The 5 Best Ifta Calculators of 2025 (Reviewed)

Finding the Best Ifta Calculator: An Introduction

Finding a reliable International Fuel Tax Agreement (IFTA) calculator can be a daunting task for many truck drivers and fleet managers. With the complexities involved in accurately calculating fuel taxes across different jurisdictions, it’s crucial to have a dependable tool at your disposal. The IFTA reporting process often requires meticulous record-keeping of miles traveled and fuel purchased in various states, making the calculations tedious and time-consuming. In this landscape of options, choosing the right IFTA calculator can significantly streamline your reporting efforts, minimize errors, and save valuable time.

The goal of this article is to review and rank the top IFTA calculators available online, helping you make an informed decision when selecting a tool that meets your specific needs. We have meticulously analyzed several calculators based on key criteria such as accuracy, ease of use, features, and customer support. Each of these factors plays a vital role in ensuring that your IFTA calculations are not only correct but also efficient.

In our ranking process, we have taken into account the user interface and overall experience of each calculator, as well as the ability to integrate with other tools, such as Electronic Logging Devices (ELDs) and fuel management systems. By focusing on these elements, we aim to provide you with a comprehensive guide that will simplify your search for the best IFTA calculator, ultimately enhancing your operational efficiency and compliance with fuel tax regulations. Whether you are a seasoned trucking professional or new to the industry, our review will help you find the right tool to facilitate your IFTA reporting process.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best IFTA Calculators

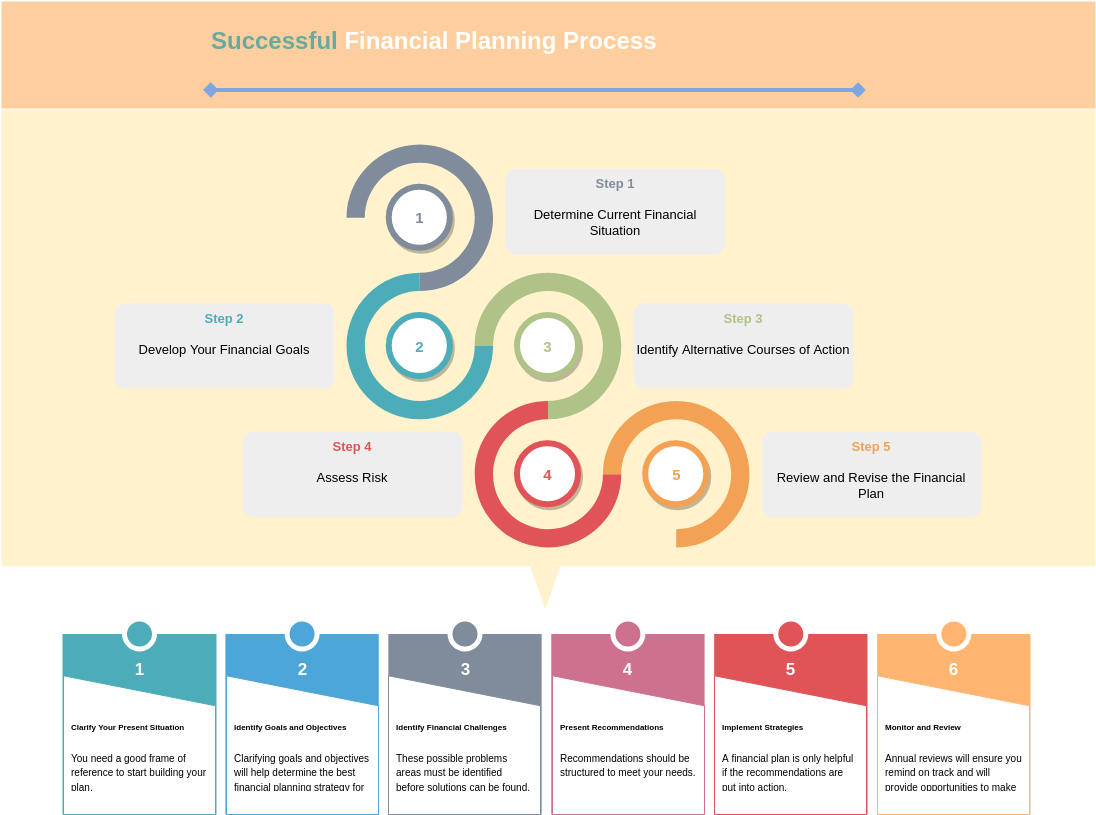

When evaluating the best online IFTA calculators, we focused on several essential criteria to ensure that users can easily and accurately calculate their International Fuel Tax Agreement (IFTA) obligations. Here’s a detailed breakdown of the key factors we considered:

-

Accuracy and Reliability

– The foremost requirement for any IFTA calculator is the accuracy of its calculations. We assessed tools that consistently provide correct tax amounts based on the latest state tax rates. Reliable calculators should also offer a self-audit feature to help users verify their inputs and results. -

Ease of Use

– A user-friendly interface is crucial for efficiency, especially for busy truckers and fleet managers. We prioritized calculators that allow quick input of necessary data without overwhelming the user. Intuitive designs with clear instructions and minimal steps to complete calculations were highly favored. -

Key Features

– We looked for tools that include essential features for comprehensive IFTA reporting. Key inputs that should be accommodated include:- Base Jurisdiction: The state or province where the vehicle is registered.

- Fuel Type: Options for different fuel types (e.g., diesel, gasoline).

- Mileage and Fuel Data: Fields for users to enter miles traveled and gallons of fuel purchased per state.

- Quarter Selection: An option to select the relevant reporting quarter.

- Tax Summary Reports: The ability to generate and download a detailed report summarizing the tax calculations.

-

Cost (Free vs. Paid)

– We evaluated both free and paid options, considering the value offered at each price point. While free calculators are appealing, we also examined paid tools that might offer additional features, integrations, or support that justify their costs. -

Integration Capabilities

– For users looking for a streamlined approach, we considered calculators that can integrate with other software tools, such as Electronic Logging Devices (ELDs) or fleet management systems. This feature allows automatic data input, reducing manual entry errors and saving time. -

Customer Support

– Access to customer support is vital for resolving issues quickly. We reviewed the availability of support options, including live chat, email, or phone assistance, which can help users navigate any challenges they encounter while using the calculator. -

User Reviews and Reputation

– Lastly, we analyzed user feedback and ratings to gauge overall satisfaction with each calculator. Tools that have garnered positive reviews from users for their functionality, reliability, and support were given higher preference.

By applying these criteria, we aimed to present a comprehensive list of the best IFTA calculators available, ensuring that our recommendations meet the diverse needs of our audience. Whether you’re a seasoned trucker or new to IFTA reporting, these tools can simplify the process and help ensure compliance.

The Best Ifta Calculators of 2025

3. IFTA Miles Calculator

The IFTA Miles Calculator from eTrucks.com is a specialized tool designed to simplify the process of calculating IFTA taxes for trucking operations. With its automated features, users can effortlessly generate accurate IFTA mileage reports, streamlining tax reporting and compliance. This trucking software not only enhances efficiency but also reduces the risk of errors, making it an essential resource for fleet operators looking to manage their IFTA obligations effectively.

- Website: etrucks.com

- Established: Approx. 27 years (domain registered in 1998)

4. Easiest Way To Calculate Your IFTA – A 4 Step Guide

The “Easiest Way To Calculate Your IFTA” guide from Switchboard offers a straightforward, four-step process tailored for fleet managers and owner-operators. It simplifies the calculation of mileages and fuel taxes, ensuring that users can efficiently manage their IFTA reporting. With clear instructions and practical tips, this guide serves as a valuable resource for those navigating the complexities of fuel tax compliance.

- Website: onswitchboard.com

- Established: Approx. 10 years (domain registered in 2015)

5. IFTA calculators, what do you guys use? Any good or bad ones to …

The discussion around IFTA calculators highlights the importance of efficient mileage and fuel tracking for commercial vehicles. Users often rely on spreadsheets to record miles and gas expenses, which they later input into IFTA filing systems. This method, while functional, can be cumbersome and prone to errors. A dedicated IFTA calculator could streamline the process, offering features like automated calculations, real-time data tracking, and integration with reporting systems for more accurate filings.

- Website: reddit.com

- Established: Approx. 20 years (domain registered in 2005)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy in IFTA calculations starts with the data you provide. Before hitting the calculate button, take a moment to carefully review your inputs. Ensure that all fields, such as miles traveled, gallons of fuel purchased, and the correct state or province, are filled out accurately. Any errors in these entries can lead to significant discrepancies in your final tax calculations. If the calculator allows for multiple entries per state, make sure that each one reflects the correct information, including different fuel types if applicable.

Understand the Underlying Assumptions

Each IFTA calculator may operate under different assumptions regarding tax rates, fuel types, and jurisdictional rules. Familiarize yourself with how the tool calculates taxes and what data it uses. For instance, some calculators automatically update tax rates based on the latest data, while others may require you to input these rates manually. Understanding these nuances can help you gauge the reliability of the results and avoid potential pitfalls that could arise from outdated or incorrect assumptions.

Use Multiple Tools for Comparison

To ensure the accuracy of your calculations, consider using more than one IFTA calculator. This can provide a form of cross-verification, allowing you to identify any inconsistencies in the results generated by different tools. By comparing outputs from multiple calculators, you can gain confidence in your final figures or spot potential errors that may need further investigation. It’s a simple yet effective way to ensure that you’re getting the most accurate estimates possible.

Keep Records of Your Inputs and Results

Maintaining a log of your inputs and the results from each calculation can be extremely beneficial. This not only helps you track your calculations over time but also provides a reference point for future reports. If discrepancies arise during audits or reviews, having a clear record of what data you entered and the calculations made can help clarify the situation and support your claims.

Stay Updated on Tax Regulations

IFTA tax rates and regulations can change frequently. To ensure your calculations are accurate, stay informed about any updates in the tax codes relevant to your base jurisdiction. Many calculators will have features that automatically update these rates, but it’s still a good practice to verify that you are working with the latest information. Regularly check state or provincial transportation websites for announcements regarding fuel tax rates and filing deadlines.

Seek Help When Needed

If you find yourself struggling to navigate the intricacies of IFTA calculations, don’t hesitate to reach out for help. Many online calculators offer customer support or resources like FAQs and tutorials. Engaging with these resources can provide clarification and enhance your understanding of the IFTA filing process, ensuring that you maximize the utility of the calculator and achieve the most accurate results possible.

Frequently Asked Questions (FAQs)

1. What is an IFTA calculator and how does it work?

An IFTA (International Fuel Tax Agreement) calculator is an online tool designed to help trucking companies and commercial vehicle operators calculate their fuel tax obligations for multiple jurisdictions. To use it, you typically need to input information such as your base jurisdiction, the fuel type, the quarter for which you are reporting, and the miles traveled and gallons of fuel purchased in each state. The calculator then processes this data and provides a tax summary report, indicating the total IFTA taxes due.

2. What information do I need to use an IFTA calculator?

To effectively use an IFTA calculator, you will need the following information:

– Your vehicle’s base jurisdiction (the state where your vehicle is registered).

– The reporting quarter for which you are calculating taxes.

– The type of fuel used (e.g., diesel, gasoline).

– The total miles traveled and gallons of fuel purchased for each jurisdiction during the quarter.

3. Who is required to file IFTA reports?

IFTA reports are required for qualified commercial motor vehicles operating in interstate transport across multiple U.S. states or Canadian provinces that are members of the IFTA agreement. A vehicle is generally considered qualified if it has three or more axles, has two axles and a gross vehicle weight exceeding 26,000 pounds, or is used in combination with a registered gross vehicle weight over 26,000 pounds. Recreational vehicles are typically excluded from this requirement.

4. When are IFTA tax returns due?

IFTA tax returns are filed quarterly, and the due dates are as follows:

– 1st Quarter (January – March): Due by April 30

– 2nd Quarter (April – June): Due by July 31

– 3rd Quarter (July – September): Due by October 31

– 4th Quarter (October – December): Due by January 31

If a due date falls on a weekend or a state holiday, the deadline is extended to the next business day.

5. Are there any costs associated with using an IFTA calculator?

Many IFTA calculators are available for free online, allowing users to perform calculations without any fees. However, some services may offer premium features or comprehensive reporting tools for a subscription or one-time fee. It’s essential to review the specific terms of the calculator you choose to understand any potential costs involved.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.