The 5 Best Heloc Interest Calculators of 2025 (Reviewed)

Finding the Best Heloc Interest Calculator: An Introduction

Finding a reliable Home Equity Line of Credit (HELOC) interest calculator can be a daunting task. With numerous options available online, it’s easy to feel overwhelmed by the sheer volume of tools that claim to simplify the process of calculating potential payments. However, not all calculators are created equal; some may lack essential features, while others may not provide accurate estimates or user-friendly interfaces. This inconsistency can lead to confusion and misinformed financial decisions, making it crucial to identify the best tools available.

The goal of this article is to review and rank the top HELOC interest calculators to save you time and effort. We understand that homeowners seeking to leverage their equity need quick and reliable estimates to navigate their financial options effectively. By focusing on the best tools, we aim to provide you with a curated list that meets your needs.

In our evaluation, we considered several key criteria to ensure that the calculators we recommend are of the highest quality. These criteria include accuracy, as precise calculations are vital for making informed decisions regarding your finances. Ease of use is another significant factor; a calculator should have an intuitive interface that allows users to input their information with minimal hassle. Additionally, we assessed the features offered by each calculator, such as the ability to compare different loan scenarios, access current interest rates, and provide detailed payment breakdowns.

By the end of this article, you will be equipped with the knowledge needed to select the best HELOC interest calculator for your specific situation, ensuring a smoother and more informed borrowing experience.

Our Criteria: How We Selected the Top Tools

Selection Criteria for HELOC Interest Calculators

When evaluating the top HELOC interest calculators, we focused on several key criteria to ensure that users have access to the most effective and user-friendly tools. Here’s a detailed breakdown of the criteria we used in our selection process:

-

Accuracy and Reliability

– The primary function of a HELOC interest calculator is to provide accurate estimates of monthly payments and total interest costs. We prioritized tools that are transparent about their calculation methods and offer reliable outputs based on current market rates. -

Ease of Use

– A user-friendly interface is crucial for any online calculator. We looked for tools that have a clean layout, intuitive navigation, and straightforward input fields. The ability to quickly input data and receive results without unnecessary complexity enhances the user experience. -

Key Features

– Effective HELOC calculators should include a variety of essential inputs to provide comprehensive results. Key features we considered include:- Property Value Input: Users should be able to enter their home’s estimated value to determine potential equity.

- Outstanding Balances: The ability to input current mortgage and other loan balances helps in calculating the available equity.

- Desired Credit Line Amount: Users should specify the total line of credit they wish to assess.

- Interest Rate Options: Including variable and fixed-rate options allows users to understand different payment scenarios.

- Draw and Repayment Periods: Clear definitions of the draw and repayment periods should be available, as these significantly affect payment calculations.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or if they require payment. Free tools provide immediate access without financial commitment, making them more accessible to a broader audience. We favored calculators that offer high-quality services at no cost. -

Additional Resources and Support

– Tools that provide supplemental information, such as educational content on HELOCs, FAQs, and customer support options, were prioritized. This additional context can help users make informed decisions regarding their home equity options. -

Mobile Compatibility

– In today’s digital age, calculators should be accessible on various devices. We looked for tools that are mobile-friendly, allowing users to calculate their HELOC payments conveniently on smartphones or tablets. -

Privacy and Security

– Given the sensitive nature of financial data, we assessed the privacy policies of the tools to ensure they protect user information adequately. Transparency regarding data handling and security measures is essential for trust.

By applying these criteria, we aimed to identify the most effective and reliable HELOC interest calculators available online, ensuring that users can confidently estimate their home equity line of credit costs.

The Best Heloc Interest Calculators of 2025

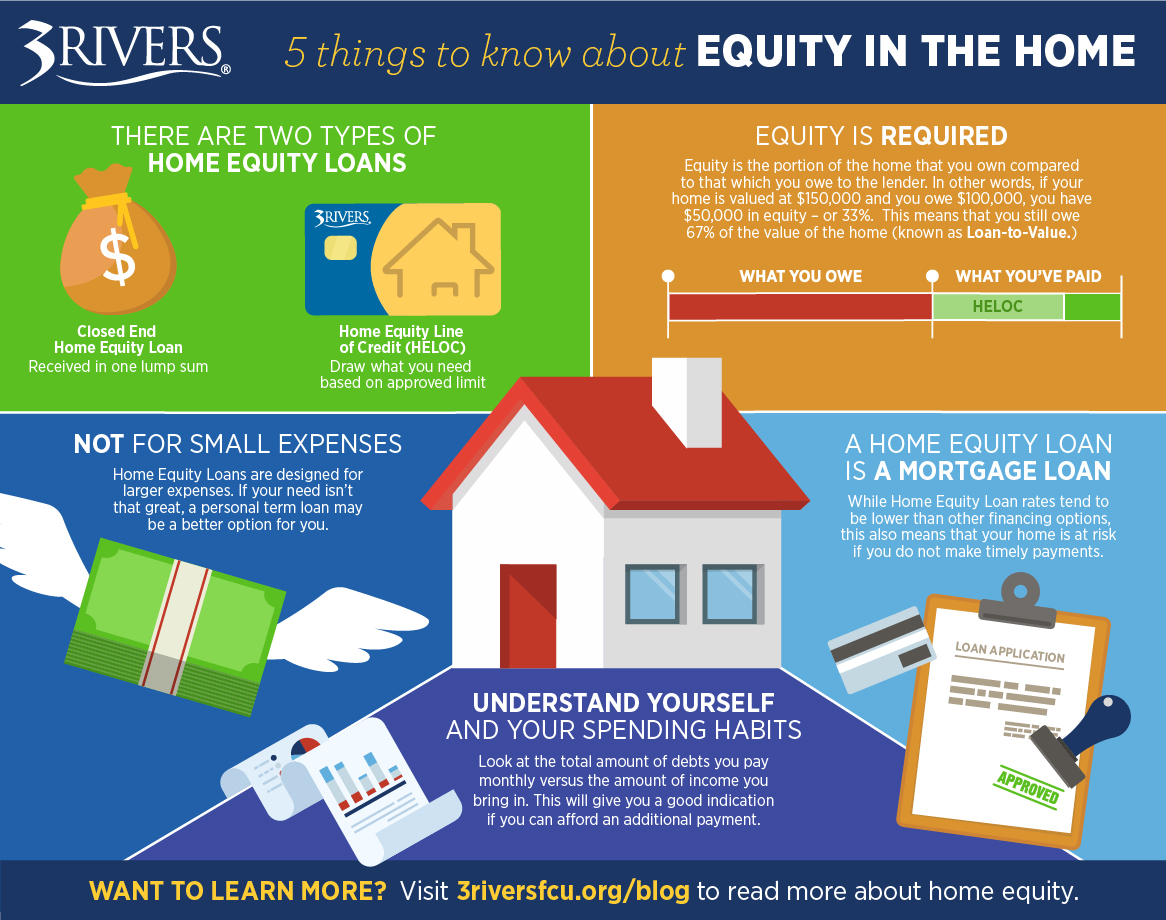

1. Monthly Home Equity Loan Repayment Calculator

The Monthly Home Equity Loan Repayment Calculator from mortgagecalculator.org is a valuable tool designed to assist users in calculating their monthly payments on home equity loans. It effectively distinguishes between interest-only payments and the potential benefits of making additional principal payments, allowing users to understand the financial implications of their choices. This feature enables borrowers to make informed decisions about their repayment strategies and overall financial planning.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

3. Home equity loan rates & HELOC calculator

The U.S. Bank Home Equity Loan and HELOC Calculator is a valuable tool designed to help homeowners estimate their potential loan payments. By providing insights into current terms and rates, users can easily assess their borrowing options for home equity loans and lines of credit. This calculator simplifies the decision-making process, making it easier to plan for financing renovations, consolidating debt, or funding other major expenses.

- Website: usbank.com

- Established: Approx. 30 years (domain registered in 1995)

5. HELOC Interest Calculator

The HELOC Interest Calculator offered by Dutch Point Credit Union is a valuable tool designed to help users understand the financial implications of their Home Equity Line of Credit. By allowing users to input various payment scenarios, the calculator demonstrates how additional payments can affect the overall loan balance. This feature empowers borrowers to make informed decisions about their repayment strategies, ultimately aiding in effective financial planning.

- Website: dutchpoint.org

- Established: Approx. 29 years (domain registered in 1996)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps in obtaining accurate results from a HELOC interest calculator is to ensure that the information you input is correct. Mistakes in entering figures, such as the estimated property value, outstanding balances, or desired line of credit, can lead to misleading results. Take a moment to review your numbers before hitting the calculate button. If possible, use a calculator or a spreadsheet to confirm your figures.

Understand the Underlying Assumptions

Each calculator may operate under different assumptions that can affect the output. For instance, some calculators might assume a fixed interest rate while others may use a variable rate that can fluctuate over time. Familiarize yourself with these assumptions, as they can significantly impact your estimated monthly payments and total interest paid. If the calculator provides options for different scenarios, explore these to see how varying the inputs affects your results.

Use Multiple Tools for Comparison

No single calculator can capture every nuance of your financial situation. To get a well-rounded understanding of your potential HELOC costs, use multiple calculators. This allows you to compare results and identify any discrepancies. Different tools may have unique features or offer varying levels of detail, which can provide you with a broader perspective on your options. Additionally, check if the calculators provide insights into the latest interest rates and terms from various lenders.

Review Current Market Conditions

Interest rates for HELOCs can change frequently based on market conditions. Before making any decisions based on your calculator results, take a moment to research current HELOC rates in your area. Many calculators provide links to local mortgage rates or may even integrate this information directly. Understanding the current economic climate can help you make more informed decisions about your borrowing options.

Seek Professional Guidance

While online calculators are a great starting point, they are not a substitute for professional advice. If you’re uncertain about your inputs or the implications of your results, consider consulting a financial advisor or a lending specialist. They can offer personalized insights based on your financial situation and help you navigate the complexities of home equity financing.

Keep Personal Financial Goals in Mind

Finally, as you use these calculators, always keep your personal financial goals in focus. Consider how taking out a HELOC fits into your overall financial plan. Whether you’re looking to consolidate debt, fund home improvements, or cover unexpected expenses, understanding your objectives will guide you in selecting the most suitable borrowing option and ensuring the calculator’s results align with your needs.

Frequently Asked Questions (FAQs)

1. What is a HELOC interest calculator?

A HELOC interest calculator is an online tool designed to help homeowners estimate the monthly payments on a Home Equity Line of Credit (HELOC). It allows users to input variables such as the loan amount, interest rate, and repayment term to calculate potential monthly payments and total interest costs. This tool can be beneficial for planning and budgeting, giving users a clearer understanding of their financial obligations before they take out a HELOC.

2. How do I use a HELOC interest calculator?

To use a HELOC interest calculator, follow these steps:

- Enter Your Property Value: Input the estimated value of your home.

- Input Outstanding Balances: Provide the current balances of any existing loans, such as mortgages or other home equity loans.

- Specify the HELOC Amount: Indicate how much credit you wish to draw from the HELOC.

- Select the Interest Rate: Enter the expected variable or fixed interest rate for the HELOC.

- Choose the Term: Select the repayment term (e.g., draw period followed by repayment period).

- Calculate: Click the calculate button to view your estimated monthly payments and total interest over the life of the loan.

3. What factors can affect my HELOC interest rate?

Several factors can influence the interest rate on a HELOC, including:

- Credit Score: Higher credit scores typically qualify for lower interest rates.

- Loan-to-Value Ratio (LTV): The ratio of your outstanding mortgage balances to your home’s appraised value can impact rates. Lower LTV ratios generally lead to better rates.

- Market Conditions: Interest rates can fluctuate based on broader economic factors and market conditions.

- Type of Interest Rate: Whether you choose a fixed or variable rate will also affect the overall cost of the HELOC.

4. Is the interest on a HELOC tax-deductible?

Under the Tax Cuts and Jobs Act of 2017, interest paid on a HELOC may be tax-deductible if the funds are used to buy, build, or substantially improve the home that secures the loan. However, if the money is used for personal expenses, such as paying off debt or funding a vacation, the interest is generally not deductible. It’s advisable to consult a tax professional for guidance based on your specific situation.

5. Can I make additional payments on my HELOC?

Yes, most HELOCs allow borrowers to make additional payments on their principal balance without penalties. Making extra payments can help reduce the overall interest paid over the life of the loan and shorten the repayment period. However, it’s essential to check with your lender for specific terms and conditions regarding additional payments, as policies may vary.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.