Key Market Trends Driving Sourcing Decisions

1. Automation and Robotics Integration

With rising labor costs in Western markets, automation has transitioned from a luxury to a necessity. Sourcing trends show a heavy spike in demand for robotic solutions to handle repetitive tasks and reduce human error.

* Pick & Place: Utilization of Fanuc Pick & Place Robots allows for high-speed handling of delicate items, reducing product damage.

* End-of-Line Automation: Robotic and Conventional Palletizers are now standard for heavy lifting, ensuring consistent stack patterns and reducing workplace injury liabilities.

2. Turnkey Line Integration

Buyers are increasingly moving away from piecemeal sourcing. The trend is toward Line Integration & Engineering Services, where a single provider connects disparate systems—from Ishida Checkweighers to Case Tapers—into a unified workflow. This approach minimizes compatibility issues and streamlines maintenance.

3. Sustainability and Material Adaptability

Sustainability is driving machinery design. Equipment must now be capable of handling eco-friendly materials that often have different tensile strengths and heat-sealing properties than traditional plastics.

* Material Reduction: Shrink Wrap and Bundling Equipment are being optimized to use thinner gauge films without compromising load stability.

* Waste Prevention: Modified Atmosphere Packaging (MAP) Equipment is critical for the food sector, extending shelf life and reducing food waste in the supply chain.

* Eco-Friendly Fill: The shift away from Styrofoam has boosted demand for Paper and Air Pillow Cushioning Equipment.

Strategic Sourcing: Evaluating Modern Equipment

When evaluating suppliers, B2B buyers must weigh technical capabilities against long-term operational value.

Illustrative Image (Source: Google Search)

| Feature | Legacy Sourcing Focus | Modern Sourcing Requirement |

|---|---|---|

| Flexibility | Dedicated to single-product runs. | Multi-SKU capability (e.g., adjustable Carton and Tray Formers). |

| Connectivity | Standalone operation. | IIoT-ready for predictive maintenance and data logging. |

| Support | Break-fix model. | Comprehensive Tech Service & Parts availability. |

| Throughput | Maximum speed (CPM) only. | Total efficiency (OEE) including changeover time. |

Conclusion

For stakeholders in the USA and Europe, navigating the machinery for packaging sector requires a focus on versatility and integration. Whether investing in Liquid Filling Systems or Starview Blister Sealers, the priority must be on equipment that supports automation, adapts to sustainable materials, and integrates seamlessly into the broader production ecosystem.

Frequently Asked Questions (FAQs) for B2B Buyers of machinery for packaging

Frequently Asked Questions (FAQs) for B2B Buyers of Machinery for Packaging

Q1: How do I determine if I need a standalone machine or a fully integrated packaging line?

A: This decision depends on your current production volume and growth projections. Standalone units (e.g., a single case taper or shrink wrapper) are cost-effective for low-to-mid volume operations. However, for high-throughput environments, line integration and engineering services are essential. An integrated system connects weighing equipment, fillers, conveyors, and robotic palletizers into a single synchronized workflow, maximizing Overall Equipment Effectiveness (OEE) and reducing labor costs.

Q2: What is the difference between Vertical Form Fill Seal (VFFS) and Horizontal Flow Wrapping?

A: The choice is dictated by the product’s physical state and handling requirements:

* Vertical Form Fill Seal (VFFS): Ideal for loose, granular, or liquid products (e.g., snacks, powders, sauces). Gravity assists in filling the bag before sealing.

* Horizontal Flow Wrapping: Best suited for solid, individual items (e.g., candy bars, bakery items, trays). The product is pushed horizontally on a conveyor through the wrapping material.

Q3: How does automation integration, such as Pick & Place Robots, impact ROI?

A: While the initial capital expenditure (CapEx) is higher, integrating Fanuc Pick & Place Robots or robotic palletizers significantly lowers operating expenses (OpEx). Automation improves consistency, reduces repetitive strain injuries (workplace safety), and allows for 24/7 operation. For high-volume lines, the Return on Investment (ROI) is typically realized through increased throughput and reduced waste within 12 to 24 months.

Q4: Can packaging machinery handle sustainable or recycled packaging materials?

A: Modern equipment is increasingly designed to run eco-friendly materials, but compatibility must be verified. Machines like shrink bundlers and pouching systems generally require specific settings for thinner gauges or recycled content films to prevent tearing or poor seals. When sourcing equipment, specify your intent to use sustainable consumables to ensure the sealing jaws and feeders are calibrated correctly.

Q5: What should I look for regarding aftermarket support and spare parts availability?

A: Unplanned downtime is the biggest threat to profitability. Prioritize suppliers that offer comprehensive Packaging Equipment Tech Service & Parts. Ensure the vendor maintains a local inventory of critical wear parts (belts, heating elements, blades) and offers remote diagnostic capabilities or rapid onsite engineering support in your region (USA/Europe).

Q6: How do Modified Atmosphere Packaging (MAP) systems extend shelf life?

A: MAP equipment flushes the package with a specific gas mixture (usually nitrogen or carbon dioxide) to displace oxygen before sealing. This process inhibits bacterial growth and oxidation without preservatives. It is critical for fresh food producers using tray sealers or flow wrappers to meet retail shelf-life requirements in competitive US and European markets.

Q7: What safety features are standard for US and European markets?

A: Machinery destined for these markets must adhere to strict safety standards (e.g., OSHA in the US, CE marking in Europe). Essential features include:

* Interlock switches on guard doors.

* Emergency stop (E-Stop) buttons accessible from multiple points.

* Light curtains for robotic cells and palletizers.

* Sanitary washdown designs (IP69K ratings) for food-contact equipment like liquid filling systems.

Q8: How does a Checkweigher improve quality control and compliance?

A: Ishida Checkweighers and similar systems verify that every package meets the specified weight weight limits. This serves two functions:

1. Regulatory Compliance: Ensures packages meet “net weight” labeling laws (NIST in US, e-mark in EU).

2. Cost Control: Prevents “giveaway” (overfilling) of expensive product.

Advanced checkweighers can typically signal reject systems to automatically remove non-compliant packs from the conveyor without stopping the line.

Strategic Sourcing Conclusion and Outlook for machinery for packaging

Strategic Sourcing Conclusion and Outlook

Effective sourcing of packaging machinery requires a shift from transactional purchasing to holistic line integration. As highlighted by the capabilities of full-service providers, the true value lies in connecting discrete processes—from Ishida checkweighers and liquid filling systems to robotic palletizers—into a seamless, automated ecosystem.

Future Outlook:

The trajectory for USA and European markets points decisively toward high-level automation and flexibility. Strategic procurement must prioritize:

- Interoperability: Ensuring primary packaging units, such as VFFS bagging systems, communicate effectively with secondary case packers.

- Robotics: Leveraging solutions like Fanuc pick & place robots to mitigate labor shortages and increase throughput.

- Scalability: Selecting equipment that adapts to changing SKUs, utilizing versatile flow wrapping and shrink bundling units.

Ultimately, the goal is optimizing Total Cost of Ownership (TCO). By partnering with suppliers who provide line integration and engineering services alongside hardware, manufacturers secure not just machinery, but sustained operational efficiency and a future-proof production floor.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.