The 5 Best Stock Average Down Calculators of 2025 (Reviewed)

Finding the Best Stock Average Down Calculator: An Introduction

In the world of investing, understanding how to manage and optimize your stock portfolio is crucial, especially when it comes to averaging down on stock purchases. A stock average down calculator can be an invaluable tool for investors looking to reduce their average cost per share when prices dip. However, with so many options available online, finding a reliable and effective calculator can be challenging.

This article aims to simplify that process by reviewing and ranking the best stock average down calculators available online. Our goal is to save you time and effort by highlighting tools that are not only user-friendly but also provide accurate and insightful calculations.

Criteria for Ranking

To ensure a comprehensive and unbiased review, we evaluated each calculator based on several key criteria:

-

Accuracy: The primary function of any calculator is to provide precise calculations. We examined how accurately each tool computes the average cost based on user input.

-

Ease of Use: A user-friendly interface is essential, especially for those who may not be tech-savvy. We looked at the simplicity of navigation and the clarity of instructions provided by each tool.

-

Features: Additional functionalities, such as the ability to handle multiple stock entries, reset options, and clear outputs, were also considered. Tools that offered advanced features like historical data or integration with stock market trends were rated higher.

-

Accessibility: We assessed whether the calculators are free to use and if they require any subscriptions or sign-ups, which could deter users.

By focusing on these criteria, we aim to present you with a curated list of the top stock average down calculators that meet the needs of both novice and experienced investors alike. Whether you’re looking to make informed decisions during market fluctuations or simply want to optimize your investment strategy, our review will guide you to the best tools available.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Best Stock Average Down Calculators

When it comes to choosing the best stock average down calculators, we focused on several critical factors to ensure that the tools we recommend are effective, user-friendly, and suited to the needs of both novice and experienced investors. Here are the key criteria we considered:

-

Accuracy and Reliability

– The primary function of a stock average down calculator is to provide accurate calculations of average stock prices. We evaluated each tool to ensure it uses correct mathematical formulas and reliably processes user inputs to deliver precise results. An accurate calculator is essential for making informed investment decisions. -

Ease of Use

– A user-friendly interface is crucial, especially for beginners. We assessed the simplicity of navigation, clarity of instructions, and overall design of each calculator. The best tools should allow users to input data easily without unnecessary complications, ensuring a smooth experience from start to finish. -

Key Features

– We looked for calculators that offer a range of useful features to enhance functionality. Important aspects include:- Multiple Transaction Inputs: The ability to enter several stock purchases at different prices and quantities is vital for accurate averaging.

- Instant Results: Users should be able to see results quickly after inputting their data.

- Reset and Remove Options: Users should have the ability to clear entries or remove specific transactions easily.

- Clear Output Display: The calculator should present results in a straightforward manner, showing average price, total shares, and total investment clearly.

-

Cost (Free vs. Paid)

– We considered whether the calculators are free to use or require payment. Free tools are generally more accessible for everyday investors, while paid options may offer additional features. We aimed to include a mix of both, highlighting the value provided by each. -

Accessibility

– The ability to access the calculator across various devices (desktop, tablet, mobile) was also an important criterion. Tools that are mobile-friendly allow users to calculate on-the-go, which is beneficial for active traders.

-

Additional Resources

– Some calculators provide educational resources or guides on how to average down stocks effectively. We valued tools that not only calculate but also educate users about the averaging process, market strategies, and risk management. -

User Reviews and Reputation

– We reviewed user feedback and ratings to gauge the effectiveness and reliability of each tool. Positive testimonials from users can indicate a calculator’s trustworthiness and functionality, while negative reviews can highlight potential issues.

By assessing these criteria, we aimed to present a well-rounded selection of stock average down calculators that cater to a wide range of user needs, ensuring that every investor can find a tool that suits their investment strategy.

The Best Stock Average Down Calculators of 2025

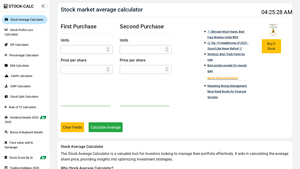

1. Stock market Average Calculator

The Stock Market Average Calculator by Praveen MP is a practical tool designed for investors aiming to optimize their portfolio management. This calculator simplifies the process of determining the average share price, enabling users to make informed decisions about their investments. Its user-friendly interface and straightforward functionality make it an essential resource for both novice and experienced investors looking to track and analyze their stock performance effectively.

- Website: praveenmp.github.io

2. Stock Average Calculator

The Stock Average Calculator from stock-screener.org is a valuable tool designed to help investors calculate the average share price they have paid for a stock. This calculator is particularly useful for determining your overall cost basis, whether you are averaging up or averaging down on a position. By providing clear insights into your investment costs, it aids in making informed trading decisions.

- Website: stock-screener.org

- Established: Approx. 10 years (domain registered in 2015)

How to Get the Most Accurate Results

Double-Check Your Inputs

Accuracy in your calculations begins with the data you enter. Take the time to double-check all your inputs, such as the number of shares purchased and the corresponding purchase prices. A simple typo can lead to significant discrepancies in your average price calculations. Ensure that you are using consistent units, such as dollars for price and shares for quantity. By verifying your inputs, you can avoid errors that may distort your financial analysis.

Understand the Underlying Assumptions

Each stock average down calculator operates on specific formulas and assumptions. Familiarize yourself with how these calculators derive their results. Most calculators use a weighted average formula, taking into account the number of shares bought at each price. Understanding this can help you interpret the results correctly and provide context for your investment strategy. For instance, if you heavily weighted your purchases towards lower prices, the average will reflect that, potentially influencing your decision to buy more shares at a current market price.

Use Multiple Tools for Comparison

To ensure the accuracy of your results and to gain a broader perspective, consider using multiple stock average down calculators. Each tool may have slight variations in their interfaces, features, or methodologies. By comparing outputs from different calculators, you can identify any inconsistencies and gain confidence in the information you are using to make investment decisions. Furthermore, different tools may offer additional features, such as visualizations or historical data, which can enhance your analysis.

Keep Records Updated

For the most reliable results, maintain accurate and up-to-date records of your stock transactions. Regularly update the quantities and prices in your calculators as you make new purchases or sell shares. This practice not only ensures that your average calculations remain relevant but also helps you track your investment performance over time. Good record-keeping facilitates informed decision-making and can provide insights into your overall investment strategy.

Take Advantage of Additional Features

Many online calculators come equipped with features beyond simple averaging. Explore these features, such as the ability to add multiple stock purchases or reset inputs easily. Some calculators may also provide options for tracking total investment amounts or visual representations of your average price trends. By utilizing these additional tools, you can gain deeper insights into your stock positions and make more informed decisions.

Stay Informed About Market Conditions

Lastly, remember that stock prices are influenced by various external factors, including market trends, economic indicators, and company performance. While calculators are invaluable for assessing your average purchase price, they should be used in conjunction with market research and news updates. Staying informed will help you understand the broader context of your investments, leading to more strategic decision-making.

Frequently Asked Questions (FAQs)

1. What is a stock average down calculator?

A stock average down calculator is an online tool designed to help investors determine the average price of their stock purchases over multiple transactions. It calculates the weighted average cost of shares, allowing users to understand their overall investment better and make informed decisions about future trades.

2. How do I use a stock average down calculator?

Using a stock average down calculator typically involves a few straightforward steps:

1. Enter Stock Quantity: Input the number of shares you have purchased in each transaction.

2. Enter Purchase Price: Input the price at which each stock was bought.

3. Add More Stocks: If you have made multiple purchases, you can add additional entries to the calculator.

4. Calculate: Click the calculate button to see the average price per share, total stock quantity, and total investment amount.

3. Why should I average down my stock purchases?

Averaging down involves buying additional shares of a stock at a lower price than your original purchase. This strategy can lower your average cost per share, which may help you break even or profit if the stock price eventually rebounds. Using a stock average down calculator can assist in determining how many additional shares you need to buy to achieve your desired average price.

4. Can I use a stock average down calculator for multiple stocks?

Yes, most stock average down calculators allow you to input multiple stock transactions. You can add as many entries as needed to calculate the average price across different purchases for the same stock. Some calculators even provide features to easily add or remove stock entries, making it convenient to manage your portfolio.

5. Is there a cost to use a stock average down calculator?

Most online stock average down calculators are free to use. However, it’s advisable to check the specific tool you are using, as some platforms may offer additional features or premium services that come with a fee. Always ensure that you are using a reputable calculator to get accurate results without any hidden costs.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.