The 5 Best 401K Loan Calculators of 2025 (Reviewed)

Finding the Best 401K Loan Calculator: An Introduction

When considering a loan from your 401(k), the process can feel daunting, particularly when it comes to understanding how much you can borrow and what your repayment terms will look like. With numerous online calculators available, finding a reliable and user-friendly 401(k) loan calculator can be challenging. Many tools offer varying levels of detail, accuracy, and features, which can leave users overwhelmed and unsure of which one to trust for their financial planning.

The goal of this article is to streamline your search by reviewing and ranking the best 401(k) loan calculators available online. We aim to save you time and effort by providing a curated list of tools that can help you make informed decisions about borrowing from your retirement savings. Each calculator will be evaluated based on several key criteria, including accuracy of calculations, ease of use, range of features offered, and overall user experience.

In this review, you will find calculators that not only estimate your monthly payments but also provide insights into the total interest paid and the implications of taking a loan against your retirement savings. By focusing on these essential factors, we hope to equip you with the necessary tools to navigate your 401(k) borrowing options with confidence. Whether you’re looking to manage your current financial obligations or make a significant investment, our guide will help you select the calculator that best fits your needs.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best 401k Loan Calculators

When evaluating the top 401k loan calculators available online, we considered a range of essential factors to ensure that users find the most effective and user-friendly tools. Here are the key criteria that guided our selection process:

-

Accuracy and Reliability

– A reliable calculator must provide accurate results based on the inputs provided. We assessed each tool’s mathematical formulas to ensure they align with standard 401k loan calculations, including principal, interest, and loan terms. The calculators should also offer transparency about the assumptions used in calculations. -

Ease of Use

– User experience is critical for any online tool. We examined the interface of each calculator for intuitive design and straightforward navigation. A good calculator should allow users to input data easily and generate results without unnecessary complexity. We prioritized tools that minimize the number of steps required to achieve a calculation. -

Key Features

– The best calculators should include specific inputs necessary for 401k loan calculations, such as:- Loan Amount: The total amount the user wishes to borrow.

- Loan Term: The duration over which the loan will be repaid, typically in years.

- Interest Rate: The applicable interest rate for the loan, often linked to the prime rate.

- Payment Frequency: Options for how often payments will be made (monthly, bi-weekly, etc.).

- Amortization Schedule: The ability to view detailed payment breakdowns over the life of the loan.

-

Cost (Free vs. Paid)

– We focused on free calculators that provide valuable insights without requiring payment or subscription. While some paid tools may offer advanced features, our goal was to highlight accessible resources that can meet the needs of the average user without financial commitment. -

Educational Resources

– Beyond just calculations, we looked for calculators that also provide educational content or resources to help users understand the implications of taking a 401k loan. This includes information on potential opportunity costs, tax implications, and alternative options to borrowing from retirement savings. -

Customer Support and Accessibility

– We considered the availability of support options, such as FAQs, tutorials, or contact information for further assistance. A good calculator should also be accessible across various devices, ensuring users can calculate their options whether on a computer, tablet, or smartphone.

-

User Reviews and Feedback

– Finally, we took into account user reviews and feedback to gauge overall satisfaction with each tool. Tools that consistently received positive feedback regarding their functionality and user experience were prioritized in our selection process.

By applying these criteria, we aimed to present a well-rounded list of 401k loan calculators that cater to the diverse needs of users looking to manage their retirement funds effectively.

The Best 401K Loan Calculators of 2025

1. Retirement loan calculator

The Retirement Loan Calculator from TIAA is designed to help users estimate their monthly payments for a retirement plan loan. This tool provides clarity on potential loan repayment amounts, enabling individuals to assess their financial commitments and make informed decisions about borrowing against their retirement savings. Its user-friendly interface simplifies the process, making it accessible for those looking to understand the implications of taking out a loan from their retirement plan.

- Website: tiaa.org

- Established: Approx. 34 years (domain registered in 1991)

3. Loan Repayment Calculator

The Loan Repayment Calculator from Fidelity Bank is a user-friendly tool designed to help borrowers quickly calculate their loan payments and interest amounts. With its intuitive interface, users can perform essential calculations in seconds, making it an ideal resource for those looking to manage their loan obligations effectively. This calculator simplifies the financial planning process, allowing users to gain clarity on their repayment schedules.

- Website: fidelitybanknc.com

- Established: Approx. 26 years (domain registered in 1999)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a 401(k) loan calculator, the accuracy of your results heavily relies on the information you input. Always ensure that you enter the correct loan amount, interest rate, and repayment period. Small errors in these figures can lead to significant discrepancies in your monthly payment and total interest calculations. Take a moment to verify that your inputs match your specific loan terms, including any stipulations your plan may have regarding maximum loan amounts or interest rates.

Understand the Underlying Assumptions

Most calculators come with predefined assumptions that can affect the accuracy of your results. For instance, some calculators may assume a fixed interest rate or a particular repayment term that may not align with your situation. Familiarize yourself with these assumptions and consider how they apply to your unique circumstances. If a calculator allows you to customize these variables, take advantage of that feature to produce a more tailored result.

Use Multiple Tools for Comparison

Different calculators may yield varying results based on their underlying algorithms and assumptions. To ensure you are making well-informed decisions, utilize multiple 401(k) loan calculators. By comparing results from different tools, you can identify any discrepancies and gain a more comprehensive understanding of your potential loan payments and total costs. This approach will also help you spot any outliers that may require further investigation.

Consider Additional Costs

While calculators primarily focus on loan amounts, interest rates, and repayment schedules, they often overlook other crucial factors. It’s important to consider the potential opportunity costs of borrowing from your 401(k). This includes the impact on your retirement savings and any tax implications that may arise if you fail to repay the loan on time. Be sure to assess these additional costs, which could significantly affect your financial situation in the long term.

Consult a Financial Advisor

If you’re unsure about the figures you’re entering or the implications of taking a 401(k) loan, consider consulting a financial advisor. They can provide personalized advice based on your financial situation and help you interpret the results from the calculators. An expert can also guide you through alternative options, ensuring that you make the best decision for your financial future.

Keep Records of Your Inputs and Results

Finally, maintain a record of the inputs you used and the results generated from each calculator. This can help you track your thought process and provide a reference point should you need to revisit your calculations later. Documenting your findings will also be useful if you decide to seek advice from a financial professional, as they can better assist you with specific information in hand.

Frequently Asked Questions (FAQs)

1. What is a 401(k) loan calculator and how does it work?

A 401(k) loan calculator is an online tool designed to help individuals estimate the monthly payments, total interest, and repayment schedules for loans taken from their 401(k) retirement savings plans. Users input the loan amount, interest rate, and loan term, and the calculator generates projections based on these inputs. It provides a clearer picture of how borrowing from a 401(k) may affect their financial situation.

2. What information do I need to use a 401(k) loan calculator?

To effectively use a 401(k) loan calculator, you’ll typically need the following information:

– Loan Amount: The total amount you plan to borrow from your 401(k).

– Interest Rate: The annual interest rate you will pay on the loan, which is often based on the prime rate plus a margin.

– Loan Term: The duration over which you plan to repay the loan, usually expressed in years.

Some calculators may also ask for your pay frequency and whether the loan is intended to pay off other debts.

3. Are the results from a 401(k) loan calculator guaranteed?

No, the results from a 401(k) loan calculator are not guaranteed. These tools provide estimates based on the information you enter and general assumptions about interest rates and loan terms. They do not account for specific terms set by your employer’s retirement plan or changes in interest rates over time. Therefore, it’s essential to consult with your plan administrator or a financial advisor for precise information.

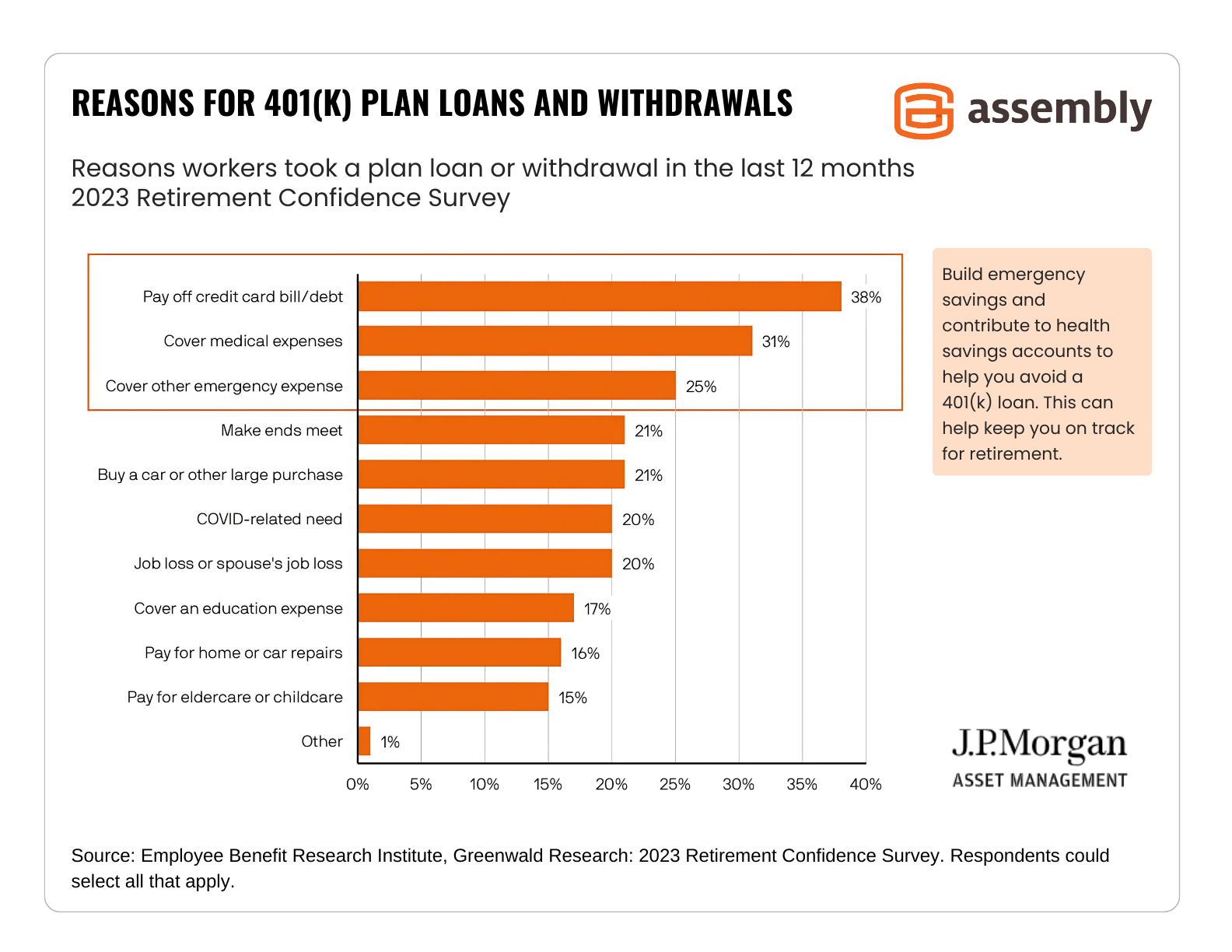

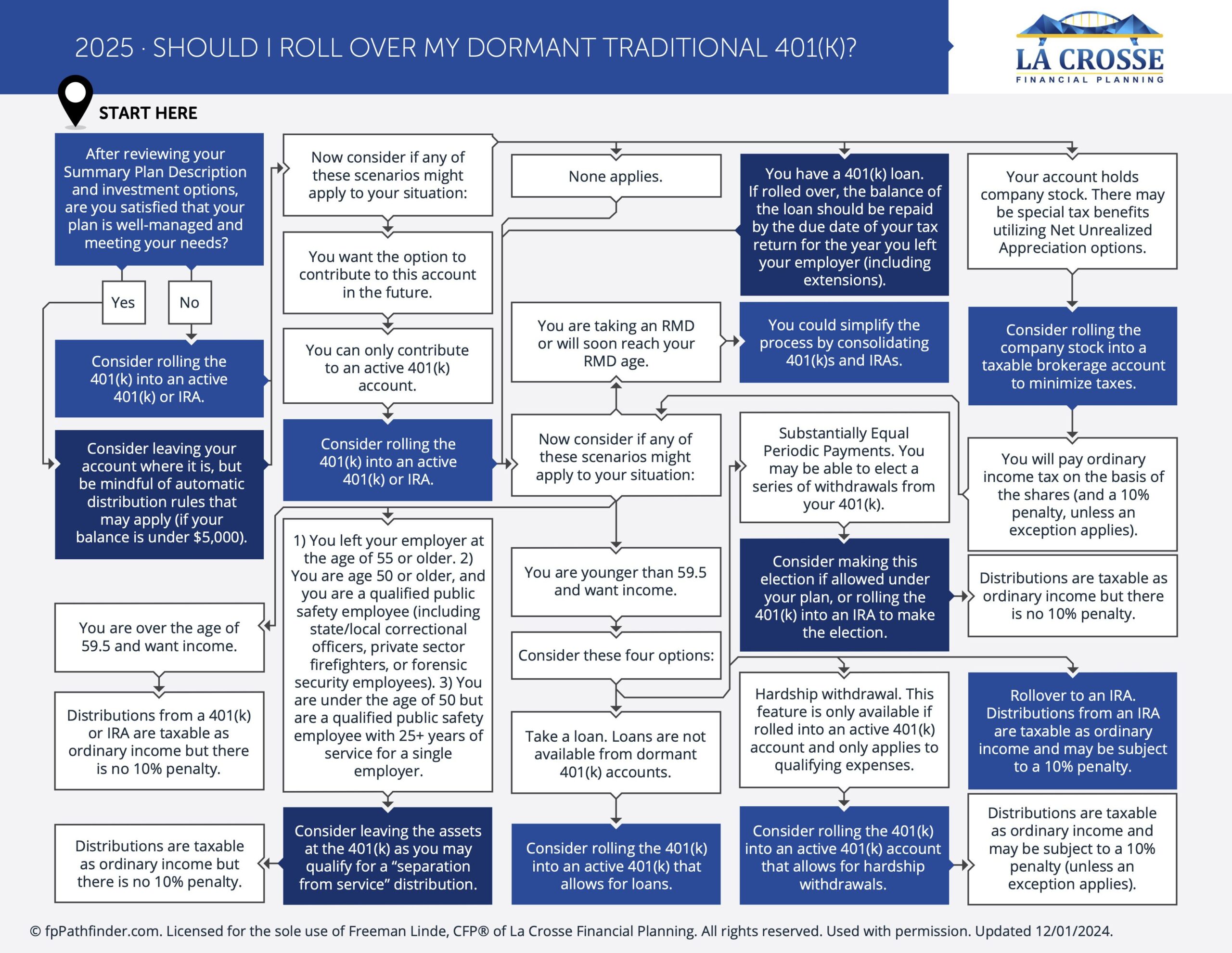

4. What are the potential risks of taking a loan from my 401(k)?

While a 401(k) loan may seem attractive due to its typically lower interest rates and no credit checks, there are significant risks involved:

– Reduced Retirement Savings: Borrowing from your 401(k) can hinder the growth of your retirement savings due to lost compound interest.

– Repayment Obligations: If you leave your job, you may need to repay the loan quickly or face taxes and penalties.

– Double Taxation: Interest paid on the loan is made with after-tax dollars and will be taxed again upon withdrawal in retirement.

Understanding these risks is crucial before deciding to take a loan from your retirement account.

5. Can I use a 401(k) loan calculator to compare borrowing options?

Yes, many 401(k) loan calculators allow users to input information about other debts they may consider paying off with the loan. This feature can help compare the costs associated with borrowing from the 401(k) versus other options, such as personal loans or credit cards. However, it’s important to keep in mind that the calculator primarily focuses on the 401(k) loan, so it’s wise to evaluate all financial options comprehensively before making a decision.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.