The 5 Best Mortgage Recast Calculators of 2025 (Reviewed)

Finding the Best Mortgage Recast Calculator: An Introduction

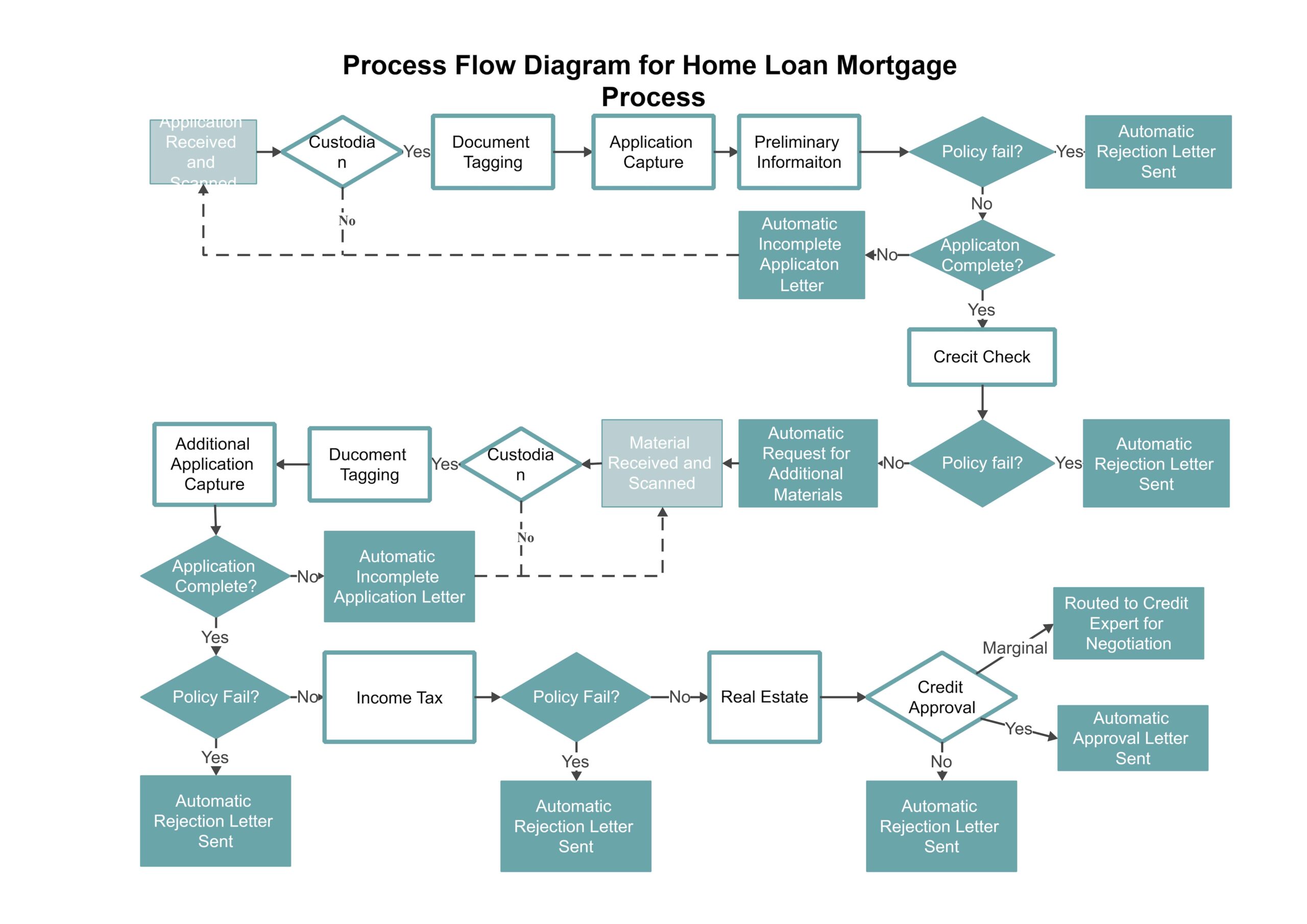

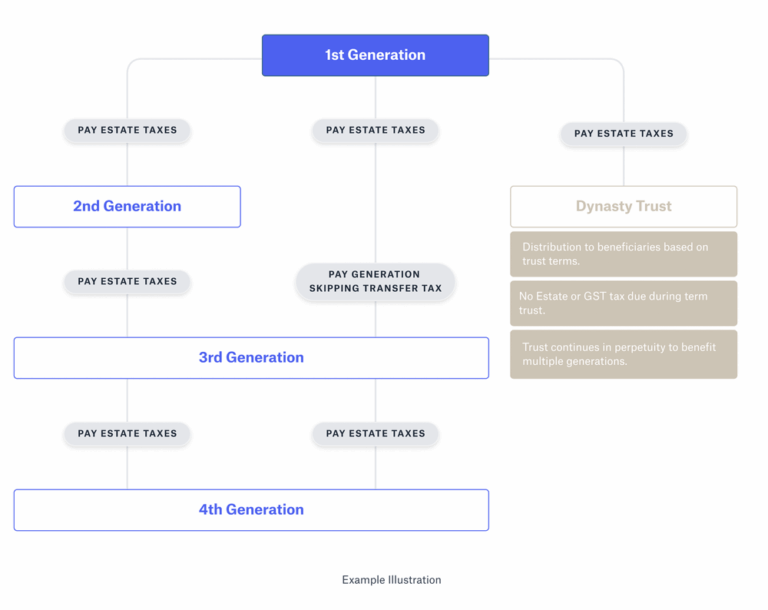

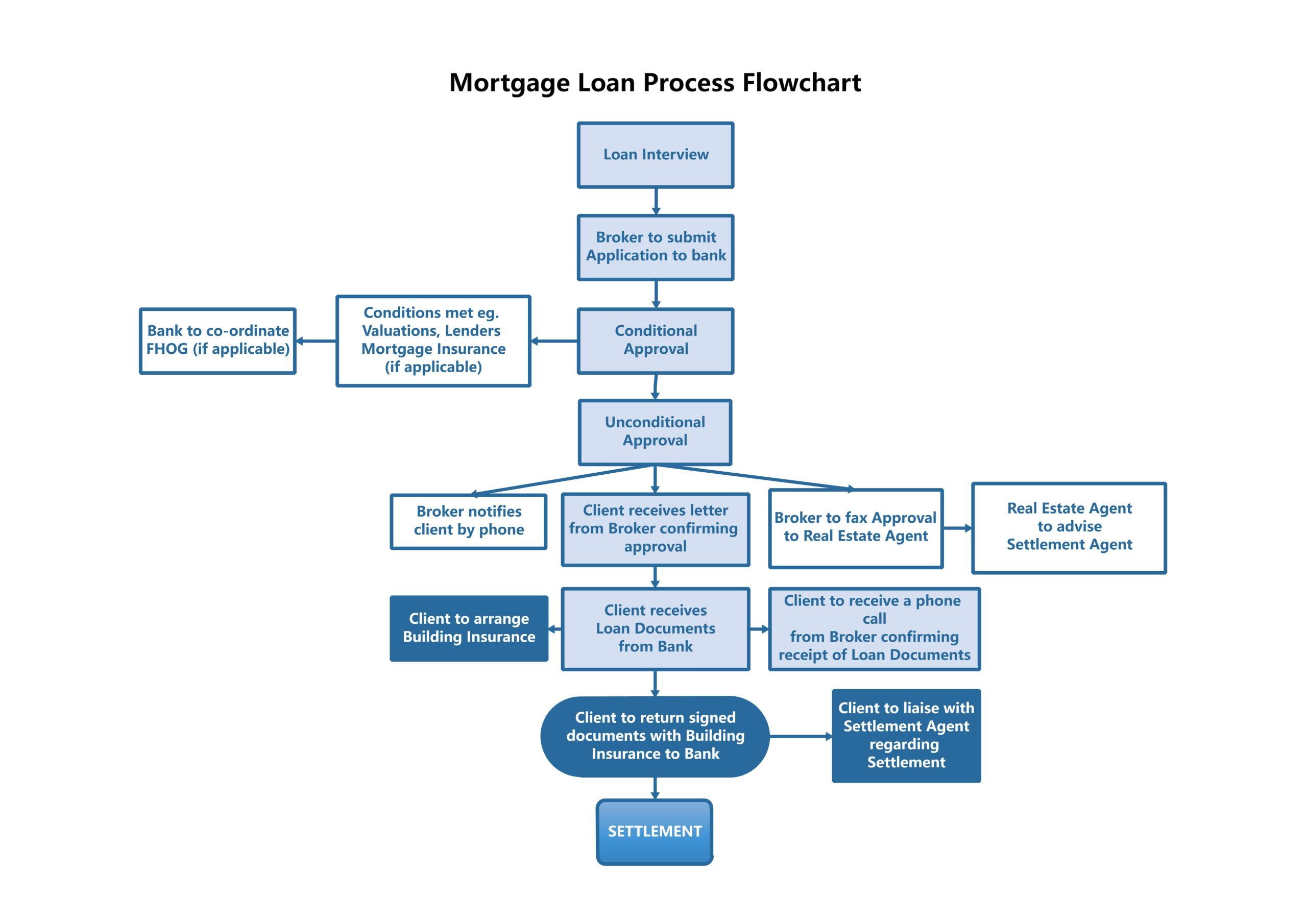

Finding the right mortgage recast calculator can be a daunting task, especially with the plethora of options available online. Many homeowners looking to lower their monthly mortgage payments through recasting face the challenge of identifying a reliable tool that provides accurate results and user-friendly features. A mortgage recast allows borrowers to make a lump-sum payment towards their principal balance, which in turn recalculates their monthly payments without changing the interest rate or loan term. This can be a beneficial alternative to refinancing, but it’s essential to have a dependable calculator to determine the potential savings accurately.

This article aims to streamline your search by reviewing and ranking the best mortgage recast calculators available online. We have evaluated a range of tools to save you time and ensure you can make informed financial decisions. Our goal is to highlight calculators that stand out in terms of accuracy, ease of use, and the features they offer.

Criteria for Ranking

-

Accuracy: We assessed how precise the calculators are in providing results based on the inputs entered. An accurate calculator should reflect real-world scenarios of mortgage recasting.

-

Ease of Use: A user-friendly interface is crucial for any online tool. We considered how intuitive the calculators are, including the simplicity of inputting data and understanding the results.

-

Features: Additional functionalities, such as the ability to compare amortization schedules or visualize potential savings over time, enhance the value of a calculator. We looked for tools that offer these extra features to better assist users in their decision-making process.

By focusing on these criteria, we aim to present you with a curated list of the top mortgage recast calculators to help you take control of your mortgage payments effectively.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Mortgage Recast Calculators

When evaluating various mortgage recast calculators, we focused on several key criteria to ensure that our recommendations meet the needs of a general audience looking to make informed financial decisions. Below are the essential factors that guided our selection process:

-

Accuracy and Reliability

– The primary function of a mortgage recast calculator is to provide accurate estimations of new monthly payments after a lump-sum payment towards the principal. We prioritized tools that use reliable algorithms and formulas to ensure users receive precise calculations that reflect their actual mortgage terms. -

Ease of Use

– A user-friendly interface is crucial for any online tool. We assessed each calculator for its design, navigation, and overall usability. The best tools allow users to input data easily and view results without unnecessary complexity. Clear instructions and intuitive layouts contribute significantly to the overall experience. -

Key Features

– Effective mortgage recast calculators should include essential inputs that reflect the user’s mortgage situation. We looked for calculators that allow users to enter:- Current mortgage balance

- Original loan amount and term

- Interest rate

- Lump-sum payment amount

- Remaining loan duration

- Additionally, we valued tools that provide a detailed breakdown of the results, such as the new monthly payment, total interest savings, and an updated amortization schedule.

-

Cost (Free vs. Paid)

– Many online calculators are available for free, which is an important consideration for users. We favored tools that do not require payment to access their features while also noting any optional paid features that might enhance user experience. Transparency regarding costs associated with recasting (e.g., lender fees) was also a factor.

-

Educational Resources

– The best calculators not only provide functionality but also educate users about mortgage recasting. We looked for tools that offer informative content, FAQs, or guides that explain the process, benefits, and potential drawbacks of mortgage recasting. This additional context helps users make informed decisions based on their unique financial situations. -

Customer Support and Accessibility

– Accessibility is vital for online tools. We considered whether the calculators were available on multiple devices and platforms, including mobile and desktop. Furthermore, tools that offer customer support or additional resources for users needing assistance were rated higher in our selection process. -

User Reviews and Feedback

– Finally, we examined user reviews and feedback to gauge the overall satisfaction and effectiveness of each calculator. Tools with positive user experiences and testimonials often indicate a higher level of trust and reliability.

By employing these criteria, we aimed to highlight the most effective and user-friendly mortgage recast calculators available, ensuring that our audience can confidently choose a tool that meets their specific needs.

The Best Mortgage Recast Calculators of 2025

1. Mortgage Recast Calculator

The Mortgage Recast Calculator from Clark Howard is a practical tool designed to help homeowners understand the potential impact of recasting their mortgage. By inputting current loan details and the desired lump sum payment, users can easily calculate how much they could lower their monthly payments. This straightforward calculator provides valuable insights, making it easier for borrowers to assess the benefits of recasting their mortgage for better financial management.

- Website: clark.com

- Established: Approx. 33 years (domain registered in 1992)

5. Recast Calculation : r/Mortgages

The Recast Calculation tool discussed in the r/Mortgages subreddit is designed to help homeowners understand the financial implications of recasting their mortgage. By allowing users to input their remaining mortgage balance and the amount they plan to pay down, the tool calculates the new payment structure. Key features include straightforward calculations that facilitate informed decision-making about recasting options, ultimately aiding in effective mortgage management.

- Website: reddit.com

- Established: Approx. 20 years (domain registered in 2005)

How to Get the Most Accurate Results

Double-Check Your Inputs

To ensure the accuracy of your mortgage recast calculator results, begin by carefully reviewing all the inputs you provide. Common fields include your current mortgage balance, original loan amount, interest rate, and the lump-sum payment you plan to make. Any errors in these figures can lead to misleading outcomes. For example, if you accidentally input an incorrect interest rate or omit a payment amount, the calculator may produce results that do not reflect your true financial situation. Take a moment to verify each entry before hitting the calculate button.

Understand the Underlying Assumptions

Mortgage recast calculators operate based on specific assumptions, which can significantly impact your results. Familiarize yourself with these assumptions, as they often include the notion that your interest rate and loan term remain constant after recasting. Additionally, be aware that the calculators typically do not account for potential fees associated with the recasting process, which can range from $250 to $500. Understanding these elements will help you interpret the results more accurately and assess whether a recast is financially beneficial for your situation.

Use Multiple Tools for Comparison

While a single mortgage recast calculator can provide valuable insights, using multiple tools can enhance your understanding and give you a broader perspective on your options. Different calculators may have varied methodologies or additional features, such as amortization schedules or detailed savings comparisons. By comparing results from several calculators, you can identify discrepancies and gain confidence in your conclusions. Additionally, some calculators may offer side-by-side comparisons with refinancing options, allowing you to evaluate which approach best suits your financial goals.

Consult with Your Lender

While online calculators are incredibly useful, they should not replace professional advice. After obtaining results from the calculator, consider discussing your findings with your mortgage lender or a financial advisor. They can provide insights tailored to your specific mortgage terms and help clarify any questions regarding the recasting process. This step can ensure that you fully understand the implications of a recast versus other options, such as refinancing or making extra payments.

Keep Your Goals in Mind

Lastly, always align your use of the mortgage recast calculator with your broader financial goals. Consider why you are looking to recast your mortgage—whether it’s to reduce monthly payments, improve cash flow, or manage unexpected expenses. By keeping your objectives clear, you can better evaluate the calculator’s output and make informed decisions that align with your financial strategy. Make sure to revisit your goals periodically, as changes in your financial situation may warrant a reevaluation of your mortgage strategy.

Frequently Asked Questions (FAQs)

1. What is a mortgage recast calculator?

A mortgage recast calculator is an online tool that helps homeowners estimate their new monthly mortgage payments after making a lump-sum payment toward the principal balance of their mortgage. By entering details such as the remaining loan balance, interest rate, remaining loan duration, and the amount of the lump-sum payment, users can see how much their monthly payments could decrease as a result of the recast.

2. How does a mortgage recast differ from refinancing?

A mortgage recast and refinancing are two different processes. A recast allows homeowners to lower their monthly payments by making a large principal payment without changing the interest rate or the original loan terms. In contrast, refinancing involves obtaining a new loan with different terms, which may include a new interest rate and potentially different fees. Recasting is often simpler and incurs fewer costs than refinancing.

3. Are there any fees associated with mortgage recasting?

Yes, most lenders charge a fee to recast a mortgage, which typically ranges from $250 to $500. This fee is generally much lower than the closing costs associated with refinancing a mortgage. However, the exact fee can vary by lender, so it’s advisable to check with your mortgage servicer for their specific charges.

4. Who should consider using a mortgage recast calculator?

Homeowners who have received a large sum of money, such as from an inheritance, bonus, or home sale, and wish to lower their monthly payments without refinancing may benefit from using a mortgage recast calculator. Additionally, those who want to maintain their current interest rate and loan term while improving cash flow may find this tool helpful in evaluating their options.

5. What information do I need to use a mortgage recast calculator?

To effectively use a mortgage recast calculator, you will need to provide several key pieces of information: the current mortgage balance, the interest rate of your mortgage, the remaining duration of the loan, and the amount you plan to pay toward the principal. Some calculators may also ask for the original mortgage amount and loan term for more accurate results.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.