The 5 Best Alimony Calculators of 2025 (Reviewed)

Finding the Best Alimony Calculator: An Introduction

Finding the right alimony calculator can be a daunting task for anyone navigating the complexities of divorce or separation. With various tools available online, each claiming to provide accurate estimates, it can be challenging to determine which one is reliable and easy to use. Moreover, the calculation of alimony can vary significantly based on individual circumstances, state laws, and specific formulas, making it essential to choose a tool that takes these factors into account.

The Importance of a Reliable Alimony Calculator

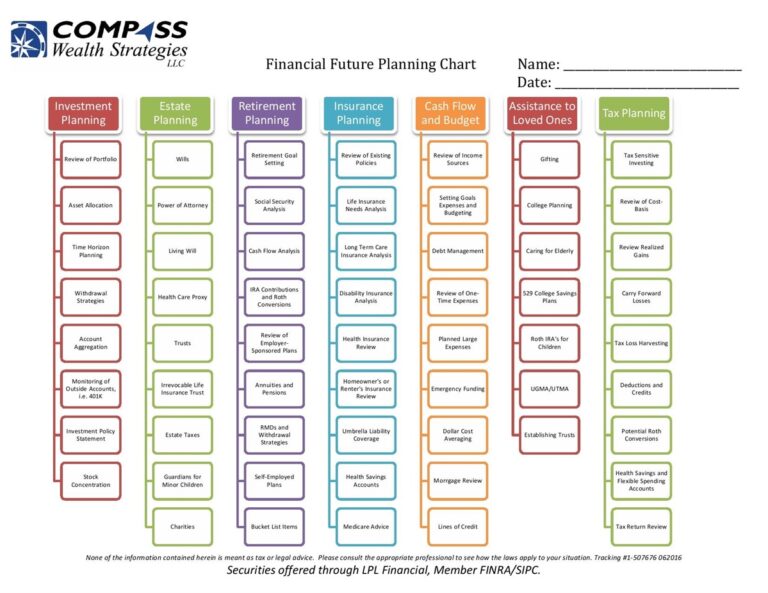

An accurate alimony calculator is crucial for understanding potential financial obligations and planning for the future. It can help individuals estimate payments based on income levels, the length of the marriage, and other relevant factors. However, not all calculators are created equal. Some may offer generalized estimates without considering state-specific guidelines or unique personal situations, which could lead to misleading results.

Purpose of This Article

The goal of this article is to review and rank the top alimony calculators available online, ultimately saving you time and effort in your search for a dependable tool. We have evaluated various calculators based on several key criteria, including:

- Accuracy: How closely the estimates align with legal standards and typical formulas used in different states.

- Ease of Use: The user interface and overall experience when navigating the calculator.

- Features: Additional functionalities, such as the ability to calculate duration or consider child support payments.

By examining these factors, we aim to provide a comprehensive overview of the best alimony calculators, helping you make an informed choice that meets your needs.

Our Criteria: How We Selected the Top Tools

Selection Criteria for Alimony Calculators

When evaluating the best online alimony calculators, we focused on several essential criteria to ensure that our recommendations provide users with the most accurate, user-friendly, and comprehensive tools available. Below are the key factors we considered:

-

Accuracy and Reliability

– The primary function of an alimony calculator is to provide an estimate that reflects real-world scenarios. We prioritized tools that utilize established formulas, such as the American Academy of Matrimonial Lawyers (AAML) guidelines, which are recognized in the legal community. Calculators that provide clear disclaimers about their estimates and suggest consulting with a legal professional for personalized advice were favored. -

Ease of Use

– A good calculator should be straightforward and intuitive. We assessed the user interface of each tool, ensuring that it allows users to input necessary data without confusion. Features like step-by-step guidance, tooltips, and a clean layout significantly enhance user experience. The time it takes to complete calculations and the clarity of output results were also considered. -

Key Features

– The most effective alimony calculators include specific inputs that are crucial for accurate estimations. We looked for tools that allow users to enter:- Gross and net monthly incomes for both the paying and receiving spouses.

- Monthly expenses for both parties.

- Length of the marriage.

- Any factors that might affect alimony, such as the presence of children or marital misconduct.

- Additional features like duration estimates for alimony payments and state-specific considerations were also taken into account.

-

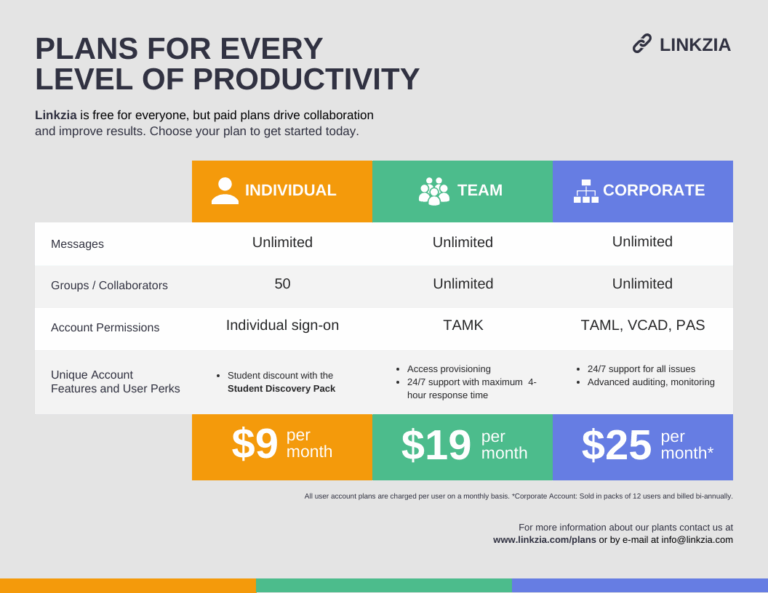

Cost (Free vs. Paid)

– Many users seek free tools to estimate alimony payments without incurring costs. We prioritized calculators that offer free access while still delivering reliable estimates. However, we also evaluated paid options that provide more comprehensive services, such as personalized consultations or advanced features, to ensure users have access to a range of choices. -

State-Specific Considerations

– Alimony laws can vary significantly from one state to another. We favored calculators that either provide state-specific calculations or offer guidance on how local laws may impact alimony estimates. This feature is particularly useful for users who are navigating the complexities of divorce and spousal support in different jurisdictions. -

User Feedback and Ratings

– We considered user reviews and ratings to gauge the effectiveness and satisfaction levels of each tool. Calculators that have received positive feedback for their accuracy, ease of use, and customer support were prioritized, as they indicate a reliable and trusted resource. -

Additional Resources

– We appreciated calculators that provide additional resources, such as articles or FAQs about alimony. These resources help users understand the context of their calculations and the factors influencing alimony decisions, ultimately aiding them in making informed choices.

By adhering to these criteria, we aimed to curate a list of alimony calculators that not only meet user needs but also empower individuals to navigate their financial futures with confidence.

The Best Alimony Calculators of 2025

1. New York State Maintenance & Child Support Calculator

The New York State Maintenance & Child Support Calculator on joyrosenthal.com is a valuable tool designed to assist users in estimating the maintenance and child support payments that a judge in New York may consider. By inputting relevant financial information, users can gain insights into potential obligations, making it easier to navigate the complexities of family law in the state.

- Website: joyrosenthal.com

- Established: Approx. 19 years (domain registered in 2006)

2. Spousal Maintenance Calculator

The Spousal Maintenance Calculator from Romanshum.com is designed to assist users in estimating alimony payments in New York. By applying a straightforward formula—multiplying the combined income of both spouses by 40% and subtracting the requesting spouse’s income—the tool provides a clear calculation to help determine potential maintenance obligations. Its user-friendly interface makes it accessible for individuals navigating the complexities of spousal support.

- Website: romanshum.com

- Established: Approx. 9 years (domain registered in 2016)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using an online alimony calculator, the accuracy of your results heavily relies on the information you provide. Before hitting the “calculate” button, take a moment to review all your inputs. Common fields include gross and net incomes, monthly expenses, and the length of the marriage. Even a small typo or miscalculation can lead to significantly different results. Ensure that all figures are accurate and up-to-date. If you’re uncertain about specific financial details, consider gathering the relevant documents, such as pay stubs, tax returns, and bank statements, to help you fill in the necessary information correctly.

Understand the Underlying Assumptions

Each alimony calculator may operate under different formulas and assumptions. For example, some calculators might use a percentage of the paying spouse’s income while others might consider the financial needs of both parties. Familiarize yourself with the method used by the calculator to understand how the results are derived. Additionally, be aware that many calculators do not account for unique circumstances such as special needs, lifestyle choices, or potential changes in income. Always read the disclaimers and explanations provided on the calculator’s website to grasp the context of the results.

Use Multiple Tools for Comparison

To ensure you are getting a well-rounded view of potential alimony obligations, it’s wise to use multiple online calculators. Each tool may yield slightly different results based on its methodology and the assumptions it makes. By comparing outputs from several calculators, you can identify a range of potential alimony amounts, which can help in discussions or negotiations. This approach also allows you to spot any discrepancies and address them with a legal professional if necessary.

Consult with a Legal Expert

While online calculators are useful for getting a preliminary estimate, they should not replace professional legal advice. Laws surrounding alimony can vary significantly from state to state, and a qualified attorney can provide personalized insights based on your unique situation. They can also clarify how various factors, such as the length of the marriage and each spouse’s financial status, may influence the final decision made by a court. Consulting with an expert ensures that you are fully informed and prepared for any legal proceedings.

Keep Context in Mind

Lastly, remember that online calculators are just tools to help you gauge potential outcomes. They are not definitive and do not account for all factors that may influence an actual court decision. Consider the emotional and relational context of your situation, as these elements can significantly affect negotiations and outcomes. Use the calculator results as a starting point for discussions rather than a final answer. By keeping these considerations in mind, you can navigate the complexities of alimony with greater confidence and clarity.

Frequently Asked Questions (FAQs)

1. How is alimony calculated using an online calculator?

Alimony calculators typically use standardized formulas that take into account factors such as the gross income of both spouses, the length of the marriage, and sometimes the expenses of both parties. For example, some calculators may apply formulas like the AAML (American Academy of Matrimonial Lawyers) guideline, which suggests a calculation based on a percentage of the paying spouse’s income minus a percentage of the recipient spouse’s income. It’s important to note that these calculators provide estimates and the final decision may vary based on individual circumstances and state laws.

2. Are online alimony calculators accurate?

While online alimony calculators can provide a good estimate of potential alimony payments, they should be used as a starting point rather than a definitive answer. The accuracy of the results can depend on the specific inputs you provide and the formulas used by the calculator. For precise calculations that consider unique personal circumstances, it is advisable to consult a family law attorney or financial expert.

3. What factors can influence the amount of alimony calculated?

Several factors can influence alimony calculations, including the income of both spouses, the duration of the marriage, the standard of living during the marriage, and the financial needs of the receiving spouse. Other considerations may include the recipient’s ability to earn income and any contributions made by either spouse to the marriage, such as raising children or supporting the other’s career.

4. Can I rely solely on an alimony calculator for my divorce proceedings?

While an alimony calculator can provide useful estimates, it is not advisable to rely solely on it for divorce proceedings. Legal standards for alimony vary by state, and judges may consider additional factors not accounted for in the calculator. Therefore, it is essential to consult with a legal professional to understand your rights and obligations in your specific situation.

5. How often are alimony payments made, and can they change?

Alimony payments can be structured in various ways, including monthly payments or a lump-sum payment. The duration and frequency of payments can depend on the agreement made between the parties or a court order. Additionally, circumstances such as changes in income, employment status, or the recipient’s financial situation can lead to modifications of the alimony agreement. It is important to stay informed about the legal requirements in your state regarding alimony modifications.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.