The 5 Best Car Loan Early Payoff Calculators of 2025 (Reviewed)

Finding the Best Car Loan Early Payoff Calculator: An Introduction

In today’s financial landscape, car loans are a common way for consumers to purchase vehicles. However, many borrowers are unaware of the potential savings available through early payoff options. This is where a reliable car loan early payoff calculator comes into play. The challenge, however, lies in finding a good tool that not only provides accurate calculations but is also user-friendly and feature-rich. With numerous options available online, it can be overwhelming to sift through them all to identify the best one for your needs.

The goal of this article is to review and rank the top car loan early payoff calculators available on the internet. We aim to save you time and effort by presenting a curated selection of tools that can help you determine how much interest you can save by making extra payments or paying off your loan early. By utilizing these calculators, you can make informed decisions about your finances, ultimately leading to significant savings.

In our ranking process, we have considered several key criteria. Accuracy is paramount, as the calculator must provide precise results based on the inputs you provide. Ease of use is another critical factor; a well-designed interface can greatly enhance the user experience. Additionally, we looked at features such as the ability to generate amortization schedules, estimate interest savings, and provide options for adjusting payment amounts. By focusing on these criteria, we aim to guide you toward the most effective tools for managing your car loan early payoff strategy.

Our Criteria: How We Selected the Top Tools

Selection Criteria for Car Loan Early Payoff Calculators

When evaluating the top car loan early payoff calculators, we focused on several essential criteria to ensure that users can make informed decisions about their auto loans. Here are the key factors we considered:

-

Accuracy and Reliability

– The calculators must provide precise calculations based on the inputs provided. Accuracy is crucial for users to trust the results they receive, especially when making financial decisions that could lead to significant savings or costs. -

Ease of Use

– A user-friendly interface is vital. The calculators should be straightforward to navigate, with clear instructions and minimal jargon. Users should be able to input their data quickly without encountering unnecessary complications. -

Key Features

– Effective calculators should include several important inputs:- Loan Amount: The total amount borrowed to purchase the vehicle.

- Annual Interest Rate (APR): The interest percentage applied to the loan.

- Loan Term: The length of the loan, typically measured in months.

- Remaining Balance: The current principal balance that is still owed.

- Prepayment Penalty: Information on any fees incurred for paying off the loan early.

- Additionally, the calculator should allow users to experiment with different payment amounts to see how they can affect their loan term and total interest paid.

-

Cost (Free vs. Paid)

– We prioritized calculators that are free to use, as this makes them accessible to a broader audience. Paid tools can be beneficial, but they may limit users who are seeking straightforward financial insights without incurring additional costs. -

Comprehensive Reporting

– The ability to generate a detailed report or amortization schedule is important. This report should summarize the results, including how much interest can be saved by increasing payments and how many months can be shaved off the loan term. The more detailed the report, the better equipped users will be to make informed decisions. -

Educational Resources

– Good calculators often come with additional resources, such as articles or FAQs, that explain the benefits of early loan payoff, potential pitfalls, and strategies for managing auto loans. These resources can enhance the user experience and provide valuable financial education.

-

Mobile Compatibility

– With many users accessing tools via smartphones or tablets, we considered whether the calculators were optimized for mobile use. A responsive design ensures that users can easily navigate and input their information on any device.

By applying these criteria, we have curated a list of the best car loan early payoff calculators available online, ensuring that users can find a tool that meets their needs effectively and efficiently.

The Best Car Loan Early Payoff Calculators of 2025

Could not retrieve enough information to build a top list for car loan early payoff calculator.

How to Get the Most Accurate Results

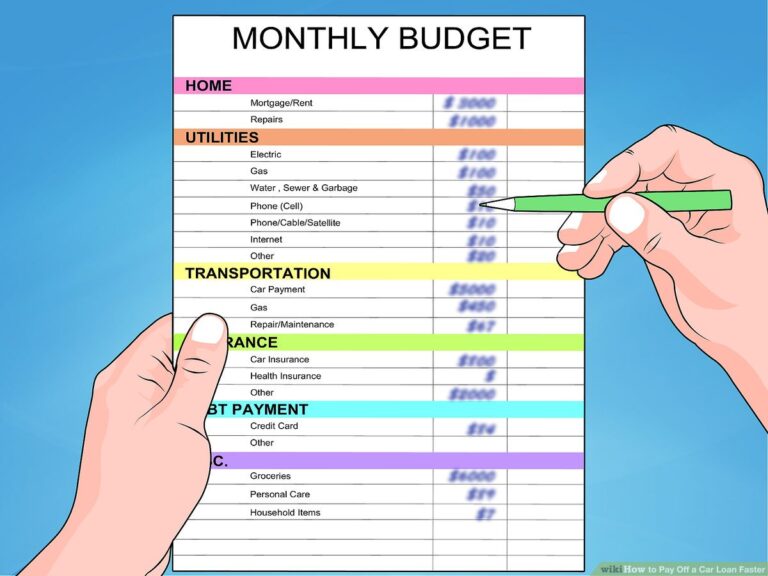

Double-Check Your Inputs

Accuracy in your calculations begins with the information you provide. Before hitting the “calculate” button, take a moment to carefully review each entry. Common inputs include your loan amount, interest rate, remaining loan term, and any additional payments you plan to make. Ensure that the figures are correct and reflect your actual loan details. Even a small error in input can lead to significantly different outcomes, which may affect your financial decisions.

Understand the Underlying Assumptions

Each auto loan early payoff calculator may operate under specific assumptions that could influence your results. For instance, some calculators might assume that your interest is calculated on a simple basis, while others may use a more complex amortization model. Familiarize yourself with how the calculator works, including factors like prepayment penalties or variations in interest calculations. Understanding these assumptions will help you interpret the results more accurately and make informed decisions about your loan payoff strategy.

Use Multiple Tools for Comparison

Not all calculators are created equal; they may vary in features and the accuracy of their outputs. To gain a comprehensive view of your auto loan payoff options, consider using multiple calculators. By comparing the results from different tools, you can identify any discrepancies and gain a more robust understanding of your potential savings. Look for calculators from reputable financial institutions or well-known financial websites, as these are more likely to provide accurate and reliable information.

Experiment with Different Scenarios

One of the key benefits of using an online calculator is the ability to explore various scenarios. Don’t hesitate to input different amounts for your additional payments or adjust the loan term. This experimentation can reveal how changes in your payment strategy can impact your total interest savings and loan duration. By playing with the numbers, you can better understand the financial implications of your choices and select a strategy that best suits your financial situation.

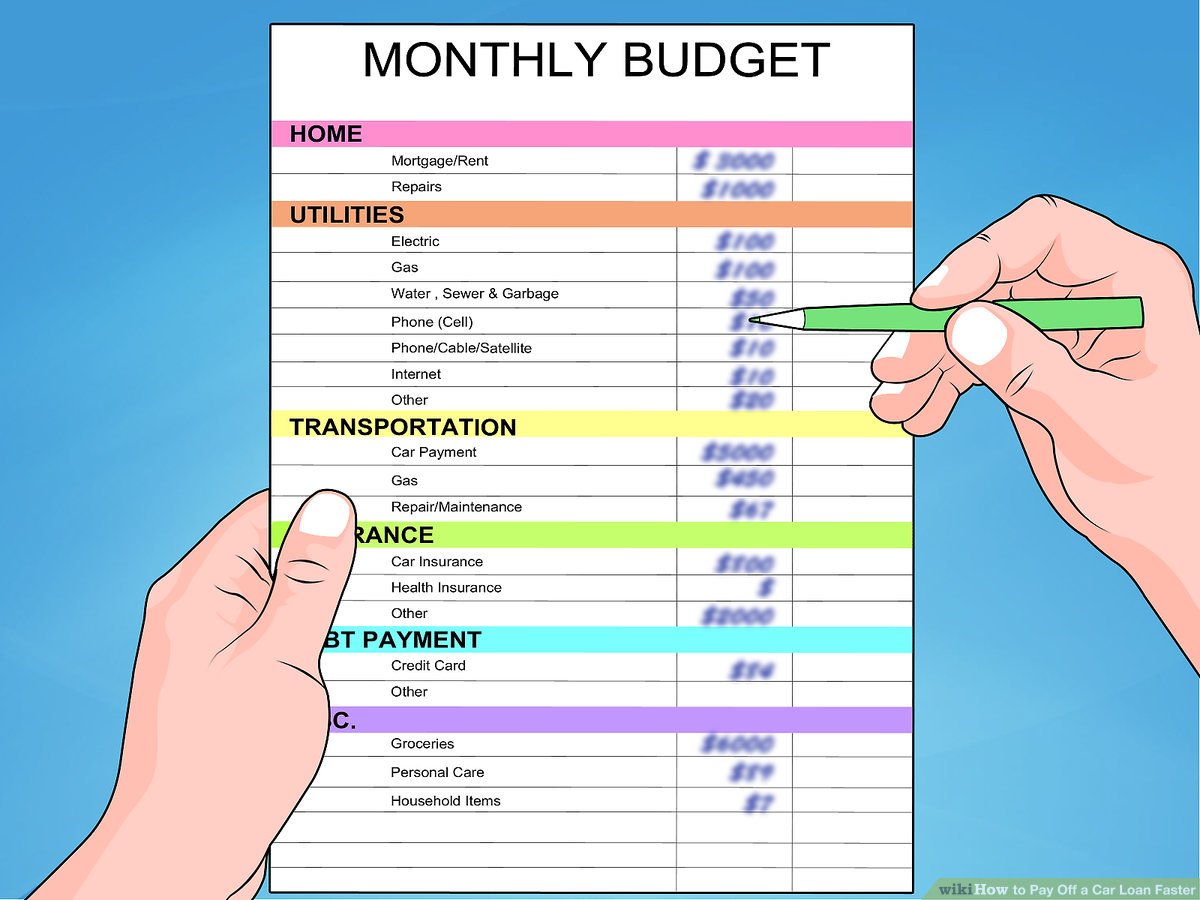

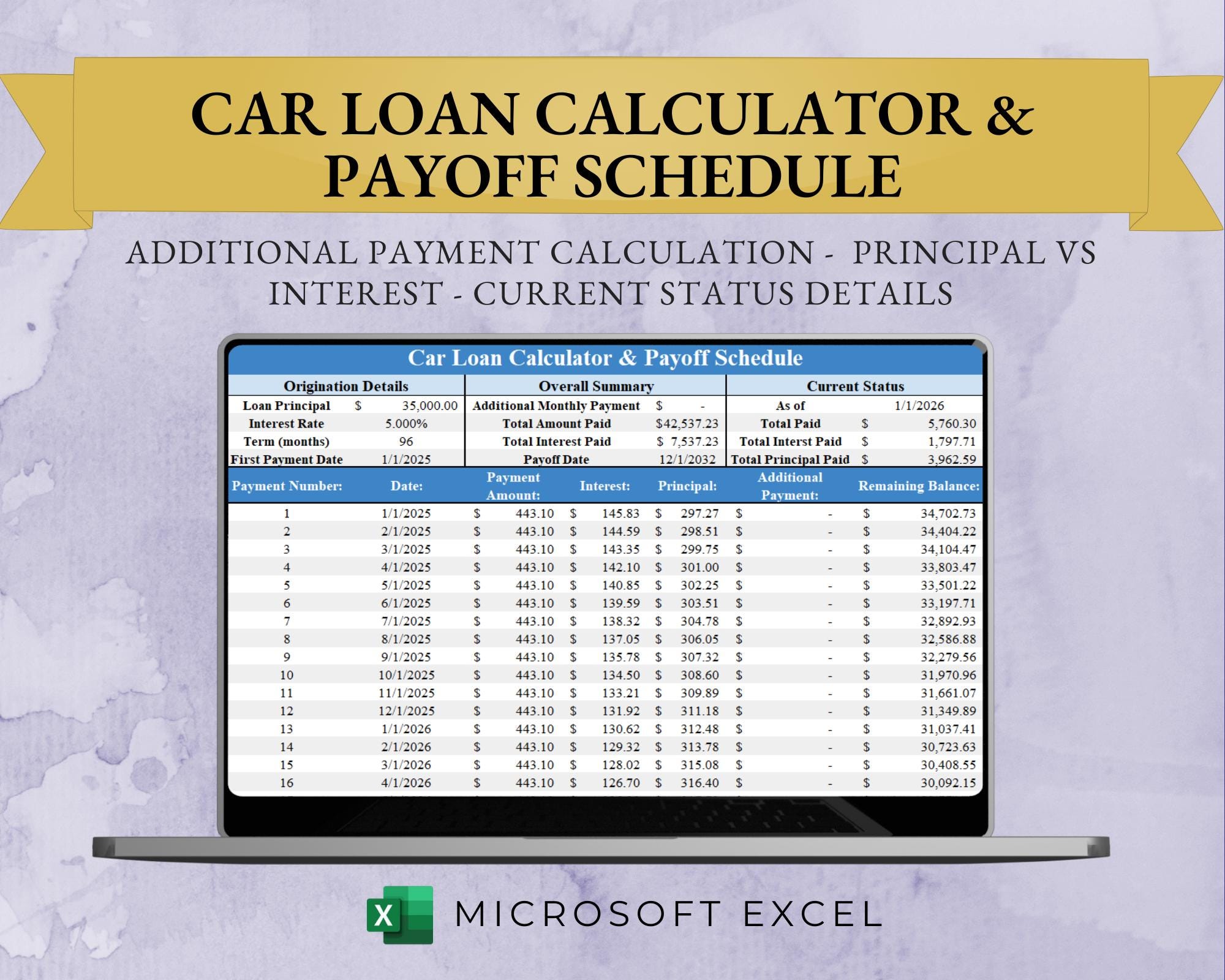

Review the Amortization Schedule

After calculating your early payoff options, take the time to review the detailed amortization schedule provided by the calculator. This schedule breaks down your payments over time, showing how much goes toward principal and interest with each payment. Analyzing this schedule can help you visualize the impact of making larger or more frequent payments, as well as help you identify the best points in your loan term to make extra payments for maximum benefit.

Consider Your Financial Goals

Lastly, align your use of the calculator with your broader financial goals. Whether you aim to reduce monthly payments, save on interest, or become debt-free sooner, keep these objectives in mind as you analyze your results. Tailoring your approach based on your financial situation will ensure that you maximize the benefits of the auto loan early payoff calculator and make informed decisions that contribute to your overall financial health.

Frequently Asked Questions (FAQs)

1. What is a car loan early payoff calculator?

A car loan early payoff calculator is an online tool that helps borrowers estimate how much they can save in interest and how quickly they can pay off their car loan by making extra payments or adjusting their monthly payment amounts. By entering details such as the loan amount, interest rate, remaining term, and any additional payment amounts, users can see potential savings and a revised amortization schedule.

2. How do I use a car loan early payoff calculator?

To use a car loan early payoff calculator, you typically need to input the following information:

– Loan Amount: The total amount borrowed to purchase the vehicle.

– Annual Interest Rate (APR): The interest rate charged on the loan.

– Loan Term: The duration of the loan, usually in months.

– Remaining Payments: The number of payments left to make.

– Additional Payment Amount: Any extra amount you plan to pay monthly.

Once you input this data, the calculator will generate results showing how much interest you could save and how many months you could shorten your loan term.

3. What are the benefits of using a car loan early payoff calculator?

Using a car loan early payoff calculator provides several benefits:

– Interest Savings: It shows how much money you can save on interest by making additional payments.

– Loan Term Reduction: You can see how much sooner you can pay off your loan by increasing your monthly payments.

– Amortization Schedule: The calculator usually generates a detailed payment schedule, illustrating how your payments will be applied over time.

– Financial Planning: It aids in budgeting and financial planning by helping you understand the impact of paying off your loan early.

4. Are there any fees associated with early loan payoff?

Some lenders impose a prepayment penalty, which is a fee charged if you pay off your car loan before the scheduled end date. This fee varies by lender and may negate some of the savings from paying off the loan early. It’s essential to check your loan agreement or contact your lender to understand any potential fees before deciding to pay off your loan early.

5. Can I use the calculator for any type of car loan?

Yes, most car loan early payoff calculators can be used for various types of auto loans, including loans for new and used vehicles. However, the accuracy of the results may depend on the specific terms and conditions of your loan, such as the interest rate and any prepayment penalties. Always ensure you enter the correct information relevant to your particular loan for the best results.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.