XRP (XRP) Explained: A Deep Dive into the Technology and Tokenomics

An Investor’s Introduction to XRP (XRP)

XRP (XRP) has emerged as one of the most significant digital assets in the cryptocurrency market, primarily known for its role in facilitating cross-border payments. Launched in 2012 as the native token of the XRP Ledger (XRPL), XRP is designed to serve as a bridge currency for international transactions, providing a faster and more cost-effective alternative to traditional payment systems. With a market capitalization that consistently places it among the top cryptocurrencies globally, XRP stands out not only for its technological capabilities but also for its potential to disrupt the legacy financial systems that dominate global finance today.

The XRP Ledger is a decentralized, open-source blockchain that offers numerous advantages, including low transaction costs—typically around $0.0002—and rapid transaction speeds, settling in just 3-5 seconds. This efficiency is particularly appealing to businesses and financial institutions looking to optimize their payment processes. Furthermore, the XRPL supports a variety of applications beyond payments, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and asset tokenization, making it a versatile platform for developers.

The purpose of this guide is to provide a comprehensive resource for both beginners and intermediate investors interested in understanding XRP. We will delve into the underlying technology of the XRP Ledger, exploring its unique features and capabilities. Additionally, we will examine the tokenomics of XRP, including its supply, distribution, and market behavior.

Investment potential is a key focus of this guide. We will analyze historical price movements, market trends, and factors influencing XRP’s valuation to help you make informed investment decisions. However, it is crucial to acknowledge the risks associated with investing in cryptocurrencies, including regulatory uncertainties, market volatility, and technological challenges. This guide will highlight these risks and provide strategies for mitigating them.

Finally, we will cover practical aspects of acquiring XRP, including where to buy it, how to store it securely, and best practices for trading. Whether you are looking to invest in XRP for its utility, potential for growth, or as part of a diversified portfolio, this guide aims to equip you with the knowledge and tools needed to navigate the complexities of the XRP ecosystem effectively.

What is XRP (XRP)? A Deep Dive into its Purpose

Overview of XRP

XRP is the native cryptocurrency of the XRP Ledger (XRPL), a decentralized blockchain network designed primarily for facilitating fast and cost-efficient cross-border payments. Launched in 2012 by David Schwartz, Jed McCaleb, and Arthur Britto, XRP was created to serve as a bridge currency that enhances the efficiency of international money transfers. Ripple Labs, the company founded by Schwartz and McCaleb, uses XRP to power its payment solutions, which are aimed at banks and financial institutions.

The Core Problem It Solves

The primary issue that XRP addresses is the inefficiency and high costs associated with traditional cross-border payment systems. Conventional methods, such as SWIFT, often involve multiple intermediaries, lengthy settlement times, and significant fees. These processes can take several days to complete and are fraught with complications such as currency conversion delays and high transaction costs.

XRP aims to streamline this process by allowing transactions to be settled in seconds at a fraction of a cent. By enabling near-instantaneous transfers, XRP reduces the need for pre-funding accounts in different currencies, a common requirement in traditional banking systems. This is especially beneficial for businesses and individuals who need to send or receive money internationally, as it minimizes liquidity costs and enhances cash flow.

Its Unique Selling Proposition

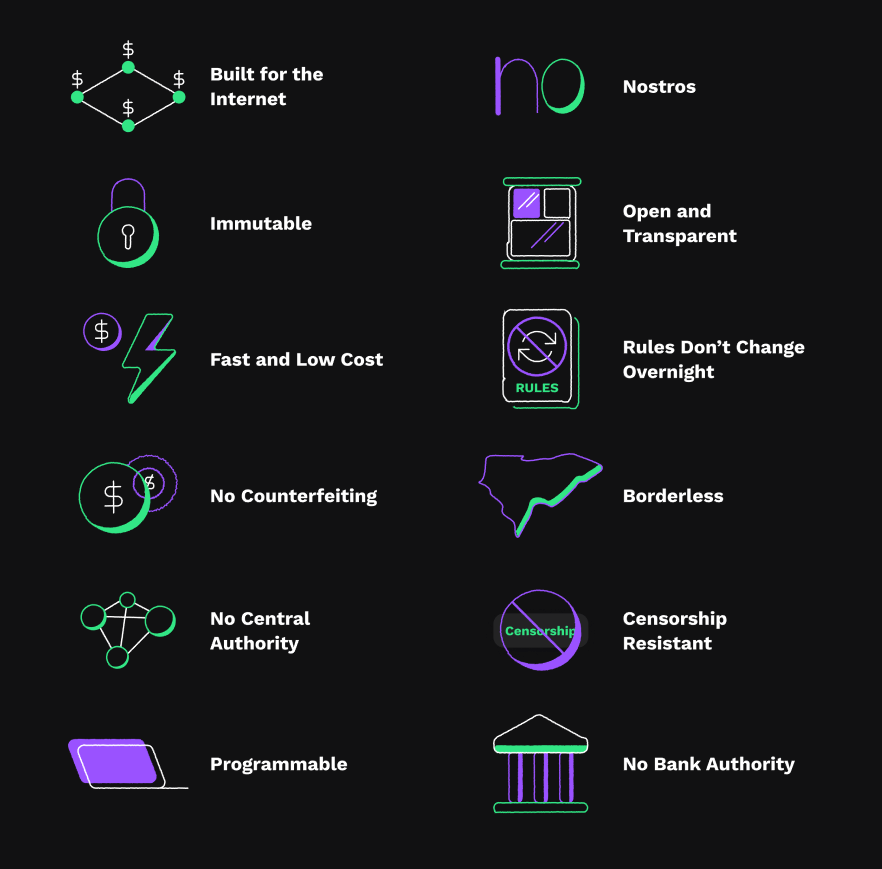

XRP’s unique selling proposition lies in its combination of speed, low transaction costs, and scalability. Here are some key features that set XRP apart from other cryptocurrencies:

-

Speed: Transactions on the XRP Ledger are confirmed in approximately 3-5 seconds. This rapid settlement time is crucial for businesses that require quick access to funds and for facilitating real-time transactions.

-

Cost Efficiency: The cost of transacting with XRP is remarkably low, typically around $0.0002 per transaction. This affordability makes it an attractive option for high-volume transactions, such as remittances and international payments.

-

Scalability: The XRPL can handle up to 1,500 transactions per second, making it one of the most scalable blockchain solutions available. This capability is essential for accommodating the growing demand for fast and reliable payment solutions.

-

Decentralized Exchange: The XRPL features a built-in decentralized exchange (DEX) that allows users to trade various assets directly on the ledger. This functionality enhances liquidity and enables users to perform cross-currency transactions seamlessly.

-

Sustainability: XRP is designed to be energy-efficient, using a consensus mechanism that does not require the energy-intensive mining processes seen in Bitcoin and some other cryptocurrencies. This makes XRP a more environmentally friendly option within the crypto ecosystem.

The Team and Backers

The development of XRP and the XRP Ledger has been spearheaded by a team of experienced professionals in the fields of finance and technology. Key figures include:

-

David Schwartz: One of the original architects of the XRP Ledger, Schwartz has played a pivotal role in the development of the technology and its underlying protocols. He currently serves as Ripple’s Chief Technology Officer.

-

Jed McCaleb: A co-founder of Ripple, McCaleb is also known for creating other notable projects such as Mt. Gox and Stellar (XLM). His vision for a decentralized payment system has been instrumental in shaping the direction of XRP.

-

Chris Larsen: Another co-founder of Ripple, Larsen has a background in technology and finance. He has been a vocal advocate for the adoption of XRP in traditional financial systems and has worked to position Ripple as a leader in blockchain-based payment solutions.

Ripple Labs, the company behind XRP, has garnered significant investment from various venture capital firms and financial institutions, further validating the project’s potential. Notably, Ripple has collaborated with several banks and financial services companies to explore the use of XRP for cross-border payments, including Santander, American Express, and Standard Chartered.

Fundamental Purpose in the Crypto Ecosystem

The fundamental purpose of XRP in the crypto ecosystem is to facilitate fast, efficient, and cost-effective cross-border transactions. By providing a solution to the limitations of traditional banking systems, XRP aims to enhance the global financial infrastructure. Its use case extends beyond mere currency transfer; it also encompasses the potential for developing decentralized finance (DeFi) applications and enabling the tokenization of assets.

As the demand for faster and cheaper payment solutions grows, XRP’s role as a bridge currency becomes increasingly relevant. It allows for seamless conversions between different fiat currencies, thereby reducing the friction associated with international transactions.

In summary, XRP represents a significant innovation in the realm of digital currencies, addressing critical challenges in the global payment landscape. With its focus on speed, low costs, and scalability, XRP is well-positioned to play a vital role in the future of finance, potentially transforming how individuals and businesses conduct transactions across borders.

The Technology Behind the Coin: How It Works

Introduction to XRP and the XRP Ledger

XRP is the native cryptocurrency of the XRP Ledger (XRPL), a decentralized blockchain technology designed to facilitate fast and cost-effective cross-border payments. Launched in 2012, XRPL aims to address the inefficiencies of traditional banking systems and offers a scalable solution for financial transactions. This guide will delve into the technology behind XRP, explaining its blockchain architecture, consensus mechanism, and key innovations that set it apart in the cryptocurrency landscape.

Blockchain Architecture

At its core, the XRP Ledger is an open-source, permissionless blockchain that enables secure and transparent transactions. Here are some key aspects of its architecture:

1. Decentralization and Open Source

The XRPL is built on a decentralized framework, meaning that no single entity controls the network. Instead, it is maintained by a global community of validators—independent servers that verify transactions. This decentralization enhances security and ensures that the network operates without a central point of failure.

Being open-source allows developers to contribute to its improvement and innovation. Anyone can access the source code, propose changes, and develop applications on the XRPL.

2. Transaction Efficiency

The XRPL is designed for high performance, capable of processing up to 1,500 transactions per second (TPS). This speed is significantly higher than that of Bitcoin and Ethereum, making XRP a suitable choice for real-time payments. Transactions on the XRPL are typically settled within 3-5 seconds, and the cost per transaction is a fraction of a cent (approximately $0.0002), making it an attractive option for both businesses and individuals.

3. Scalability

Scalability is a crucial feature of the XRPL, allowing it to handle a growing number of transactions without compromising performance. The architecture supports various applications, from micropayments to large-scale financial transactions, making it adaptable to different use cases.

Consensus Mechanism

Unlike many cryptocurrencies that rely on energy-intensive consensus mechanisms like Proof-of-Work (PoW) or Proof-of-Stake (PoS), the XRPL uses a unique consensus protocol called Federated Consensus.

1. How Federated Consensus Works

In the Federated Consensus model, a group of independent validators works together to confirm transactions. Here’s how it operates:

-

Validators: The XRPL has over 150 validators, which include universities, exchanges, and businesses. These validators maintain the network’s integrity by agreeing on the order and outcome of transactions.

-

Consensus Process: When a transaction is initiated, it is sent to the validators for verification. Validators then check the transaction against the rules of the network. If a majority of validators (at least 80%) agree that the transaction is valid, it is confirmed and added to the ledger.

-

Public Ledger: All transactions are recorded on a public ledger, ensuring transparency. Anyone can access the ledger and verify transactions, contributing to the trustworthiness of the system.

2. Advantages of Federated Consensus

The Federated Consensus mechanism offers several advantages:

-

Speed: Transactions are confirmed quickly, usually within seconds, allowing for efficient processing of payments.

-

Energy Efficiency: Unlike PoW systems, which require significant computational power and energy, Federated Consensus operates with minimal resource consumption, making it a more environmentally friendly option.

-

Security: The decentralized nature of the consensus process reduces the risk of central points of failure and enhances the overall security of the network.

Key Technological Innovations

The XRP Ledger incorporates several innovative features that enhance its functionality and usability:

1. Decentralized Exchange (DEX)

One of the standout features of the XRPL is its built-in decentralized exchange. This DEX allows users to trade various assets directly on the ledger without relying on third-party exchanges. Key benefits include:

-

Peer-to-Peer Trading: Users can trade assets directly with one another, eliminating the need for intermediaries and reducing transaction costs.

-

Cross-Currency Transactions: The DEX supports atomic swaps, enabling seamless trading between different currencies, including fiat and cryptocurrencies.

2. Tokenization

The XRPL allows for the creation of custom tokens, which can represent various assets, including fiat currencies, commodities, and even digital assets like NFTs. This tokenization capability opens up new avenues for financial applications and services. Key points include:

-

Asset Representation: Any asset can be represented as a token on the XRPL, making it versatile for various use cases.

-

Interoperability: Tokens on the XRPL can be exchanged easily, facilitating cross-border transactions and enhancing liquidity.

3. Payment Channels

The XRPL supports payment channels, enabling users to conduct multiple transactions off-chain before settling them on the ledger. This feature offers several advantages:

-

Micropayments: Users can conduct small transactions without incurring high fees, making it ideal for applications like content monetization and IoT payments.

-

Speed: Payment channels allow for instant transactions between parties, enhancing the overall user experience.

4. Multi-Signing and Security

The XRPL includes multi-signing capabilities, which enhance account security. Users can set up accounts that require multiple signatures to authorize transactions, providing an additional layer of protection against unauthorized access. This feature is particularly useful for businesses that manage large sums of money and require stringent security measures.

Real-World Applications

The technology behind XRP has led to various real-world applications that leverage its speed, low cost, and efficiency:

-

Cross-Border Payments: Financial institutions use XRP to facilitate instant international transactions, reducing the time and costs associated with traditional remittance systems.

-

RippleNet: Ripple, the company behind XRP, provides financial solutions through its RippleNet network, which utilizes XRP for liquidity and settlement.

-

DeFi and NFTs: The XRPL is evolving to support decentralized finance (DeFi) applications and non-fungible tokens (NFTs), expanding its use cases in the digital asset space.

Conclusion

XRP and the XRP Ledger represent a significant advancement in blockchain technology, offering unique solutions for fast, secure, and cost-effective transactions. By leveraging a decentralized architecture, an efficient consensus mechanism, and innovative features like a built-in DEX and tokenization capabilities, XRP is well-positioned to address the challenges of traditional financial systems. As the ecosystem continues to grow and evolve, XRP’s technology may play a pivotal role in shaping the future of digital payments and finance.

Understanding XRP (XRP) Tokenomics

XRP (XRP) is a digital asset that operates within the XRP Ledger (XRPL), a decentralized blockchain that facilitates fast and cost-effective cross-border payments. Understanding the tokenomics of XRP is essential for both new and intermediate investors to grasp its potential and utility in the evolving cryptocurrency landscape. This section will cover key metrics, token utility, and distribution methods.

| Metric | Value |

|---|---|

| Total Supply | 99.98 billion XRP |

| Max Supply | 100 billion XRP |

| Circulating Supply | 59.61 billion XRP |

| Inflation/Deflation Model | Deflationary (with a limited supply and transaction fees burned) |

Token Utility (What is the coin used for?)

XRP serves multiple functions within the XRPL ecosystem, primarily focusing on enhancing the efficiency of cross-border payments. Here are the main utilities of XRP:

-

Cross-Border Payments: XRP is designed to facilitate real-time international money transfers with minimal fees, making it a preferred choice for banks and financial institutions. The XRP Ledger can settle transactions in approximately 3 to 5 seconds at a cost of about $0.0002 per transaction.

-

Liquidity Provision: Financial institutions can use XRP as a bridge currency to provide liquidity for cross-border transactions. This alleviates the need for pre-funding accounts in destination currencies, which can tie up capital unnecessarily. By using XRP, financial institutions can execute transactions without holding large amounts of foreign currency.

-

Transaction Fees: Every transaction on the XRPL requires a small fee, which is paid in XRP. This fee is designed to prevent spam and ensure that the network remains efficient. A portion of these fees is permanently removed from circulation, contributing to XRP’s deflationary nature.

-

Decentralized Exchange (DEX): The XRP Ledger includes a built-in DEX that allows users to trade different currencies and tokens without needing a centralized exchange. XRP can be used to facilitate these trades, enhancing the liquidity and usability of the platform.

-

Tokenization of Assets: The XRPL allows for the creation of tokens representing other assets, which can be traded or transferred on the ledger. XRP can be utilized as a means of payment or collateral in these transactions, expanding its use cases beyond just currency.

-

Integration with Financial Services: Ripple, the company behind the XRP Ledger, has partnered with numerous financial institutions and payment providers to leverage XRP for cross-border remittances, making it an integral part of modern financial services.

Token Distribution

The distribution of XRP has been structured to ensure that the asset can be effectively utilized while also maintaining its value. Here are the key aspects of XRP’s distribution:

-

Initial Distribution: When the XRP Ledger was launched in 2012, a total of 100 billion XRP was created. Of this amount, approximately 80 billion XRP was allocated to Ripple Labs to support the development of its payment network, RippleNet, and to foster the adoption of XRP among financial institutions.

-

Circulating Supply: As of now, approximately 59.61 billion XRP is in circulation. The remaining XRP is held by Ripple and is subject to a controlled release. Ripple has committed to releasing these tokens in a manner that does not disrupt the market, with the aim of maintaining a stable price.

-

Escrow Mechanism: To manage the release of XRP into the market, Ripple has established an escrow account containing around 55 billion XRP. This mechanism allows Ripple to release a maximum of 1 billion XRP per month, with any unutilized tokens being returned to escrow. This controlled supply helps prevent sudden influxes of XRP that could destabilize its price.

-

Transaction Fees and Burn Mechanism: As mentioned earlier, transaction fees on the XRPL are paid in XRP. A portion of these fees is burned, meaning they are permanently removed from circulation. This deflationary model is designed to gradually reduce the total supply of XRP over time, potentially increasing its value as demand grows.

-

Market Dynamics: The distribution and release strategy of XRP plays a crucial role in its market dynamics. By controlling the supply and ensuring that XRP is used within a wide range of financial applications, Ripple aims to create a sustainable and valuable ecosystem around XRP.

In conclusion, the tokenomics of XRP is characterized by a well-structured supply model, diverse utility, and a strategic distribution approach. By understanding these elements, investors can better appreciate the role of XRP in the cryptocurrency market and its potential for future growth.

Price History and Market Performance

Key Historical Price Milestones

XRP, the native cryptocurrency of the XRP Ledger, has experienced significant price fluctuations since its inception in 2012. Understanding these historical price milestones can provide insights into the asset’s volatility and market behavior.

-

Initial Launch and Early Days (2012-2014): XRP was launched in 2012 at a negligible price, often trading under a cent. By July 2014, it reached an all-time low of approximately $0.0028, marking a challenging period for the asset. During this time, the overall cryptocurrency market was still in its infancy, and XRP struggled to gain traction.

-

2017 Bull Run: The year 2017 was pivotal for XRP, aligning with a broader cryptocurrency market boom. XRP’s price surged dramatically, hitting a high of around $3.84 on January 4, 2018. This spike was driven by increased media attention, a growing user base, and Ripple’s partnerships with financial institutions, which showcased the potential utility of XRP in facilitating cross-border payments.

-

Post-Bull Market Correction (2018-2020): Following its all-time high, XRP’s price experienced a prolonged downturn, mirroring the overall trend in the cryptocurrency market. By early 2020, XRP had retraced significantly, trading around $0.18. This period was characterized by market skepticism and regulatory uncertainties that affected investor confidence.

-

Legal Challenges and Market Reactions (2020-Present): The SEC’s lawsuit against Ripple Labs in December 2020, claiming that XRP was an unregistered security, had a profound impact on its price. Initially, the price dropped sharply, falling to around $0.20 in early 2021. However, as the legal case unfolded, XRP’s price saw periods of recovery, indicating the market’s fluctuating sentiment towards the resolution of the legal issues. As of October 2023, XRP’s price stands at approximately $2.84, reflecting a significant recovery and a 435% increase from its price one year prior.

Factors Influencing the Price

Historically, the price of XRP has been influenced by a variety of factors, including market trends, regulatory developments, and technological advancements. Understanding these influences can provide context for its price movements.

-

Market Sentiment and Speculation: Like many cryptocurrencies, XRP’s price is highly sensitive to market sentiment. Speculative trading, driven by news and social media trends, often leads to rapid price changes. For example, during the 2017 bull run, the enthusiasm surrounding cryptocurrencies led to significant investments in XRP, pushing its price to unprecedented levels. Conversely, negative sentiment, such as regulatory news or market downturns, can lead to sharp declines.

-

Regulatory Environment: Regulatory scrutiny has played a critical role in XRP’s price fluctuations. The SEC lawsuit has not only affected XRP’s price directly but has also influenced broader market perceptions of cryptocurrencies. Investors closely monitor regulatory developments, as favorable outcomes can boost confidence and lead to price increases, while unfavorable news can have the opposite effect.

-

Technological Developments and Partnerships: XRP’s utility is closely tied to its underlying technology, the XRP Ledger, which is designed for fast, low-cost transactions. Partnerships with financial institutions and payment service providers have historically enhanced the asset’s credibility and utility, positively impacting its price. For instance, announcements of new partnerships often coincide with price rallies, as they signal increased adoption and potential for future growth.

-

Market Competition: XRP operates in a competitive landscape with numerous cryptocurrencies vying for market share in the payments sector. The emergence of new technologies and competing platforms can impact XRP’s market position and pricing. Investors often consider how XRP compares to other digital assets, especially those that offer similar functionalities, which can lead to shifts in demand and pricing.

-

Supply Dynamics: The total supply and circulating supply of XRP also influence its price. With a maximum supply capped at 100 billion XRP, the distribution and release of tokens can affect scarcity and market value. For instance, large-scale token unlocks or sales by major holders can lead to increased supply in the market, potentially driving prices down. Conversely, a reduction in circulating supply through buybacks or burns can create upward pressure on prices.

In summary, XRP’s price history is marked by significant milestones and influenced by a complex interplay of market dynamics, regulatory developments, technological advancements, and competitive pressures. Understanding these factors provides a clearer picture of XRP’s market performance and the challenges it faces as it seeks to establish itself in the evolving cryptocurrency landscape.

Where to Buy XRP (XRP): Top Exchanges Reviewed

5 Reasons Why Kraken is Your Go-To for Buying XRP Today!

Kraken’s guide to buying XRP highlights the exchange’s user-friendly approach, allowing purchases starting from just $10. It stands out for its diverse payment options, including credit/debit cards, ACH deposits, and mobile payment methods like Apple and Google Pay, making it accessible for both novice and seasoned investors. With its robust security measures and comprehensive resources, Kraken positions itself as a reliable platform for trading digital assets.

- Website: kraken.com

- Platform Age: Approx. 25 years (domain registered in 2000)

5. Coinbase – Easiest Way to Buy XRP in the USA!

Coinbase stands out as a leading centralized exchange for purchasing XRP in the United States, renowned for its security and user-friendly interface. As one of the most trusted platforms in the cryptocurrency space, Coinbase offers a seamless experience for both individuals and businesses looking to buy, sell, and manage XRP. Its robust regulatory compliance and extensive educational resources further enhance its appeal to new and experienced investors alike.

- Website: coinbase.com

- Platform Age: Approx. 14 years (domain registered in 2011)

5. Top Exchanges for XRP in 2025 – Your Ultimate Guide!

In the quest for the best crypto exchange for XRP in 2025, this comprehensive guide highlights top platforms like Binance, Coinbase, Kraken, Bitstamp, and Uphold. Each exchange is evaluated based on factors such as user experience, security features, trading fees, and liquidity. Notably, Binance stands out for its extensive trading options and low fees, while Coinbase is praised for its user-friendly interface, making both ideal choices for XRP investors.

- Website: medium.com

- Platform Age: Approx. 27 years (domain registered in 1998)

19. Crypto.com – Ideal for Seamless XRP Transactions

In “Buy Ripple: Compare 19 Best Exchanges (233 Reviews) – Cryptoradar,” readers can explore a comprehensive analysis of the top platforms for purchasing Ripple. This guide distinguishes itself by providing real-time price comparisons, detailed fee structures, various payment options, and authentic user reviews, enabling both beginners and seasoned investors to make informed decisions when selecting the best exchange for their Ripple transactions.

- Website: cryptoradar.com

- Platform Age: Approx. 10 years (domain registered in 2015)

How to Buy XRP (XRP): A Step-by-Step Guide

1. Choose a Cryptocurrency Exchange

The first step in buying XRP is to select a cryptocurrency exchange. There are numerous exchanges where you can purchase XRP, including well-known platforms like Binance, Coinbase, Bitstamp, and Huobi. When choosing an exchange, consider the following factors:

- Reputation: Look for exchanges with a solid track record and positive user reviews.

- Fees: Different exchanges have varying fee structures for trading and withdrawals. Make sure to review these costs to understand how they will affect your investment.

- Payment Methods: Check what payment options are available. Most exchanges accept bank transfers and credit/debit cards, while some may allow PayPal or other methods.

- Security Features: Ensure the exchange has robust security measures in place, such as two-factor authentication (2FA) and cold storage for funds.

2. Create and Verify Your Account

Once you’ve chosen an exchange, the next step is to create an account. This typically involves the following:

- Sign Up: Go to the exchange’s website and click on the sign-up button. You will be required to provide your email address and create a password.

- Email Verification: After signing up, check your email for a verification link. Click on it to confirm your email address.

- Complete KYC (Know Your Customer): Most exchanges require you to verify your identity. This usually involves uploading a government-issued ID and possibly a selfie for facial recognition. The verification process can take anywhere from a few minutes to a couple of days, depending on the exchange.

3. Deposit Funds

After your account is verified, you need to deposit funds to buy XRP. Here’s how to do it:

- Log in to Your Account: Access your account on the exchange.

- Go to the Deposit Section: Navigate to the section where you can deposit funds. This is usually found in your account dashboard.

- Select Your Deposit Method: Choose the payment method you prefer (bank transfer, credit card, etc.). Follow the instructions provided to complete the deposit.

- Confirm the Deposit: Depending on the method, your funds may be available immediately or take some time to process. Check your account balance to confirm the funds are available.

4. Place an Order to Buy XRP (XRP)

With funds in your account, you can now purchase XRP. Follow these steps:

- Navigate to the XRP Trading Pair: Go to the trading section of the exchange and find the XRP trading pair that corresponds to the currency you deposited (e.g., XRP/USD, XRP/EUR).

- Choose Your Order Type: You can generally place two types of orders:

- Market Order: This order buys XRP at the current market price. It’s quick and easy but may result in a slightly higher price due to market fluctuations.

- Limit Order: This order allows you to set the price at which you want to buy XRP. The order will only execute when the market reaches your specified price.

- Enter the Amount: Specify how much XRP you want to buy. Ensure you have enough funds to cover the purchase.

- Review and Confirm: Double-check the details of your order, including fees, before confirming the transaction.

5. Secure Your Coins in a Wallet

After purchasing XRP, it’s crucial to secure your investment. While you can leave your XRP on the exchange, it is generally safer to transfer it to a personal wallet. Here’s how to do it:

- Choose a Wallet: There are various types of wallets available, including:

- Hardware Wallets: These are physical devices that store your cryptocurrencies offline, providing high security (e.g., Ledger Nano S, Trezor).

- Software Wallets: These are applications or software that store your cryptocurrencies on your computer or mobile device (e.g., Exodus, Atomic Wallet).

- Paper Wallets: This involves printing your private keys and addresses on paper. This method is secure from online threats but requires careful handling.

- Transfer Your XRP: If you choose a wallet, find your wallet address and initiate a withdrawal from the exchange to your wallet. Always double-check the address to avoid sending your XRP to the wrong location.

- Backup Your Wallet: If using a software or hardware wallet, ensure you back up your recovery phrase. This step is essential for recovering your funds if you lose access to your wallet.

By following these steps, you can successfully buy and secure your XRP investment. Remember to stay informed about market trends and security best practices as you navigate the world of cryptocurrency.

Investment Analysis: Potential and Risks

Potential Strengths (The Bull Case)

Strong Use Case in Cross-Border Payments

XRP was designed primarily to serve as a bridge currency for cross-border payments, facilitating fast and cost-effective transactions. With transaction costs averaging around $0.0002 and settlement times between 3-5 seconds, XRP can significantly enhance the efficiency of international money transfers compared to traditional banking systems. This utility positions XRP favorably within the global financial ecosystem, especially as demand for quicker, cheaper remittance solutions continues to grow.

Established Network and Market Position

Since its launch in 2012, XRP has built a robust infrastructure known as the XRP Ledger (XRPL). The XRPL is an open-source, decentralized blockchain that has proven reliable over more than a decade, processing over 70 million ledgers without significant downtime. XRP currently ranks as the third-largest cryptocurrency by market capitalization, with a market cap of approximately $169 billion, highlighting its established presence in the crypto market.

Institutional Adoption and Partnerships

Ripple, the company behind XRP, has formed numerous partnerships with financial institutions and payment providers worldwide. These collaborations aim to utilize XRP for liquidity in cross-border transactions, thereby enhancing its adoption as a payment solution. As traditional financial institutions increasingly recognize the potential of blockchain technology, XRP could benefit from greater institutional investment and usage.

Innovative Features and Development

The XRP Ledger supports a variety of features that extend beyond simple transactions. It includes a decentralized exchange (DEX), tokenization capabilities, and payment channels for micropayments. These functionalities not only enhance the utility of XRP but also attract developers and businesses looking to build applications on the XRPL, fostering innovation and expanding its use cases.

Environmental Sustainability

XRP has been highlighted as an environmentally friendly cryptocurrency due to its low energy consumption and carbon-neutral nature. This characteristic could appeal to investors and institutions increasingly focused on sustainability and responsible investing, as environmental considerations gain traction in the financial sector.

Potential Risks and Challenges (The Bear Case)

Market Volatility

Like many cryptocurrencies, XRP is subject to significant price volatility. Fluctuations in market sentiment, regulatory news, and macroeconomic factors can lead to rapid price changes. For instance, XRP’s price has seen substantial highs and lows, with an all-time high of $3.84 in January 2018 followed by prolonged periods of decline. Investors must be prepared for the inherent risks associated with investing in a volatile asset class.

Regulatory Uncertainty

One of the most pressing challenges facing XRP is the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). The SEC’s lawsuit, which alleges that XRP is a security and was sold without proper registration, poses a significant risk to the future of the cryptocurrency. Depending on the outcome, XRP could face stricter regulations or even be classified as a security, potentially limiting its use and trading. This uncertainty can deter institutional investment and impact XRP’s price.

Competition from Other Cryptocurrencies

XRP operates in a competitive landscape populated by numerous cryptocurrencies and blockchain projects aimed at enhancing payment systems. Ethereum, Stellar, and newer entrants like Algorand and Solana are all vying for market share in the cross-border payment space. As these technologies evolve, XRP may face pressure to maintain its market position and relevance. Continuous innovation and differentiation will be crucial for XRP to fend off competitors.

Technological Risks

While the XRP Ledger is known for its reliability, no technology is immune to risks. Potential vulnerabilities in the code or issues related to network upgrades could pose challenges. Moreover, as the blockchain space evolves, XRP must adapt to incorporate new features and functionalities that meet changing market demands. Failure to innovate or address technological shortcomings could hinder XRP’s growth and utility.

Centralization Concerns

Despite being marketed as a decentralized solution, some critics argue that XRP is more centralized than other cryptocurrencies, primarily due to the significant amount of XRP held by Ripple Labs. This concentration of tokens raises concerns about potential market manipulation and governance issues. If Ripple were to sell large amounts of XRP or make decisions that do not align with the interests of the broader community, it could negatively impact investor confidence and the asset’s value.

Conclusion

Investing in XRP presents both promising opportunities and notable risks. Its strong use case in cross-border payments, established market position, and innovative features contribute to a compelling investment narrative. However, prospective investors must remain vigilant about regulatory uncertainties, market volatility, and competition in the ever-evolving cryptocurrency landscape. A well-rounded understanding of these factors is essential for making informed investment decisions regarding XRP. As always, potential investors should conduct thorough research and consider their risk tolerance before engaging in cryptocurrency investments.

Frequently Asked Questions (FAQs)

1. What is XRP (XRP)?

XRP is the native cryptocurrency of the XRP Ledger (XRPL), a decentralized blockchain designed for fast and cost-effective cross-border payments. Launched in 2012, XRP aims to facilitate efficient transactions and is primarily used within the Ripple payment network, which targets financial institutions and enterprises. The XRP Ledger allows for quick transaction settlement, typically within 3-5 seconds, and offers low transaction fees of around $0.0002.

2. Who created XRP (XRP)?

XRP was created by David Schwartz, Jed McCaleb, and Arthur Britto, who launched the XRP Ledger in 2012. Alongside Chris Larsen, they founded Ripple Labs, the company that utilizes XRP for its payment solutions. The team aimed to develop a faster, more energy-efficient alternative to Bitcoin, focusing on improving global payment systems.

3. What makes XRP (XRP) different from Bitcoin?

XRP differs from Bitcoin in several key aspects:

- Transaction Speed: XRP transactions settle in 3-5 seconds, while Bitcoin can take 10 minutes or more.

- Consensus Mechanism: XRP uses a Federated Consensus model, which relies on a network of independent validators to confirm transactions, unlike Bitcoin’s Proof of Work system that requires energy-intensive mining.

- Purpose: XRP is designed specifically for facilitating cross-border payments and financial transactions, while Bitcoin is primarily viewed as a store of value or digital gold.

- Supply: XRP has a total supply of 100 billion coins, with a significant portion pre-mined, whereas Bitcoin has a capped supply of 21 million coins that are gradually mined.

4. Is XRP (XRP) a good investment?

Whether XRP is a good investment depends on various factors, including market conditions, regulatory developments, and individual investment goals. As of now, XRP is ranked among the top cryptocurrencies by market capitalization and has shown significant price volatility. Potential investors should conduct thorough research, consider their risk tolerance, and stay updated on ongoing legal issues, such as the ongoing lawsuit between Ripple Labs and the SEC, which could impact XRP’s future.

5. How can I buy XRP (XRP)?

XRP can be purchased on numerous centralized exchanges (CeFi) such as Binance, Huobi, and Bitstamp. To buy XRP, you will typically need to create an account on one of these exchanges, complete any required identity verification, deposit funds (like USD or another cryptocurrency), and then execute a buy order for XRP. Additionally, XRP can also be traded on some decentralized exchanges (DEX).

6. What are the main use cases of XRP?

XRP’s primary use cases include:

- Cross-Border Payments: XRP facilitates fast and low-cost international transactions, making it attractive for financial institutions looking to enhance their remittance services.

- Tokenization: The XRP Ledger allows for the creation of custom tokens, enabling various use cases in finance and beyond.

- Decentralized Exchange (DEX): The XRPL features a built-in DEX that allows users to trade different currencies directly on the blockchain.

- Payment Channels: XRP supports micropayments and payment channels, which can be used for applications requiring rapid transaction settlement.

7. How is the XRP Ledger secured?

The XRP Ledger employs a Federated Consensus mechanism, which enables a network of independent validators to confirm transactions without relying on a single point of failure. Validators reach consensus on transaction order and validity based on the rules of the network. This model is distinct from the energy-intensive mining processes used in Bitcoin and Ethereum, making the XRPL more efficient and environmentally friendly.

8. What is the current status of the Ripple vs. SEC lawsuit?

As of October 2023, Ripple Labs is engaged in an ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) regarding the classification of XRP as a security. The SEC alleges that Ripple conducted an unregistered securities offering by selling XRP, while Ripple contends that XRP is a currency and not a security. The outcome of this case is significant, as it could set important precedents for the entire cryptocurrency industry and impact XRP’s regulatory status and market perception.

Final Verdict on XRP (XRP)

Overview of XRP

XRP is the native cryptocurrency of the XRP Ledger (XRPL), a decentralized and open-source blockchain platform designed for fast and cost-efficient cross-border payments. Launched in 2012, XRP aims to facilitate secure and instantaneous transactions across various currencies, making it particularly appealing to financial institutions and enterprises. With transaction costs averaging just $0.0002 and speeds of 3-5 seconds, XRP stands out as a viable alternative to traditional payment systems and blockchain networks.

Technology and Use Cases

The XRP Ledger employs a unique Federated Consensus mechanism, which enables transaction validation without the need for mining, thereby enhancing efficiency and sustainability. This technology supports a variety of applications, including payments, decentralized finance (DeFi), and asset tokenization. Additionally, the XRPL features a built-in decentralized exchange (DEX), allowing users to trade assets directly on the ledger. Its proven reliability, with over 70 million ledgers closed since inception, highlights the robustness of the platform.

Risks and Opportunities

While XRP has shown significant price appreciation—up over 400% in the past year—investors should remain cautious. The ongoing legal battle between Ripple Labs and the SEC raises uncertainties regarding XRP’s classification as a security, which could have profound implications for its future. As with any cryptocurrency, XRP represents a high-risk, high-reward investment opportunity. Market volatility, regulatory changes, and technological developments could all impact its price and utility.

Conclusion

In summary, XRP offers a compelling solution for cross-border payments, supported by innovative technology and a strong community. However, potential investors should carefully weigh the risks associated with its legal status and market volatility. As always, it’s crucial to conduct your own thorough research (DYOR) before making any investment decisions in this dynamic and rapidly evolving space.

Investment Risk Disclaimer

⚠️ Investment Risk Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and carry a significant risk of loss. Always conduct your own thorough research (DYOR) and consult with a qualified financial advisor before making any investment decisions.