The 5 Best Coast Fire Calculators of 2025 (Reviewed)

Finding the Best Coast Fire Calculator: An Introduction

Finding the right Coast FIRE calculator can be a daunting task, especially with the growing number of financial tools available online. With so many options to choose from, how do you determine which calculators are reliable, user-friendly, and best suited to your unique financial situation? The concept of Coast FIRE—allowing your investments to grow without requiring additional contributions—requires careful calculations and planning, making it essential to find a tool that can accurately guide you through this process.

The goal of this article is to review and rank the top Coast FIRE calculators available online, saving you time and effort in your search. We understand that a reliable calculator is not just about crunching numbers; it also needs to provide a clear and intuitive user experience.

Criteria for Ranking

To ensure you have access to the best tools, we evaluated several key criteria:

-

Accuracy: Each calculator’s ability to deliver precise Coast FIRE numbers based on user inputs, including age, retirement age, current assets, and expected returns.

-

Ease of Use: We assessed the user interface and overall experience, ensuring that even those new to financial planning can navigate the tool without confusion.

-

Features: Additional functionalities, such as the ability to visualize growth over time, account for inflation, and adjust various inputs to see different scenarios, were also considered.

By focusing on these criteria, we aim to provide you with a comprehensive overview of the best Coast FIRE calculators, helping you take confident steps toward achieving financial independence. Whether you’re just starting or are already on your journey, the right calculator can make all the difference.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Top Coast FIRE Calculators

When evaluating the best Coast FIRE calculators, we focused on several key criteria to ensure that users have access to reliable and effective tools for planning their financial independence. Each calculator was assessed based on the following factors:

-

Accuracy and Reliability

– A good Coast FIRE calculator must provide accurate outputs based on user inputs. This accuracy is crucial as users rely on the results to make significant financial decisions. We prioritized calculators that use established formulas and methodologies, such as the Safe Withdrawal Rate (SWR) and investment growth assumptions. -

Ease of Use

– The user interface and overall experience are essential for ensuring that individuals of all financial literacy levels can navigate the calculator with ease. We looked for tools that feature intuitive designs, clear instructions, and minimal jargon, making it straightforward for users to input their data and interpret the results. -

Key Features

– Effective Coast FIRE calculators should offer a range of inputs that reflect the complexity of retirement planning. Important features we considered include:- Current Age and Retirement Age: Allowing users to specify their ages helps in calculating the time frame for investment growth.

- Annual Spending: Users should be able to input their expected annual expenses during retirement, which is crucial for determining their Coast FIRE number.

- Current Invested Assets: This input indicates how much money users already have saved for retirement.

- Monthly Contributions: Some calculators allow users to input ongoing contributions, while others focus on a no-contribution scenario.

- Investment Growth Rate and Inflation Rate: Users should have the ability to adjust these rates based on their expectations, as they significantly affect the outcome.

- Safe Withdrawal Rate: Including this parameter helps users understand how much they can withdraw in retirement without depleting their savings.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or require payment. Free tools are generally more accessible to a wider audience, but we also considered the value of paid tools that might offer additional features or personalized services. The cost should align with the features provided, ensuring that users feel they are receiving good value for their investment. -

Visual Representation

– A well-designed calculator should provide visual outputs, such as graphs or charts, to help users easily understand their financial journey. Visual representations can effectively illustrate growth over time and the relationship between inputs and outputs, enhancing user comprehension. -

User Feedback and Reviews

– We took into account user feedback and reviews to gauge the effectiveness and satisfaction of each calculator. Tools that consistently receive positive feedback for functionality and user experience were prioritized in our selection.

By applying these criteria, we aimed to identify the most effective Coast FIRE calculators that can assist users in navigating their financial planning and achieving their retirement goals.

The Best Coast Fire Calculators of 2025

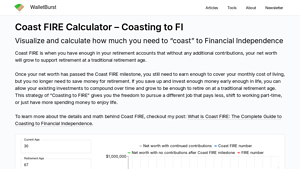

1. Coast FIRE Calculator – Coasting to FI

The Coast FIRE Calculator from WalletBurst is an interactive tool designed to help users estimate the growth of their current investments as they pursue Financial Independence (FI). By allowing users to visualize their investment trajectory, this calculator simplifies the planning process for those aiming to reach a point where they can “coast” to retirement without needing to save aggressively. Its user-friendly interface makes it accessible for both beginners and seasoned investors alike.

- Website: walletburst.com

- Established: Approx. 7 years (domain registered in 2018)

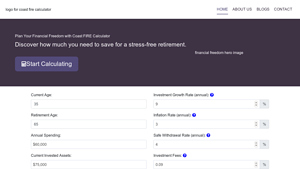

2. Coast FIRE Calculator

The Coast FIRE Calculator is a free online tool designed to assist users in their journey toward financial independence by offering a balanced approach to retirement planning. This user-friendly calculator allows individuals to estimate how much they need to save and invest now, enabling them to “coast” to retirement without needing to make aggressive contributions later. Its intuitive interface and clear guidance make it an essential resource for anyone looking to achieve financial freedom.

- Website: coastfirecalc.com

- Established: Approx. 1 years (domain registered in 2024)

3. Need a Good Calculator : r/coastFIRE

The FundsForge platform offers a comprehensive coast FIRE calculator designed to help users evaluate their financial scenarios effectively. While the coast FIRE calculator is specifically tailored for those pursuing financial independence, the full FundsForge wealth planning tool provides a broader range of features for detailed financial analysis and planning. This makes it a versatile choice for anyone looking to optimize their financial strategy.

- Website: reddit.com

- Established: Approx. 20 years (domain registered in 2005)

4. Coast FIRE Calculator

The Coast FIRE Calculator from Marriage Kids and Money is a valuable tool designed to help users determine their progress toward achieving Coast Financial Independence, Retire Early (FIRE). This free calculator allows individuals to assess their current savings and investment strategies, providing insights into how close they are to reaching their financial goals. With its user-friendly interface, it empowers users to plan effectively for a secure and fulfilling future.

- Website: marriagekidsandmoney.com

- Established: Approx. 9 years (domain registered in 2016)

5. Coast FIRE Calculator

The Coast FIRE Calculator by Clark Howard is a straightforward tool designed to assist users in determining when they can achieve financial independence and “coast” to retirement. By inputting essential financial information, users can easily assess their progress towards retirement goals, making it a valuable resource for those looking to optimize their savings strategy and plan for a secure future.

- Website: clark.com

- Established: Approx. 33 years (domain registered in 1992)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy in your calculations starts with the data you provide. Each calculator requires specific inputs, such as your current age, retirement age, annual spending, current invested assets, and expected rates of return. Take the time to double-check each entry for typos or miscalculations. For example, entering your current invested assets as $200,000 instead of $20,000 could lead to drastically different results. If possible, keep records of your financial data handy for quick reference.

Understand the Underlying Assumptions

Different calculators may use varying assumptions about investment growth rates, inflation, and safe withdrawal rates. Familiarize yourself with these underlying assumptions, as they can significantly impact your results. For instance, many tools might use a default investment growth rate of 7% based on historical averages. However, your personal circumstances and market conditions could mean a different rate applies to you. Adjust these parameters according to your financial situation and outlook for a more accurate representation.

Use Multiple Tools for Comparison

No single calculator can account for every variable in your financial life. Using multiple Coast FIRE calculators can provide a range of outcomes, giving you a better understanding of your financial situation. Different calculators may have unique features or methodologies that yield different results. By comparing outputs, you can identify trends and make more informed decisions. For instance, one tool might emphasize the impact of inflation more heavily, while another may focus on investment fees.

Consider Real-World Variables

While online calculators are useful for theoretical planning, they can’t predict every life event or market fluctuation. Consider incorporating real-world variables into your planning. For example, think about potential changes in your income, major life events like marriage or children, or economic downturns that could affect your investments. Adjust your calculations accordingly to account for these uncertainties and ensure your plan remains resilient under varying scenarios.

Regularly Revisit Your Calculations

Your financial situation and the economic landscape are not static; they change over time. Regularly revisiting your Coast FIRE calculations will help you stay on track with your retirement goals. Consider setting a schedule to check in on your progress every six months or annually. This practice allows you to adjust your inputs based on changes in your financial situation, such as salary increases or new expenses, ensuring your retirement plan remains relevant and achievable.

Seek Professional Guidance

If you’re uncertain about your calculations or financial planning, don’t hesitate to seek advice from a financial advisor. A professional can offer personalized insights and help you navigate the complexities of retirement planning. They can also assist in interpreting the results from the calculators and aligning them with your long-term financial goals. Engaging with an expert may provide peace of mind and clarity as you pursue your Coast FIRE journey.

Frequently Asked Questions (FAQs)

1. What is a Coast FIRE calculator?

A Coast FIRE calculator is a financial tool designed to help individuals determine how much money they need to have saved and invested to achieve Coast Financial Independence (Coast FIRE). This approach allows you to stop making retirement contributions while your existing investments continue to grow through compound interest. By inputting factors such as current age, desired retirement age, current savings, expected investment growth rate, and annual spending, the calculator provides insights into your financial independence journey.

2. How do I use a Coast FIRE calculator?

Using a Coast FIRE calculator typically involves entering several key pieces of information: your current age, planned retirement age, annual spending, current invested assets, monthly contributions, investment growth rate, inflation rate, safe withdrawal rate, and any investment fees. After inputting this data, you can click the calculate button to see if you’ve reached your Coast FIRE number and to visualize your potential retirement savings over time.

3. What factors should I consider when using a Coast FIRE calculator?

When using a Coast FIRE calculator, it’s essential to consider several factors, including:

– Current Age and Retirement Age: These determine the investment time horizon.

– Annual Spending: Estimate your expenses in retirement to determine your financial needs.

– Current Invested Assets: Include all retirement accounts, excluding your primary residence.

– Investment Growth Rate: Typically set between 5-7%, reflecting conservative market expectations.

– Inflation Rate: Usually around 3%, accounting for the decreasing value of money over time.

– Safe Withdrawal Rate: Often set at 4%, based on studies like the Trinity Study.

4. What are the benefits of using a Coast FIRE calculator?

The primary benefits of using a Coast FIRE calculator include:

– Clarity on Retirement Goals: It helps you visualize how much you need to save and how your investments can grow over time.

– Financial Independence Planning: You can determine when you can stop saving aggressively and focus on enjoying life.

– Flexible Financial Strategy: It allows for a balanced approach to saving and spending, enabling career changes and lifestyle adjustments without the stress of financial insecurity.

– Reduced Financial Pressure: Once you reach your Coast number, you can make career choices based on personal fulfillment rather than financial necessity.

5. Can I achieve Coast FIRE without significant upfront savings?

Achieving Coast FIRE typically requires substantial upfront savings during your early career. This strategy relies on the principle of compound interest, where early investments have more time to grow exponentially. However, the amount needed can vary based on individual circumstances, including lifestyle choices, expected investment returns, and personal financial goals. While it may be challenging, focusing on maximizing early contributions, minimizing expenses, and strategically planning your investments can help make Coast FIRE attainable.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.