The 5 Best Hard Money Loan Calculators of 2025 (Reviewed)

Finding the Best Hard Money Loan Calculator: An Introduction

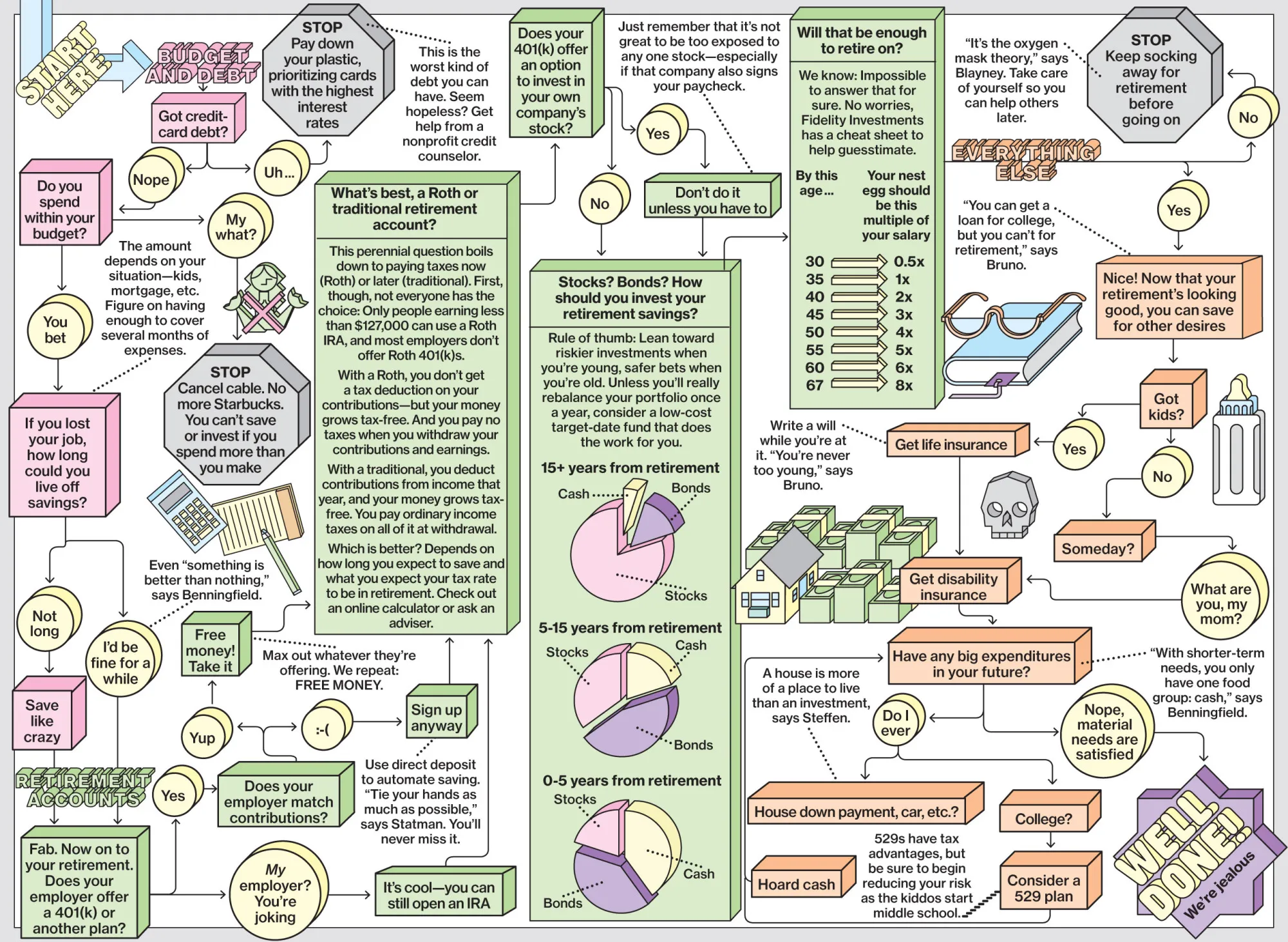

When it comes to navigating the world of hard money loans, one of the most critical tools at your disposal is a reliable hard money loan calculator. However, with countless options available online, finding a good and trustworthy calculator can be a daunting task. Many calculators may promise quick results but often fall short in terms of accuracy or features. This inconsistency can lead to confusion and frustration, especially for borrowers who rely on precise calculations to make informed financial decisions.

This article aims to simplify the search by reviewing and ranking the top hard money loan calculators available online. Our goal is to save you time and effort, allowing you to focus on what matters most—your investment decisions. Whether you’re a seasoned investor or a first-time borrower, the right calculator can help you understand your loan payments, interest rates, and overall financial obligations more clearly.

Criteria for Ranking

To ensure that our rankings are thorough and beneficial, we have established specific criteria for evaluating each calculator. These criteria include:

-

Accuracy: We assess how reliably each calculator produces correct payment estimates based on the input data.

-

Ease of Use: A user-friendly interface is essential for quick calculations. We consider how intuitive and straightforward each tool is to navigate.

-

Features: Beyond basic calculations, we look for additional functionalities such as amortization schedules, options for interest-only payments, and the ability to account for origination fees.

By focusing on these aspects, we aim to present a comprehensive guide that will help you select the best hard money loan calculator tailored to your needs.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Hard Money Loan Calculators

When evaluating hard money loan calculators, we focused on several essential criteria to ensure that users have access to the most effective and user-friendly tools available. Here are the key factors that guided our selection process:

-

Accuracy and Reliability

– It is crucial that the calculators provide precise calculations based on the input data. Accurate estimations for monthly payments, interest rates, and balloon payments are vital for users to make informed financial decisions. We prioritized tools that have been tested and verified for their accuracy in real-world scenarios. -

Ease of Use

– The user interface of the calculator plays a significant role in its overall effectiveness. We looked for tools that are intuitive and straightforward, allowing users to input their data with minimal effort. A well-designed interface can enhance the user experience, making it easier for individuals with varying levels of financial knowledge to navigate the tool. -

Key Features

– A good hard money loan calculator should include a variety of inputs that reflect the complexities of hard money loans. Essential features we considered include:- Loan Amount: The total amount being borrowed.

- Interest Rate: The annual percentage rate (APR) for the loan.

- Amortization Term: The length of time over which the loan will be repaid.

- Down Payment: The initial amount paid upfront, often a percentage of the property value.

- Loan Origination Fee: The fee charged by the lender for processing the loan.

- Balloon Payment: The final payment due at the end of the loan term, which is often a large sum.

- Additionally, calculators that generate a printable amortization schedule were favored, as they provide users with a comprehensive view of their payment structure.

-

Cost (Free vs. Paid)

– We assessed whether the calculators were free to use or required payment. Free tools that deliver robust features and accurate results were prioritized, as they provide greater accessibility for users. If a paid tool offers significant advantages, such as advanced features or personalized advice, we took that into consideration as well. -

Additional Resources and Support

– Tools that offer educational resources, FAQs, or customer support to help users understand hard money loans and how to use the calculator effectively were rated higher. This can enhance the user’s overall experience and knowledge, empowering them to make better financial decisions. -

User Reviews and Feedback

– Finally, we considered user reviews and feedback to gauge the effectiveness and satisfaction level of the calculators. Tools that consistently received positive testimonials for their performance and user experience were favored in our selection.

By applying these criteria, we aimed to identify the best hard money loan calculators that cater to the diverse needs of borrowers, ensuring they have the necessary tools to navigate their financing options effectively.

The Best Hard Money Loan Calculators of 2025

1. Hard Money Loan Calculator

The Hard Money Loan Calculator from MortgageCalculator.org is a valuable tool designed to help users estimate their monthly payments on hard money loans. It offers calculations for various repayment structures, including Principal and Interest (P&I), Interest-Only, and Balloon payments. This versatility allows borrowers to understand their financial obligations clearly, making it easier to plan their budgets effectively while exploring hard money lending options.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

2. Hard Money Loan Calculator

The Hard Money Loan Calculator from LoanBase is a user-friendly tool designed to help borrowers quickly determine their monthly payments on hard money loans. By simply inputting the principal amount, interest rate, and loan term, users can easily obtain accurate calculations, making it an essential resource for those considering hard money financing. Its straightforward interface ensures that users can navigate the process with ease, facilitating informed financial decisions.

- Website: loanbase.com

- Established: Approx. 27 years (domain registered in 1998)

4. Best Hard Money Calculator

The Best Hard Money Calculator from New Funding Resources is an essential tool for real estate investors looking to evaluate deal profitability with ease. This user-friendly calculator allows users to accurately determine their net profit, return on investment (ROI), and return on cash, enabling informed decision-making for potential investments. Its illustrative design enhances usability, making it a valuable resource for both novice and experienced investors.

- Website: newfundingresources.com

- Established: Approx. 15 years (domain registered in 2010)

5. Hard Money Loan & Lending Calculator for Flipping Houses

The Hard Money Loan & Lending Calculator from ABL is a valuable tool designed for real estate investors looking to flip houses. By simply entering project details, users can quickly estimate potential returns on their investments. This calculator streamlines the decision-making process by providing clear financial projections, helping investors gauge the profitability of their projects before committing to a hard money loan.

- Website: ablfunding.com

- Established: Approx. 8 years (domain registered in 2017)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy starts with the data you provide. Before hitting “calculate,” take a moment to review all the inputs you’ve entered into the hard money loan calculator. Common fields include loan amount, interest rate, amortization period, and down payment. A single typo or incorrect figure can lead to significantly skewed results. Ensure that your property price, down payment percentage, and loan terms are all correctly stated. This attention to detail will help you obtain a more reliable estimate of your monthly payments and total costs.

Understand the Underlying Assumptions

Every calculator operates based on certain assumptions. Familiarize yourself with these assumptions to better interpret the results. For instance, many calculators assume a fixed interest rate over the loan term, while actual rates may fluctuate based on market conditions. Additionally, calculators might not account for other potential costs like origination fees, property taxes, or insurance. Understanding these factors will allow you to consider the results in a broader financial context and make informed decisions.

Use Multiple Tools for Comparison

Not all calculators are created equal. Different tools may utilize varying formulas, assumptions, and user interfaces, which can lead to different results. To ensure you’re getting a well-rounded view of your potential hard money loan, use multiple calculators and compare the outcomes. This practice can highlight discrepancies and help you identify the most consistent estimates. Look for tools that provide comprehensive breakdowns of payment structures, including interest-only payments and balloon payments.

Consult Additional Resources

While calculators are useful for quick estimates, they should not be your sole source of information. Consult additional resources such as financial guides, expert articles, or even professionals in the field. Understanding the nuances of hard money loans—such as their typical terms, risks, and benefits—can enhance your decision-making process. Supplementing your calculator use with qualitative research ensures that you make informed choices backed by a well-rounded understanding of the lending landscape.

Keep Your Financial Goals in Mind

When using a hard money loan calculator, it’s essential to align the results with your financial goals. Consider what you aim to achieve with the loan—be it a quick flip of a property or long-term investment. Your strategy can influence how you interpret the calculator’s output. For example, if you’re looking for short-term financing, focus on the interest-only payments and balloon payment implications rather than long-term amortization schedules. Keeping your objectives in mind will help you better assess whether the calculated figures are viable for your specific situation.

By following these tips, you can maximize the accuracy and relevance of the results obtained from hard money loan calculators, helping you make more informed financial decisions.

Frequently Asked Questions (FAQs)

1. What is a hard money loan calculator?

A hard money loan calculator is an online tool designed to help borrowers estimate their monthly payments, total interest costs, and potential balloon payments associated with hard money loans. By entering key information such as the loan amount, interest rate, amortization period, and loan origination fees, users can gain insights into the financial implications of their hard money financing options.

2. How do I use a hard money loan calculator?

To use a hard money loan calculator, you typically need to input several pieces of information:

– Loan Amount: The total amount of money you plan to borrow.

– Annual Interest Rate: The interest rate charged on the loan.

– Down Payment: The amount you plan to pay upfront, which affects the loan amount.

– Amortization Term: The length of time over which the loan will be repaid, usually expressed in years.

– Loan Origination Fee: Any upfront fees charged by the lender, often expressed as a percentage of the loan amount.

Once you enter this data, the calculator will compute your estimated monthly payments, total interest paid, and any balloon payment due at the end of the loan term.

3. What are the benefits of using a hard money loan calculator?

Using a hard money loan calculator offers several benefits:

– Quick Calculations: It allows you to quickly estimate potential loan costs without needing to consult a lender or financial advisor.

– Comparison Tool: You can use the calculator to compare different loan scenarios by adjusting variables such as loan amounts or interest rates.

– Budgeting Assistance: It helps you understand how much you can afford in monthly payments and whether a hard money loan fits your financial situation.

– Informed Decisions: By visualizing the costs associated with a hard money loan, you can make more informed decisions about whether to proceed with borrowing.

4. Are the results from a hard money loan calculator accurate?

While a hard money loan calculator can provide a good estimate of your potential payments and costs, the results are based on the information you input and may not reflect the exact terms offered by lenders. Factors such as your creditworthiness, specific lender fees, and changes in interest rates can affect the final loan terms. It’s advisable to use the calculator as a starting point and consult with a lender for precise figures tailored to your situation.

5. Can I use a hard money loan calculator for refinancing?

Yes, a hard money loan calculator can also be useful for refinancing scenarios. By inputting the current loan details along with the proposed new loan terms, you can evaluate the potential benefits of refinancing, such as lower monthly payments or reduced total interest costs. This can help you decide if refinancing your hard money loan is a financially sound choice based on your current situation and market conditions.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.