The 5 Best How To Calculate Variable Cost Calculators of 2025 (Revi…

Finding the Best How To Calculate Variable Cost: An Introduction

Calculating variable costs can be a daunting task for many individuals and businesses alike. Variable costs, which fluctuate with production output, are crucial for understanding profitability, pricing strategies, and overall financial health. However, navigating the myriad of online tools and calculators available can be overwhelming. With so many options, how do you determine which tool is reliable, accurate, and user-friendly?

The goal of this article is to streamline your search by reviewing and ranking the best online tools for calculating variable costs. We understand that time is valuable, and finding a trustworthy resource can significantly ease the burden of financial analysis. Whether you are a small business owner, a student, or someone simply looking to grasp the concept of variable costs better, our curated list aims to provide you with the most effective solutions.

To ensure a fair and thorough assessment, we have established specific criteria for our rankings. Key factors include accuracy, as precise calculations are vital for sound financial decisions; ease of use, ensuring that users can navigate the tools without unnecessary complications; and features, such as additional functionalities that enhance the user experience. By focusing on these aspects, we aim to present a comprehensive overview of the top tools available, saving you both time and effort in your quest to master variable cost calculations.

Our Criteria: How We Selected the Top Tools

How We Selected the Top Tools

When evaluating the best online tools for calculating variable costs, we established a set of criteria to ensure that the selected calculators meet the needs of users ranging from small business owners to students. Below are the key factors that influenced our selection process:

-

Accuracy and Reliability

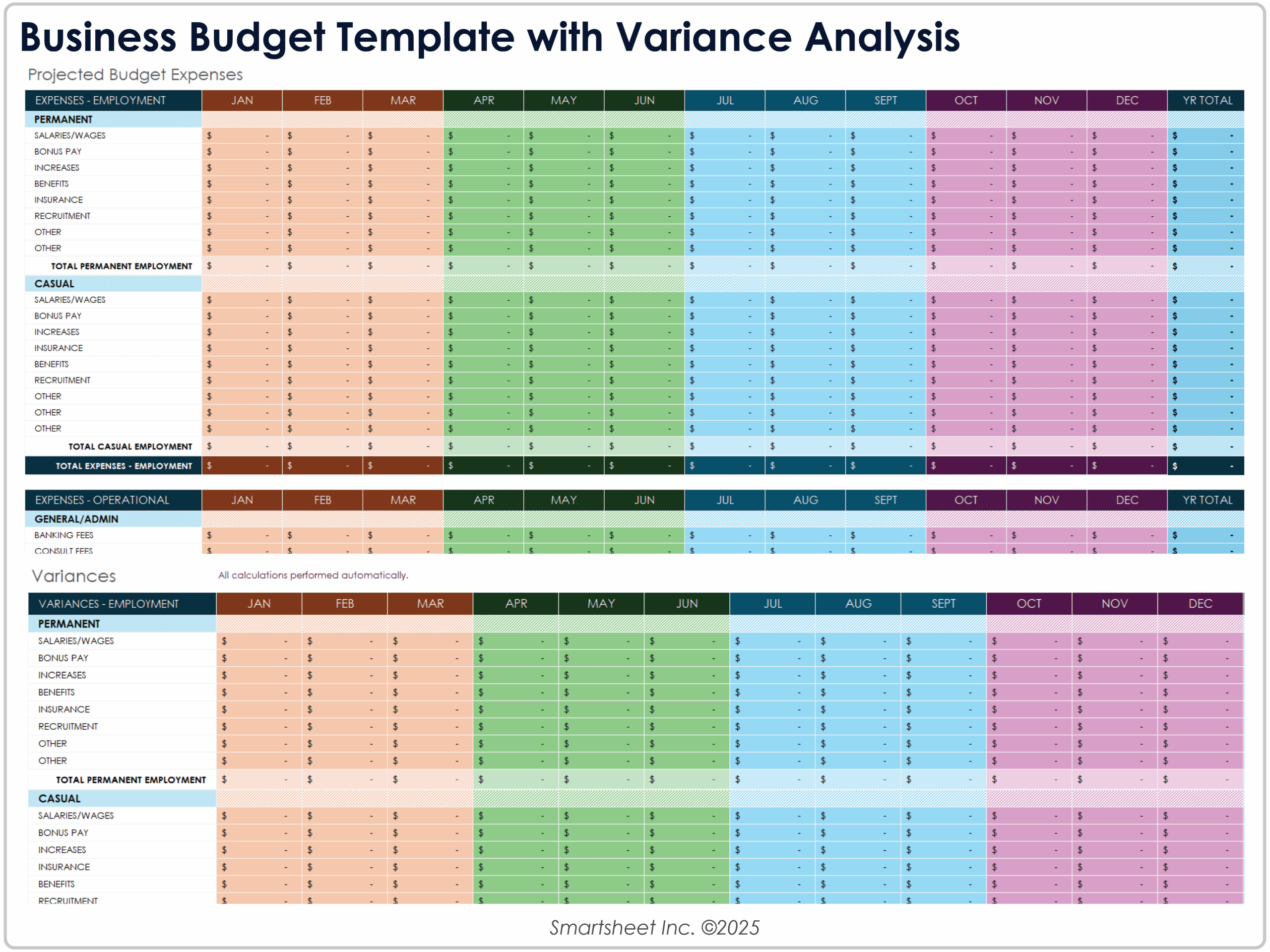

– The foremost criterion for any calculation tool is its accuracy. We prioritized calculators that provide precise outputs based on commonly accepted formulas for variable costs, such as:- Total Variable Cost = Total Quantity of Output x Variable Cost Per Unit of Output.

- Tools that include references or links to reputable financial sources for validation were favored.

-

Ease of Use

– User-friendliness is essential, especially for those who may not have a strong background in finance. We looked for tools with intuitive interfaces that guide users through the calculation process without requiring extensive financial knowledge.

– Features such as step-by-step instructions, tooltips, or examples of variable cost calculations enhanced usability. -

Key Features

– Effective variable cost calculators should allow users to input various parameters relevant to their specific scenarios. Key features we considered include:- Options to input multiple types of variable costs (e.g., raw materials, labor, utilities).

- The ability to adjust production levels to see how costs change dynamically.

- Visual aids like graphs or charts to illustrate how variable costs fluctuate with production volume.

- Additionally, calculators that allow users to save or export their calculations for later reference were highly regarded.

-

Cost (Free vs. Paid)

– We analyzed the cost structure of each tool. While many users prefer free tools, we also considered paid options if they offered significant advantages in terms of features and support.

– Transparency regarding any potential hidden fees or subscription costs was essential in our evaluation. -

Customer Support and Resources

– The availability of customer support or additional resources, such as FAQs, tutorials, or articles on variable costs, can greatly enhance the user experience. Tools that provide comprehensive support options were given priority.

-

Compatibility and Accessibility

– Given the diverse devices users may employ, we assessed whether the tools are mobile-friendly or compatible with various operating systems. Accessibility across different platforms (desktop, tablet, mobile) ensures that users can calculate variable costs anytime, anywhere. -

User Reviews and Ratings

– Finally, we considered user feedback and ratings from credible sources. Tools with positive reviews and a proven track record of user satisfaction were more likely to be included in our top list.

By adhering to these criteria, we aimed to present a well-rounded selection of calculators that effectively meet the needs of anyone looking to calculate variable costs accurately and efficiently.

The Best How To Calculate Variable Costs of 2025

1. Variable Cost: Formula, Definition, and Examples

The article from American Express provides a comprehensive overview of variable costs, detailing their definition, formula, and practical examples. It emphasizes the fundamental principle that variable costs fluctuate with production output, offering insights into how businesses can identify and manage these expenses effectively. This resource serves as a valuable guide for entrepreneurs and financial professionals seeking to understand the impact of variable costs on overall profitability.

- Website: americanexpress.com

- Established: Approx. 30 years (domain registered in 1995)

3. Variable Cost: Examples, Definition, & Formula

The article from Management Consulted provides a comprehensive overview of variable costs, including a clear definition, relevant examples, and a straightforward formula for calculating total variable costs. It emphasizes the relationship between output quantity and variable cost per unit, making it a valuable resource for managers and business students seeking to understand cost structures in various production scenarios.

- Website: managementconsulted.com

- Established: Approx. 17 years (domain registered in 2008)

5. How to Calculate Total Variable Cost

The “How to Calculate Total Variable Cost” guide on Indeed.com provides a straightforward method for businesses to determine their total variable costs. The primary focus of the tool is to help users understand the calculation by multiplying the cost to produce a single unit by the total number of units produced. This clear approach simplifies budgeting and financial planning, making it an essential resource for entrepreneurs and managers looking to optimize their cost management strategies.

- Website: indeed.com

- Established: Approx. 27 years (domain registered in 1998)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in achieving accurate results when using online variable cost calculators is to ensure that your inputs are precise. Carefully review the values you enter for production quantities and variable cost per unit. Even a small error in these figures can lead to significant discrepancies in your total variable cost calculation. If the calculator allows for multiple entries or categories of costs, make sure all relevant costs are included, such as raw materials, direct labor, and utilities.

Understand the Underlying Assumptions

Each calculator may operate under specific assumptions regarding variable costs. Familiarize yourself with these assumptions to better interpret the results. For instance, some calculators might assume linear relationships between production levels and costs, while others may factor in economies of scale or bulk pricing discounts. Understanding these nuances will help you assess whether the output aligns with your business context and production dynamics.

Use Multiple Tools for Comparison

To enhance the reliability of your calculations, consider using multiple online calculators. Different tools may employ various methodologies or formulas, leading to slightly varied results. By comparing outputs from several calculators, you can identify any inconsistencies and gain a more comprehensive understanding of your variable costs. This practice not only increases your confidence in the accuracy of your results but also provides a broader perspective on how different assumptions can affect your calculations.

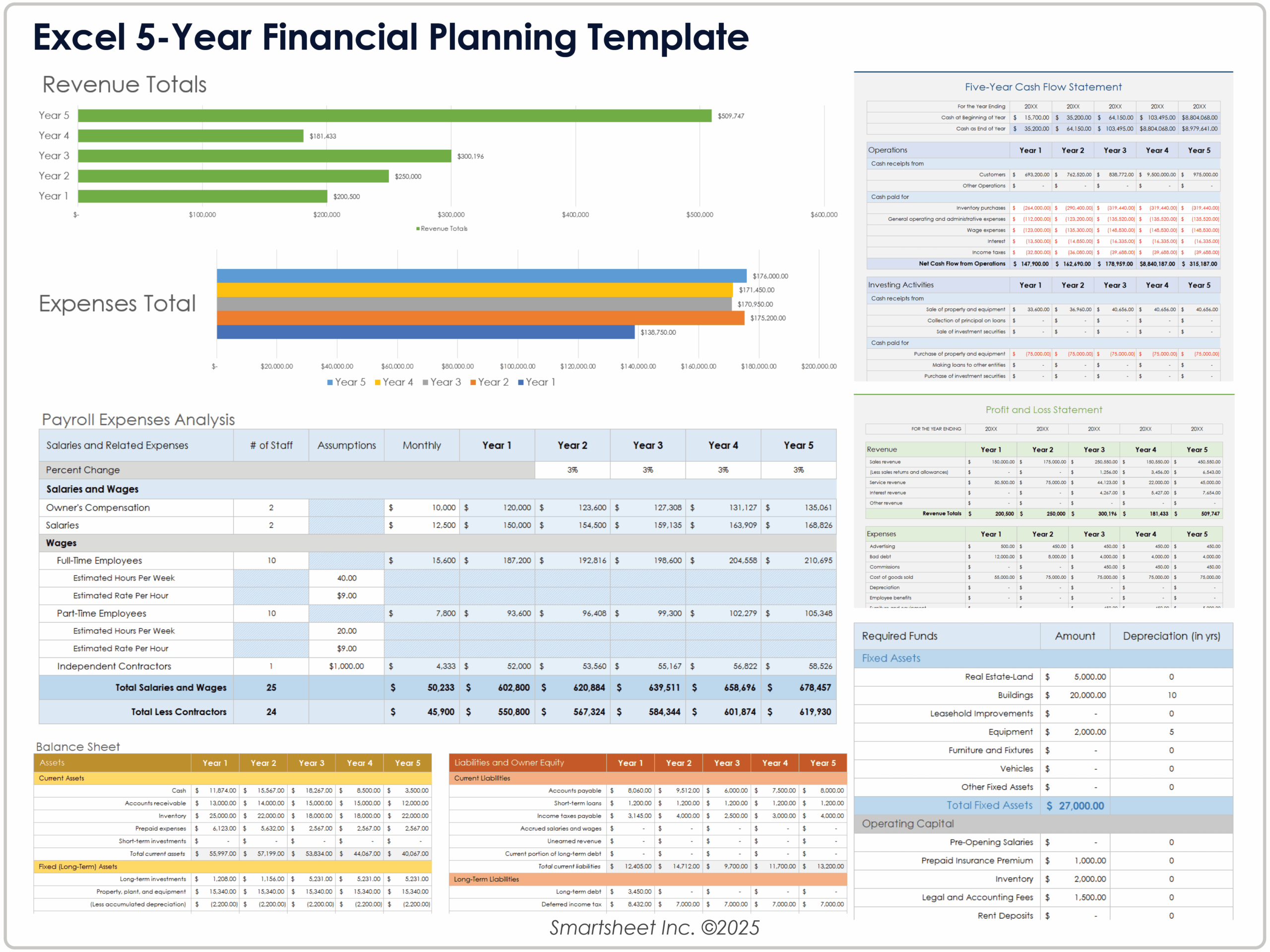

Review Historical Data

If available, leverage historical data on your production costs. Cross-referencing your calculator results with actual past expenses can help you identify trends and validate the accuracy of your calculations. Historical data can also provide context for your variable costs, allowing you to make more informed decisions about budgeting and pricing.

Consult Additional Resources

While online calculators are useful tools, they should not be the only resource you rely on. Consider consulting financial literature, industry reports, or professional advice to gain deeper insights into variable costs. Understanding the broader economic factors and industry-specific considerations can help you refine your calculations and overall cost analysis.

Keep It Updated

As your production methods or business conditions change, so too will your variable costs. Regularly revisit your calculations and update your inputs accordingly. This will ensure that your financial planning remains accurate and relevant, helping you make informed decisions that align with your current operational realities.

By following these guidelines, you can maximize the accuracy and relevance of your variable cost calculations, ultimately supporting better financial decision-making for your business.

Frequently Asked Questions (FAQs)

1. What is a variable cost, and how is it different from fixed costs?

Variable costs are expenses that change in direct proportion to the level of production or sales output. Examples include costs for raw materials, direct labor, and shipping. In contrast, fixed costs remain constant regardless of production levels, such as rent or salaries. Understanding the difference is crucial for effective budgeting and financial planning.

2. How do I calculate total variable costs?

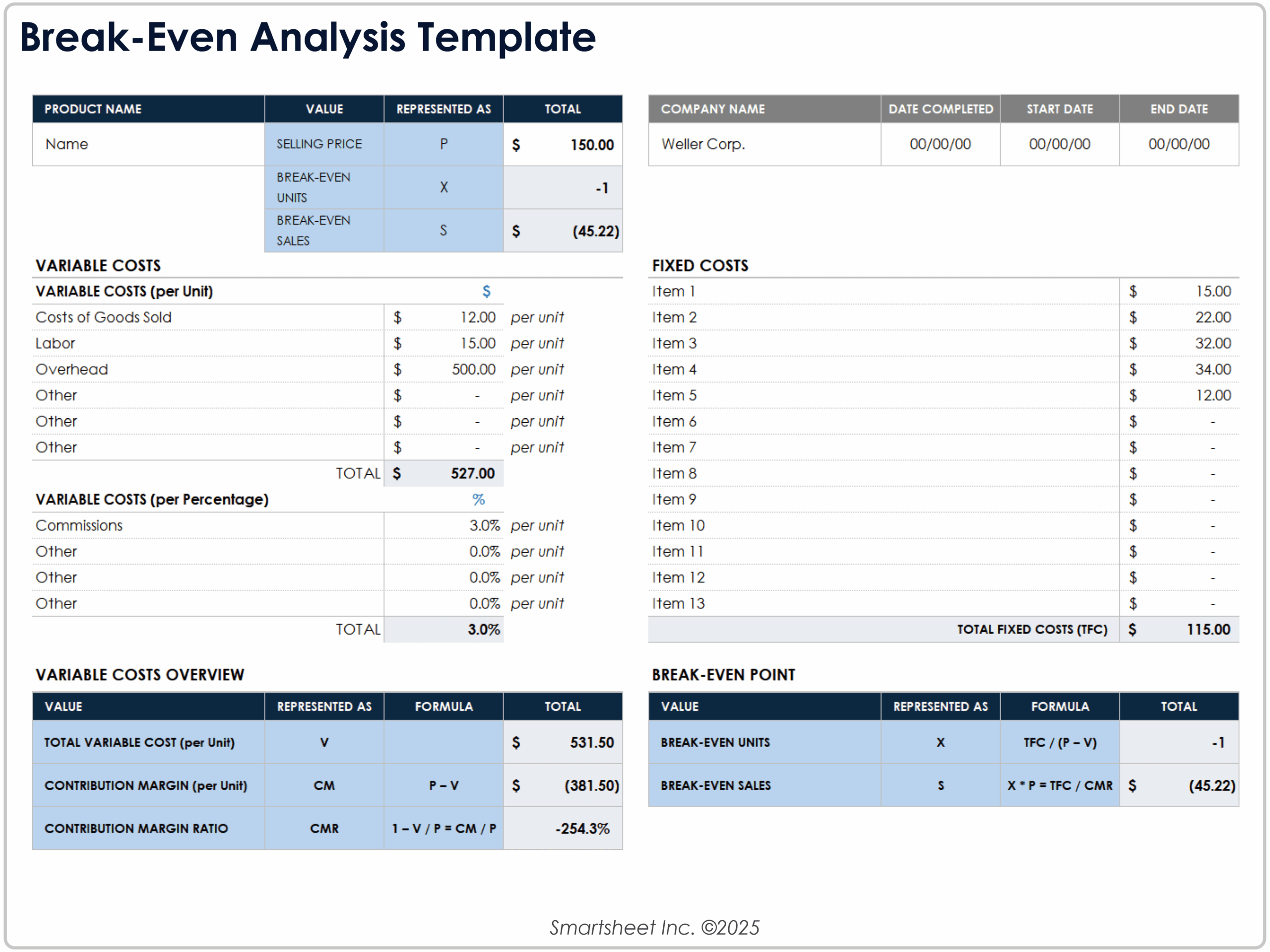

To calculate total variable costs, use the formula:

Total Variable Cost = Quantity of Output x Variable Cost Per Unit

This means you multiply the number of units produced by the variable cost associated with each unit. For example, if you produce 100 items at a variable cost of $5 per item, the total variable cost would be $500.

3. Why is it important to analyze variable costs?

Analyzing variable costs is essential for several reasons: it helps in setting competitive prices, budgeting for production, determining break-even points, and assessing overall profitability. By understanding how variable costs fluctuate with production levels, businesses can make informed decisions about scaling operations and improving profit margins.

4. Can variable costs affect my business’s pricing strategy?

Yes, variable costs directly impact pricing strategies. If a business understands its variable costs, it can set prices that cover these costs while ensuring a profit margin. For instance, if the variable cost of producing a product is $10 and the business wants to achieve a 50% profit margin, it should price the product at $20.

5. What tools or calculators can help me calculate variable costs online?

There are numerous online tools and calculators designed to assist with calculating variable costs. Many accounting software options, like QuickBooks and FreshBooks, offer features to track and analyze variable costs. Additionally, dedicated cost calculators are available on financial websites, which can help simplify the process by allowing users to input their data and receive instant calculations.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.