The 5 Best Calculate Dscr Calculators of 2025 (Reviewed)

Finding the Best Calculate Dscr: An Introduction

In today’s financial landscape, accurately calculating the Debt Service Coverage Ratio (DSCR) is crucial for real estate investors, lenders, and anyone involved in commercial financing. However, with numerous online tools available, finding a reliable and efficient calculator can be a daunting task. Many tools promise quick results, but not all deliver on their claims of accuracy and comprehensiveness. Users often face the challenge of sifting through countless options, making it difficult to identify which calculators truly meet their needs.

The primary goal of this article is to review and rank the top online tools for calculating DSCR, allowing you to save time and focus on making informed financial decisions. We have thoroughly analyzed various calculators based on several key criteria to ensure a fair evaluation. These criteria include:

- Accuracy: The precision of the calculations and the reliability of the underlying formulas.

- Ease of Use: The user interface and overall experience when inputting data and interpreting results.

- Features: Additional functionalities that enhance the calculator’s utility, such as integration with other financial metrics or customizable inputs.

By focusing on these aspects, we aim to provide you with a curated list of the best tools available online, helping you navigate the complexities of DSCR calculations with confidence. Whether you are a seasoned investor or a newcomer to the world of real estate finance, our comprehensive review will equip you with the knowledge needed to choose the right calculator for your specific requirements.

Our Criteria: How We Selected the Top Tools

Selection Criteria for DSCR Calculators

When evaluating the best online tools for calculating the Debt Service Coverage Ratio (DSCR), we established a set of criteria to ensure that the selected calculators are effective, user-friendly, and comprehensive. Here’s how we approached our selection:

-

Accuracy and Reliability

– The primary function of a DSCR calculator is to provide accurate results. We prioritized tools that utilize the correct formulas and methodologies for calculating DSCR. This includes ensuring that they incorporate all necessary components like Net Operating Income (NOI) and total debt obligations accurately. -

Ease of Use

– A good calculator should be intuitive and straightforward. We assessed the user interface of each tool, looking for clear instructions and a logical flow that allows users to input their data without confusion. Accessibility on various devices (desktop and mobile) was also a key consideration. -

Key Features

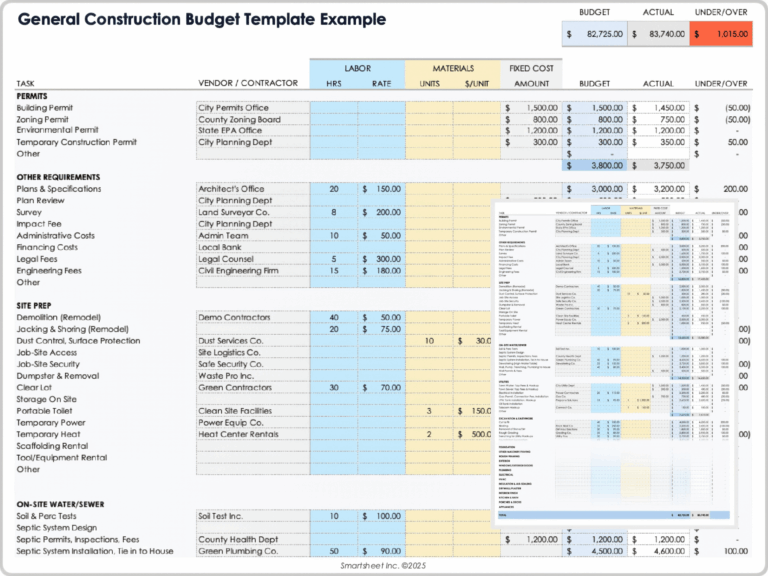

– Effective DSCR calculators should offer a range of features that enhance their usability. Important inputs we looked for include:- Monthly Rental Income: A crucial factor that directly influences cash flow calculations.

- Loan Amount: Essential for determining the scale of debt obligations.

- Interest Rate: The cost of borrowing, impacting overall debt service.

- Term Length: Knowing the duration of the loan is vital for accurate calculations.

- Additional Costs: Options for including property taxes, insurance, and HOA fees, which can affect the overall debt service calculations.

- We also considered whether calculators provided options for different types of properties (e.g., residential, commercial) and scenarios (e.g., interest-only vs. fixed payments).

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or if they require a subscription or one-time payment. Free tools were prioritized, but we also considered paid options that offer additional features or more comprehensive analyses. Transparency in pricing was essential; users should know upfront what costs may be involved. -

Support and Resources

– The availability of support resources, such as FAQs, tutorials, or customer service, was another important factor. We preferred tools that provided educational content to help users understand not only how to use the calculator but also the implications of the DSCR and how it affects their financing decisions. -

User Feedback and Reputation

– We considered user reviews and testimonials to gauge the real-world effectiveness of each calculator. Tools with a strong track record of positive feedback and a solid reputation in the finance and real estate communities were favored.

By applying these criteria, we ensured that the selected DSCR calculators not only meet the basic requirements of functionality but also offer users an enhanced experience in understanding and managing their debt obligations effectively.

The Best Calculate Dscrs of 2025

Could not retrieve enough information to build a top list for calculate dscr.

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in obtaining accurate results from a Debt Service Coverage Ratio (DSCR) calculator is ensuring that all inputs are correct. Before hitting the calculate button, take a moment to verify that you have entered all figures accurately. Common inputs include net operating income (NOI), debt obligations, and other relevant expenses such as taxes and insurance. A small mistake in any of these numbers can lead to significant discrepancies in your DSCR result. Additionally, ensure that you understand the units of measurement (e.g., monthly vs. annual figures) you are using, as this can also impact your results.

Understand the Underlying Assumptions

Each DSCR calculator may have its own set of assumptions regarding the definitions of inputs and the methodology used for calculations. Familiarize yourself with these assumptions by reading the calculator’s guidelines or descriptions. For instance, some calculators may consider only principal and interest payments, while others may include taxes, insurance, and homeowners association (HOA) fees in their calculations. Understanding these nuances will help you interpret your results more accurately and make better financial decisions based on them.

Use Multiple Tools for Comparison

To ensure the accuracy and reliability of your DSCR calculations, it is advisable to use multiple online tools. Different calculators may use varied methodologies or algorithms, leading to slightly different outcomes. By comparing results from multiple calculators, you can identify any significant discrepancies and investigate the reasons behind them. This practice not only provides a more rounded perspective but also increases your confidence in the final figures you use for decision-making.

Keep Context in Mind

Remember that the DSCR is just one metric among many that lenders consider when evaluating a loan application. While a high DSCR is typically favorable, it is essential to view it in the context of other financial indicators, such as loan-to-value (LTV) ratios and the overall financial health of the property or business. Use the DSCR alongside other metrics to form a comprehensive view of your financial situation.

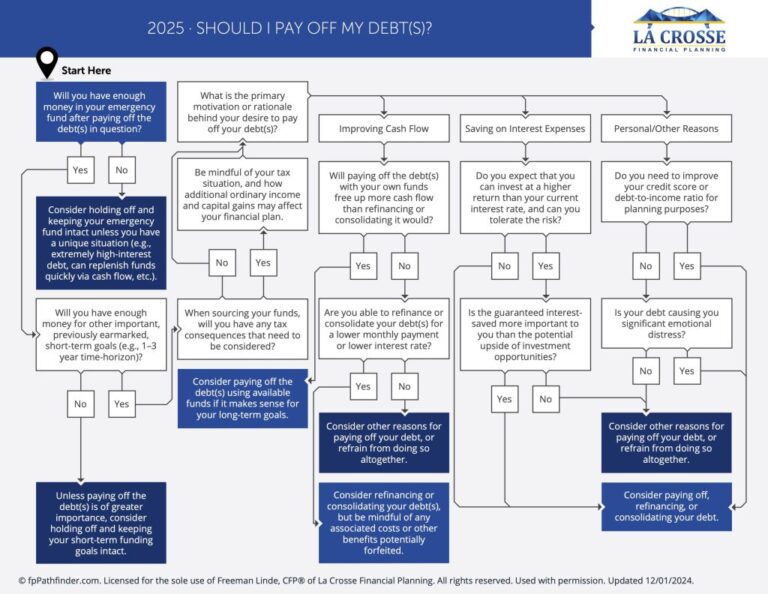

Consult with a Financial Advisor

If you are unsure about how to interpret the results from the calculators or how they apply to your specific financial situation, consider consulting with a financial advisor. A professional can provide personalized insights and help you understand the implications of your DSCR in the broader context of your investment strategy or financing options.

Keep Updated on Market Conditions

Lastly, stay informed about current market conditions and interest rates, as these factors can affect your DSCR calculations. Changes in rental income, property expenses, or the overall economic landscape can impact your cash flow and debt obligations. Regularly updating your calculations based on the latest data will ensure that you have the most accurate and relevant information for making financial decisions.

Frequently Asked Questions (FAQs)

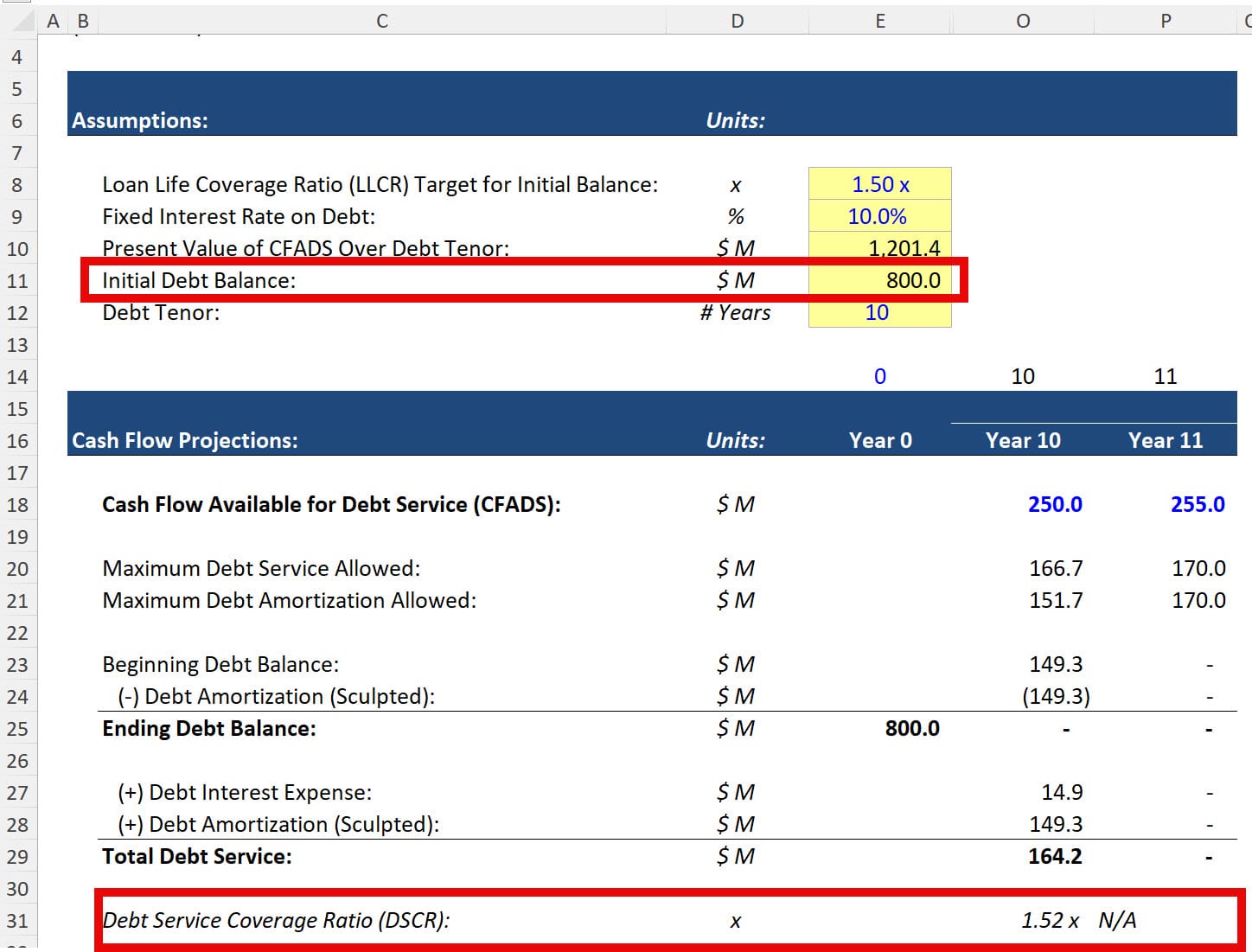

1. What is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) is a financial metric used to measure a property’s cash flow relative to its debt obligations. It indicates the ability of an income-producing property to generate enough income to cover its debt payments. A DSCR of less than 1 means the property does not generate enough cash flow to meet its debt obligations, while a DSCR greater than 1 indicates that the property generates sufficient income to cover its debts.

2. How is DSCR calculated?

DSCR is calculated using the formula:

DSCR = Net Operating Income (NOI) ÷ Total Debt Obligations

In this formula, Net Operating Income is the income generated by the property after operating expenses, but before deducting interest, taxes, depreciation, and amortization. Total Debt Obligations include all payments required for the debt, such as principal and interest.

3. Why is DSCR important for lenders?

Lenders use DSCR as a critical measure of credit risk when evaluating loan applications for commercial real estate. A higher DSCR indicates a lower risk for lenders, as it suggests that the borrower is more likely to meet their debt obligations. Typically, lenders prefer a DSCR of at least 1.25, but this can vary based on the type of property and the borrower’s financial strength.

4. What is considered a good DSCR?

A “good” DSCR generally depends on the type of property and the lending criteria of the financial institution. However, a DSCR of 1.25 or higher is commonly viewed as favorable in the commercial real estate sector. For riskier property types, such as hotels or retail spaces, lenders might require a DSCR of 1.40 or even 1.50.

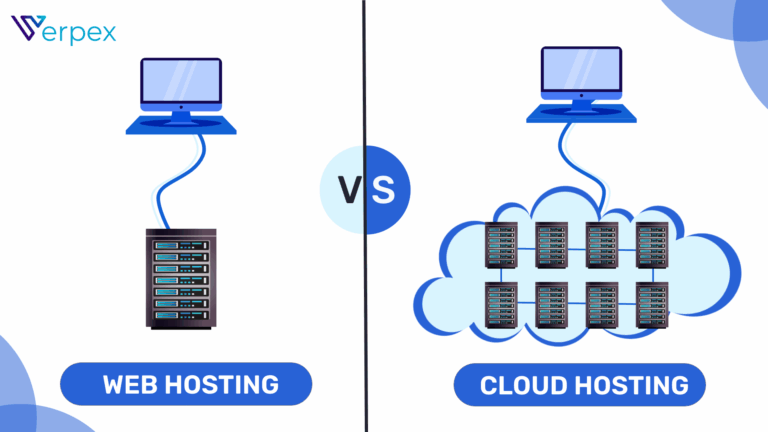

5. Can I calculate DSCR using online tools?

Yes, there are numerous online calculators available that can help you easily compute your Debt Service Coverage Ratio. These tools typically require inputs such as net operating income, monthly mortgage payments, and other relevant expenses. They provide a quick and straightforward way to evaluate the financial viability of a property without needing complex financial calculations.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.