The 5 Best Mobile Home Loan Calculators of 2025 (Reviewed)

Finding the Best Mobile Home Loan Calculator: An Introduction

Finding the right mobile home loan calculator can be a daunting task for potential homebuyers. With numerous options available online, each claiming to provide the best estimates and features, it can be overwhelming to determine which tool truly meets your needs. Whether you’re a first-time buyer or looking to refinance, the stakes are high, and having access to a reliable calculator is essential for making informed financial decisions.

This article aims to simplify your search by reviewing and ranking the top mobile home loan calculators available online. Our goal is to save you time and effort by presenting a curated list of tools that stand out in terms of functionality and user experience.

Criteria for Ranking

To ensure that our recommendations are trustworthy and effective, we have established a set of criteria for evaluating each calculator. Key factors include:

- Accuracy: The calculator’s ability to provide precise estimates based on the inputs you provide, including loan amount, interest rate, and loan term.

- Ease of Use: A user-friendly interface that allows you to navigate the tool effortlessly, regardless of your technical expertise.

- Features: Additional functionalities that enhance the calculator’s utility, such as the ability to compare multiple loan scenarios, adjust for property taxes and insurance, and access various loan types (FHA, VA, USDA, etc.).

- Instant Results: The capability to deliver real-time calculations without long wait times, allowing for quick decision-making.

By focusing on these criteria, we aim to guide you toward the most effective mobile home loan calculators that can help you make informed financial choices. Let’s dive into our top picks!

Our Criteria: How We Selected the Top Tools

Key Criteria for Selecting the Best Mobile Home Loan Calculators

When evaluating the best mobile home loan calculators, we considered a range of factors to ensure that each tool meets the needs of users looking to finance their mobile home. Here are the key criteria we used in our selection process:

-

Accuracy and Reliability

– Precision in Calculations: The calculator should provide accurate estimates based on the inputs provided. It should incorporate various factors, such as interest rates, loan terms, and down payment amounts, to deliver reliable monthly payment estimates.

– Updated Data: Tools should utilize the latest interest rates and loan guidelines to ensure users receive current information. -

Ease of Use

– User-Friendly Interface: The calculator should have an intuitive design that allows users to navigate easily. A well-organized layout with clear instructions can enhance the user experience.

– Mobile Compatibility: Given the increasing use of smartphones, the tool should be optimized for mobile devices, enabling users to calculate their loan estimates on the go. -

Key Features

– Customizable Inputs: The calculator should allow users to input various parameters such as:- Loan Amount: The total amount desired for the loan.

- Interest Rate: The rate based on current market conditions or personal pre-qualification.

- Loan Term: Options for different durations (e.g., 15, 20, 30 years).

- Down Payment: The amount the user plans to pay upfront.

- Property Taxes and Insurance: Ability to include these estimates for a more comprehensive monthly payment calculation.

- Comparison Capabilities: Users should be able to compare multiple loan scenarios by adjusting different inputs easily.

-

Cost (Free vs. Paid)

– Accessibility: The best calculators should be available for free, allowing users to access essential tools without incurring costs. If any paid options exist, they should offer significant additional features that justify the expense.

– Transparency in Costs: Any potential fees associated with using the calculator or obtaining a loan through the platform should be clearly outlined. -

Support and Resources

– Educational Materials: The tool should provide users with access to helpful resources, such as guides on mobile home financing, FAQs, and customer support options to assist with any queries.

– Contact Options: Availability of support through chat, phone, or email can enhance user satisfaction and confidence in using the tool.

By adhering to these criteria, we ensured that the selected mobile home loan calculators are not only functional but also user-friendly, accurate, and supportive of the needs of prospective mobile home buyers.

The Best Mobile Home Loan Calculators of 2025

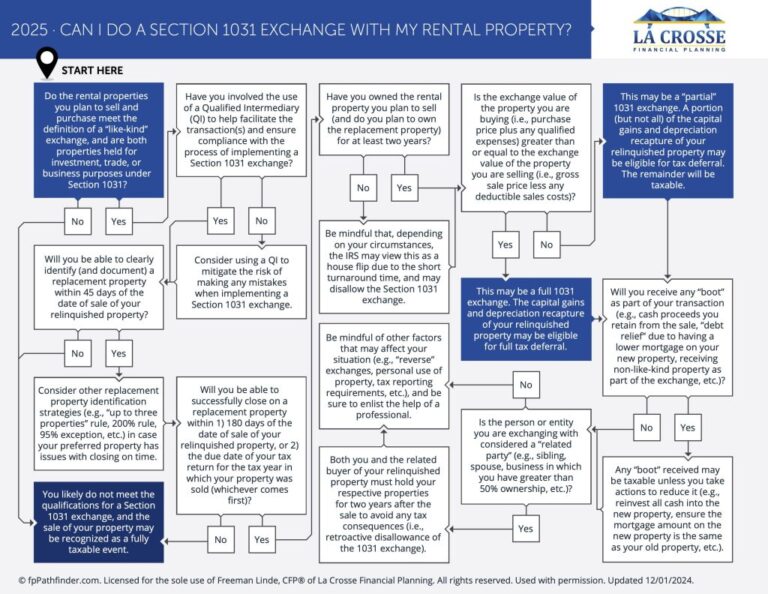

1. Monthly Payment Calculator

The Monthly Payment Calculator from Champion Homes is a user-friendly tool designed to help prospective homebuyers estimate their mortgage payments. By allowing users to input and adjust various financial values, it provides a clear overview of potential monthly costs associated with purchasing a new home. This calculator empowers individuals to make informed decisions and take control of their home buying journey, ensuring they find an affordable mortgage rate that fits their budget.

- Website: championhomes.com

- Established: Approx. 25 years (domain registered in 2000)

4. Mortgage Calculator

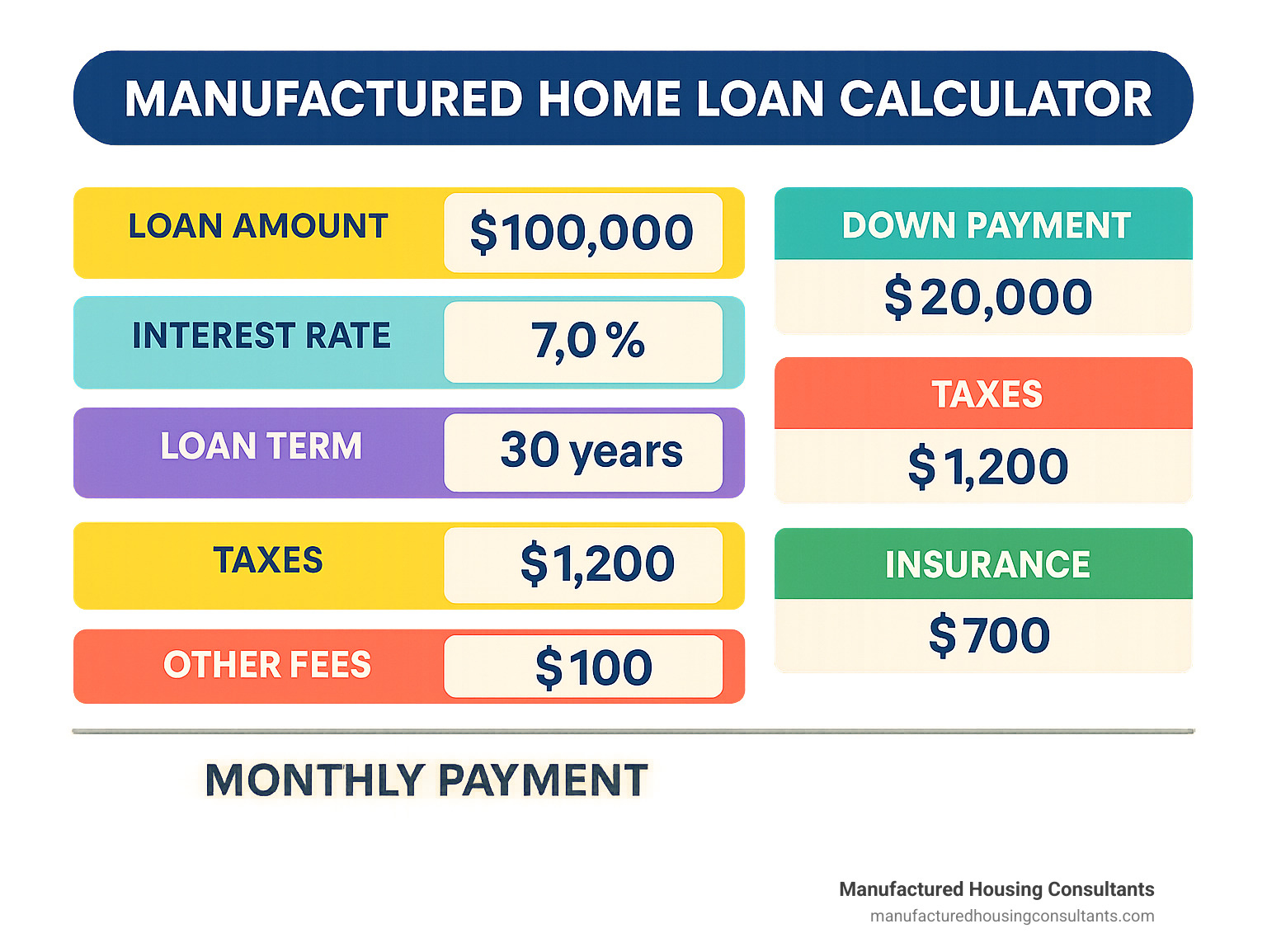

The Mortgage Calculator at mortgagecalculator.org is a powerful, user-friendly tool designed to help homeowners and prospective buyers estimate their monthly mortgage payments. This free calculator allows users to incorporate essential factors such as private mortgage insurance (PMI), property taxes, and homeowners insurance, ensuring a comprehensive understanding of total housing costs. By utilizing this tool, users can make informed financial decisions and potentially save money on their home loans.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a mobile home loan calculator, the accuracy of your results heavily depends on the information you provide. Before finalizing your calculations, take a moment to double-check all inputs. This includes the loan amount, interest rate, loan term, down payment, property taxes, and insurance costs. Small errors in these figures can lead to significant discrepancies in your estimated monthly payments. For example, if you underestimate your property taxes, your payment could be much lower than what you’ll actually owe.

Understand the Underlying Assumptions

Every loan calculator operates under specific assumptions that can affect your results. Familiarize yourself with these assumptions to interpret your output correctly. For instance, some calculators may assume a fixed interest rate throughout the loan term, while others might incorporate potential fluctuations. Additionally, calculators may or may not include other costs like private mortgage insurance (PMI) or homeowners insurance in their estimates. Understanding these factors will give you a clearer picture of your financial obligations.

Use Multiple Tools for Comparison

To ensure you are getting the best possible estimate, it’s wise to use multiple mobile home loan calculators. Different tools may have varying algorithms, assumptions, and features that can yield different results. By comparing outputs from several calculators, you can identify any inconsistencies and better understand the range of possible monthly payments. This approach will not only enhance your confidence in the figures provided but also help you make more informed decisions regarding your financing options.

Adjust for Real-World Variables

While calculators provide a great starting point, remember that they may not account for all real-world variables. For instance, your credit score, income, and debt-to-income ratio can significantly influence your loan eligibility and interest rates. Therefore, it’s beneficial to consult with a loan officer or mortgage specialist who can provide personalized insights based on your unique financial situation. They can also help you understand how changes in your inputs might affect your overall loan terms.

Keep Up with Market Trends

Interest rates and loan terms can fluctuate based on market conditions. Regularly check current mortgage rates and market trends to ensure that your calculations reflect the most accurate and up-to-date information. Many lenders provide resources or updates on prevailing rates, which can be invaluable in making timely and informed financial decisions.

Seek Professional Guidance

Finally, while online calculators are excellent tools for estimating your potential loan payments, they should not replace professional advice. Once you have a good estimate, consider reaching out to mortgage lenders or financial advisors. They can provide additional insights and help you navigate the complexities of mobile home financing, ensuring that you select the best loan option for your needs.

Frequently Asked Questions (FAQs)

1. How does a mobile home loan calculator work?

A mobile home loan calculator allows users to input various financial parameters, such as loan amount, interest rate, loan term, down payment, and additional costs like property taxes and insurance. Once these details are entered, the calculator provides an estimate of the monthly mortgage payment, helping users understand their potential financial commitment.

2. What factors can I adjust in a mobile home loan calculator?

Most mobile home loan calculators offer adjustable inputs for several key factors, including:

– Loan Amount: The total amount you wish to borrow.

– Interest Rate: The annual percentage rate (APR) you expect to pay.

– Loan Term: The duration of the loan, typically ranging from 15 to 30 years.

– Down Payment: The initial payment made towards the purchase of the home.

– Property Taxes and Insurance: Estimates for additional costs that may affect monthly payments.

These adjustments allow users to see how different scenarios impact their monthly payments.

3. Can I use a mobile home loan calculator for different loan types?

Yes, many mobile home loan calculators accommodate various loan types, including FHA, VA, USDA, and conventional loans. By selecting the appropriate loan type, users can input specific parameters and receive tailored estimates based on the unique requirements and benefits of each loan option.

4. How accurate are the estimates provided by a mobile home loan calculator?

While mobile home loan calculators provide useful estimates, it’s important to remember that they are based on the information you input. Variations can occur due to factors such as changes in interest rates, lender fees, and other personal financial details. For the most accurate assessment of your loan eligibility and monthly payments, it’s advisable to consult with a mortgage lender or financial advisor.

5. Do I need to provide personal information to use a mobile home loan calculator?

Generally, you do not need to provide personal information to use a basic mobile home loan calculator. These tools typically require only the financial inputs necessary for calculating estimates. However, for personalized loan options or pre-qualification, lenders may request additional information, including your credit score and financial history. Always ensure you are using a reputable calculator to protect your privacy.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.