The 5 Best Suburban Paycheck Calculators of 2025 (Reviewed)

Finding the Best Suburban Paycheck Calculator: An Introduction

Navigating the world of personal finance can be daunting, especially when it comes to understanding your paycheck. For those living in suburban areas, the challenge of accurately calculating take-home pay becomes even more complex due to varying state and local tax regulations. A reliable suburban paycheck calculator is essential for anyone who wants to gain clarity on their earnings after taxes, deductions, and withholdings. However, with numerous options available online, finding a trustworthy tool can be overwhelming.

This article aims to simplify your search by reviewing and ranking the top suburban paycheck calculators currently accessible on the internet. Our goal is to save you time and effort by providing a comprehensive analysis of each tool, highlighting their strengths and weaknesses. Whether you are a salaried employee, an hourly worker, or a contractor, having a dependable calculator at your fingertips can make a significant difference in managing your finances effectively.

Criteria for Ranking

To ensure that our recommendations are both accurate and user-friendly, we have established specific criteria for evaluating each paycheck calculator. These criteria include:

- Accuracy: Each calculator must provide reliable results based on the latest federal, state, and local tax rates.

- Ease of Use: We assessed the user interface and overall experience, focusing on how straightforward it is to input data and retrieve results.

- Features: Additional functionalities, such as the ability to factor in various deductions, allowances, and pay frequencies, were considered to determine the versatility of each tool.

By evaluating these factors, we aim to guide you toward the best suburban paycheck calculator that meets your specific needs, helping you take control of your financial planning with confidence.

Our Criteria: How We Selected the Top Tools

Accuracy and Reliability

When selecting the best suburban paycheck calculators, accuracy and reliability were paramount. Each calculator needed to provide precise estimates of take-home pay by accurately deducting federal, state, and local taxes, as well as other withholdings such as Social Security and Medicare. We ensured that the tools were based on the most current tax regulations and withholding tables, allowing users to trust the results for their financial planning.

Ease of Use

User-friendliness was another critical factor in our evaluation. The calculators needed to feature intuitive interfaces that make it easy for users to input their data without confusion. We looked for tools that allowed quick navigation and minimized the number of steps required to get results, catering to both tech-savvy users and those who may not be as comfortable with online tools.

Key Features

To effectively serve suburban residents, we focused on calculators that offered essential features tailored to their needs. Key inputs that were considered essential include:

– Income Type: Options for both hourly and salaried income.

– Pay Frequency: Various choices such as weekly, bi-weekly, semi-monthly, and monthly.

– Federal and State Withholding: Ability to input relevant information from the W-4 form, including marital status and allowances.

– Additional Deductions: Support for pre-tax deductions like 401(k) contributions, health insurance, and other withholdings.

– Local Taxes: Consideration for local tax deductions, which can vary significantly depending on the suburban area.

Cost (Free vs. Paid)

We prioritized free tools to ensure accessibility for all users. While some calculators may offer premium features at a cost, the best options in our list provided comprehensive services without requiring any payment. This ensures that individuals can access necessary financial tools without worrying about added expenses.

User Reviews and Feedback

Finally, we considered user reviews and feedback as a vital criterion. Tools with positive ratings and testimonials from actual users were favored, as they provide insights into the practical performance of the calculators. We aimed for a selection of calculators that not only met our standards but were also well-received by the community, indicating reliability and user satisfaction.

By adhering to these criteria, we curated a list of suburban paycheck calculators that cater to a wide range of needs while ensuring accuracy, ease of use, and accessibility.

The Best Suburban Paycheck Calculators of 2025

1. Paycheck Calculator

The Paycheck Calculator from Suburban Computer Services is a free and user-friendly tool designed to help individuals calculate their take-home pay effortlessly. It accommodates both hourly and salary income, making it versatile for various employment types. Additionally, the calculator supports multiple pay frequencies, ensuring accurate results tailored to different payroll schedules. This makes it an essential resource for anyone looking to understand their earnings better.

- Website: suburbancomputer.com

- Established: Approx. 28 years (domain registered in 1997)

2. Calculate your paycheck with pay calculators and tax …

PaycheckCity offers a suite of free online tools designed to help users accurately calculate their paychecks. Key features include paycheck calculators that convert gross income to net pay, bonus calculators, and resources for completing Form W-4 and state withholding forms. Additionally, the platform provides a 401(k) savings and retirement calculator, making it a comprehensive resource for individuals looking to manage their finances effectively.

- Website: paycheckcity.com

- Established: Approx. 26 years (domain registered in 1999)

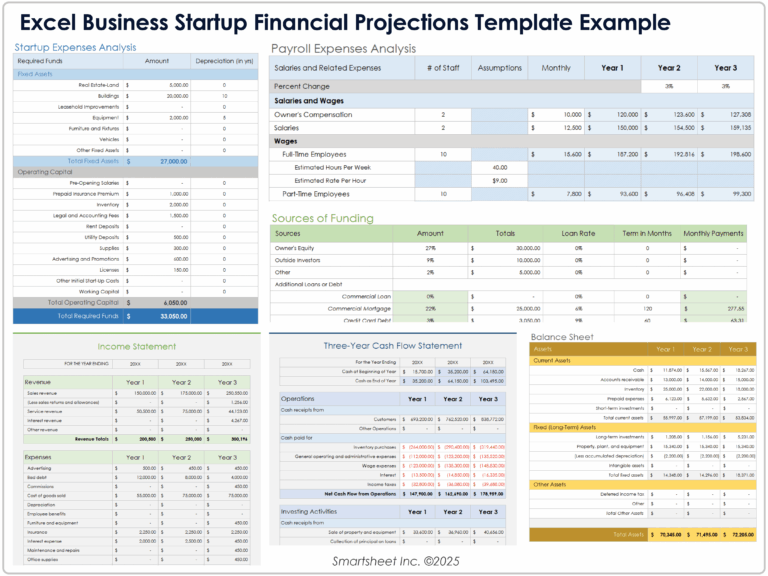

4. Paycheck Calculator [2025]

The QuickBooks Paycheck Calculator for 2025 is a free online tool designed to help users estimate an employee’s net pay, whether they are hourly or salaried. By factoring in various taxes and withholdings, this calculator provides accurate insights into take-home earnings, making it an invaluable resource for both employers and employees looking to understand their payroll deductions better. Its user-friendly interface ensures quick and efficient calculations.

- Website: quickbooks.intuit.com

- Established: Approx. 31 years (domain registered in 1994)

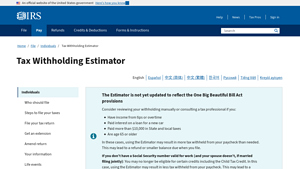

5. Tax Withholding Estimator

The Tax Withholding Estimator provided by the Internal Revenue Service (IRS) is a valuable online tool designed to help individuals determine the appropriate amount of federal income tax to withhold from their paychecks. By inputting personal financial information, users can receive tailored estimates that ensure they meet their tax obligations while avoiding over- or under-withholding. This tool simplifies the withholding process, making it easier for taxpayers to manage their finances effectively.

- Website: irs.gov

- Established: Approx. 28 years (domain registered in 1997)

How to Get the Most Accurate Results

Double-Check Your Inputs

One of the most crucial steps in obtaining accurate results from a suburban paycheck calculator is to ensure that all your inputs are correct. This includes your income amount, pay frequency (weekly, bi-weekly, etc.), marital status, and number of allowances. A small error in any of these fields can lead to significant discrepancies in your calculated take-home pay. After entering your information, take a moment to review each entry. It’s also wise to familiarize yourself with the terminology used in the calculator, such as the difference between gross pay and net pay, to avoid any misunderstandings.

Understand the Underlying Assumptions

Different paycheck calculators may operate based on varied assumptions regarding tax rates, deductions, and local laws. For instance, some calculators may not include local taxes or may use outdated tax tables. Before relying on the results, read the calculator’s guidelines or FAQs to understand how it processes your data. Knowing what is included (or excluded) in the calculations can help you interpret your results correctly and make necessary adjustments if needed.

Use Multiple Tools for Comparison

To gain a more comprehensive view of your take-home pay, consider using multiple paycheck calculators. Different tools may yield slightly different results based on their methodologies, algorithms, and tax assumptions. By comparing the outputs from various calculators, you can identify a range of possible take-home pay scenarios. This practice can also highlight any discrepancies that may arise from specific inputs or assumptions, providing you with a more balanced perspective.

Keep Up with Tax Changes

Tax laws and regulations can change frequently, impacting your paycheck calculations. Many calculators update their systems to reflect the most current federal and state tax rates, but it’s always a good idea to stay informed about any recent changes. Check the calculator’s notes or announcements for updates on tax laws, and consider consulting official state or federal websites for the latest tax information. This knowledge can help you make more informed predictions about your take-home pay and financial planning.

Factor in Additional Deductions

When using a paycheck calculator, remember to account for any additional deductions that may apply to your situation. This could include pre-tax contributions to retirement accounts, health insurance premiums, or other benefits that affect your net pay. Inputting these amounts accurately can help you achieve a more precise estimate of your take-home pay. If you’re unsure about what deductions to include, reviewing your previous pay stubs can provide clarity.

Seek Professional Advice When Necessary

While paycheck calculators are valuable tools for estimating your take-home pay, they should not replace professional financial advice. If you have complex financial situations, such as multiple income sources, investments, or unique tax circumstances, consulting a tax professional or financial advisor can offer personalized insights tailored to your needs. They can help you interpret the results from your calculator more effectively and guide you on optimizing your tax withholdings.

Frequently Asked Questions (FAQs)

1. What is a suburban paycheck calculator?

A suburban paycheck calculator is an online tool designed to help individuals estimate their take-home pay after accounting for various deductions such as federal, state, and local taxes. It typically supports both hourly and salaried income, allowing users to input their earnings, pay frequency, and withholding details to obtain an accurate estimate of their net pay.

2. How do I use a suburban paycheck calculator?

To use a suburban paycheck calculator, follow these steps:

1. Select Your Pay Type: Choose between hourly or salary.

2. Input Earnings: Enter your gross pay (hourly wage or annual salary).

3. Choose Pay Frequency: Select how often you are paid (e.g., weekly, bi-weekly, monthly).

4. Enter Tax Information: Provide details such as federal and state withholding allowances, marital status, and any additional withholdings.

5. Calculate: Click the calculate button to see your estimated take-home pay.

3. Are suburban paycheck calculators accurate?

Yes, suburban paycheck calculators are generally accurate as they utilize the latest federal and state tax tables to compute deductions. However, the accuracy of the estimate may depend on the correctness of the information you provide, such as your income, allowances, and deductions. For the most precise calculations, ensure that you have up-to-date information regarding tax rates and your personal financial situation.

4. Can I use a suburban paycheck calculator for different states?

Absolutely! Most suburban paycheck calculators allow you to select your state from a dropdown menu. This feature ensures that the calculator considers state-specific tax rates and regulations, providing you with a more accurate estimate of your take-home pay based on your location.

5. Is my personal information safe when using a suburban paycheck calculator?

Most reputable suburban paycheck calculators do not require you to input personal information such as your name or social security number. They focus solely on the financial details necessary for the calculation. Always check the privacy policy of the calculator you are using to ensure your data is not being stored or shared.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.

![Screenshot of Paycheck Calculator [2025] - Hourly & Salary - QuickBooks](https://www.cify.info/wp-content/uploads/2025/09/quickbooks-intuit-com-screenshot-7153.jpg)