The 5 Best Missouri Vehicle Sales Tax Calculators of 2025 (Reviewed)

Finding the Best Missouri Vehicle Sales Tax Calculator: An Introduction

Navigating the complexities of vehicle sales tax in Missouri can be a daunting task, especially for those who are unfamiliar with the state’s tax structure. With varying rates based on location and specific regulations, calculating the correct tax amount can lead to confusion and frustration. The challenge lies in finding a reliable and user-friendly online tool that accurately computes vehicle sales tax, factoring in the intricate details unique to Missouri’s tax system.

This article aims to simplify that search by reviewing and ranking the best Missouri vehicle sales tax calculators available online. By providing a curated list of top tools, our goal is to save you valuable time and effort while ensuring you have access to the most accurate and efficient calculators at your disposal.

To determine the best options, we evaluated several key criteria. Accuracy is paramount; we ensured that each tool provides reliable calculations based on the latest tax rates and regulations. Ease of use was also a significant factor, as a user-friendly interface can greatly enhance the experience for individuals who may not be tax-savvy. Additionally, we examined the features offered by each calculator, such as the ability to input specific ZIP codes, view a breakdown of tax components, and receive instant results.

With this comprehensive analysis, you can feel confident in selecting a Missouri vehicle sales tax calculator that meets your needs, allowing you to make informed decisions when purchasing a vehicle. Let’s explore the top contenders in this essential category.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Missouri Vehicle Sales Tax Calculators

When evaluating the top online tools for calculating vehicle sales tax in Missouri, we focused on several key factors to ensure that users can find the most effective and reliable calculators. The following criteria guided our selection process:

-

Accuracy and Reliability

– The primary function of a sales tax calculator is to provide accurate results. We prioritized tools that utilize the latest tax rates and regulations, ensuring that users receive precise calculations based on their specific circumstances. Tools that are frequently updated to reflect changes in tax laws were favored. -

Ease of Use

– A user-friendly interface is crucial for any online tool. We looked for calculators that are intuitive and straightforward, allowing users to navigate easily without confusion. Clear instructions and a simple layout can significantly enhance the user experience, especially for those who may not be tech-savvy. -

Key Features

– Effective calculators should offer essential inputs that reflect the complexities of vehicle sales tax in Missouri. We assessed the following features:- Input Fields: The ability to enter the sale amount, select a ZIP code or tax region, and choose specific vehicle types (if applicable).

- Tax Breakdown: A detailed view of the various components of the tax, including state, county, city, and any special district taxes.

- Real-Time Calculations: Instant feedback on the tax amount and total cost after including sales tax.

-

Cost (Free vs. Paid)

– We focused on the availability of free calculators, as many users seek no-cost solutions for tax calculations. Tools that provide comprehensive features without requiring a subscription or payment were prioritized, ensuring accessibility for all users. -

Mobile Compatibility

– Given the increasing use of mobile devices, we evaluated whether the calculators are optimized for mobile use. Tools that function seamlessly on smartphones and tablets allow users to perform calculations on the go, which is particularly valuable for those making quick decisions during vehicle transactions.

-

Customer Support and Resources

– Access to customer support, FAQs, and additional resources can enhance the user experience. We considered tools that offer guidance, whether through chat support or comprehensive help sections, as they can assist users in resolving any issues or questions they may have. -

User Reviews and Ratings

– Feedback from actual users can provide insight into the effectiveness and reliability of a calculator. We reviewed user testimonials and ratings to gauge overall satisfaction and identify any common issues that might affect user experience.

By adhering to these criteria, we aimed to identify the most effective Missouri vehicle sales tax calculators that meet the needs of a diverse audience, from individual consumers to businesses.

The Best Missouri Vehicle Sales Tax Calculators of 2025

3. Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator by TimeTrex is a user-friendly tool designed to help users accurately determine sales tax rates based on ZIP code or region. Its straightforward interface allows for quick calculations, ensuring that users receive precise tax amounts efficiently. Ideal for businesses and consumers alike, this calculator simplifies the process of sales tax management in Missouri, making it a valuable resource for anyone needing accurate tax information.

- Website: timetrex.com

- Established: Approx. 21 years (domain registered in 2004)

4. Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator from Omni Calculator is designed to simplify the process of estimating sales tax for purchases made within the state. This user-friendly tool allows users to input their purchase amount and quickly calculates the applicable sales tax, ensuring accurate budgeting and financial planning. Its straightforward interface makes it accessible for anyone looking to understand their tax obligations in Missouri.

- Website: omnicalculator.com

- Established: Approx. 11 years (domain registered in 2014)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a Missouri vehicle sales tax calculator, the first step to ensuring accurate results is to carefully input the necessary data. This typically includes the sale amount and the appropriate ZIP code or tax region. A small error in the sale amount or selecting the wrong location can significantly affect your tax calculation. Take a moment to review your entries before hitting the “Calculate” button. If the calculator allows for it, consider using a numeric format (e.g., 15000 instead of $15,000) to avoid misinterpretation of your inputs.

Understand the Underlying Assumptions

Different calculators may operate on varying assumptions regarding tax rates, exemptions, and additional fees. Familiarize yourself with the specific tool you are using. For instance, some calculators might automatically include local sales tax, while others may require you to account for it manually. Understanding how the calculator derives its results can help you interpret the output more effectively and identify any additional calculations you may need to perform.

Use Multiple Tools for Comparison

To achieve the most accurate tax estimate, it can be beneficial to use multiple Missouri vehicle sales tax calculators. By comparing the results from different tools, you can identify any discrepancies and gain a better understanding of the tax landscape. Each calculator may utilize slightly different algorithms or tax rate databases, so cross-referencing multiple sources can help ensure that you are working with the most reliable figures.

Keep Updated with Tax Changes

Sales tax rates can change frequently due to new legislation or local government decisions. Before making a significant purchase, ensure that the calculator you are using is updated with the latest tax rates. Many calculators will indicate when they were last updated; if you notice that a tool hasn’t been refreshed recently, consider checking the Missouri Department of Revenue website for the most current rates.

Review Tax Exemptions

Certain transactions may qualify for tax exemptions, which can significantly impact your final sales tax amount. Familiarize yourself with the specific exemptions applicable in Missouri, such as those for agricultural purchases or non-profit organizations. Some calculators may allow you to input exemption details, while others may not. Knowing what exemptions you might qualify for can help you adjust your calculations accordingly and avoid overestimating your tax liability.

Consult with a Tax Professional

If you have unique circumstances or are unsure about the inputs required for the calculator, consulting a tax professional can provide clarity. They can offer personalized guidance and help ensure that you understand all relevant tax obligations, including any local nuances that may not be captured by online calculators. This step is particularly vital for larger transactions or if you are unsure about eligibility for specific exemptions.

By following these tips, you can maximize the accuracy of your sales tax calculations and make informed financial decisions when purchasing a vehicle in Missouri.

Frequently Asked Questions (FAQs)

1. What is a Missouri vehicle sales tax calculator?

A Missouri vehicle sales tax calculator is an online tool designed to help individuals and businesses estimate the sales tax owed on vehicle purchases in Missouri. By inputting the sale amount and selecting the relevant ZIP code or tax region, users can quickly calculate the total sales tax, including state, county, and city rates.

2. How do I use the Missouri vehicle sales tax calculator?

Using the calculator is straightforward. First, select a ZIP code or tax region where the vehicle purchase will occur. Next, enter the total sale amount of the vehicle (before tax) in the designated field. After that, click the “Calculate Tax” button to view the estimated sales tax, tax breakdown by jurisdiction, and the total amount due (sale amount plus tax).

3. Why is it important to know the sales tax for vehicle purchases in Missouri?

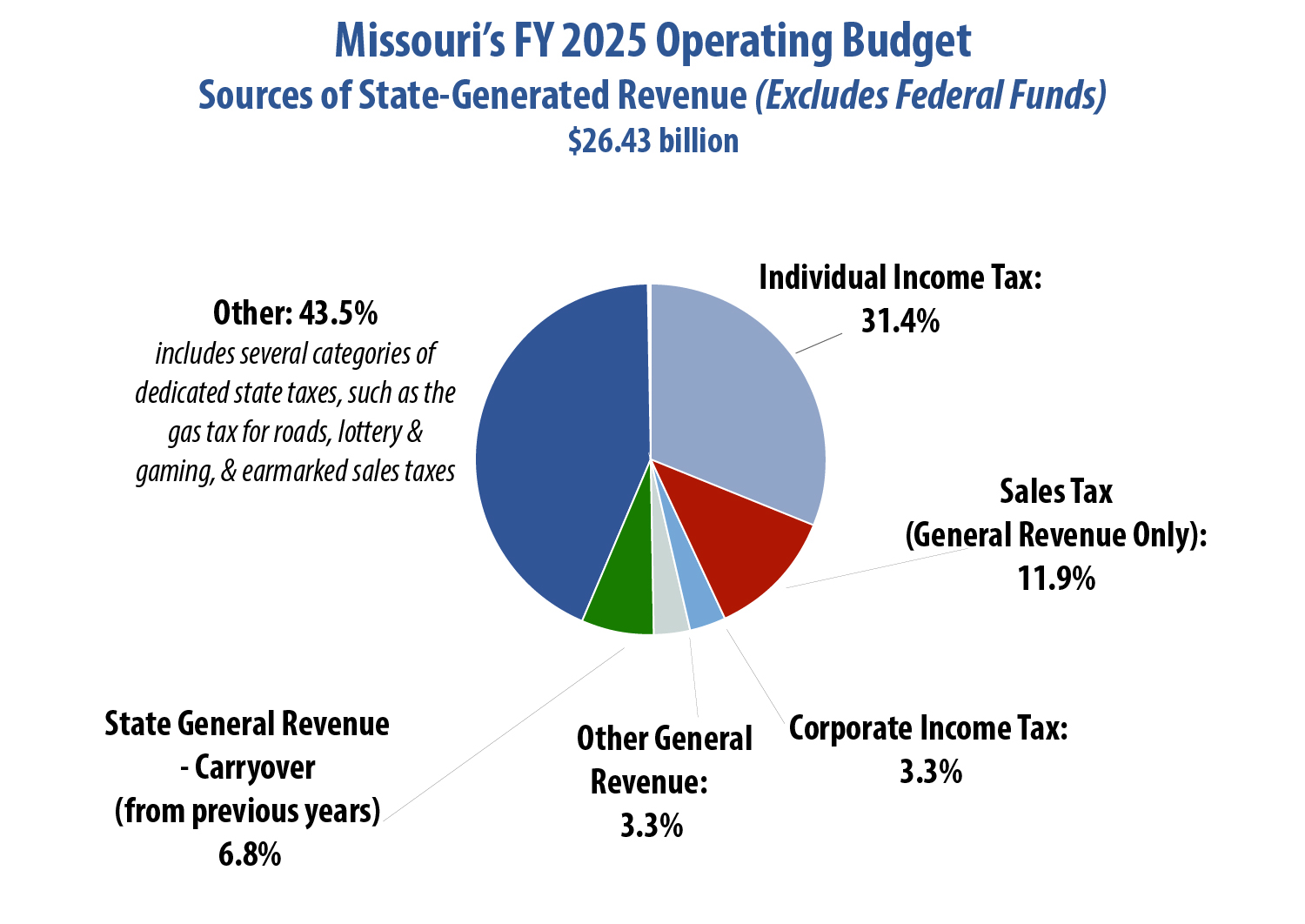

Understanding the sales tax applicable to vehicle purchases is crucial for budgeting and compliance. Missouri’s sales tax can vary significantly based on location due to state, county, and city rates. Accurately calculating the tax ensures that buyers are prepared for the total cost of the vehicle and can avoid unexpected financial burdens at the time of purchase.

4. Are there any exemptions or deductions available when calculating vehicle sales tax in Missouri?

Yes, Missouri has specific exemptions and deductions that may apply to vehicle sales tax. For instance, certain agricultural vehicles may be exempt from sales tax, and buyers may also qualify for deductions if trading in a vehicle. It’s important to check the latest Missouri sales tax laws or consult with a tax professional to determine eligibility for any exemptions.

5. Can I use the Missouri vehicle sales tax calculator for other types of purchases?

While the Missouri vehicle sales tax calculator is primarily designed for vehicle purchases, it can also provide insights into general sales tax calculations for various taxable goods and services within Missouri. However, for specific products, it is advisable to use calculators tailored to those items, as different rules and rates may apply.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.