The 5 Best Heloc Payment Calculators of 2025 (Reviewed)

Finding the Best Heloc Calculator Payment: An Introduction

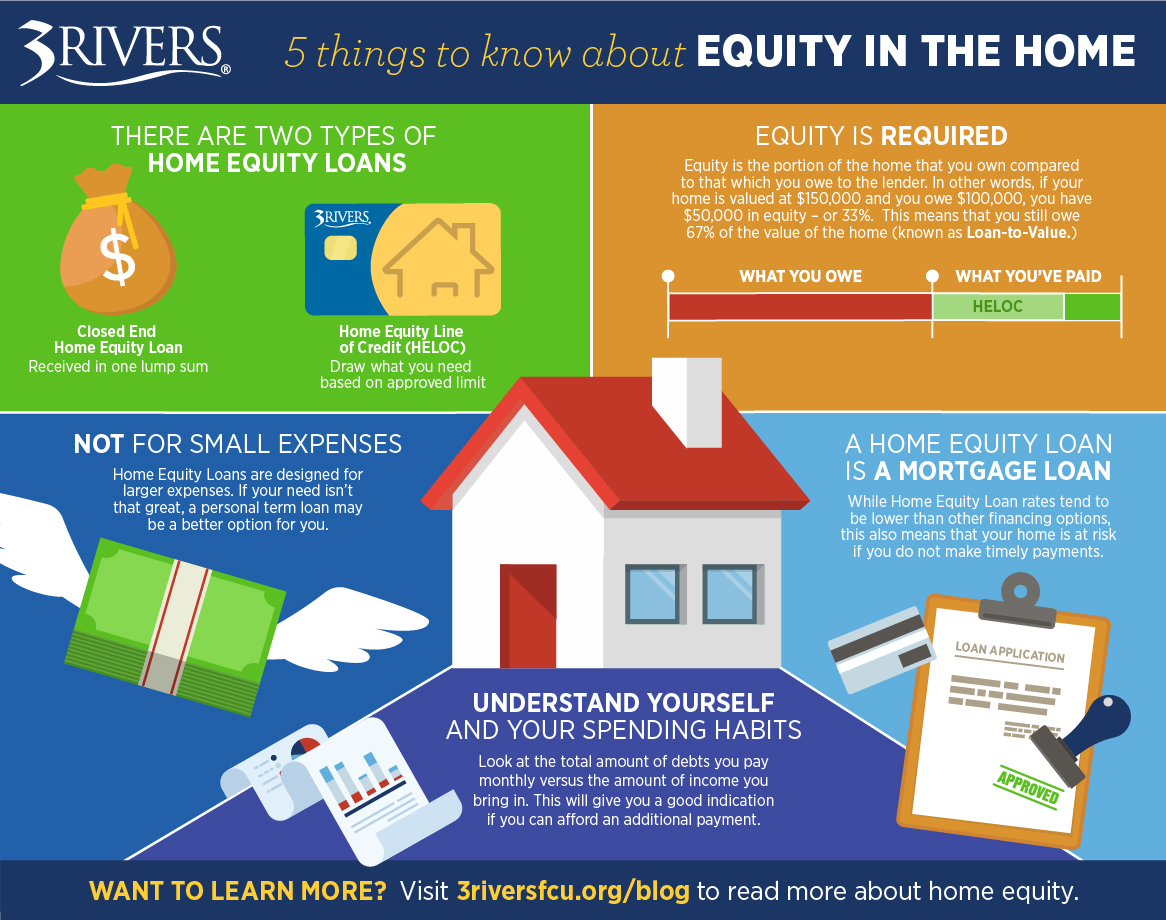

Finding a reliable Home Equity Line of Credit (HELOC) payment calculator can be a daunting task for many homeowners. With various options available online, each claiming to offer unique features and benefits, it’s easy to become overwhelmed. Homeowners need a tool that not only provides accurate estimates but also simplifies the complex calculations associated with HELOC payments. This is particularly important given the financial implications of borrowing against home equity, which can vary significantly based on interest rates, loan terms, and repayment options.

The goal of this article is to review and rank the top HELOC payment calculators available online, allowing you to save time and make informed decisions. We will explore each tool’s features, user interface, and overall reliability, ensuring you can find the best fit for your needs.

In our ranking process, we utilized several key criteria to ensure a comprehensive evaluation. Accuracy is paramount; we assessed how closely the calculators align with industry standards and real-world scenarios. Ease of use was another critical factor; a user-friendly interface can greatly enhance the experience, especially for those who may not be financially savvy. Additionally, we looked for features that add value, such as the ability to adjust for different interest rates, loan amounts, and repayment periods. By focusing on these aspects, our review aims to provide you with the most effective tools for navigating your HELOC payment calculations. Whether you’re a first-time borrower or looking to refinance, our insights will help you make confident financial decisions.

Our Criteria: How We Selected the Top Tools

Selection Criteria for HELOC Payment Calculators

When reviewing and selecting the best HELOC payment calculators, we focused on several key criteria to ensure that users have access to the most effective and user-friendly tools available. Here’s a breakdown of the essential factors we considered:

-

Accuracy and Reliability

– The primary function of any calculator is to provide precise results. We evaluated each tool’s formula and methodology to ensure it accurately calculates monthly payments based on various inputs, such as interest rates and loan amounts. Reliable calculators will also reflect current market conditions and provide realistic estimations. -

Ease of Use

– A good calculator should be intuitive and user-friendly. We assessed the user interface of each tool, looking for clear instructions, straightforward navigation, and minimal technical jargon. Tools that allow users to quickly enter information and receive results without unnecessary complications scored higher on our list. -

Key Features

– Effective HELOC calculators should include specific inputs that allow users to customize their experience. We looked for tools that offered:- Loan Amount: The total amount of the HELOC.

- Interest Rate: The applicable interest rate, whether fixed or variable.

- Draw Period: The length of time the user can withdraw funds.

- Repayment Period: The duration over which payments will be made after the draw period ends.

- Additional Principal Payments: The option to input extra payments to see how they affect the overall payment schedule.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or if they require a subscription or payment. Free tools were prioritized, but we also considered the value offered by any paid options that might provide additional features or enhanced support. Transparent pricing models were important in our assessment. -

Additional Resources

– We considered whether the calculators provided supplementary information or resources that could help users make informed decisions. This includes educational content on HELOCs, tips for managing payments, or links to current interest rates and lender offers. -

Mobile Compatibility

– In today’s digital age, accessibility is crucial. We checked whether the calculators are optimized for mobile devices, ensuring that users can easily access them on smartphones and tablets. -

Customer Support and Guidance

– Finally, we looked at the availability of customer support or guidance for users who may have questions or need assistance with the calculator. Tools that offer chat support, FAQs, or detailed user guides were favored.

By applying these criteria, we aimed to curate a list of HELOC payment calculators that not only meet the diverse needs of users but also provide a seamless experience in managing their home equity loans.

The Best Heloc Calculator Payments of 2025

1. Monthly Home Equity Loan Repayment Calculator

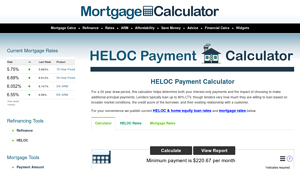

The Monthly Home Equity Loan Repayment Calculator from mortgagecalculator.org is a valuable tool designed to help users assess their loan repayment options. It effectively calculates both interest-only payments and allows users to explore the effects of making additional principal payments. This feature aids in understanding how extra contributions can reduce overall interest costs and shorten loan duration, making it an essential resource for homeowners looking to manage their equity loans efficiently.

- Website: mortgagecalculator.org

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps to obtaining accurate results from a HELOC payment calculator is to ensure that all inputs are correct. This includes values such as your home’s estimated value, outstanding mortgage balance, desired line of credit, and interest rates. Mistakes in these figures can lead to significant discrepancies in your estimated payments. Take the time to verify each number before hitting the calculate button. If you’re unsure about the estimated value of your home, consider using online real estate tools or consulting with a local real estate agent.

Understand the Underlying Assumptions

Each calculator may operate on different assumptions, such as the length of the draw period, repayment period, and how interest rates are applied. For instance, some calculators may assume a variable interest rate, while others might provide options for fixed-rate loans. Familiarize yourself with the terms and conditions that each calculator uses, as this will help you interpret the results more accurately. Knowing whether the calculator is considering interest-only payments or principal plus interest will greatly impact your understanding of the estimated payments.

Use Multiple Tools for Comparison

To ensure you’re getting the most accurate and comprehensive understanding of your potential HELOC payments, consider using multiple online calculators. Different tools may provide varied results based on their algorithms and assumptions. By comparing results from several calculators, you can identify any inconsistencies and gain a better overall perspective on what to expect. This approach also allows you to explore different scenarios, such as adjusting the interest rate or changing the loan amount, to see how these factors influence your monthly payments.

Keep Current Market Conditions in Mind

Interest rates and lending terms can fluctuate frequently based on market conditions. When using a HELOC calculator, make sure to input the most current interest rate information. Many calculators provide links to current rates, so take advantage of these resources to ensure your estimates are as accurate as possible. Additionally, understanding the broader economic environment can help you make informed decisions about when to secure your HELOC.

Seek Professional Advice

While online calculators can provide a good starting point, they cannot replace personalized financial advice. If you’re unsure about any aspect of your HELOC, consider consulting with a financial advisor or a mortgage specialist. They can help clarify your options, provide tailored advice, and ensure that you’re making decisions that align with your financial goals.

Review Results Periodically

Finally, remember that your financial situation and market conditions can change. It’s wise to periodically revisit your HELOC calculator and re-evaluate your options, especially if you’re considering applying for a line of credit or making significant changes to your current loan. By keeping your information up to date, you can make better-informed decisions that reflect your current financial circumstances.

Frequently Asked Questions (FAQs)

1. What is a HELOC payment calculator and how does it work?

A Home Equity Line of Credit (HELOC) payment calculator is a tool that helps homeowners estimate their monthly payments on a HELOC. By inputting details such as the total line of credit, interest rate, and outstanding balance, the calculator can provide an estimate of the monthly payment amount. It typically factors in both principal and interest payments, and may also show how different loan amounts or interest rates affect your monthly obligations.

2. What information do I need to use a HELOC payment calculator?

To effectively use a HELOC payment calculator, you generally need to provide the following information:

– Estimated Property Value: The current market value of your home.

– Outstanding Balance: Any existing loans against your home, including your current mortgage.

– Total Line of Credit Desired: The amount you wish to borrow through the HELOC.

– Interest Rate: The expected variable or fixed interest rate for the HELOC.

– Draw Period and Repayment Terms: Information on how long you plan to draw from the line of credit and the repayment schedule thereafter.

3. Can I calculate both interest-only and principal payments with a HELOC calculator?

Yes, many HELOC payment calculators allow you to calculate both interest-only payments and payments that include principal. Interest-only payments are typically lower and are often used during the draw period. However, when the repayment period starts, you will need to pay both principal and interest, which will result in higher monthly payments. Make sure to check the features of the calculator to see if it offers this functionality.

4. Are there any limitations to using a HELOC payment calculator?

While HELOC payment calculators can provide helpful estimates, there are limitations to consider:

– Estimates Only: The results are based on the information you input and are only estimates. Actual payments can vary based on changes in interest rates and other factors.

– Variable Rates: If your HELOC has a variable interest rate, the monthly payments may change over time as the rate fluctuates.

– Not a Loan Approval: Using a calculator does not equate to loan approval or guarantee. It is essential to speak with a lender for exact terms and conditions.

5. How can I use the results from a HELOC payment calculator to make financial decisions?

The results from a HELOC payment calculator can guide you in several ways:

– Budgeting: Understanding potential monthly payments can help you budget for your expenses and determine if a HELOC is financially feasible for you.

– Comparing Options: By adjusting the loan amount or interest rate, you can compare different scenarios to find the most suitable HELOC option for your needs.

– Planning for Future Payments: Knowing how your payments might change after the draw period can help you plan for future financial commitments and ensure you can meet your obligations.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.