The 5 Best Heloc Repayment Calculators of 2025 (Reviewed)

Finding the Best Heloc Repayment Calculator: An Introduction

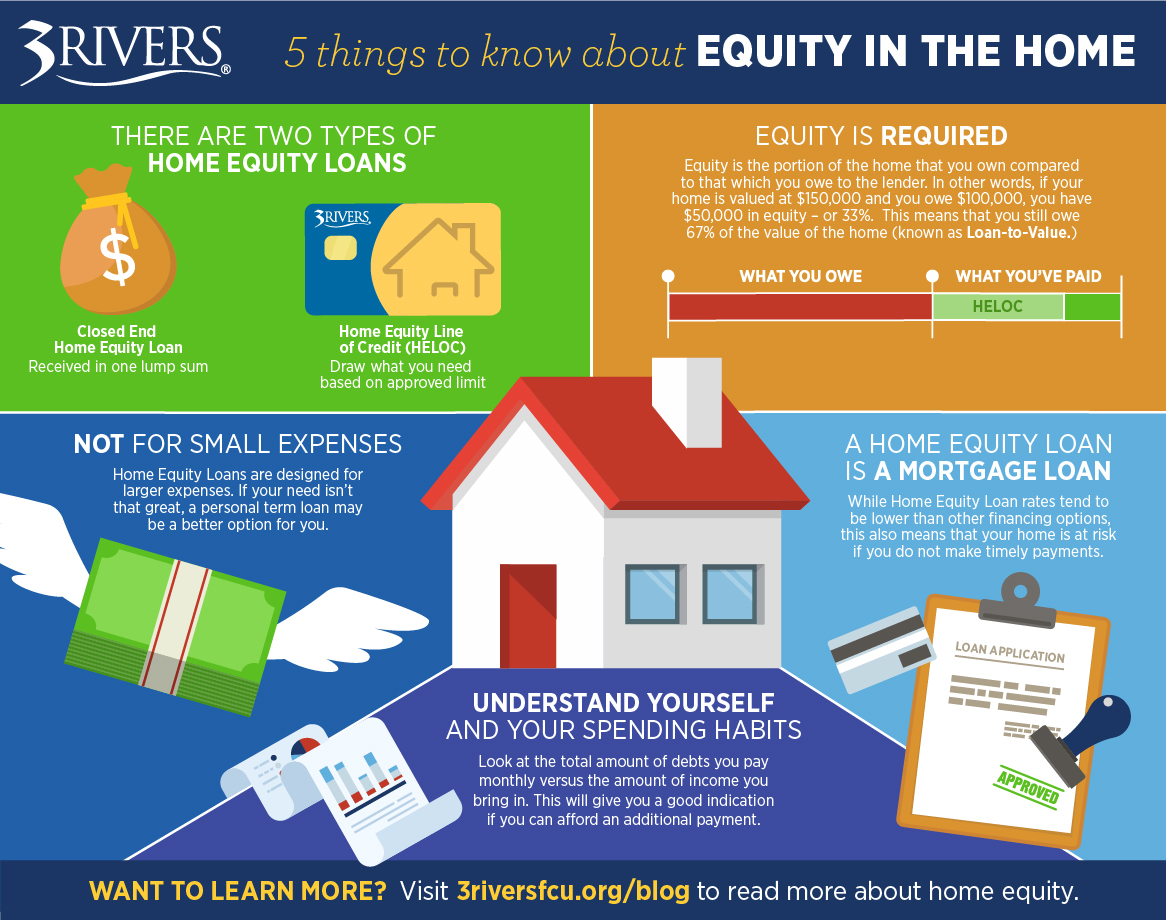

Finding the right home equity line of credit (HELOC) repayment calculator can be a daunting task. With numerous options available online, it’s essential to identify a tool that not only provides accurate calculations but also meets your specific financial needs. HELOCs offer flexibility in borrowing against your home’s equity, but understanding the repayment structure—especially with variable interest rates—can be challenging. Without the right calculator, you may struggle to visualize how different repayment scenarios will affect your finances over time.

This article aims to simplify your search by reviewing and ranking the best HELOC repayment calculators available online. Our goal is to save you time and effort, allowing you to focus on making informed financial decisions. We have meticulously analyzed a variety of calculators to determine which tools stand out in terms of reliability and user experience.

Criteria for Ranking

To ensure a comprehensive evaluation, we considered several key factors:

- Accuracy: The calculators must provide precise estimates of monthly payments and total repayment amounts based on user inputs.

- Ease of Use: A user-friendly interface is crucial for navigating through different scenarios without confusion.

- Features: Additional functionalities, such as the ability to simulate different interest rates, repayment periods, and extra payments, enhance the calculator’s utility.

- Accessibility: Tools that are readily available and do not require extensive personal information or complicated sign-up processes are prioritized.

By focusing on these criteria, we aim to present you with the most effective tools to help manage your HELOC repayment strategy efficiently.

Our Criteria: How We Selected the Top Tools

When evaluating the top HELOC repayment calculators available online, we established a set of criteria to ensure that the tools we recommend are not only effective but also user-friendly. Here are the key factors we considered in our selection process:

1. Accuracy and Reliability

The foremost criterion for selecting a HELOC repayment calculator is its accuracy. The tool must provide precise calculations based on the inputs provided by the user. This includes the ability to factor in variable interest rates and different repayment scenarios. We examined calculators that have been tested and validated by financial experts to ensure they deliver reliable results.

2. Ease of Use

A user-friendly interface is essential for any online tool. The calculators we selected feature intuitive designs that allow users to input their data without confusion. We looked for tools that provide clear instructions and a straightforward layout, making it easy for users of all skill levels to navigate and obtain their results quickly.

3. Key Features

We evaluated the calculators based on the features they offer. Essential functionalities include:

– Flexible Input Options: Users should be able to input various loan amounts, interest rates, draw periods, and repayment terms.

– Payment Breakdown: The tool should provide a detailed breakdown of monthly payments, including principal and interest components.

– Scenario Analysis: The ability to simulate different scenarios, such as changes in interest rates or additional principal payments, is crucial for effective planning.

– Amortization Schedule: A feature that generates an amortization schedule helps users visualize their repayment journey over time.

4. Cost (Free vs. Paid)

The availability of free tools is a significant consideration. We prioritized calculators that do not require any payment, ensuring accessibility for all users. However, if a paid option offers substantial additional features or superior accuracy, we also considered its value relative to the benefits it provides.

5. Mobile Compatibility

In today’s digital age, mobile access is vital. We assessed whether the calculators are optimized for use on various devices, including smartphones and tablets. A responsive design allows users to perform calculations on the go, enhancing convenience.

6. Customer Support and Resources

Lastly, we considered the availability of customer support and additional resources. The best calculators offer comprehensive FAQs, tutorials, and customer service options to assist users with any questions they may have.

By applying these criteria, we aimed to identify the most effective HELOC repayment calculators that cater to a wide range of user needs, helping homeowners make informed financial decisions.

The Best Heloc Repayment Calculators of 2025

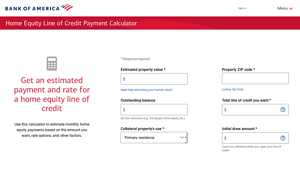

3. Home Equity Line of Credit Payment Calculator

The Home Equity Line of Credit Payment Calculator from Bank of America is a user-friendly tool designed to help homeowners estimate their monthly payments for a home equity line of credit (HELOC). By inputting the desired loan amount, interest rate options, and other relevant factors, users can quickly gain insights into their potential payment obligations, making it easier to plan and budget for borrowing against their home equity.

- Website: bankofamerica.com

- Established: Approx. 27 years (domain registered in 1998)

5. Home equity line of credit (HELOC) payment calculator

The Home Equity Line of Credit (HELOC) payment calculator from UNFCU is a user-friendly tool designed to help homeowners estimate their monthly payments for both traditional and interest-only HELOC options. With its straightforward interface, users can quickly assess their potential costs before applying for a HELOC online at no charge. This calculator is ideal for those looking to leverage their home equity efficiently and make informed financial decisions.

- Website: unfcu.org

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy in any calculation starts with the data you provide. Before hitting that “calculate” button, take a moment to review your inputs. Ensure that figures like your loan amount, interest rate, and repayment term are correct. Even small mistakes can lead to significant discrepancies in the results. For example, entering an interest rate as 8% instead of 3% can drastically alter your monthly payments and total interest paid over the life of the loan. Always re-check your numbers for accuracy.

Understand the Underlying Assumptions

Every calculator has specific assumptions that can affect the results. Familiarize yourself with how the calculator operates. For instance, some calculators may only offer standard repayment plans without factoring in additional payments or varying interest rates. Understanding these assumptions allows you to interpret the results correctly and make informed decisions. Look for notes or explanations within the calculator regarding its methodology, as this can provide crucial context for your results.

Use Multiple Tools for Comparison

No single calculator can provide a complete picture. It’s wise to use multiple HELOC repayment calculators to compare results. Different tools may have varied algorithms, assumptions, or features that could yield different outcomes. By cross-referencing results from different calculators, you can gain a more comprehensive understanding of your potential payments and options. This practice can also help identify any discrepancies that may warrant further investigation.

Explore Different Scenarios

Many calculators allow you to adjust variables such as the interest rate or loan term. Take advantage of this feature by exploring various scenarios. For instance, you could examine how changing the interest rate impacts your monthly payments or how making additional payments affects your overall interest paid. This flexibility can help you better understand your financial options and prepare for any potential changes in market conditions or personal circumstances.

Review Additional Resources

In addition to using calculators, consider reviewing educational resources provided by the calculator websites. Many platforms offer articles, FAQs, and guides that explain HELOCs in detail. This information can enhance your understanding of how a HELOC works and help you make more informed decisions. Additionally, these resources often highlight common pitfalls to avoid, which can be invaluable as you navigate your borrowing options.

Consult with a Financial Advisor

Finally, while online calculators are excellent tools for preliminary estimates, they shouldn’t replace professional advice. If you’re uncertain about your financial situation or the implications of a HELOC, consider consulting with a financial advisor. They can provide personalized insights based on your unique circumstances, helping you make the best choice for your financial future.

Frequently Asked Questions (FAQs)

1. What is a HELOC repayment calculator?

A HELOC repayment calculator is an online tool that helps homeowners estimate their monthly payments on a Home Equity Line of Credit (HELOC). It takes into account factors such as the loan amount, interest rate, draw period, and repayment period to provide a clear picture of what your payments might look like over time. This can assist borrowers in budgeting and planning their finances effectively.

2. How do I use a HELOC repayment calculator?

To use a HELOC repayment calculator, you typically need to input specific details about your loan. This includes the total amount of credit you wish to draw, the interest rate (which is often variable), the length of the draw period (usually 5 to 10 years), and the repayment period (which can last up to 20 years). Once you enter this information, the calculator will generate estimates for your monthly payments during both the draw and repayment phases.

3. Why is it important to calculate HELOC repayments?

Calculating HELOC repayments is crucial because it helps homeowners understand how much they will owe each month and how their payments may change over time. During the draw period, payments may be interest-only, but they will increase significantly once the repayment period begins, as you will start paying both principal and interest. Knowing these details can help you avoid financial surprises and plan your budget accordingly.

4. Can a HELOC repayment calculator help me decide if I should get a HELOC?

Yes, a HELOC repayment calculator can be instrumental in your decision-making process. By estimating potential monthly payments, you can evaluate whether you can comfortably afford the repayments based on your current financial situation. It also allows you to compare the costs of a HELOC with other financing options, like personal loans or cash-out refinancing, to determine the best choice for your needs.

5. What factors can affect my HELOC repayment amounts?

Several factors can influence your HELOC repayment amounts, including the interest rate (which can be variable), the total amount borrowed, the length of the draw period, and the repayment term. Additionally, if you draw more funds from your HELOC, your monthly payments will increase since they will be based on the outstanding balance. Changes in market interest rates can also affect your payments if your HELOC has a variable rate.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.