The 5 Best Share Certificate Calculators of 2025 (Reviewed)

Finding the Best Share Certificate Calculator: An Introduction

Navigating the world of finance can often feel overwhelming, especially when it comes to finding reliable tools that help maximize your savings. One such tool is the share certificate calculator, which allows users to estimate potential earnings from share certificates, commonly known as certificates of deposit (CDs). However, with numerous options available online, it can be challenging to identify a trustworthy and effective calculator that meets your needs.

The goal of this article is to simplify your search by reviewing and ranking the top share certificate calculators currently available. We understand that time is precious, and our aim is to provide you with a curated list of tools that can aid in your financial planning without the hassle of sifting through countless websites.

In our evaluation process, we focused on several key criteria to ensure that our recommendations are both practical and user-friendly. Accuracy is paramount; we assessed how reliably each calculator computes potential returns based on user-inputted data, such as initial deposit, interest rate, and term length. Ease of use is another vital factor; a good calculator should have an intuitive interface that allows users to quickly input their information and receive results without confusion. Additionally, we considered the features offered by each tool, such as the ability to generate detailed reports, view different compounding options, and access educational resources.

By the end of this article, you’ll be equipped with the knowledge needed to choose the best share certificate calculator that aligns with your financial goals, ensuring that you can make informed decisions about your savings strategy.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Share Certificate Calculators

When it comes to choosing the top share certificate calculators, we assessed a variety of tools based on several key criteria. These factors ensure that users have access to reliable, user-friendly, and effective calculators that meet their needs. Below are the primary criteria we used in our evaluation:

-

Accuracy and Reliability

– The foremost consideration is the accuracy of the calculations provided by the tool. A good calculator should deliver precise results for the annual percentage yield (APY) and ending balance, based on the inputs provided. This reliability is crucial for users making financial decisions based on the calculator’s output. -

Ease of Use

– User experience is critical. The interface should be intuitive, allowing users to input their data without confusion. A straightforward layout, clear instructions, and responsive design contribute to a positive user experience, making it accessible for individuals with varying levels of financial literacy. -

Key Features

– Effective share certificate calculators typically include several important features:- Initial Deposit Amount: Users should be able to enter the amount they plan to invest.

- Deposit Term: The ability to specify the duration of the investment, whether in months or years.

- Interest Rate: Users need to input the interest rate, often presented as the annual percentage rate (APR).

- Compounding Frequency: Options to select how often the interest is compounded (e.g., annually, semi-annually, quarterly, monthly) are essential for calculating the APY accurately.

- Detailed Reports: A feature that generates a comprehensive report detailing the balance and interest earned over the investment period adds significant value.

-

Cost (Free vs. Paid)

– Most of the calculators we evaluated are free to use, which is an important consideration for our audience. We prioritized tools that do not require any financial commitment while still providing robust functionality. Transparent pricing and the absence of hidden fees are also critical factors for a trustworthy calculator.

-

Additional Resources and Support

– The best calculators often come with supplementary resources, such as FAQs, financial education articles, and customer support. These resources can help users understand share certificates better and make informed financial decisions. -

Mobile Compatibility

– With the increasing use of mobile devices, we considered whether the calculators are optimized for mobile use. A responsive design ensures that users can access the calculator from their smartphones or tablets without compromising functionality. -

User Reviews and Feedback

– Lastly, we took into account user reviews and feedback. Real-world experiences from users can provide insights into the tool’s performance and reliability, helping to validate our selections.

By applying these criteria, we aimed to identify the best share certificate calculators available online, ensuring that our audience can choose the right tool for their financial planning needs.

The Best Share Certificate Calculators of 2025

1. Share Certificate Calculator

The Share Certificate Calculator from Sharonview Federal Credit Union is a user-friendly online tool designed to help users determine their annual percentage yield (APY) and projected ending balance on share certificates. By simply inputting a few key details, users can quickly assess potential earnings, making it an essential resource for anyone looking to maximize their savings through share certificates.

- Website: sharonview.org

2. Certificate Calculator

The Certificate Calculator from Navy Federal Credit Union is a user-friendly tool designed to help members calculate their Annual Percentage Yield (APY) on share certificates. By inputting different deposit amounts and terms, users can easily determine potential earnings, making it a valuable resource for planning savings and investment strategies. This calculator simplifies the decision-making process for those looking to maximize their returns on share certificates.

- Website: navyfederal.org

- Established: Approx. 28 years (domain registered in 1997)

3. Share Certificate Calculator

The Share Certificate Calculator from CoVantage Credit Union is a user-friendly financial tool designed to help users calculate the annual percentage yield (APY) and the ending balance of their share certificates. This calculator simplifies the process of assessing potential earnings on high-yield savings, allowing users to make informed decisions about their investments. Its straightforward interface ensures that both novice and experienced savers can easily navigate and utilize its features effectively.

- Website: covantagecu.org

- Established: Approx. 24 years (domain registered in 2001)

4. Share Certificate Calculator

The Share Certificate Calculator from Staley Credit Union is a user-friendly tool designed to help users determine the annual percentage yield (APY) and final balance of their share certificates. By simply inputting a few key details, users can easily calculate their potential returns, making it a valuable resource for individuals looking to maximize their investment in Staley CU’s certificate offerings.

- Website: staleycu.com

- Established: Approx. 28 years (domain registered in 1997)

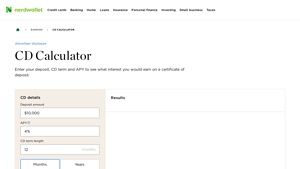

5. CD Calculator

NerdWallet’s CD Calculator is a valuable tool designed to help users estimate potential earnings from a certificate of deposit (CD). By inputting details such as the deposit amount, interest rate, and term length, users can visualize how their savings will grow over time. This calculator is particularly useful for individuals looking to maximize their returns by comparing different CD options and understanding the benefits of long-term savings.

- Website: nerdwallet.com

- Established: Approx. 16 years (domain registered in 2009)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most critical steps to obtaining accurate results from a share certificate calculator is to ensure that all your inputs are correct. This includes the initial deposit amount, the interest rate, the term length, and the compounding frequency. A simple typo or incorrect number can lead to significant discrepancies in the results. Always take a moment to review each entry before hitting the calculate button. If available, use any provided examples or tooltips to guide your input.

Understand the Underlying Assumptions

Each calculator operates based on specific formulas and assumptions. Familiarize yourself with how the calculator works, particularly regarding the definitions of terms like Annual Percentage Yield (APY) and interest rates. For example, APY accounts for compounding, while the stated interest rate may not. Understanding these nuances will help you interpret the results correctly and make informed decisions based on them. Look for explanations or guides on the calculator’s webpage to better understand the assumptions behind its calculations.

Use Multiple Tools for Comparison

Different calculators may yield slightly varying results due to differences in their algorithms or assumptions. To ensure that you’re getting a well-rounded view of your potential earnings, consider using multiple calculators. This can help you identify any discrepancies and allow you to make more informed decisions. When comparing results, pay attention to how each tool defines and calculates terms, as this can impact your total projected returns.

Review Current Rates

Interest rates for share certificates can fluctuate based on market conditions and the financial institution’s policies. Before using a calculator, check the most current rates offered by your chosen institution. If the calculator allows you to input the interest rate, make sure it reflects the latest figures to ensure the accuracy of your projections. Some calculators might even provide links to current rates, making it easier to stay updated.

Consider Additional Factors

While calculators provide a great starting point, they may not account for all factors impacting your investment. Consider aspects such as early withdrawal penalties, minimum deposit requirements, and fees that could reduce your earnings. Understanding the full terms and conditions of your certificate will help you create a more accurate financial picture. Always read the fine print or consult with a financial advisor if you’re uncertain about specific terms.

Document Your Results

After running your calculations, document the results for future reference. This can help you track your potential earnings and compare them against actual performance once your share certificate matures. Keeping a record of your inputs and outputs can also provide insights into your financial decisions over time, helping you refine your investment strategy.

By following these guidelines, you can maximize the accuracy of your results and make more informed decisions regarding your investments in share certificates.

Frequently Asked Questions (FAQs)

1. What is a share certificate calculator?

A share certificate calculator is an online tool that helps users estimate the potential returns on a share certificate (also known as a certificate of deposit or CD). By inputting specific details such as the initial deposit amount, interest rate, term length, and compounding frequency, users can calculate their expected annual percentage yield (APY) and final balance at maturity.

2. How do I use a share certificate calculator?

To use a share certificate calculator, follow these steps:

1. Input your initial deposit: Enter the amount of money you plan to invest in the share certificate.

2. Select the term length: Choose the duration for which your funds will be locked in, typically measured in months or years.

3. Enter the interest rate: Input the annual interest rate offered by the financial institution.

4. Specify the compounding frequency: Indicate how often interest is compounded (e.g., annually, semi-annually, quarterly, or monthly).

5. Calculate: Click the calculate button to view your estimated APY and ending balance.

3. What information do I need to provide for accurate results?

To obtain accurate results from a share certificate calculator, you need to provide:

– Initial Deposit Amount: The sum of money you plan to invest.

– Interest Rate: The annual percentage rate (APR) offered by the financial institution.

– Term Length: The duration (in months or years) of the investment.

– Compounding Frequency: How often the interest is calculated and added to the principal balance.

4. What is the difference between APY and APR?

APY (Annual Percentage Yield) and APR (Annual Percentage Rate) are both measures of interest. The key difference is that APY includes the effects of compounding, while APR does not. APY reflects the total amount of interest earned in a year based on the initial deposit and the compounding frequency, giving a more accurate picture of the potential earnings from a share certificate.

5. Are the results from a share certificate calculator guaranteed?

No, the results from a share certificate calculator are not guaranteed. They provide estimates based on the input data, which may vary due to changes in interest rates, compounding methods, or early withdrawal penalties. Always consult with a financial advisor or the financial institution for the most accurate and personalized information regarding your specific situation.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.