The 5 Best Manufactured Home Mortgage Calculators of 2025 (Reviewed)

Finding the Best Manufactured Home Mortgage Calculator: An Introduction

Finding the right mortgage calculator for manufactured homes can be a daunting task. With the increasing popularity of manufactured homes as a viable housing option, many potential buyers are seeking reliable online tools to help them navigate the complexities of mortgage financing. However, not all calculators are created equal. Many may lack essential features, provide inaccurate estimates, or be overly complicated to use, which can lead to confusion and frustration for users.

This article aims to simplify your search by reviewing and ranking the top manufactured home mortgage calculators available online. Our goal is to save you time and effort by providing clear, unbiased evaluations of these tools, helping you make informed decisions about your financing options.

Criteria for Ranking

To determine the best calculators, we have considered several key factors:

- Accuracy: We assessed how well each calculator estimates monthly payments, considering various inputs such as loan amount, interest rate, and loan term.

- Ease of Use: User-friendly interfaces and straightforward navigation were prioritized to ensure that even those unfamiliar with mortgage calculations can use the tools effectively.

- Features: We examined the range of features offered, including the ability to input different loan types, down payment amounts, and additional costs like property taxes and insurance.

- Customer Support: The availability of customer assistance and educational resources was also a factor, as these can enhance the user experience.

By focusing on these criteria, we hope to provide you with a comprehensive overview of the best manufactured home mortgage calculators, enabling you to choose the one that best suits your needs.

Our Criteria: How We Selected the Top Tools

Selection Criteria for the Best Manufactured Home Mortgage Calculators

When evaluating the top manufactured home mortgage calculators, we considered several essential criteria that ensure users can make informed decisions about their financing options. Below are the key factors that guided our selection process:

-

Accuracy and Reliability

The primary goal of any mortgage calculator is to provide users with accurate estimations of their potential mortgage payments. We assessed each tool’s ability to deliver reliable results based on the inputs provided. This included checking if the calculators incorporate current interest rates, taxes, and insurance costs relevant to manufactured homes. -

Ease of Use

A user-friendly interface is crucial for a positive user experience. We looked for calculators that are intuitive and straightforward, allowing users to input their data without confusion. Clear instructions and a logical flow of input fields significantly enhance usability, especially for first-time home buyers. -

Key Features

Effective mortgage calculators should offer a variety of inputs that cater specifically to manufactured home financing. We prioritized tools that include:

– Home Price: The estimated purchase price of the manufactured home.

– Down Payment: Options to specify both the amount and percentage of the down payment.

– Loan Amount: Calculation of the mortgage amount after the down payment.

– Loan Term: Flexibility to choose different loan durations (e.g., 15, 20, or 30 years).

– Interest Rate: Ability to input current market interest rates.

– Property Tax and Insurance: Fields to include annual property taxes and homeowners insurance costs, which are vital for accurate monthly payment estimates.

– Private Mortgage Insurance (PMI): Options to calculate PMI costs, particularly for loans with down payments less than 20%. -

Cost (Free vs. Paid)

We analyzed whether the calculators were free to use or required payment. Free tools are generally more accessible for users, but we also considered the value offered by paid options, such as additional features or personalized services. Transparency regarding any costs associated with the calculator is essential for user trust.

-

Customer Support and Resources

Excellent customer support can enhance the user experience, especially for those unfamiliar with mortgage processes. We favored tools that provide easily accessible resources, such as FAQs, contact information, and educational materials to help users better understand their mortgage options. -

Reviews and Reputation

Finally, we considered user feedback and expert reviews of each calculator. Tools with positive ratings and testimonials from users, as well as a solid reputation in the industry, were given priority in our selection.

By focusing on these criteria, we aimed to identify the best manufactured home mortgage calculators that meet the needs of potential homebuyers, helping them make informed financial decisions with confidence.

The Best Manufactured Home Mortgage Calculators of 2025

1. Mobile Home Mortgage Calculator

The Mobile Home Mortgage Calculator from Triad Financial Services is a user-friendly tool designed to help potential homeowners estimate their monthly payments on manufactured home loans. This calculator not only simplifies the process of budgeting for a mobile home purchase but also provides insights into various affordable financing options available. With its straightforward interface, users can quickly assess their financial commitments and make informed decisions about their mobile home investments.

- Website: triadfs.com

- Established: Approx. 25 years (domain registered in 2000)

2. Calculator

The Manufactured Home Mortgage Calculator from mhmloan.com is a user-friendly tool designed to help potential borrowers estimate their monthly payments on a conventional loan for a manufactured home. By inputting specific loan parameters, users can quickly determine their total payment amount, exemplified by a calculated payment of $1,523.64 for a loan with a 0.00% down payment. This calculator simplifies the mortgage planning process, making it easier for users to understand their financial commitments.

- Website: mhmloan.com

- Established: Approx. 20 years (domain registered in 2005)

3. Mortgage Calculator

The Mortgage Calculator at mortgagecalculator.org is a user-friendly online tool designed to help homeowners estimate their monthly mortgage payments accurately. It takes into account essential factors such as private mortgage insurance (PMI), property taxes, and homeowners insurance, providing a comprehensive overview of potential costs. This free resource is ideal for anyone looking to save money on their home loan by gaining insight into their financial obligations before making a purchase.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

4. Monthly Payment Calculator

The Monthly Payment Calculator from Champion Homes is a user-friendly tool designed to help prospective homebuyers estimate their mortgage payments. By allowing users to input and adjust various values, this calculator provides a clear estimate of affordable mortgage rates tailored to individual financial situations. Its intuitive interface empowers users to take charge of their home buying journey, making it easier to plan and budget for their new home.

- Website: championhomes.com

- Established: Approx. 25 years (domain registered in 2000)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps in using manufactured home mortgage calculators is to ensure that all your inputs are accurate. These calculators typically require information such as home price, down payment, loan term, interest rate, and monthly debts. A small error in any of these figures can lead to significantly different results. Before hitting the calculate button, take a moment to review each entry for accuracy. If possible, consult financial documents or recent statements to verify your numbers.

Understand the Underlying Assumptions

Each mortgage calculator operates under specific assumptions that can affect your results. For instance, some calculators may include or exclude certain costs, such as property taxes, homeowners insurance, and private mortgage insurance (PMI). Familiarize yourself with these assumptions and understand what they mean for your calculations. This knowledge will help you interpret the results more effectively and apply them to your financial planning.

Use Multiple Tools for Comparison

No single calculator can provide a complete picture of your mortgage situation. To get the most accurate results, consider using multiple mortgage calculators. Different tools may offer unique features or take into account various factors that others do not. By comparing results across different calculators, you can identify discrepancies and gain a more comprehensive understanding of your potential mortgage payments. This approach also allows you to evaluate different scenarios, such as varying interest rates or down payment amounts.

Experiment with Different Scenarios

Mortgage calculators often allow you to manipulate various inputs to see how changes affect your monthly payments and overall loan costs. Don’t hesitate to experiment with different scenarios. For example, try adjusting the down payment percentage, loan term, or interest rate to see how these changes impact your monthly payments and total interest paid over the life of the loan. This experimentation can provide valuable insights into what loan structure might work best for your financial situation.

Consult with a Financial Advisor

While online calculators are excellent tools for estimating mortgage payments, they should not replace professional financial advice. If you’re unsure about any aspect of the mortgage process or how to interpret your calculator results, consider consulting with a financial advisor or mortgage specialist. They can provide personalized guidance based on your unique financial circumstances and help you make informed decisions about your manufactured home mortgage.

Keep Up with Market Trends

Interest rates and lending criteria can fluctuate based on market conditions. To ensure your calculations remain relevant, stay informed about current mortgage rates and trends. Regularly checking financial news or consulting with lenders can help you adjust your inputs accordingly, ensuring that your estimates reflect the most accurate and up-to-date information available.

Frequently Asked Questions (FAQs)

1. What is a manufactured home mortgage calculator?

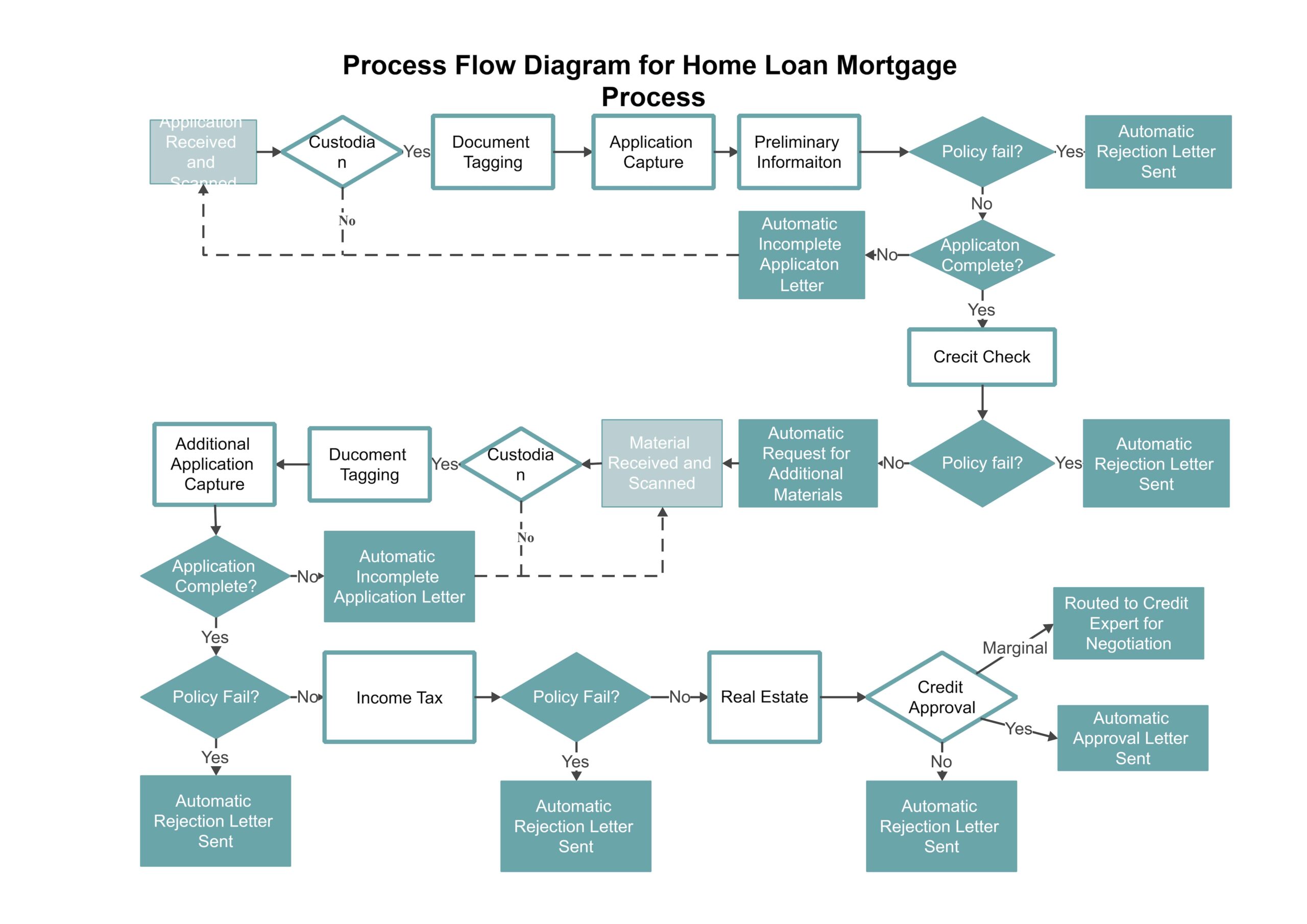

A manufactured home mortgage calculator is an online tool that helps potential buyers estimate their monthly mortgage payments for a manufactured or mobile home. By inputting details such as home price, down payment, interest rate, loan term, and additional costs (like property taxes and insurance), users can get a clear idea of what their monthly obligations may be. This tool is beneficial for budgeting and understanding the financial commitment involved in purchasing a manufactured home.

2. How do I use a manufactured home mortgage calculator?

Using a manufactured home mortgage calculator is straightforward. First, gather the necessary information, including the home price, down payment amount or percentage, interest rate, loan term (in years), and any additional costs such as property taxes and insurance. Enter these details into the calculator, and it will compute your estimated monthly payment, including principal and interest. Some calculators also provide a breakdown of costs, helping you understand where your money will go each month.

3. Are the results from a manufactured home mortgage calculator accurate?

The results from a manufactured home mortgage calculator are estimates based on the information you provide. While they can give you a good approximation of your potential monthly payments, they may not reflect the exact terms offered by lenders. Factors like your credit score, specific loan terms, and market conditions can influence the final figures. It’s always advisable to consult with a mortgage professional for a more precise assessment tailored to your situation.

4. What factors can I input into a manufactured home mortgage calculator?

Most manufactured home mortgage calculators allow users to input several key factors, including:

- Home Price: The total cost of the manufactured home.

- Down Payment: The amount or percentage you plan to pay upfront.

- Interest Rate: The annual interest rate for the mortgage.

- Loan Term: The duration of the loan, typically in years (e.g., 15, 20, or 30 years).

- Property Taxes: Yearly taxes that will be included in your monthly payment.

- Homeowners Insurance: Annual insurance costs for protecting your home.

- Private Mortgage Insurance (PMI): If applicable, this protects the lender in case of default.

Entering these factors allows for a comprehensive calculation of your monthly mortgage payment.

5. Can I use a manufactured home mortgage calculator for refinancing?

Yes, you can use a manufactured home mortgage calculator for refinancing your existing mortgage. When refinancing, you’ll want to input your current mortgage balance, the new interest rate, the loan term for the refinance, and any additional costs associated with the new loan. This will help you estimate your new monthly payments and compare them with your existing mortgage payments to determine if refinancing is a beneficial option for you.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.