The 5 Best Break Even For Social Security Benefits Calculators of …

Finding the Best Break Even Calculator For Social Security Benefits: An Introduction

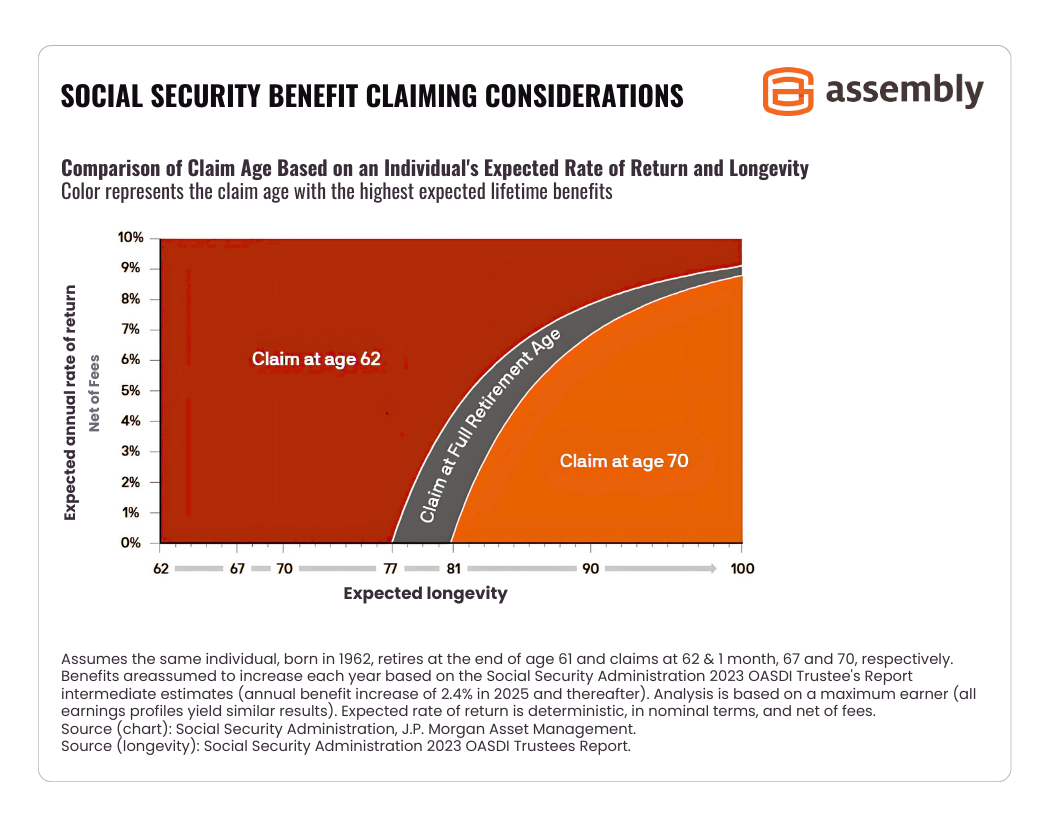

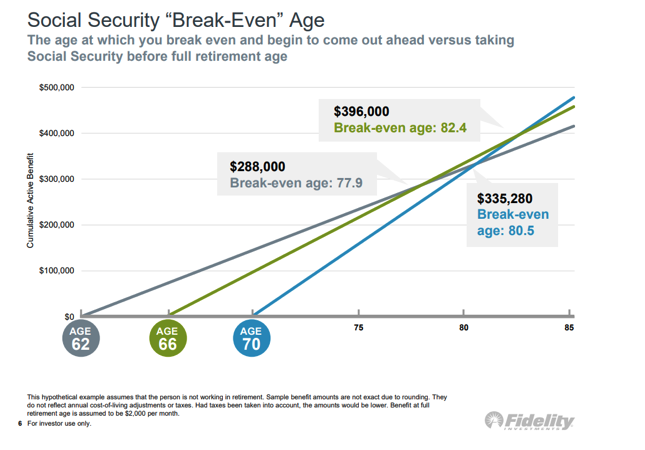

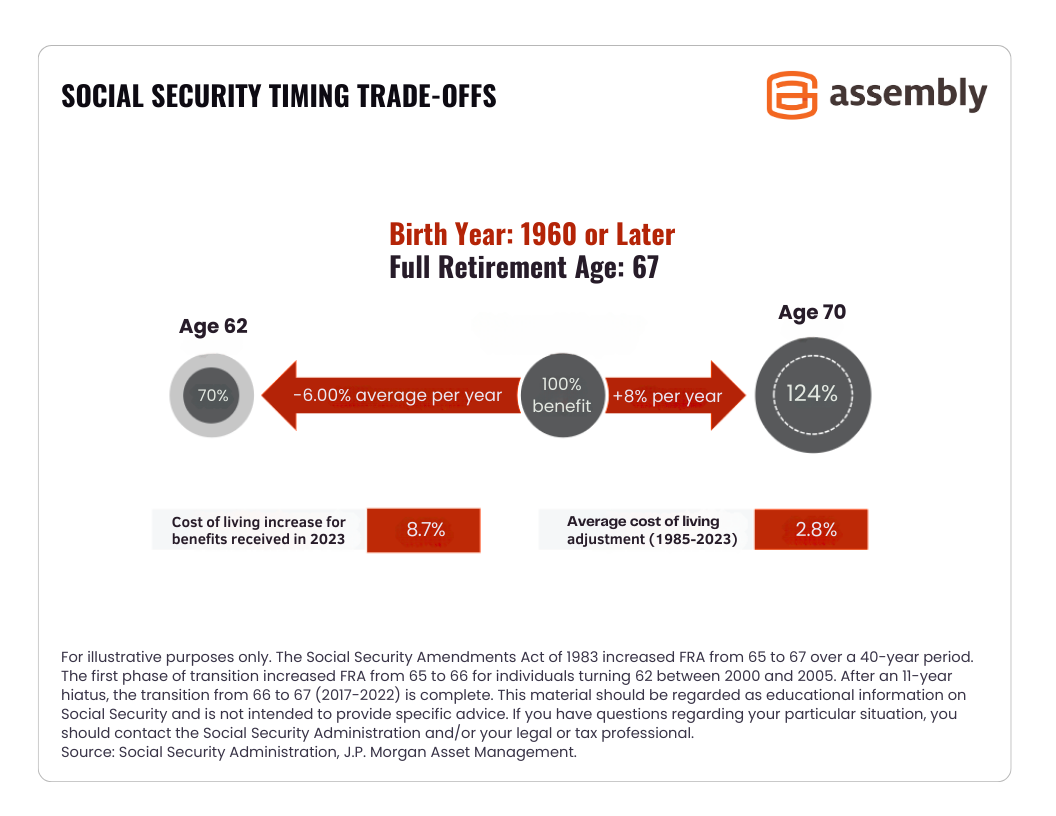

Navigating the complexities of Social Security benefits can be a daunting task, particularly when trying to determine the optimal age to file for benefits. With so many factors at play, including your financial situation, health, and life expectancy, finding a reliable break-even calculator for Social Security benefits becomes essential. These calculators help estimate the cumulative benefits you can expect based on different filing ages, allowing you to make informed decisions that can significantly impact your financial future.

However, not all calculators are created equal. Many available tools can produce varying results, leaving users confused about which one to trust. This article aims to simplify your search by reviewing and ranking the top break-even calculators currently available online. Our goal is to save you time and provide you with the best options for evaluating your Social Security filing strategy.

To ensure a comprehensive evaluation, we have established specific criteria for ranking these calculators. Key factors include accuracy, as it is crucial that the tool provides reliable estimates based on current Social Security regulations. Ease of use is also a priority, as a user-friendly interface can make the calculation process less intimidating. Additionally, we will consider the features offered by each tool, such as the ability to factor in inflation or customize variables like life expectancy and spousal benefits. By focusing on these criteria, we hope to guide you in selecting the best break-even calculator tailored to your needs.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Break Even Calculators for Social Security Benefits

When evaluating the top online calculators for determining the break-even point for Social Security benefits, we considered a range of critical factors to ensure that users receive the most reliable and user-friendly tools available. Here’s a detailed breakdown of our selection criteria:

-

Accuracy and Reliability

– The primary goal of any break-even calculator is to provide accurate estimates of cumulative Social Security benefits based on various filing ages. We prioritized tools that are backed by reputable financial organizations and have been validated through user testimonials and expert reviews. Calculators that incorporate inflation adjustments and account for cost-of-living adjustments (COLA) were favored for their accuracy. -

Ease of Use

– A user-friendly interface is essential, especially for those who may not be financially savvy. We selected calculators that feature intuitive designs, clear instructions, and minimal steps required to perform calculations. The ability to easily input data and quickly receive results enhances the overall user experience. -

Key Features

– Effective calculators should include specific inputs relevant to determining break-even points. We looked for tools that allow users to enter:- Date of birth

- Monthly benefit estimates at different ages (e.g., age 62, full retirement age, age 70)

- Options for adjusting the average annual increase for inflation

- The ability to compare benefits across different filing ages.

- Additional features, such as visual representations of cumulative benefits over time or the option to consider spousal benefits, were also taken into account.

-

Cost (Free vs. Paid)

– We focused on calculators that are accessible to a wide audience, primarily those that are free to use. While some premium tools may offer advanced features or personalized advice, we aimed to highlight options that provide valuable insights without incurring costs. Transparency regarding any fees associated with advanced features was also an important factor. -

Educational Resources

– Quality calculators often come with supplementary resources, such as articles, videos, or FAQs that explain how to effectively use the tool and understand the calculations. We selected calculators that provide clear guidance on interpreting results and making informed decisions regarding Social Security filing.

-

User Feedback and Reviews

– We considered user feedback from various platforms to gauge the effectiveness and satisfaction levels associated with each calculator. Tools that consistently received positive reviews for their functionality, accuracy, and customer support were prioritized.

By applying these criteria, we aimed to identify the most effective break-even calculators for Social Security benefits, ensuring that users can make well-informed decisions regarding their retirement planning.

The Best Break Even Calculator For Social Security Benefitss of 2025

1. Break Even Calculator for Social Security

The Break Even Calculator for Social Security by Carroll Advisory Group is designed to help individuals determine the optimal age to file for Social Security benefits. By analyzing various filing ages, the tool calculates which option will yield the highest total lifetime benefits. Its user-friendly interface and straightforward calculations make it an essential resource for anyone looking to maximize their Social Security income effectively.

- Website: carrolladvisory.com

- Established: Approx. 7 years (domain registered in 2018)

3. Break Even Calculator

The Break Even Calculator from Social Security Intelligence is designed to help users determine the optimal age to file for Social Security benefits by calculating which filing age will yield the highest lifetime payments. This tool considers various factors, allowing individuals to make informed decisions about when to claim benefits, ultimately maximizing their total Social Security income over time. Its user-friendly interface makes it accessible for anyone looking to plan their retirement finances effectively.

- Website: socialsecurityintelligence.com

- Established: Approx. 11 years (domain registered in 2014)

4. Social Security Calculator 2025: Estimate Your Benefits

The Social Security Calculator 2025 from NerdWallet is a user-friendly online tool designed to help individuals estimate their retirement benefits. By inputting personal details such as age, planned retirement date, and earnings history, users can gain insights into their potential Social Security payouts. This calculator serves as a valuable resource for financial planning, allowing users to make informed decisions about their retirement strategy.

- Website: nerdwallet.com

- Established: Approx. 16 years (domain registered in 2009)

5. Social Security break

The “Social Security Break-Even Point” tool from Thrivent.com is designed to help individuals determine the optimal age to start receiving Social Security benefits. By calculating the difference in total benefits received if claiming at age 62 versus delaying until age 70, users can assess their financial strategy over time. The tool simplifies the process by multiplying the monthly benefit amount by the number of months delayed, providing a clear view of potential earnings and losses.

- Website: thrivent.com

- Established: Approx. 25 years (domain registered in 2000)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a break-even calculator for Social Security benefits, accuracy starts with the data you provide. Carefully input your birth date, full retirement age (FRA), and expected monthly benefits at various filing ages (early, FRA, and late). A small error in these figures can lead to significantly different results. Take a moment to review each entry before hitting “calculate.” Additionally, ensure that you are using the correct definitions and values as specified by the Social Security Administration (SSA) to avoid confusion.

Understand the Underlying Assumptions

Every calculator operates based on certain assumptions, which can influence the results. For instance, many calculators do not factor in inflation or changes in cost of living adjustments (COLA). Understanding these assumptions helps you interpret the results more accurately. Some calculators may also assume a specific lifespan or average life expectancy, which can affect break-even points. Familiarize yourself with these assumptions to better gauge how they may impact your decision-making process.

Use Multiple Tools for Comparison

No single calculator can provide a definitive answer regarding the best time to claim Social Security benefits. It’s wise to use multiple calculators to compare results. Each tool may use different algorithms or inputs, leading to varying break-even points. By reviewing the outputs from several calculators, you can identify trends and make a more informed decision. Look for commonalities in the results, and consider consulting with financial advisors or retirement planners for additional insights.

Factor in Personal Circumstances

Your personal financial situation plays a crucial role in determining the optimal time to claim Social Security benefits. Consider other sources of income, such as pensions or savings, as well as your health and longevity expectations. If you have a family history of longevity, you may benefit from delaying benefits to maximize your monthly payout. Conversely, if you need immediate income or have health concerns, early filing might be more advantageous. Tailoring the calculator results to your unique circumstances will yield more applicable insights.

Review Additional Resources

Many calculators provide links to articles, guides, or videos that explain how to use them effectively. Take advantage of these resources to deepen your understanding of Social Security benefits and the implications of your filing age. Exploring educational materials can enhance your decision-making process and help you grasp the broader context of your financial planning.

Consult a Professional

While online calculators are useful, they should not replace personalized advice from a financial planner or retirement specialist. These professionals can provide tailored insights that consider your entire financial picture, including tax implications and estate planning. If you are uncertain about your calculations or how to interpret them, seeking professional guidance can help clarify your options and lead to better financial outcomes.

Frequently Asked Questions (FAQs)

1. What is a break-even calculator for Social Security benefits?

A break-even calculator for Social Security benefits is an online tool designed to help individuals determine the best age to start receiving Social Security retirement benefits. By comparing the cumulative benefits received at different starting ages, the calculator estimates how long it will take for the total benefits from starting at a later age to equal those from an earlier age. This can assist users in making more informed decisions about when to file for benefits.

2. How do I use a break-even calculator for Social Security benefits?

To use a break-even calculator, you typically need to input several key pieces of information: your date of birth, expected monthly benefits at different ages (e.g., age 62, full retirement age, and age 70), and any other relevant financial details. Once you input this data, the calculator will generate results that show your break-even point, indicating the age at which total benefits received will be equal, helping you assess the implications of filing early versus later.

3. Why should I consider factors beyond the calculator’s results?

While a break-even calculator provides valuable insights, it should not be the sole factor in your decision-making process. Other critical considerations include your health and life expectancy, current financial needs, potential future income, and any spousal benefits. It’s advisable to take a holistic view of your retirement planning, including other income sources, expenses, and personal circumstances.

4. Does the calculator account for inflation or cost-of-living adjustments?

Most break-even calculators do have options to factor in inflation or cost-of-living adjustments (COLA) when estimating future benefits. This is important because Social Security benefits are typically adjusted for inflation over time. When using the calculator, make sure to specify whether you want to include these adjustments for a more accurate projection of your total benefits.

5. Can I use a break-even calculator if I plan to work during retirement?

Yes, you can still use a break-even calculator if you plan to work during retirement. However, it’s essential to consider how additional income from work might affect your Social Security benefits, especially if you claim benefits before your full retirement age. Earning above certain limits can lead to reductions in your Social Security benefits, so it’s crucial to factor in your expected work income when evaluating your options.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.