The 5 Best Fdic Coverage Calculators of 2025 (Reviewed)

Finding the Best Fdic Coverage Calculator: An Introduction

Finding a reliable FDIC coverage calculator can be a daunting task for many individuals and businesses. With the increasing number of online financial tools available, it is essential to identify a calculator that not only provides accurate estimates but also is user-friendly and efficient. The Federal Deposit Insurance Corporation (FDIC) offers insurance coverage up to $250,000 per depositor, per insured bank, but understanding how this coverage applies to various types of accounts can be complex. As such, the right calculator can help demystify these rules and ensure that your deposits are well protected.

The goal of this article is to review and rank the top FDIC coverage calculators available online, saving you time and effort in your search. We have meticulously evaluated several tools, focusing on critical factors such as accuracy, ease of use, features, and overall user experience. An effective calculator should allow users to input different account types, assess coverage limits, and provide a clear summary of their insurance status.

In this review, we will guide you through the best options, highlighting their strengths and weaknesses. By the end of this article, you will have a clearer understanding of which FDIC coverage calculator best suits your needs, empowering you to make informed decisions about your financial safety. Whether you are an individual with personal accounts or a business managing multiple deposits, our rankings aim to simplify your experience and enhance your understanding of FDIC coverage.

Our Criteria: How We Selected the Top Tools

How We Selected the Top FDIC Coverage Calculators

When evaluating the best FDIC coverage calculators, we focused on several key criteria to ensure that users have access to reliable and effective tools. Our goal was to provide a comprehensive list that meets the needs of individuals seeking to understand their FDIC insurance coverage. Here are the main criteria we considered:

-

Accuracy and Reliability

– The primary function of an FDIC coverage calculator is to provide accurate estimations of insurance coverage based on current FDIC regulations. We prioritized tools that utilize the official Electronic Deposit Insurance Estimator (EDIE) provided by the FDIC to ensure that users receive trustworthy calculations. -

Ease of Use

– User experience is crucial for any online tool. We looked for calculators that feature intuitive interfaces, simple navigation, and clear instructions. The best tools allow users to input their data without confusion, making the process straightforward for both novices and experienced users. -

Key Features

– Effective FDIC calculators should include several essential inputs, such as:- Types of accounts (e.g., checking, savings, CDs, IRAs)

- Ownership categories (individual, joint, trust accounts)

- Total amounts deposited in each account

- The number of account holders in joint accounts

- Additionally, we appreciated tools that allow users to save or print their results for future reference, as well as those that provide explanations of FDIC coverage limits.

-

Cost (Free vs. Paid)

– Since FDIC coverage calculators are primarily informational tools, we focused on those that are freely accessible. We eliminated any tools that required payment, ensuring that users can access vital information without incurring costs. -

Availability of Support and Resources

– We considered the availability of additional resources, such as FAQs or customer support, which can help users better understand FDIC coverage. Tools that provide links to educational content about deposit insurance and its implications were favored. -

Compatibility and Accessibility

– A good calculator should be compatible with various devices, including desktops, tablets, and smartphones. We assessed whether the tools functioned well across different browsers and operating systems, ensuring accessibility for all users. -

Reputation and Credibility

– We also evaluated the reputation of the institutions providing the calculators. Tools offered by well-established banks or financial organizations were prioritized due to their credibility and trustworthiness in the financial sector.

By carefully considering these criteria, we aimed to present a selection of FDIC coverage calculators that not only meet the needs of our audience but also enhance their understanding of deposit insurance and how to protect their assets.

The Best Fdic Coverage Calculators of 2025

1. Calculator

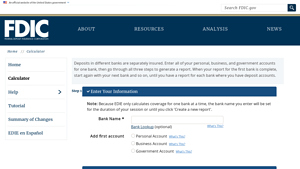

The FDIC’s Electronic Deposit Insurance Estimator (EDIE) is a valuable online tool that helps users accurately calculate their deposit insurance coverage. By inputting specific account information, users can determine the level of protection provided by the FDIC for their deposits. EDIE’s effectiveness hinges on the correct entry of data, ensuring that individuals can make informed decisions about their banking arrangements and understand their insurance limits.

- Website: edie.fdic.gov

- Established: Approx. 28 years (domain registered in 1997)

2. FDIC EDIE Calculator

The FDIC EDIE Calculator offered by United Citizens Bank & Trust is a valuable tool designed to help consumers and bankers understand deposit insurance coverage on a per-bank basis. This online estimator simplifies the process of determining how FDIC insurance rules and limits apply to specific accounts, ensuring users can make informed decisions regarding their deposits. Its user-friendly interface makes it accessible for anyone seeking clarity on their insurance coverage.

- Website: unitedcitizensbank.com

- Established: Approx. 26 years (domain registered in 1999)

3. FDIC Calculator

The FDIC Calculator offered by Reliance State Bank is a valuable tool designed to help users estimate their deposit insurance coverage under the Federal Deposit Insurance Corporation (FDIC). Utilizing the FDIC’s Electronic Deposit Insurance Estimator (EDIE), this calculator allows individuals to assess their insured amounts for various account types, ensuring they understand their financial safety. Additionally, it complements other calculators on the site, such as those for CD interest and college savings, enhancing overall financial planning.

- Website: rsbiowa.com

- Established: Approx. 13 years (domain registered in 2012)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps in using an FDIC coverage calculator is to ensure that all your inputs are accurate. Mistakes in entering account balances, account types, or ownership categories can lead to incorrect coverage estimates. Before hitting the calculate button, take a moment to review each entry carefully. Make sure you include all relevant accounts, such as checking, savings, CDs, and IRAs, and verify that the amounts reflect your current balances.

Understand the Underlying Assumptions

Different calculators may operate under varying assumptions regarding FDIC coverage. For instance, some tools might apply standard limits of $250,000 per depositor per insured bank, while others may account for joint accounts or different ownership categories, which can affect total coverage. Familiarize yourself with how the calculator you are using defines these parameters. Reading the instructions or help section can clarify how the calculations are made and help you understand the results better.

Use Multiple Tools for Comparison

To ensure the accuracy of your results, consider using more than one FDIC coverage calculator. Each tool may have unique features or approaches that could yield slightly different outcomes. By comparing results from multiple calculators, you can gain a more comprehensive understanding of your insurance coverage and identify any discrepancies. This practice can also provide reassurance that you are interpreting your coverage limits correctly.

Familiarize Yourself with FDIC Rules

Having a good grasp of FDIC insurance rules can significantly enhance your experience with these calculators. For example, knowing that coverage limits are per depositor, per bank, and per ownership category can guide you in structuring your accounts to maximize your insured deposits. Additionally, understanding the implications of joint accounts or trust accounts can help you make informed decisions about how to organize your funds.

Keep Records of Your Calculations

Most FDIC coverage calculators offer options to print or save your results. Take advantage of this feature to keep a record of your calculations. Having a documented report can be useful for future reference or in discussions with your financial advisor. This record will also allow you to track any changes in your account balances or ownership structures over time, enabling you to reassess your coverage as needed.

Stay Updated on Changes in FDIC Coverage

FDIC coverage limits and regulations can change, so it’s essential to stay informed about any updates that could affect your insurance. Regularly check the FDIC website or subscribe to newsletters to receive the latest information. This proactive approach ensures that you are always using the most accurate and relevant data when calculating your insurance coverage.

By following these guidelines, you can maximize the accuracy and effectiveness of the FDIC coverage calculators, ensuring that your deposits are well-protected.

Frequently Asked Questions (FAQs)

1. What is an FDIC coverage calculator?

An FDIC coverage calculator is an online tool that helps individuals and businesses determine the amount of deposit insurance coverage provided by the Federal Deposit Insurance Corporation (FDIC) for their bank accounts. This calculator evaluates various factors, such as account types and ownership categories, to provide users with an estimate of their insured deposits, ensuring they understand how much of their money is protected in case of a bank failure.

2. How does the FDIC coverage calculator work?

The FDIC coverage calculator, often referred to as the Electronic Deposit Insurance Estimator (EDIE), allows users to input details about their deposit accounts, including account types (such as checking, savings, and certificates of deposit) and ownership structures (individual, joint, trust accounts, etc.). Based on this information, the calculator calculates the total coverage amount and identifies any portions of deposits that exceed the FDIC insurance limits, which is currently set at $250,000 per depositor, per bank, for each ownership category.

3. Who should use an FDIC coverage calculator?

Any individual or business with deposit accounts at an FDIC-insured bank should consider using an FDIC coverage calculator. This includes those who have multiple accounts, joint accounts, or accounts in different ownership categories. By using the calculator, users can ensure they are aware of how much of their deposits are insured and can make informed decisions regarding their banking arrangements to maximize their FDIC coverage.

4. Are there any limitations to using the FDIC coverage calculator?

Yes, there are some limitations. The FDIC coverage calculator is specifically designed for deposit accounts at FDIC-insured banks and does not apply to investment accounts, such as stocks, bonds, or mutual funds, which are not insured by the FDIC. Additionally, the calculator is only accurate for accounts held at institutions that are FDIC members. Users should also be aware that the calculator provides estimates based on the information entered, so it’s important to input accurate data for the most reliable results.

5. Is there a cost to use the FDIC coverage calculator?

No, the FDIC coverage calculator is a free tool provided by the FDIC. Users can access the Electronic Deposit Insurance Estimator (EDIE) on the FDIC’s official website without any charges. This makes it an accessible resource for anyone looking to understand their deposit insurance coverage without incurring any fees or expenses.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.