The 5 Best Solo 401K Calculators of 2025 (Reviewed)

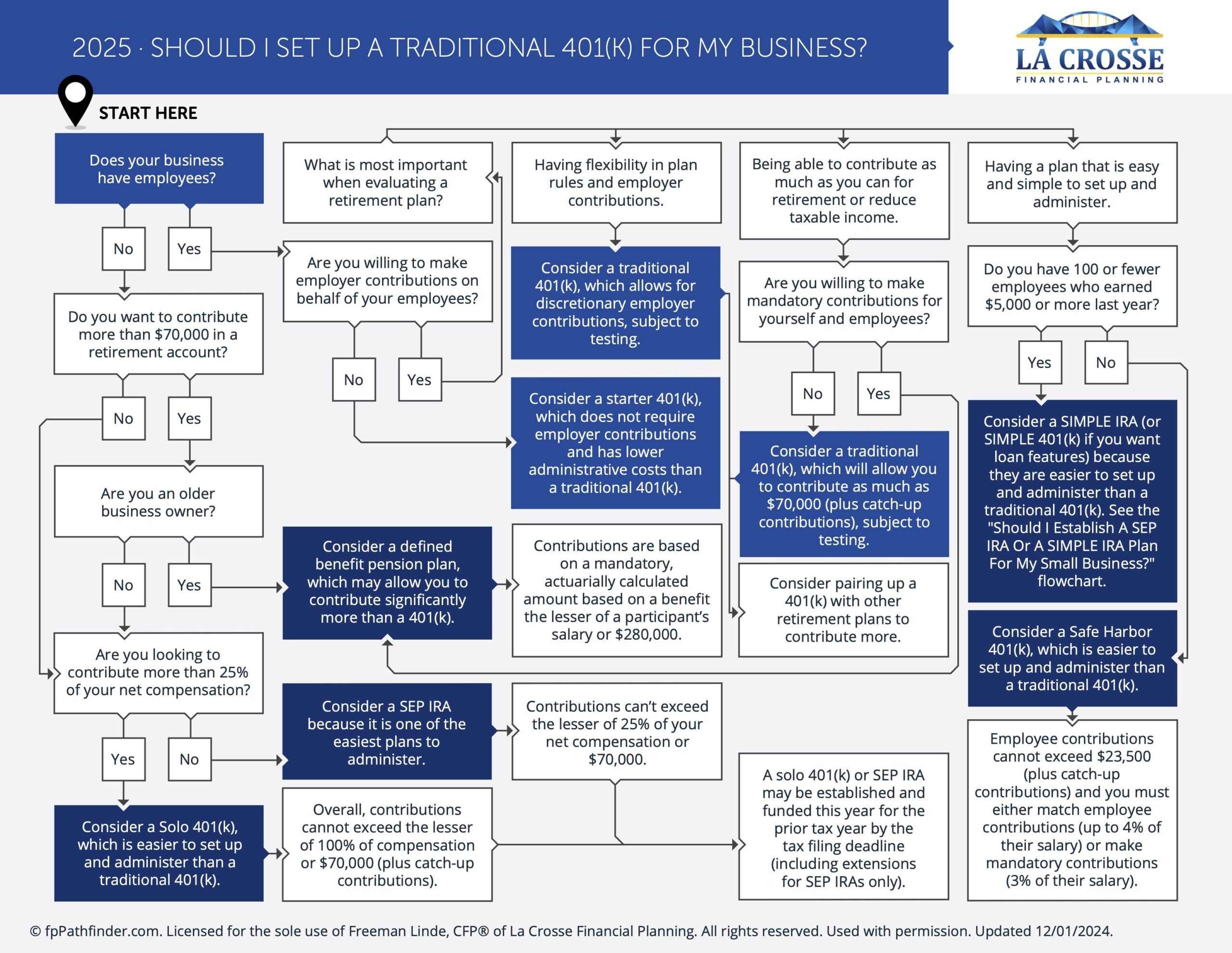

Finding the Best Solo 401K Calculator: An Introduction

Finding the right solo 401(k) calculator can be a daunting task for self-employed individuals and small business owners. With numerous options available online, it can be challenging to identify which calculators are reliable, user-friendly, and capable of providing accurate contributions based on your unique financial situation. As you navigate through different tools, you may find that some calculators lack essential features, while others may be overly complex or difficult to understand. This can lead to confusion and miscalculations, ultimately impacting your retirement planning.

The goal of this article is to simplify your search by reviewing and ranking the top solo 401(k) calculators available online. We have meticulously analyzed various tools to help you save time and ensure that you choose a calculator that meets your needs effectively. Our comprehensive review will highlight the strengths and weaknesses of each calculator, providing you with clear insights into which tool might be the best fit for your retirement planning.

Criteria for Ranking

To ensure a fair and thorough evaluation, we utilized specific criteria in our ranking process. These include:

- Accuracy: We examined how well each calculator computes potential contributions based on user input and IRS guidelines.

- Ease of Use: We assessed the user interface and overall experience, ensuring that the calculators are intuitive and accessible for individuals with varying levels of financial knowledge.

- Features: We looked for essential functionalities such as the ability to account for catch-up contributions, the option to include other income sources, and the clarity of output provided.

By focusing on these key factors, our aim is to guide you toward the most effective solo 401(k) calculator that can help you maximize your retirement savings.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Solo 401k Calculators

When reviewing the top solo 401k calculators, we focused on several essential criteria to ensure that each tool effectively meets the needs of self-employed individuals and small business owners. Here’s how we evaluated each calculator:

-

Accuracy and Reliability

– The foremost criterion was the accuracy of the calculations provided. We looked for calculators that are based on the latest IRS regulations and contribution limits to ensure users receive correct and reliable results. This includes proper handling of different scenarios, such as age-based catch-up contributions. -

Ease of Use

– User-friendliness is crucial for a calculator to be effective. We assessed the interface of each tool, ensuring that it is intuitive and easy to navigate. A straightforward design with clear instructions helps users input their data without confusion, making the tool accessible even for those with limited financial knowledge. -

Key Features

– The most effective calculators include specific inputs that cater to the nuances of solo 401k contributions. Key features we considered include:- Profit from Business: Users can input their net earnings to determine contribution limits accurately.

- Age Input: Options for different age categories (under 50, 50-59, and 60+) to calculate potential catch-up contributions.

- Additional Earnings: The ability to account for income from other jobs, which can affect contribution limits.

- Contribution Types: Distinctions between employee contributions, employer contributions, and catch-up contributions.

-

Cost (Free vs. Paid)

– We evaluated whether the calculators are free to use or come with a fee. While many calculators offer basic functions for free, some may require payment for advanced features or ongoing support. We aimed to include a mix of both types to accommodate various user needs and budgets. -

Support and Resources

– The availability of additional resources, such as FAQs, customer support, and educational content, enhances the user experience. Tools that provide guidance on how to interpret results or further explore retirement planning options were prioritized.

-

Customization Options

– We also looked for calculators that allow users to customize their inputs for a more tailored analysis. This includes options for different business structures (sole proprietorship, LLC, etc.) and investment strategies. -

Reviews and User Feedback

– Finally, we considered user reviews and feedback to gauge overall satisfaction and effectiveness. Tools that consistently receive positive ratings from users for their functionality and support were given preference.

By applying these criteria, we ensured that the selected solo 401k calculators are not only effective but also user-friendly, reliable, and equipped with the necessary features to assist users in making informed retirement planning decisions.

The Best Solo 401K Calculators of 2025

1. Solo 401(k) Contribution Calculator

The Solo 401(k) Contribution Calculator from Oblivious Investor is designed specifically for sole proprietors and LLCs taxed as sole proprietorships, helping users determine their maximum contribution limits for retirement savings. This user-friendly tool simplifies the complex calculations involved in Solo 401(k) contributions, ensuring that sole business owners can optimize their retirement funding while adhering to IRS regulations. For those with different business structures, the site advises consulting a professional for tailored guidance.

- Website: obliviousinvestor.com

- Established: Approx. 17 years (domain registered in 2008)

2. Solo 401k Contribution Calculator

The Solo 401k Contribution Calculator from solo401k.com is a valuable tool designed to help users estimate their potential contributions to an Individual 401(k) plan. It allows for easy comparisons with other retirement plans, such as SIMPLE and SEP IRAs, making it straightforward for self-employed individuals to evaluate their options. With its user-friendly interface, this calculator simplifies the planning process for maximizing retirement savings.

- Website: solo401k.com

- Established: Approx. 24 years (domain registered in 2001)

3. Solo 401k Annual Contribution Calculator

The Solo 401k Annual Contribution Calculator from mysolo401k.net is a user-friendly tool designed to help individuals determine their annual contribution limits for a Solo 401k plan. With a quick loading time of approximately five seconds, it streamlines the process of calculating contributions, ensuring users can efficiently plan their retirement savings. This calculator is an essential resource for self-employed individuals looking to maximize their retirement contributions.

- Website: mysolo401k.net

- Established: Approx. 14 years (domain registered in 2011)

4. Individual 401k Calculator

The Individual 401(k) Calculator from DuTrac Community Credit Union is designed to assist self-employed individuals in planning their retirement savings effectively. This user-friendly tool allows users to estimate potential contributions and growth of their Individual 401(k) accounts, helping them understand how to maximize their retirement savings. By leveraging this calculator, self-employed individuals can make informed decisions to secure their financial future.

- Website: dutrac.org

- Established: Approx. 29 years (domain registered in 1996)

5. Solo 401(k) Contribution Calculator

The Solo 401(k) Contribution Calculator from ShareBuilder 401k is a user-friendly tool designed to help self-employed individuals and small business owners calculate their maximum contribution limits for a Solo 401(k) plan. By inputting relevant financial data, users can easily determine the optimal amount to contribute, ensuring they maximize their retirement savings potential while adhering to IRS regulations. This calculator streamlines the planning process for retirement funding.

- Website: sharebuilder401k.com

- Established: Approx. 20 years (domain registered in 2005)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps in obtaining accurate results from a solo 401(k) calculator is ensuring that the data you input is correct. Mistakes in entering your profit from self-employment, age, or other financial details can lead to misleading outputs. Take the time to review each entry before you hit the calculate button. Use clear, straightforward figures without commas or dollar signs, as many calculators require. If you’re unsure about any numbers, consult your financial documents or speak with a tax professional for clarification.

Understand the Underlying Assumptions

Different calculators may operate under various assumptions regarding contribution limits, tax implications, and self-employment income. Familiarize yourself with these assumptions to understand how they impact your results. For instance, some calculators may not account for contributions made to other retirement plans, while others might have different methods for calculating employer contributions. By understanding these assumptions, you can better interpret the results and make informed decisions based on your unique financial situation.

Use Multiple Tools for Comparison

No single calculator can provide a complete picture of your solo 401(k) contribution potential. To ensure accuracy, consider using multiple calculators. Each tool might offer unique features or interpret regulations slightly differently, leading to varied results. By comparing outputs from different calculators, you can identify discrepancies and better gauge a realistic contribution range. This practice not only enhances accuracy but also helps you discover new features or options that you might not have considered before.

Keep Track of Changes in Regulations

The rules surrounding solo 401(k) plans can change annually, particularly regarding contribution limits and tax regulations. Stay updated on the latest IRS guidelines to ensure that the calculator reflects the most current information. Check for any updates or announcements from the calculator provider regarding changes in their calculations or methodologies. This diligence will help you avoid miscalculations that could arise from outdated information.

Consult a Financial Advisor

While online calculators are valuable tools, they cannot replace professional financial advice. If you’re uncertain about the results or how to implement them into your broader retirement planning strategy, consider consulting a financial advisor. An expert can provide personalized insights based on your entire financial picture, helping you navigate complex issues like tax implications, retirement goals, and investment strategies. Their expertise can complement the calculator’s output, ensuring you’re making the most of your solo 401(k) plan.

Stay Organized

Finally, keep detailed records of your inputs, calculations, and any advice received. This organization will not only help you track your progress but also assist in future planning. Having a comprehensive view of your contributions and changes over time can help you make informed decisions as you approach retirement. By maintaining organization in your financial planning, you increase your chances of achieving your retirement goals effectively.

Frequently Asked Questions (FAQs)

1. What is a Solo 401(k) calculator and how does it work?

A Solo 401(k) calculator is an online tool designed to help self-employed individuals or business owners estimate their maximum contribution limits for a Solo 401(k) retirement plan. Users input various data points, including their age, business profits, and any contributions made to other retirement plans. The calculator then computes the allowable contributions, which can include employee contributions, employer contributions, and catch-up contributions for those aged 50 and older.

2. Who should use a Solo 401(k) calculator?

The Solo 401(k) calculator is intended for sole proprietors, single-member LLC owners, and self-employed individuals who do not have any full-time employees other than themselves or their spouse. It’s particularly useful for those who want to maximize their retirement savings through contributions that take advantage of both employee and employer contribution limits.

3. What information do I need to use a Solo 401(k) calculator?

To effectively use a Solo 401(k) calculator, you typically need the following information:

– Your age at the end of the contribution year.

– Your net earnings from self-employment (business profits).

– Any contributions made to other retirement plans (e.g., 401(k) or 403(b)).

– If applicable, the amount of any catch-up contributions if you are 50 or older.

This information helps the calculator determine your maximum contribution limits accurately.

4. Can I use a Solo 401(k) calculator if I have other employment?

Yes, you can still use a Solo 401(k) calculator if you have other employment. However, the calculator will factor in contributions you have already made to other retirement accounts, which may reduce your maximum allowable contributions to your Solo 401(k). It’s essential to provide accurate figures for any contributions made to other plans to get a precise estimate.

5. Are there any limitations to using a Solo 401(k) calculator?

While a Solo 401(k) calculator provides a helpful estimate of contribution limits, it has limitations. The calculations are based on the information you provide and may not account for all specific circumstances, such as changes in IRS regulations or individual tax situations. Therefore, it is advisable to consult with a tax professional or financial advisor to ensure compliance and to understand the full implications of your retirement planning strategy.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.