The 5 Best Mortgage Missouri Calculators of 2025 (Reviewed)

Finding the Best Mortgage Calculator Missouri: An Introduction

When it comes to navigating the complex world of home buying in Missouri, one of the most essential tools at your disposal is a reliable mortgage calculator. However, with a plethora of options available online, finding a good and trustworthy mortgage calculator can be a daunting task. Each tool claims to offer the best results, but not all calculators provide the same level of accuracy, features, or ease of use. This is particularly crucial for prospective homebuyers who need to assess their financial capabilities and plan their budgets effectively.

The goal of this article is to review and rank the top mortgage calculators available online specifically for users in Missouri. By focusing on the most reputable options, we aim to save you time and help you make informed decisions. We understand that different users have unique needs, whether you’re a first-time homebuyer, looking to refinance, or simply exploring your options.

To ensure our rankings are comprehensive and useful, we evaluated each calculator based on several criteria. Accuracy is paramount; we looked for tools that provide reliable estimates and clear breakdowns of costs. Ease of use is also critical, as a user-friendly interface can significantly enhance the experience. Lastly, we considered the features offered by each calculator, such as the ability to input various loan types, property taxes, insurance, and more, which can greatly influence your monthly payments and overall financial planning.

By the end of this article, you’ll have a curated list of the best mortgage calculators tailored for Missouri, equipping you with the tools necessary to make informed financial decisions on your home-buying journey.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Mortgage Calculators in Missouri

When evaluating the top online mortgage calculators specifically for Missouri, we considered several essential criteria to ensure that users have access to reliable, user-friendly tools that meet their needs. Here’s a breakdown of the key factors that guided our selection process:

-

Accuracy and Reliability

– Precision of Calculations: The calculators must provide accurate estimates of monthly payments, total interest paid, and loan pay-off dates. We checked that the calculations align with standard mortgage formulas and financial principles.

– Up-to-Date Information: We prioritized tools that incorporate current mortgage rates and local tax information relevant to Missouri, ensuring that users receive realistic projections based on the latest data. -

Ease of Use

– User-Friendly Interface: The best calculators feature intuitive designs that allow users to navigate easily without confusion. Clear labeling of input fields and a straightforward layout enhance the overall experience.

– Accessibility: We ensured that the calculators are accessible on various devices, including smartphones and tablets, allowing users to compute their mortgage scenarios on the go. -

Key Features

– Comprehensive Input Options: An effective mortgage calculator should allow users to input various parameters, including:- Home value

- Down payment (amount and percentage)

- Loan amount

- Interest rate

- Loan term (e.g., 15, 20, or 30 years)

- Start date of the loan

- Property taxes, PMI (Private Mortgage Insurance), home insurance, and HOA (Homeowners Association) fees.

- Amortization Tables: Tools that provide detailed amortization schedules help users visualize their payment breakdown over time, showing how much of each payment goes toward principal versus interest.

-

Cost (Free vs. Paid)

– Affordability: We focused on tools that are free to use, ensuring that potential homeowners can access these valuable resources without any financial burden. While some calculators offer premium features for a fee, the basic functionalities should remain accessible without cost. -

Additional Resources

– Educational Content: The best calculators often come with additional resources, such as articles or FAQs that explain mortgage-related concepts. This educational content can help users make informed decisions about their mortgage options.

– Customer Support: Reliable calculators provide access to customer support or help sections, assisting users who may have questions or need further clarification.

By employing these criteria, we ensured that our selection of mortgage calculators not only meets the specific needs of Missouri residents but also enhances their understanding of mortgage processes, ultimately empowering them to make informed financial decisions.

The Best Mortgage Calculator Missouris of 2025

2. Mortgage Calculator

The Mortgage Calculator at mortgagecalculator.org is a powerful and user-friendly tool designed to help homeowners and prospective buyers estimate their monthly mortgage payments. This free calculator takes into account key factors such as private mortgage insurance (PMI), property taxes, and homeowner’s insurance, providing a comprehensive overview of potential costs. By utilizing this calculator, users can make informed decisions and potentially save money on their home loans.

- Website: mortgagecalculator.org

- Established: Approx. 21 years (domain registered in 2004)

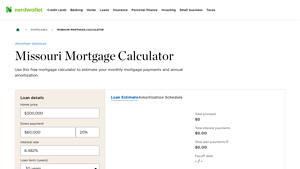

4. Missouri Mortgage Calculator

The Missouri Mortgage Calculator from NerdWallet is a free tool designed to help users estimate their monthly mortgage payments and annual amortization schedules. With its user-friendly interface, this calculator simplifies the home-buying process by allowing potential homeowners to input various loan parameters and receive clear financial projections, making it easier to budget for a mortgage in Missouri.

- Website: nerdwallet.com

- Established: Approx. 16 years (domain registered in 2009)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a mortgage calculator, the accuracy of your results heavily relies on the information you provide. Make sure to double-check all inputs, including the home value, down payment, interest rate, and loan term. Even small errors can lead to significant differences in your estimated monthly payments and overall loan costs. For instance, a misplaced decimal point in the interest rate can drastically alter the total interest paid over the life of the loan. Take your time to ensure each figure is accurate before hitting the calculate button.

Understand the Underlying Assumptions

Mortgage calculators often operate under specific assumptions that can affect the accuracy of your results. For example, many calculators assume a fixed interest rate throughout the loan term, which may not reflect your actual situation if you opt for an adjustable-rate mortgage. Additionally, some calculators may not account for property taxes, homeowners insurance, or private mortgage insurance (PMI) unless explicitly included. Familiarize yourself with these assumptions to better interpret the results and understand how they may apply to your unique financial circumstances.

Use Multiple Tools for Comparison

Different mortgage calculators can yield varying results based on their algorithms and assumptions. To get a well-rounded view of your potential mortgage costs, utilize multiple calculators. This will help you identify discrepancies and give you a broader perspective on what to expect. For instance, some calculators might offer additional features, such as the ability to visualize amortization schedules or compare different loan scenarios. By cross-referencing multiple tools, you can make more informed decisions about your mortgage options.

Factor in Additional Costs

While mortgage calculators primarily focus on monthly payments, it’s essential to consider other costs associated with homeownership. These can include property taxes, homeowners insurance, and HOA fees, which can significantly impact your total monthly expenditure. Make sure to input these costs into the calculator if possible, or be aware of them when reviewing your estimated payments. This holistic approach will provide a more accurate picture of your financial obligations and help you budget effectively.

Stay Updated on Current Rates

Mortgage rates fluctuate frequently based on market conditions. To ensure that your calculations reflect the most accurate potential costs, check current mortgage rates before using a calculator. Many online tools allow you to view today’s rates, but also consider consulting financial news or lender websites for the latest information. Using outdated rates can lead to misleading estimates and potentially affect your home buying or refinancing decisions.

Consult with a Financial Advisor

While online calculators are a great starting point, they should not replace professional financial advice. If you’re uncertain about any aspect of the mortgage process or need personalized guidance, consider consulting a financial advisor or mortgage specialist. They can provide tailored advice based on your financial situation and help you navigate complex decisions, ensuring you make the best choices for your home financing needs.

Frequently Asked Questions (FAQs)

1. What is a mortgage calculator and how can it help me in Missouri?

A mortgage calculator is an online tool that allows users to estimate monthly mortgage payments based on various inputs such as home price, down payment, loan amount, interest rate, and loan term. For those in Missouri, it can help determine what you can afford based on local property taxes and insurance rates, providing a clearer picture of your financial obligations when purchasing a home.

2. What factors should I input into a mortgage calculator?

When using a mortgage calculator, you should input the following factors:

– Home Value: The price of the property you are considering.

– Down Payment: The initial amount you plan to pay upfront, expressed either as a dollar amount or percentage.

– Loan Amount: The total amount you will borrow, which is the home value minus the down payment.

– Interest Rate: The annual percentage rate (APR) you expect to pay on the loan.

– Loan Term: The duration over which you will repay the loan, typically in years (e.g., 15, 20, or 30 years).

– Property Tax and Insurance: Optional fields to include local taxes and insurance costs, which can vary by location in Missouri.

3. Are there any specific mortgage calculators for Missouri?

While many mortgage calculators are available online, some are tailored to Missouri by including local property tax rates and insurance estimates. Websites of local banks, such as The Bank of Missouri, often provide calculators that factor in regional specifics, making them particularly useful for Missouri residents.

4. Can I calculate additional costs associated with a mortgage using a calculator?

Yes, most mortgage calculators allow you to account for additional costs such as property taxes, homeowner’s insurance, and private mortgage insurance (PMI). By including these costs, you can obtain a more comprehensive estimate of your total monthly payment, which is crucial for budgeting.

5. How accurate are the estimates provided by mortgage calculators?

The estimates from mortgage calculators are generally quite accurate, but they are based on the inputs you provide. They do not account for variables such as changing interest rates, lender fees, or changes in property tax assessments. For the most precise financial planning, it is advisable to consult with a mortgage professional who can provide a detailed analysis based on your specific situation.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.