The 5 Best 457 Calculators of 2025 (Reviewed)

Finding the Best 457 Calculator: An Introduction

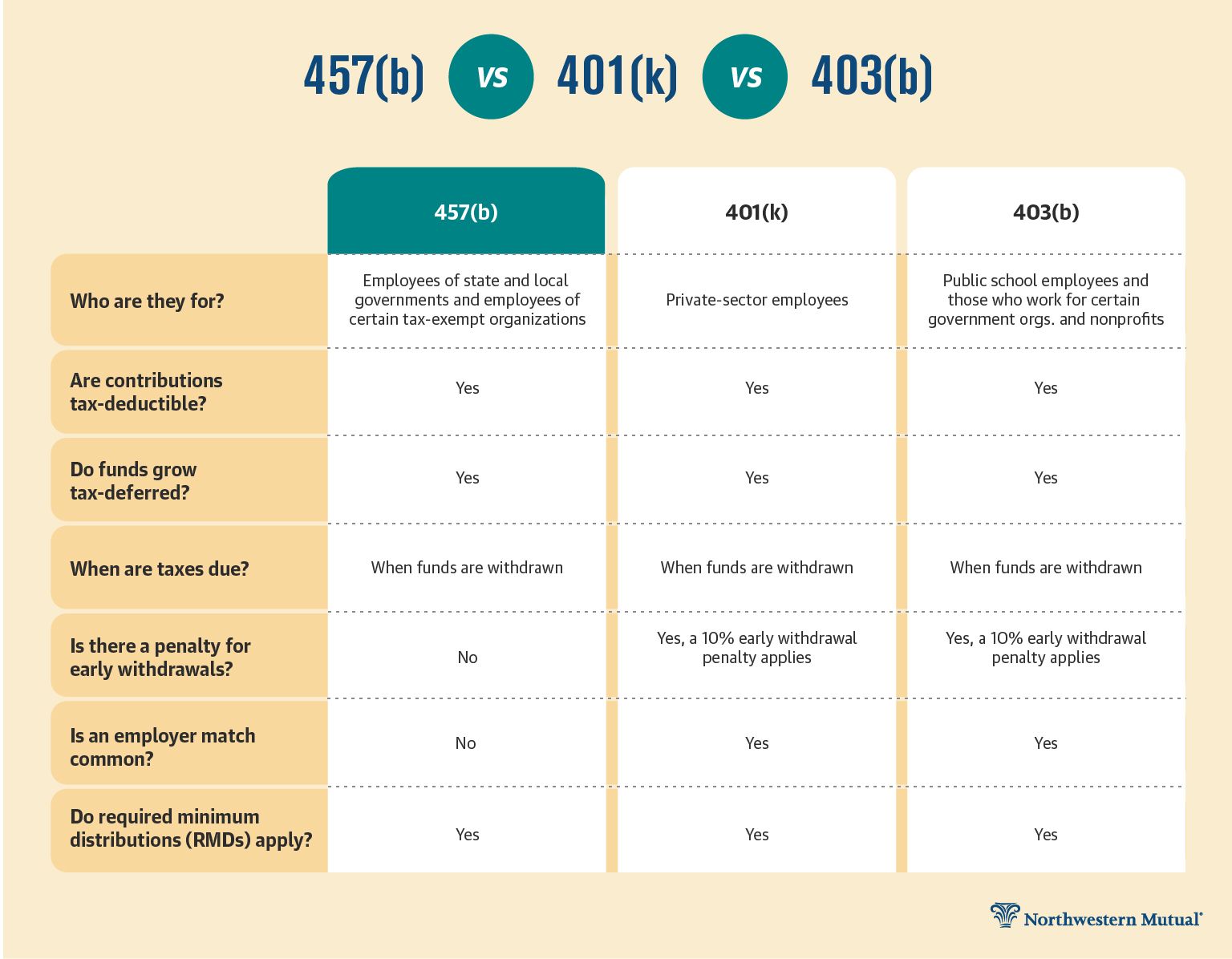

Finding a reliable and effective 457 calculator can be a daunting task, especially with the plethora of options available online. The 457 plan, designed primarily for government and certain non-profit employees, offers unique tax advantages and contribution options that can significantly impact retirement savings. However, with so many calculators out there, determining which one truly meets your needs requires careful consideration.

This article aims to simplify your search by reviewing and ranking the top 457 calculators currently available online. Our goal is to save you time and effort while ensuring you have access to the best tools to manage your retirement planning effectively. We understand that each user has different preferences and needs, so we have taken a comprehensive approach to evaluate these calculators.

Evaluation Criteria

To provide you with an unbiased and informative ranking, we used several key criteria in our evaluation:

-

Accuracy: The calculator’s ability to produce precise estimates based on user inputs is paramount. We looked for tools that provide reliable projections for retirement savings and potential tax implications.

-

Ease of Use: A user-friendly interface can make a significant difference, especially for those who may not be financially savvy. We prioritized calculators that are intuitive and straightforward, allowing users to navigate effortlessly.

-

Features: We assessed the variety of features each calculator offers, such as options for different contribution scenarios, projections for employer matching, and additional tools for retirement planning.

-

Accessibility: Given the technological landscape, we also considered how easily users can access these tools, including compatibility with different browsers and devices.

By focusing on these criteria, we aim to guide you towards the best 457 calculators that will empower you to make informed decisions about your retirement savings.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best 457 Calculators

When evaluating the top online tools for calculating 457 retirement plans, we established a set of criteria to ensure that users can find reliable and user-friendly calculators that meet their needs. Here are the key factors we considered:

-

Accuracy and Reliability

– The foremost requirement for any financial calculator is the accuracy of its results. We prioritized tools that are backed by reputable organizations and have undergone rigorous testing to ensure they produce reliable calculations. This includes proper handling of tax-deferred contributions and employer matching contributions, which are critical for 457 plans. -

Ease of Use

– A good calculator should be intuitive and easy to navigate, even for users who may not be financially savvy. We assessed the user interface and overall experience, ensuring that the calculators are accessible on various devices, including smartphones and tablets. Clear instructions and a straightforward design enhance usability, making it easier for users to input their data and interpret the results. -

Key Features

– Effective 457 calculators should include essential inputs that allow users to customize their calculations. We looked for tools that offer:- Initial Contribution Amount: Users should easily input how much they plan to contribute initially.

- Annual Contribution Increase: The ability to project future contributions as they increase over time.

- Expected Rate of Return: Users should be able to input their expected annual rate of return on investments.

- Withdrawal Age: This feature helps users calculate how their savings will grow until retirement.

- Employer Match: Calculators should allow for the inclusion of potential employer matching contributions to provide a more accurate savings projection.

-

Cost (Free vs. Paid)

– We focused on tools that are free to use, as many individuals seeking to manage their retirement savings may prefer not to incur additional costs. While some paid calculators may offer advanced features, we prioritized free options that still provide comprehensive functionality. Transparency regarding any potential fees or subscription models was also a key consideration. -

Additional Resources and Support

– Beyond basic calculations, we assessed whether the calculators provide additional resources, such as educational content about 457 plans, retirement strategies, and links to professional advice. Tools that offer insights into the implications of different savings strategies or provide context for the calculations can significantly enhance user understanding. -

User Reviews and Feedback

– Finally, we considered user reviews and feedback to gauge the overall satisfaction and effectiveness of each calculator. Tools with positive testimonials from real users indicate a higher likelihood of meeting the needs of individuals planning for retirement.

By utilizing these criteria, we aimed to present a selection of 457 calculators that not only deliver accurate calculations but also offer a user-friendly experience and valuable insights into retirement planning.

The Best 457 Calculators of 2025

2. 457 Savings Calculator

The 457 Savings Calculator at mersofmich.com is designed to help users maximize their retirement savings through a 457 plan. This tool highlights two key advantages of 457 plans: tax deferral on contributions and potential employer matching. By using this calculator, individuals can estimate their future savings and make informed decisions about their retirement strategy, ensuring a more secure financial future.

- Website: mersofmich.com

- Established: Approx. 25 years (domain registered in 2000)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in using any online calculator, including a 457 calculator, is to ensure that the information you input is accurate. Take the time to double-check all entries, including your current savings, expected contributions, rate of return, and retirement age. Even a small error in these figures can lead to significantly different outcomes, impacting your retirement planning. If the calculator allows, review any default settings and modify them according to your personal financial situation.

Understand the Underlying Assumptions

Each calculator is built on specific assumptions that can greatly affect the results. For instance, many calculators assume a constant rate of return on investments, which may not reflect market volatility. Additionally, some calculators may not account for factors like inflation, taxes, or changes in income. Familiarize yourself with these assumptions by reading the calculator’s instructions or FAQs. This understanding will help you interpret the results more accurately and adjust your expectations accordingly.

Use Multiple Tools for Comparison

No single calculator can provide a complete picture of your financial future. To obtain a more nuanced understanding, utilize multiple calculators to compare results. Each tool may have different features or algorithms, leading to varied outputs. By cross-referencing the results from several calculators, you can better gauge the reliability of the data and identify any inconsistencies. This approach can also highlight different scenarios, such as the impact of increasing contributions or delaying retirement.

Seek Professional Advice

While online calculators are valuable tools for initial assessments and projections, they should not replace personalized financial advice. Consider consulting with a financial advisor who can take into account your unique circumstances, including income, expenses, and long-term goals. Professional guidance can help you interpret the calculator results and create a tailored retirement strategy that aligns with your specific needs.

Stay Informed About Changes

Retirement planning is not a one-time task; it requires ongoing management and adjustments. Stay informed about any changes in tax laws, contribution limits, and investment options that could impact your 457 plan and retirement savings. Regularly revisiting your calculations with updated information will ensure that your retirement strategy remains relevant and effective.

Review Your Progress Regularly

Finally, make it a habit to review your retirement calculations periodically. As you progress in your career and your financial situation evolves, your retirement goals may change as well. Set reminders to revisit your 457 calculator and adjust your inputs as necessary to reflect your current financial state. This proactive approach will help you stay on track toward achieving your retirement objectives.

Frequently Asked Questions (FAQs)

1. What is a 457 calculator?

A 457 calculator is an online tool designed to help individuals estimate their retirement savings and contributions under a 457 deferred compensation plan. It typically allows users to input various parameters, such as current savings, expected contributions, retirement age, and anticipated returns, to project future account balances and retirement income.

2. How does a 457 plan benefit my retirement savings?

A 457 plan provides two primary advantages: tax deferral and potential employer matching contributions. Contributions made to a 457 plan are not taxed until withdrawal, allowing your investments to grow without immediate tax implications. Additionally, many employers offer matching contributions, which can significantly enhance your retirement savings.

3. What information do I need to use a 457 calculator?

To effectively use a 457 calculator, you typically need to provide information such as your current age, retirement age, current savings amount, annual contribution amount, expected rate of return, and any expected employer match. This data helps the calculator generate a more accurate projection of your retirement savings.

4. Are the results from a 457 calculator guaranteed to be accurate?

No, the results from a 457 calculator are not guaranteed to be accurate. These calculators provide estimates based on the information entered and assumptions about future market conditions, interest rates, and personal circumstances. It’s important to use these tools as a guide and consult with a financial advisor for personalized advice tailored to your individual situation.

5. Can I access a 457 calculator on mobile devices?

Most 457 calculators are designed to be accessible on various devices, including mobile phones and tablets. However, some calculators may require specific browser settings or may function better on desktop computers. Always check the compatibility of the calculator with your device to ensure optimal use.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.