The 5 Best Tennessee Payroll Calculators of 2025 (Reviewed)

Finding the Best Tennessee Payroll Calculator: An Introduction

When it comes to managing payroll in Tennessee, finding a reliable payroll calculator can be quite challenging. With the absence of state income tax and specific local regulations, navigating through the various tools available online can feel overwhelming. Business owners, freelancers, and employees alike need a straightforward way to estimate their take-home pay, factoring in federal taxes and any applicable deductions. However, many calculators fall short in accuracy or usability, leaving users frustrated and confused.

The goal of this article is to streamline your search by reviewing and ranking the top Tennessee payroll calculators available online. We have taken the time to assess each tool based on several key criteria to ensure that you can find the best fit for your needs.

Criteria for Ranking

-

Accuracy: A payroll calculator should provide precise estimates of net pay by correctly factoring in federal taxes, FICA contributions, and any other deductions relevant to Tennessee.

-

Ease of Use: The user interface should be intuitive, allowing users to input their information quickly and receive results without unnecessary complications.

-

Features: Additional features, such as options for calculating overtime, handling different pay frequencies, or incorporating pre-tax deductions, enhance the calculator’s overall utility.

-

Reliability: The tools must come from reputable sources, ensuring that the calculations are based on up-to-date tax laws and regulations.

By evaluating these criteria, we aim to save you time and effort in finding a payroll calculator that meets your needs effectively. Whether you are a business owner looking to simplify payroll processing or an employee wanting to understand your paycheck better, our insights will help you make an informed choice.

Our Criteria: How We Selected the Top Tools

Criteria for Selecting the Top Tennessee Payroll Calculators

When reviewing and selecting the best Tennessee payroll calculators, we focused on several key criteria to ensure that users find reliable, user-friendly, and comprehensive tools. Here’s a breakdown of the essential factors we considered:

-

Accuracy and Reliability

– The primary function of a payroll calculator is to provide accurate estimates of take-home pay after taxes and deductions. We assessed each tool’s methodology and data sources to ensure they comply with current federal and state tax regulations. Tools that included disclaimers about their estimates being general guidance rather than precise calculations were noted, as this is crucial for user awareness. -

Ease of Use

– A user-friendly interface is vital for a positive experience. We evaluated how intuitive each calculator is, including the simplicity of navigation and the clarity of instructions. Tools that require minimal input and provide straightforward outputs were prioritized, making it easy for users of all backgrounds to understand their results. -

Key Features

– A robust payroll calculator should allow for various inputs that reflect users’ unique financial situations. We looked for calculators that offered:- Input for salary or hourly wages: Users should be able to specify whether they are salaried or hourly employees.

- Tax allowances and deductions: The ability to input federal and state allowances, along with pre-tax and post-tax deductions (such as retirement contributions, health insurance, etc.), is essential for accurate calculations.

- Multiple pay frequencies: Options for different pay periods (e.g., weekly, bi-weekly, monthly) enhance flexibility.

- Local taxes: While Tennessee does not have state income tax, the inclusion of other relevant deductions or considerations was noted.

-

Cost (Free vs. Paid)

– We examined whether the calculators are free to use or require payment. Free tools were favored, especially for individuals or small business owners seeking straightforward payroll calculations without incurring additional costs. However, we also considered the value offered by paid options, particularly if they provided advanced features or enhanced accuracy. -

Additional Resources and Support

– We considered whether the calculator was part of a broader suite of financial tools or resources. Tools that provide educational content about Tennessee payroll laws, tax changes, and additional financial planning resources were viewed positively, as they add value for users looking to understand more about their payroll situation. -

User Reviews and Feedback

– Lastly, we took into account user feedback and reviews for each calculator. Tools that consistently received high ratings for accuracy, ease of use, and overall satisfaction were prioritized in our selection.

By considering these criteria, we aimed to identify the best Tennessee payroll calculators that can effectively meet the needs of users seeking accurate payroll calculations and insights.

The Best Tennessee Payroll Calculators of 2025

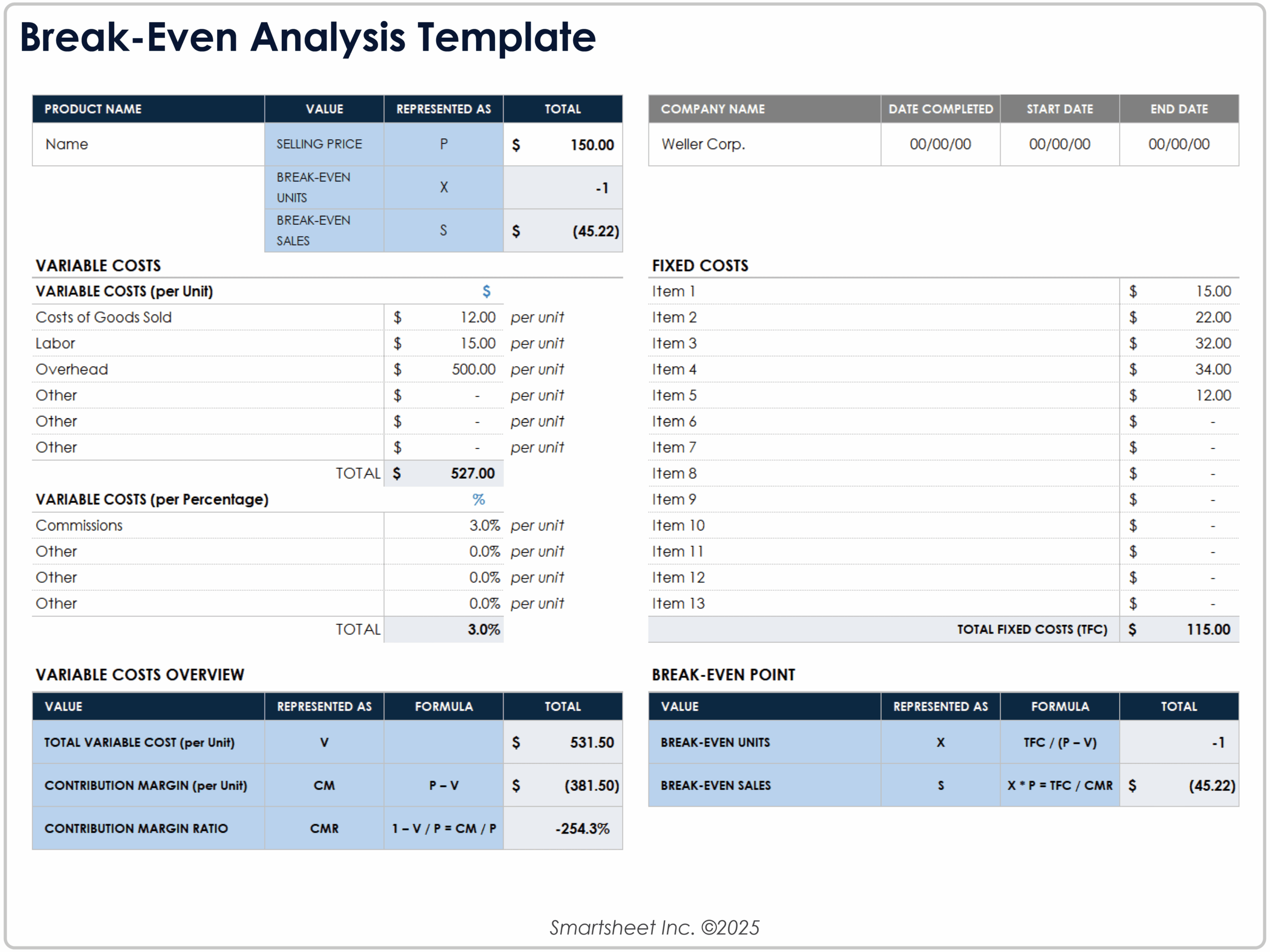

1. Tennessee Paycheck Calculator

ADP’s Tennessee Paycheck Calculator is a user-friendly tool designed to help both hourly and salaried employees estimate their net or “take home” pay. By simply inputting wages and tax withholdings, users can quickly gain insights into their earnings after deductions. This calculator is particularly valuable for individuals looking to understand their financial situation better and plan their budgets accordingly.

- Website: adp.com

- Established: Approx. 34 years (domain registered in 1991)

3. Tennessee Salary Paycheck Calculator

The Tennessee Salary Paycheck Calculator by Gusto is a user-friendly tool designed to help employers accurately calculate take-home pay for their hourly employees. It allows users to determine various withholdings, ensuring compliance with state regulations. By inputting relevant salary information, employers can quickly gain insights into net earnings, making payroll management more efficient and transparent for both employers and employees in Tennessee.

- Website: gusto.com

- Established: Approx. 30 years (domain registered in 1995)

5. 2025 Tennessee Hourly Paycheck Calculator

The 2025 Tennessee Hourly Paycheck Calculator from PaycheckCity is a valuable online tool designed to help users estimate their take-home pay based on hourly wages. It offers features such as withholding calculators and tax calculators, making it easier for individuals to understand their payroll deductions. This comprehensive resource is ideal for both employees and employers looking to navigate Tennessee’s tax landscape effectively.

- Website: paycheckcity.com

- Established: Approx. 26 years (domain registered in 1999)

How to Get the Most Accurate Results

Double-Check Your Inputs

When using a Tennessee payroll calculator, accuracy in your inputs is crucial for obtaining reliable results. Before hitting the calculate button, carefully review all information you provide, including your salary or hourly wage, pay frequency, marital status, and any applicable deductions. A simple typo or incorrect figure can significantly impact your estimated take-home pay. Make sure to also include any pre-tax deductions, such as health insurance or retirement contributions, as these will influence your taxable income.

Understand the Underlying Assumptions

Each payroll calculator operates based on specific assumptions regarding tax rates and deductions. Familiarize yourself with these assumptions to better understand how they affect your results. For instance, some calculators may not account for certain local taxes or specific deductions that apply to your situation. It’s also important to remember that these tools provide estimates and should not be considered definitive calculations. If your financial situation is complex, consider consulting a tax professional for personalized advice.

Use Multiple Tools for Comparison

To achieve the most accurate results, it’s wise to use multiple payroll calculators. Different tools may have varying algorithms, tax tables, or user interfaces, which can lead to discrepancies in your take-home pay estimates. By comparing results from various calculators, you can identify any significant differences and adjust your inputs accordingly. This approach can also help you understand the range of possible outcomes based on different scenarios, enhancing your financial planning.

Keep Up with Tax Changes

Tax laws and rates can change from year to year, and it’s essential to stay informed about any updates that may affect your payroll calculations. For instance, federal and state tax rates, as well as deductions, can be adjusted during tax season. Before using a payroll calculator, ensure that it reflects the most current tax information. Many reputable online calculators will update their data regularly, but it’s good practice to verify this information, especially if you’re using a less-known tool.

Review Your Results

After obtaining your estimated take-home pay, take a moment to analyze the results. Look for breakdowns of federal and other taxes withheld, as well as any deductions applied. Understanding these components can provide insights into your financial situation and help you make informed decisions regarding budgeting or tax planning. If the results seem off, revisit your inputs or consider trying another calculator for a second opinion.

Plan for Variability

Finally, keep in mind that payroll calculators provide estimates based on the information you input. Changes in your employment status, hours worked, or tax situation throughout the year can lead to variations in your actual take-home pay. Use the calculator as a planning tool, but regularly reassess your financial situation and adjust your expectations as needed. This proactive approach will help you maintain a clear picture of your finances and better prepare for any changes that may arise.

Frequently Asked Questions (FAQs)

1. What is a Tennessee payroll calculator?

A Tennessee payroll calculator is an online tool designed to help employees and employers estimate net or “take home” pay after accounting for federal taxes and any applicable deductions. By inputting details such as gross income, tax withholdings, and other relevant financial information, users can obtain a clearer picture of their expected earnings per pay period.

2. How do I use a Tennessee payroll calculator?

To use a Tennessee payroll calculator, follow these simple steps:

1. Input Your Information: Enter your gross salary or hourly wage, pay frequency (weekly, bi-weekly, etc.), and any applicable deductions such as health insurance or retirement contributions.

2. Select Tax Information: Choose your marital status, number of dependents, and any additional tax withholdings you want to include.

3. Calculate: Click the calculate button to generate your estimated take-home pay, which will display the breakdown of taxes withheld and other deductions.

3. Are there any state income taxes in Tennessee?

No, Tennessee does not impose a state income tax on wages. This means that residents only have to worry about federal income tax and FICA taxes (Social Security and Medicare) when calculating their take-home pay. However, it’s important to note that Tennessee has a high sales tax rate, which can affect overall budgeting.

4. Can I rely on the results from a Tennessee payroll calculator for accurate payroll processing?

While Tennessee payroll calculators provide useful estimates, they should not be relied upon for precise payroll calculations. These tools are designed for general guidance and may not account for every individual circumstance, such as specific deductions or credits. For accurate payroll processing, it is advisable to consult a payroll professional or use comprehensive payroll software.

5. What should I do if my tax situation changes?

If your tax situation changes—such as getting married, having a child, or taking on a new job—you should update your information in the payroll calculator to reflect these changes. It may also be necessary to fill out a new W-4 form with your employer to adjust your withholding allowances. Regularly reviewing your paycheck calculations can help ensure that you are withholding the correct amount and avoiding any surprises during tax season.

Important Disclaimer

⚠️ Important Disclaimer

The information and reviews in this guide are for educational purposes only and are based on publicly available information. We are not affiliated with any of the tools mentioned. Features and pricing may change. Always conduct your own research before choosing a tool for your needs.