The 5 Best Cost Of Equity Calculators of 2025 (Reviewed)

Finding the Best Cost Of Equity Calculator: An Introduction

Finding a reliable cost of equity calculator can be a daunting task, especially with the abundance of options available online. Investors and financial analysts need a tool that not only provides accurate calculations but also offers a user-friendly experience. The cost of equity is a crucial metric that helps businesses determine the return required by equity investors, making it essential to have a dependable calculator at your disposal. However, the varying complexity of these tools, their accessibility, and the underlying financial models they utilize can create confusion.

The goal of this article is to review and rank the top cost of equity calculators available online, saving you time and effort in your search. Whether you’re a CFO, financial analyst, or an individual investor, having access to the right calculator can significantly enhance your financial decision-making process. We will evaluate each tool based on several key criteria to ensure you find the best fit for your needs.

Criteria for Ranking

-

Accuracy: The primary function of any financial calculator is to provide accurate results. We will assess how well each tool adheres to widely accepted financial formulas, such as the Capital Asset Pricing Model (CAPM) and the Dividend Capitalization Model.

-

Ease of Use: A good calculator should be intuitive and straightforward, allowing users to input data and receive results without unnecessary complications. We will evaluate the user interface and overall user experience.

-

Features: Additional functionalities, such as the ability to save calculations, export results, or access educational resources, can enhance the usefulness of a calculator. We will consider these extra features when ranking the tools.

By following this guide, you can confidently choose a cost of equity calculator that meets your requirements and helps you make informed financial decisions.

Our Criteria: How We Selected the Top Tools

How We Selected the Top Tools

When it comes to selecting the best cost of equity calculators, we took a comprehensive approach to ensure that our recommendations meet the needs of a diverse audience. Below are the key criteria we used to evaluate each tool:

-

Accuracy and Reliability

– Precision of Calculations: We assessed each calculator for its ability to deliver accurate results based on the widely accepted formulas for calculating cost of equity, such as the Capital Asset Pricing Model (CAPM) and the Dividend Capitalization Model.

– Trustworthiness of Sources: Tools developed by reputable financial institutions or professionals received higher marks for reliability, as they are more likely to adhere to industry standards. -

Ease of Use

– User-Friendly Interface: A clean, intuitive design that simplifies data input and result interpretation is crucial. We favored tools that minimize user error and provide straightforward navigation.

– Instructions and Guidance: We looked for calculators that offer clear explanations of each input required and how the calculations work, making it easier for users to understand the process. -

Key Features

– Essential Inputs: The calculators were evaluated based on the specific inputs they require. For CAPM-based calculators, we focused on essential parameters like:- Risk-Free Rate: The return on a virtually risk-free investment (e.g., government bonds).

- Beta Coefficient: A measure of the stock’s volatility in relation to the market.

- Expected Market Return: The anticipated average return from the market.

- Additional Tools: We considered whether the calculators offered complementary features, such as options to calculate the Weighted Average Cost of Capital (WACC) or provide investment analysis insights.

-

Cost (Free vs. Paid)

– Accessibility: We prioritized free tools that provide robust functionality without requiring payment, ensuring that users can access necessary financial metrics without incurring additional costs.

– Value for Paid Options: In cases where tools required payment, we assessed whether the additional features justified the cost, such as enhanced accuracy, advanced analytics, or customer support. -

Support and Resources

– Educational Content: We evaluated whether the calculators came with additional resources, such as articles, tutorials, or FAQs, to help users deepen their understanding of cost of equity calculations and their implications.

– Customer Support: Tools that offer responsive customer service or technical support were favored, as they enhance the user experience and provide assistance when needed.

By considering these criteria, we aimed to provide a well-rounded selection of cost of equity calculators that cater to both novice investors and seasoned financial professionals.

The Best Cost Of Equity Calculators of 2025

1. Cost of Equity Calculator

The Cost of Equity Calculator from Omni Calculator is a valuable tool designed to determine the cost of equity, which represents the expected rate of return for equity investors in a company. This calculator simplifies the process by providing a straightforward interface to input relevant financial data, enabling users to quickly assess the potential returns required by investors. Its user-friendly design makes it accessible for both novice and experienced financial professionals.

- Website: omnicalculator.com

- Established: Approx. 11 years (domain registered in 2014)

3. Cost of Equity (ke)

The Cost of Equity Calculator from Wall Street Prep is designed to help users accurately determine the cost of equity (ke) for investment analysis. It provides a straightforward interface to calculate different scenarios, including base, upside, and downside cases, with example outputs of 6.0%, 8.0%, and 4.6% respectively. This tool is essential for finance professionals looking to assess potential returns and make informed investment decisions.

- Website: wallstreetprep.com

- Established: Approx. 22 years (domain registered in 2003)

4. Cost of equity: how to calculate it, models and examples

Rho’s article on calculating the cost of equity provides a comprehensive overview of two primary methodologies: the Capital Asset Pricing Model (CAPM) and the Dividend Capitalization Model (DCM). It outlines the fundamental principles behind each model, offering practical examples to illustrate their application. This resource is ideal for finance professionals seeking to understand and implement cost of equity calculations in investment analysis and valuation.

- Website: rho.co

- Established: Approx. 15 years (domain registered in 2010)

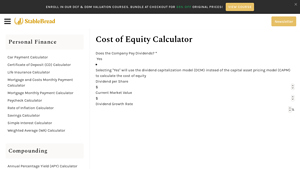

5. Cost of Equity Calculator

The Cost of Equity Calculator by StableBread is a versatile financial tool designed to help users determine the cost of equity for their investments. It offers the option to use either the Dividend Capitalization Model (DCM) or the Capital Asset Pricing Model (CAPM), allowing for tailored calculations based on user preferences. This flexibility makes it a valuable resource for investors seeking to analyze their equity costs accurately.

- Website: stablebread.com

- Established: Approx. 6 years (domain registered in 2019)

How to Get the Most Accurate Results

Double-Check Your Inputs

The accuracy of any cost of equity calculator heavily relies on the data you input. Before hitting the calculate button, take a moment to review your entries for errors. Common inputs include the risk-free rate, beta, expected market return, and dividend details (if applicable). A simple typo or incorrect figure can significantly skew your results, leading to misguided financial decisions. To ensure accuracy, gather your data from reliable sources, such as financial news websites, stock analysis platforms, or company reports.

Understand the Underlying Assumptions

Each calculator may operate on different models (e.g., Capital Asset Pricing Model – CAPM or Dividend Discount Model). Familiarize yourself with the assumptions behind these models. For instance, CAPM assumes that the market is efficient and that the risk associated with an investment can be quantified through beta. Understanding these assumptions helps you interpret the results more effectively and apply them appropriately to your specific situation. If a model’s assumptions don’t align with your investment scenario, consider using a different calculator that fits your needs better.

Use Multiple Tools for Comparison

To gain a well-rounded view of your cost of equity, don’t rely on a single calculator. Different tools might yield slightly different results due to variations in their underlying formulas or market assumptions. By comparing results from multiple calculators, you can identify any significant discrepancies and average the results for a more balanced outcome. This practice can also help you spot potential errors in your inputs or calculations, enhancing your overall confidence in the results.

Stay Updated on Market Conditions

Market conditions can fluctuate, impacting key inputs like the risk-free rate and expected market return. For instance, changes in interest rates or economic outlooks can affect the risk-free rate derived from government bonds. Regularly update your data to reflect current conditions, especially if you are making long-term financial decisions. Many calculators allow you to input real-time data; use this feature to ensure that your calculations reflect the most accurate market conditions.

Seek Expert Advice When Necessary

While online calculators provide valuable insights, they should not replace professional financial advice. If you are making significant investment decisions or if your financial situation is complex, consider consulting with a financial advisor. They can help you interpret the results more thoroughly and provide personalized guidance based on your unique financial goals and risk tolerance.

Document Your Process

Finally, keep a record of your calculations and the inputs used for future reference. This documentation can be invaluable if you need to revisit your calculations later or justify your decisions to stakeholders. It will also help you track how changes in inputs affect your cost of equity over time, allowing for better-informed financial planning and investment strategies.

Frequently Asked Questions (FAQs)

1. What is a cost of equity calculator?

A cost of equity calculator is an online tool designed to help businesses and investors determine the expected rate of return required by equity investors for taking on the risk of investing in a company. This calculation is essential for making informed financial decisions, such as evaluating investments, understanding capital costs, and assessing the attractiveness of stocks.

2. How does a cost of equity calculator work?

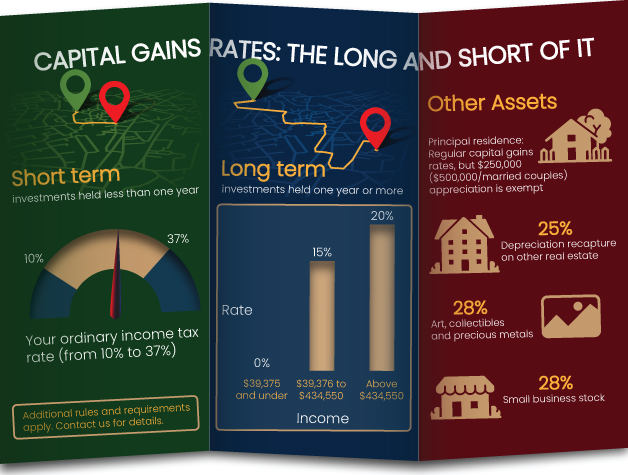

Cost of equity calculators typically use established financial models, such as the Capital Asset Pricing Model (CAPM) or the Dividend Discount Model (DDM). Users input specific data, including the risk-free rate, the stock’s beta (a measure of its volatility), and the expected market return. The calculator then processes this information to provide the cost of equity as a percentage, which reflects the return investors expect for the risk they are taking.

3. Why is the cost of equity important for investors and businesses?

The cost of equity is crucial because it serves as a benchmark for evaluating potential investments. It helps investors determine whether the expected return on an investment justifies the associated risks. For businesses, understanding their cost of equity aids in financial planning, capital budgeting, and optimizing their capital structure to minimize overall financing costs.

4. What inputs are needed for a cost of equity calculator?

The specific inputs may vary by calculator, but common inputs typically include:

– Risk-Free Rate: The return expected from a virtually risk-free investment, such as government bonds.

– Beta: A measure of a stock’s volatility in relation to the market. A beta greater than 1 indicates higher risk, while a beta less than 1 indicates lower risk.

– Expected Market Return: The average return investors expect from the overall market, often based on historical performance.

5. Can I use a cost of equity calculator for companies that do not pay dividends?

Yes, many cost of equity calculators, particularly those utilizing the CAPM, are designed to work for companies that do not pay dividends. The CAPM approach focuses on systematic risk and market returns rather than dividend payments, making it suitable for a broader range of companies. If a company does pay dividends, users can also apply the Dividend Discount Model for their calculations.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.