The 5 Best How Do You Calculate Contribution Margin Calculators of …

Finding the Best How Do You Calculate Contribution Margin: An Introduction

Calculating contribution margin can be a daunting task for many, particularly for those unfamiliar with financial metrics. This essential calculation, which reflects the profitability of individual products by subtracting variable costs from revenue, is crucial for businesses aiming to understand their cost structure and optimize pricing strategies. However, with numerous online resources and tools available, finding a reliable method to accurately perform this calculation can be overwhelming. Many users may struggle with the intricacies of different formulas and the varying interpretations of contribution margin, leading to confusion and inefficiency.

The goal of this article is to review and rank the best online tools for calculating contribution margin, thereby saving you valuable time and effort. We have meticulously analyzed a range of options to identify those that offer the most accurate calculations, user-friendly interfaces, and additional features that enhance the overall experience.

Criteria for Ranking

Our evaluation criteria include:

-

Accuracy: The reliability of the calculations provided by each tool is paramount. We ensure that the formulas used are correct and the results are consistent with standard accounting practices.

-

Ease of Use: A tool should be intuitive, allowing users of all skill levels to navigate without difficulty. We assess the user interface and the clarity of instructions provided.

-

Features: Beyond basic calculations, we consider additional functionalities such as the ability to generate reports, save calculations, or integrate with other financial tools.

By focusing on these criteria, we aim to present you with a well-rounded selection of tools that cater to your needs, whether you are a small business owner, a finance student, or a professional looking to refine your financial analysis skills.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting Top Contribution Margin Calculators

When evaluating online tools for calculating contribution margin, we focused on several key criteria to ensure that users can find reliable, efficient, and user-friendly options. Here’s how we selected the top calculators:

-

Accuracy and Reliability

– The primary function of any financial calculator is to provide accurate results. We assessed each tool’s formula and underlying assumptions to ensure they adhered to standard accounting principles. Tools that demonstrated a clear methodology for calculating contribution margin—subtracting variable costs from revenue—were prioritized. -

Ease of Use

– User experience is crucial, especially for those who may not have extensive financial backgrounds. We looked for calculators that offered intuitive interfaces, straightforward instructions, and quick results. The ability to input data easily without confusion was a significant factor in our selection process. -

Key Features

– A good contribution margin calculator should include several essential features to enhance its usability:- Input Flexibility: The ability to enter various forms of revenue and variable costs, including total figures and per-unit data.

- Output Clarity: Clear presentation of the contribution margin, contribution margin ratio, and other related metrics.

- Comparative Analysis: Some tools offer comparisons against industry benchmarks or historical data, aiding users in making informed decisions.

- Scenario Analysis: Tools that allow users to test different pricing or cost scenarios were favored, as they provide deeper insights into how changes affect profitability.

-

Cost (Free vs. Paid)

– We considered the pricing models of each tool. While many users prefer free calculators, we also evaluated paid options that offered advanced features or additional resources. Transparency regarding costs and what users receive at each price point played a vital role in our assessment. -

Educational Resources

– Tools that provide additional learning materials, such as articles, guides, or tutorials on contribution margin analysis, were favored. This added value helps users not only to calculate their contribution margins but also to understand the implications of their results on business decision-making. -

Customer Support

– Accessibility to customer support can significantly enhance user experience. We looked for calculators that offered robust support options, such as FAQs, live chat, or email assistance, ensuring users could get help if needed. -

Compatibility

– The ability to integrate with other software, such as Excel or accounting tools, was also considered. This feature allows users to export their calculations for further analysis, making the tool more versatile.

By focusing on these criteria, we aimed to provide a comprehensive overview of the best online tools for calculating contribution margin, ensuring that users can make informed choices based on their specific needs and circumstances.

The Best How Do You Calculate Contribution Margins of 2025

1. Contribution Margin

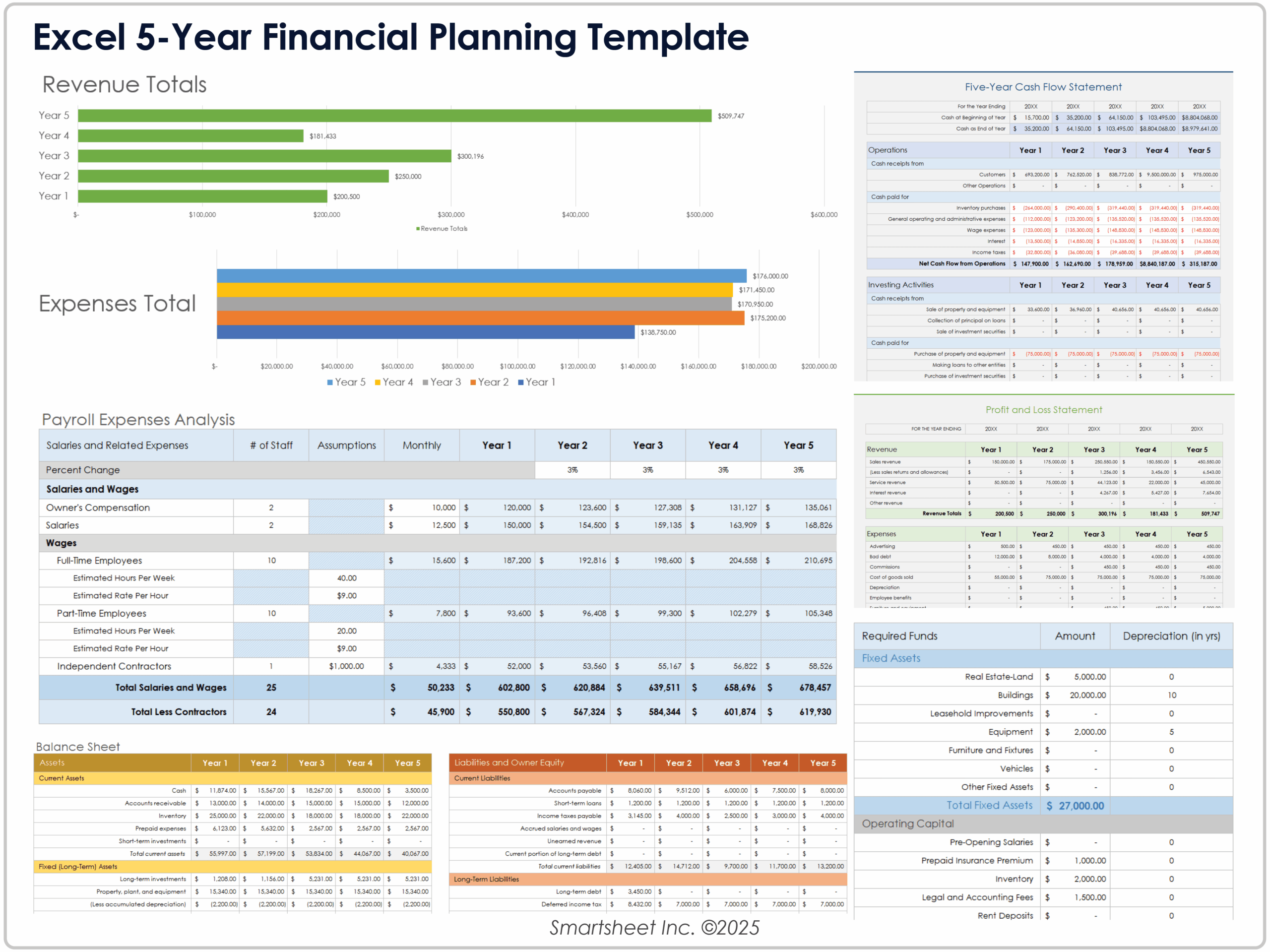

The Contribution Margin Calculator from Wall Street Prep is a valuable tool designed to help users determine the contribution margin by calculating the difference between revenue and variable costs. This tool simplifies the process of analyzing profitability by providing a clear formula and intuitive interface, making it accessible for both finance professionals and students. Its focus on variable costs, which change with production volume, enhances understanding of financial dynamics in business operations.

- Website: wallstreetprep.com

- Established: Approx. 22 years (domain registered in 2003)

2. Contribution Margin

The Contribution Margin tool from Corporate Finance Institute provides a comprehensive overview of how to calculate and analyze contribution margin, which is defined as sales revenue minus variable costs. This tool is essential for businesses to understand how contribution dollars can be allocated to cover fixed costs, such as rent, thereby aiding in financial decision-making and profitability analysis. Its clear guidance on fixed and variable costs enhances users’ ability to optimize their financial strategies.

- Website: corporatefinanceinstitute.com

- Established: Approx. 10 years (domain registered in 2015)

3. What Is Contribution Margin and How To Calculate

The article “What Is Contribution Margin and How To Calculate” from Indeed.com serves as a comprehensive guide for understanding and calculating contribution margin, a key financial metric. It emphasizes the importance of focusing solely on the variable costs associated with production or sales. The piece provides clear instructions and insights that can help businesses assess profitability and make informed financial decisions.

- Website: indeed.com

- Established: Approx. 27 years (domain registered in 1998)

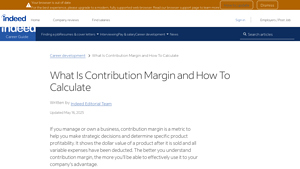

4. Contribution margin income statements: a complete guide [2025]

The “Contribution Margin Income Statements: A Complete Guide [2025]” from Cube Software serves as a comprehensive resource for understanding and calculating contribution margins. This tool enables users to easily compute the contribution margin by deducting variable costs from total revenue, while also guiding them in identifying and analyzing fixed costs for specific periods. Its straightforward approach aids businesses in assessing profitability and making informed financial decisions.

- Website: cubesoftware.com

- Established: Approx. 19 years (domain registered in 2006)

5. Contribution Margin: Definition, Tips & Strategies for Increasing Profit

The article from Peel Insights provides a comprehensive overview of contribution margin, emphasizing its significance in understanding profitability. It defines contribution margin as the revenue remaining after covering all variable expenses associated with product sales. Additionally, the piece offers practical tips and strategies for businesses to enhance their contribution margins, ultimately guiding them toward increased profitability and better financial decision-making.

- Website: peelinsights.com

- Established: Approx. 7 years (domain registered in 2018)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in obtaining accurate results from contribution margin calculators is to ensure that the data you input is correct. Before submitting your information, take a moment to review your figures for sales revenue and variable costs. Even minor errors can lead to significant discrepancies in your results. For example, if you mistakenly enter a variable cost as $100 instead of $10, your calculated contribution margin will be drastically skewed. Always verify that you are using consistent units (e.g., dollars, percentages) and that all inputs align with the specific product or service you are analyzing.

Understand the Underlying Assumptions

Each online calculator may operate under different assumptions regarding fixed and variable costs, as well as the definitions of contribution margin. Familiarize yourself with these assumptions to understand how they may affect your results. Some calculators might incorporate additional factors, such as seasonal fluctuations in sales or variations in cost structures. By grasping the underlying logic of the tool you are using, you can better interpret the results and apply them to your unique business context.

Use Multiple Tools for Comparison

To enhance the accuracy of your analysis, consider using multiple contribution margin calculators. Different tools may use varying methodologies or offer unique features that could provide additional insights. By comparing results across several platforms, you can identify any inconsistencies and gain a more comprehensive understanding of your contribution margin. This practice can also help you recognize patterns or outliers that may warrant further investigation.

Seek Contextual Understanding

While calculators provide numerical outputs, they often lack contextual information about your business model, market conditions, and competitive landscape. Take the time to analyze the results in conjunction with qualitative data. For example, understanding your industry’s average contribution margins can help you gauge whether your numbers are competitive. Additionally, consider how external factors, such as economic conditions or changes in consumer behavior, might impact your contribution margin over time.

Interpret Results with Caution

Finally, remember that contribution margin is just one of many financial metrics used to assess business performance. While it offers valuable insights into product profitability, it should not be viewed in isolation. Use your contribution margin results as part of a broader financial analysis that includes metrics like gross margin, net profit margin, and return on investment (ROI). This holistic approach will provide a more accurate picture of your business’s financial health and inform better decision-making.

By following these guidelines, you can maximize the accuracy and relevance of your contribution margin calculations, leading to more informed business strategies and improved financial outcomes.

Frequently Asked Questions (FAQs)

1. What is contribution margin and why is it important?

Contribution margin is the amount of revenue that exceeds total variable costs. It represents the portion of sales revenue that contributes to covering fixed costs and generating profit. Understanding contribution margin is crucial for businesses as it helps in making pricing decisions, evaluating product profitability, and determining break-even points.

2. How do you calculate contribution margin?

To calculate contribution margin, you can use the formula:

Contribution Margin = Revenue – Variable Costs

This formula allows you to determine how much money is available to cover fixed costs and contribute to profits after accounting for variable costs associated with producing a product or service.

3. What is the difference between contribution margin and gross margin?

The primary difference lies in what they measure. Contribution margin focuses on the profitability of individual products or services by accounting only for variable costs. In contrast, gross margin considers all costs related to goods sold, including fixed costs, thus providing a broader overview of overall profitability across all products.

4. How can I use an online tool to calculate contribution margin?

Many online calculators are available to help you compute contribution margin easily. You typically enter your total revenue and variable costs, and the tool will automatically calculate the contribution margin and, in some cases, the contribution margin ratio. Look for tools that provide clear outputs and possibly further insights into your product’s profitability.

5. What factors can affect my contribution margin?

Several factors can influence contribution margin, including pricing strategies, variable costs (like materials and labor), and sales volume. If variable costs increase or if the selling price decreases, the contribution margin will shrink. Conversely, reducing variable costs or increasing sales prices can enhance the contribution margin, leading to improved profitability.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.

![Screenshot of Contribution margin income statements: a complete guide [2025]](https://www.cify.info/wp-content/uploads/2025/09/cubesoftware-com-screenshot-8741.jpg)