The 5 Best Mo Vehicle Sales Tax Calculators of 2025 (Reviewed)

Finding the Best Mo Vehicle Sales Tax Calculator: An Introduction

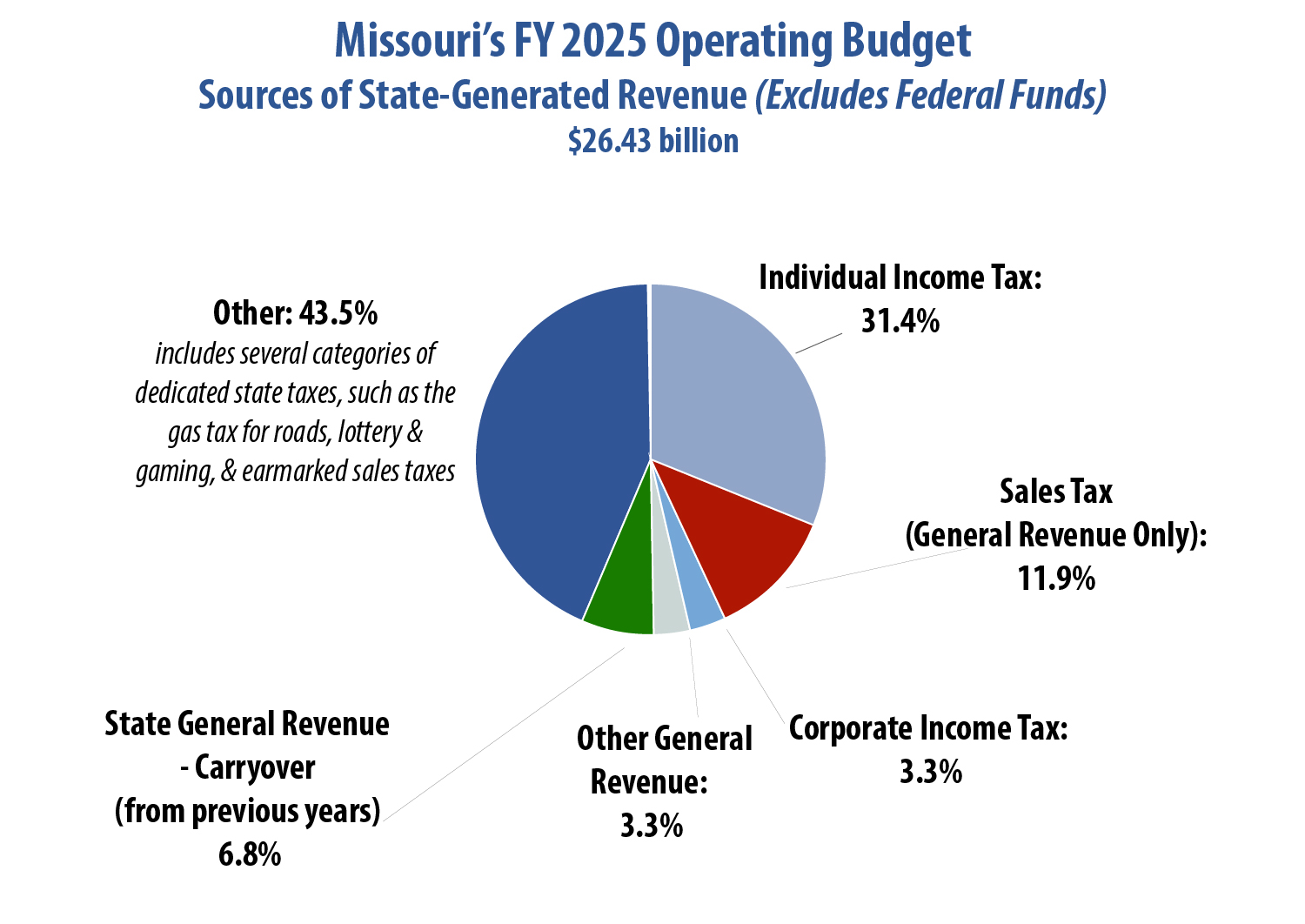

When it comes to purchasing a vehicle in Missouri, understanding the sales tax implications can be quite a daunting task. The state has a complex tax structure that varies not just by the state but also by county and city, making it essential for buyers to calculate their expected sales tax accurately. However, with so many online tools available, finding a reliable Missouri vehicle sales tax calculator can be challenging. Many calculators may lack essential features, provide outdated information, or lead to confusion with their interfaces.

This article aims to simplify that search by reviewing and ranking the top Missouri vehicle sales tax calculators available online. Our goal is to save you time and effort by identifying the most effective tools that deliver accurate calculations and user-friendly experiences.

Criteria for Ranking

To ensure that we provide you with the best options, we evaluated each calculator based on several key criteria:

-

Accuracy: Each tool must provide precise calculations based on the latest tax rates and regulations in Missouri.

-

Ease of Use: A good calculator should be intuitive and easy to navigate, allowing users to input their data quickly and effortlessly.

-

Features: We considered additional functionalities such as breakdowns of tax rates, support for exemptions, and the ability to calculate taxes based on different locations.

-

Accessibility: The availability of the calculator across various devices and its loading speed were also taken into account.

By focusing on these criteria, we aim to guide you towards the most effective tools to assist you in your vehicle purchase decision-making process. Whether you are a first-time buyer or a seasoned car owner, understanding the sales tax landscape is crucial, and the right calculator can make all the difference.

Our Criteria: How We Selected the Top Tools

Selection Criteria for Missouri Vehicle Sales Tax Calculators

When evaluating the best online tools for calculating Missouri vehicle sales tax, we focused on several critical factors to ensure that users can easily find an accurate and reliable calculator. Below are the key criteria we considered:

-

Accuracy and Reliability

– The foremost requirement for any sales tax calculator is its ability to provide accurate results. We assessed each tool’s methodology for calculating tax rates based on the latest Missouri sales tax regulations, including state, county, city, and special district rates. Tools that frequently update their databases or provide clear sources for their tax rates were prioritized. -

Ease of Use

– User-friendliness is crucial for any online tool. We looked for calculators that feature intuitive interfaces, allowing users to navigate easily without needing extensive technical knowledge. Clear instructions and a straightforward input process enhance the user experience significantly. -

Key Features

– A comprehensive calculator should offer several essential features, including:- Input Options: Users should be able to enter the sale amount and select their ZIP code or tax region to receive precise tax calculations.

- Detailed Tax Breakdown: The best tools provide a detailed breakdown of the total tax amount, including individual rates for state, county, city, and any applicable special district taxes.

- Total Cost Calculation: A useful feature is the ability to show the total cost, combining the sale amount and calculated tax, for a complete financial picture.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or require a subscription or one-time payment. Free tools were favored, especially those that do not compromise on features or accuracy. Transparency regarding any costs associated with the tool was also considered essential.

-

Mobile Compatibility

– With many users accessing tools from mobile devices, we assessed the mobile-friendliness of each calculator. Responsive designs that maintain functionality and readability across different screen sizes are critical for accessibility. -

User Reviews and Feedback

– We considered user reviews and testimonials to gauge overall satisfaction and reliability. Tools that received consistent positive feedback regarding their performance and accuracy were rated higher. -

Support and Resources

– Finally, we looked for calculators that offer additional resources, such as FAQs, customer support, or tax-related articles. This feature can help users better understand the tax implications of their vehicle purchases and navigate any complexities.

By applying these criteria, we ensured that the selected Missouri vehicle sales tax calculators not only meet user needs but also provide a reliable and efficient way to calculate sales tax accurately.

The Best Mo Vehicle Sales Tax Calculators of 2025

3. Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator by TimeTrex is a user-friendly tool designed to help individuals and businesses accurately calculate sales tax rates based on ZIP code or region. Its key features include the ability to obtain precise tax amounts effortlessly, ensuring compliance with local tax regulations. This calculator streamlines the sales tax calculation process, making it an essential resource for anyone operating within Missouri.

- Website: timetrex.com

- Established: Approx. 21 years (domain registered in 2004)

4. Missouri Sales Tax Calculator

The Missouri Sales Tax Calculator from Omni Calculator is designed to assist users in estimating the sales tax owed on purchases made within the state. This user-friendly tool simplifies the calculation process by allowing individuals to input the purchase amount, ensuring they can easily determine the total cost including tax. Its straightforward interface makes it accessible for anyone needing to calculate sales tax accurately and efficiently.

- Website: omnicalculator.com

- Established: Approx. 11 years (domain registered in 2014)

5. Sales Tax Calculator

The Sales Tax Calculator by TaxJar is a user-friendly tool designed to help businesses determine the combined sales tax rate for specific locations by simply entering a city and zip code. This feature is particularly beneficial for ensuring accurate sales tax calculations, which can be automated for efficiency. TaxJar’s calculator is an essential resource for businesses seeking to streamline their sales tax processes and maintain compliance with local regulations.

- Website: taxjar.com

- Established: Approx. 13 years (domain registered in 2012)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps in obtaining accurate results from a Missouri vehicle sales tax calculator is to ensure that all your inputs are correct. Take a moment to carefully enter the sale amount, ZIP code, or tax region. Mistakes in these entries can lead to significant discrepancies in your tax calculations. For instance, entering an incorrect sale price can inflate or deflate the estimated tax amount, affecting your overall budgeting. If the calculator allows, verify the entered information against official documents or receipts to ensure accuracy.

Understand the Underlying Assumptions

Different calculators may operate on varying assumptions regarding tax rates and exemptions. Familiarize yourself with the specific tax rates applicable to your situation, including state, county, and city rates, as well as any special district taxes. Additionally, be aware of any exemptions that may apply to your vehicle purchase. Understanding these elements will help you interpret the calculator’s output effectively and ensure that you are accounting for all potential factors influencing your tax obligations.

Use Multiple Tools for Comparison

To enhance the reliability of your results, consider using multiple Missouri vehicle sales tax calculators. Different tools may yield slightly different results due to variations in their databases or calculation methods. By comparing results from several calculators, you can identify any significant discrepancies and gain a more rounded understanding of your potential tax liability. This strategy can also help you spot any errors in your input data, as a consistent result across multiple calculators can give you more confidence in your figures.

Stay Updated on Tax Changes

Sales tax regulations can change frequently, which may impact the accuracy of online calculators. Regularly check for updates regarding Missouri’s vehicle sales tax rates, exemptions, and other relevant regulations. Many calculators will provide updates, but it’s beneficial to stay informed through official state resources or news outlets. Being aware of changes can help you adjust your calculations accordingly and avoid surprises during the purchase process.

Consult with a Tax Professional

If you find the calculations complex or if your vehicle purchase involves special circumstances (like trade-ins or exemptions), consider consulting with a tax professional. They can provide personalized advice and ensure that you are compliant with Missouri tax laws. A professional can also help clarify any questions about the nuances of sales tax and assist you in maximizing your savings.

Document Your Calculations

Once you’ve completed your calculations, it’s wise to document them for future reference. Keep a record of the tax amounts calculated, the tools used, and any assumptions made during the process. This documentation can be useful if you need to revisit your figures later or if you face inquiries from tax authorities. By maintaining clear records, you will also have a reference point for similar transactions in the future.

By following these tips, you can make the most of the Missouri vehicle sales tax calculators available online, ensuring that your calculations are as accurate and beneficial as possible.

Frequently Asked Questions (FAQs)

1. What is a Missouri vehicle sales tax calculator?

A Missouri vehicle sales tax calculator is an online tool that helps users estimate the sales tax amount due when purchasing a vehicle in Missouri. By inputting the sale amount and selecting the relevant ZIP code or tax region, the calculator provides an accurate calculation of the total sales tax, including state, county, city, and any special district taxes.

2. How do I use a Missouri vehicle sales tax calculator?

Using a Missouri vehicle sales tax calculator is straightforward. First, you need to select either a ZIP code or a tax region to determine the applicable tax rates. Next, enter the sale amount of the vehicle in the designated field. Once you click the “Calculate Tax” button, the calculator will display the total sales tax amount, the breakdown of the tax rates, and the total amount you would pay, including the sale price and tax.

3. Are there any exemptions I should be aware of when calculating vehicle sales tax in Missouri?

Yes, Missouri has various sales tax exemptions that may apply to vehicle purchases. For example, certain agricultural vehicles may qualify for exemptions. Additionally, sales to nonprofit organizations or government entities may also be exempt. It’s essential to check the specific exemptions applicable to your situation to ensure accurate tax calculations.

4. Why is it important to know the exact sales tax amount when buying a vehicle?

Knowing the exact sales tax amount is crucial for budgeting purposes, as it affects the total cost of purchasing a vehicle. Sales tax can significantly increase the overall price you pay, and understanding this cost helps in making informed financial decisions. Moreover, accurate calculations ensure compliance with state tax laws and prevent any potential issues during the vehicle registration process.

5. Can I rely on the results from a Missouri vehicle sales tax calculator?

Yes, most Missouri vehicle sales tax calculators provide real-time and accurate results based on the latest tax rates and regulations. However, it’s always a good practice to verify the results with official state resources or consult a tax professional, especially if your purchase involves unique circumstances or exemptions that may affect the final tax amount.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.